PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940709

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940709

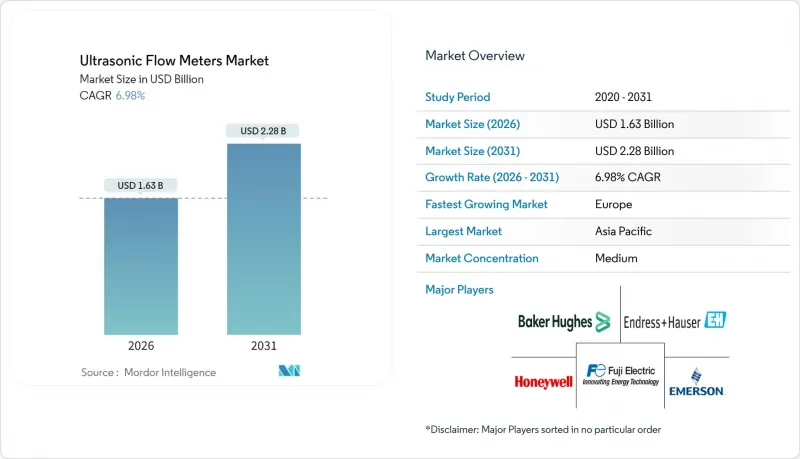

Ultrasonic Flow Meters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Ultrasonic flow meters market size in 2026 is estimated at USD 1.63 billion, growing from 2025 value of USD 1.52 billion with 2031 projections showing USD 2.28 billion, growing at 6.98% CAGR over 2026-2031.

The growing deployment of custody-transfer-grade meters in large-diameter gas pipelines, retrofit demand for clamp-on devices in aging water networks, and early-stage investments in hydrogen infrastructure sustain near-double-digit demand across the process industries. Operators favor ultrasonic designs for zero pressure loss, predictive maintenance, and IIoT integration, which reduce lifetime operating expenditure compared with differential-pressure or turbine meters. Adoption accelerates where environmental compliance drives high-accuracy flow control, such as zero-liquid-discharge mandates in chemical processing and leakage-reduction programs in municipal water systems. Competitive differentiation is increasingly centered on edge-AI diagnostics and multi-path redundancy, which maintain +-0.15% repeatability in demanding custody-transfer conditions.

Global Ultrasonic Flow Meters Market Trends and Insights

Accelerated shift to custody-transfer-grade ultrasonic meters in large-diameter gas pipelines

Pipeline operators have begun phasing out turbine meters because ultrasonic units eliminate pressure-drop penalties, reducing compressor energy consumption by up to 15% while offering 20-year lifetimes with minimal maintenance. Multi-path designs now deliver API-compliant accuracy and enable field verification through small-volume provers, limiting downtime for calibration. Adoption is most visible in North American shale gas corridors and Middle Eastern export pipelines, where throughput variability requires wide Reynolds-number tolerance.

Rapid retrofit demand for non-invasive clamp-on meters in water-stress hotspots

Non-invasive clamp-on devices enable utilities to instrument prestressed concrete cylinder pipelines without cutting, thereby mitigating the risk of catastrophic failure while identifying leaks responsible for 20-30% of treated-water losses in emerging economies. Municipal projects can deploy hundreds of meters in weeks, enabling district-metered-area analytics that optimize pressure and drive down non-revenue water.

High initial CAPEX vs. legacy DP/turbine meters

Ultrasonic installations cost three to five times more than differential-pressure alternatives once commissioning and training are included, challenging smaller municipal budgets despite lifecycle OPEX savings. Financing constraints slow the adoption of advanced diagnostics in developing regions, where functionality often takes precedence over advanced diagnostics.

Other drivers and restraints analyzed in the detailed report include:

- Hydrogen-ready ultrasonic designs enable early-mover advantage in energy transition

- Edge-AI self-diagnostics cut OPEX for utilities and boost predictive maintenance adoption

- Accuracy drift in multiphase/slurry service without advanced signal conditioning

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In-line designs accounted for 65.60% of the ultrasonic flow meters market share in 2025. Clamp-on units, however, are projected to register an 8.18% CAGR, reflecting expanding retrofit programs across APAC utilities. The clamp-on segment benefits from WaveInjector transducer housings that can tolerate process ranges of -200 °C to +630 °C. As non-invasive devices avoid production outages, demand accelerates for emergency leak surveys and temporary audits in industrial plants.

Second-generation coupling pads and automated mounting rigs halve installation time, reinforcing economic advantages where shutdown costs exceed instrument price. Utilities piloting smart-water programs confirm leak-rate reductions within months of clamp-on deployments, supporting rapid investment payback and further penetration of the ultrasonic flow meters market in constrained capital environments.

Transit-time units held an 82.10% share in 2025 and are set to grow at an 8.36% CAGR through 2031. Their capability to capture sonic velocity supports composition monitoring needed for hydrogen-gas blends, elevating their value proposition as decarbonization momentum builds. Machine-learning-driven profile correction now sustains +-0.5% accuracy even under variable temperature regimes.

Doppler devices remain confined to dirty-fluid contexts due to their lower precision, while hybrid platforms combining Doppler and transit-time measurements are emerging for multiphase pipelines where shortfalls of single-method approaches are apparent. Modular electronics that switch between principles enable operators to standardize on one transmitter family, reducing inventory even as application diversity expands.

The Ultrasonic Flow Meters Market Report is Segmented by Mounting Method (Clamp-On, In-Line), Measurement Technology (Transit-Time, Doppler, Hybrid/Multipath), End-User Industry (Oil and Gas, Water and Wastewater, Chemical and Petrochemical, Industrial, Other Industries), Number of Paths (Single-Path, Multi-Path), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 41.25% of global revenue in 2025, fueled by China's Belt and Road pipeline projects and India's Smart Cities Mission that mandates high-accuracy metering. Local producers in Japan and South Korea enhance competitiveness through IoT-ready transmitters and temperature-compensating transducers, reinforcing regional supply security. Governments channel infrastructure stimulus toward wastewater reuse, thereby elevating the adoption of ultrasonic flow meters in municipal projects.

Europe is projected to expand at a 10.11% CAGR as EU policy drives hydrogen-ready pipeline retrofits and rigorous conformance to the Measuring Instruments Directive. Germany's chemical heartland embeds ultrasonic meters within process intensification programs to reduce energy consumption per ton of output, while the Netherlands accelerates hydrogen injection pilots that require custody-grade mass reconciliation. Regional suppliers leverage vertical integration, combining instruments with cloud analytics to satisfy stringent sustainability audits.

North America sustains mid-single-digit growth, anchored by shale gas custody-transfer upgrades and water utility leakage projects in drought-prone western states. Federal infrastructure bills subsidize smart-water deployments that favor clamp-on meters for aging ductile-iron mains. South America and the Middle East-Africa represent emerging demand pockets, though limited accredited calibration facilities above DN 1000 slow some greenfield pipeline approvals. Suppliers counter by deploying mobile providers and remote support hubs, easing service barriers.

- Baker Hughes Company

- Endress+Hauser Group Services AG

- Fuji Electric Co., Ltd.

- Honeywell International Inc.

- Emerson Electric Co.

- ABB Ltd.

- Aichi Tokei Denki Co., Ltd.

- Apator SA

- Arad Group

- Badger Meter Inc.

- Bronkhorst High-Tech BV

- Diehl Metering GmbH

- FLEXIM Instruments GmbH

- Itron Inc.

- Kamstrup A/S

- KOBOLD Messring GmbH

- KROHNE Group

- Landis+Gyr AG

- Mueller Systems LLC

- Neptune Technology Group Inc.

- Omega Engineering Inc.

- SICK AG

- Siemens AG

- Sensus USA Inc.

- WEIHAI Ploumeter Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Impact of Macroeconomic Factors

- 4.3 Market Drivers

- 4.3.1 Accelerated shift to custody-transfer-grade ultrasonic meters in large-diameter gas pipelines

- 4.3.2 Rapid retrofit demand for non-invasive clamp-on meters in water-stress hotspots

- 4.3.3 Hydrogen-ready ultrasonic designs enable early-mover advantage in energy transition

- 4.3.4 Edge-AI self-diagnostics cut OPEX for utilities and boost predictive maintenance adoption

- 4.3.5 Mandatory zero-liquid-discharge policies push high-accuracy flow control in chemicals

- 4.3.6 OEM-embedded ultrasonic transmitters in smart pumps expand addressable OEM market

- 4.4 Market Restraints

- 4.4.1 High initial CAPEX vs. legacy DP/turbine meters

- 4.4.2 Accuracy drift in multiphase / slurry service without advanced signal conditioning

- 4.4.3 Scarcity of accredited calibration labs above DN 1000 in emerging regions

- 4.4.4 Cyber-security concerns over IIoT-connected meters in critical infrastructure

- 4.5 Industry Supply Chain Analysis

- 4.6 Regulatory Landscape

- 4.7 Technological Outlook (IoT-enabled, hydrogen-ready, AI)

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Mounting Method

- 5.1.1 Clamp-on

- 5.1.2 In-line

- 5.2 By Measurement Technology

- 5.2.1 Transit-time

- 5.2.2 Doppler

- 5.2.3 Hybrid / Multipath

- 5.3 By End-User Industry

- 5.3.1 Oil and Gas

- 5.3.2 Water and Wastewater

- 5.3.3 Chemical and Petrochemical

- 5.3.4 Industrial (F&B, Aerospace, Automotive)

- 5.3.5 Other Industries (Life Sciences, Mining and Metals)

- 5.4 By Number of Paths

- 5.4.1 Single-path

- 5.4.2 Multi-path (3-Path, 4-Path, 5+-Path)

- 5.5 By Geography (Value)

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Baker Hughes Company

- 6.4.2 Endress+Hauser Group Services AG

- 6.4.3 Fuji Electric Co., Ltd.

- 6.4.4 Honeywell International Inc.

- 6.4.5 Emerson Electric Co.

- 6.4.6 ABB Ltd.

- 6.4.7 Aichi Tokei Denki Co., Ltd.

- 6.4.8 Apator SA

- 6.4.9 Arad Group

- 6.4.10 Badger Meter Inc.

- 6.4.11 Bronkhorst High-Tech BV

- 6.4.12 Diehl Metering GmbH

- 6.4.13 FLEXIM Instruments GmbH

- 6.4.14 Itron Inc.

- 6.4.15 Kamstrup A/S

- 6.4.16 KOBOLD Messring GmbH

- 6.4.17 KROHNE Group

- 6.4.18 Landis+Gyr AG

- 6.4.19 Mueller Systems LLC

- 6.4.20 Neptune Technology Group Inc.

- 6.4.21 Omega Engineering Inc.

- 6.4.22 SICK AG

- 6.4.23 Siemens AG

- 6.4.24 Sensus USA Inc.

- 6.4.25 WEIHAI Ploumeter Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment