PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940725

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940725

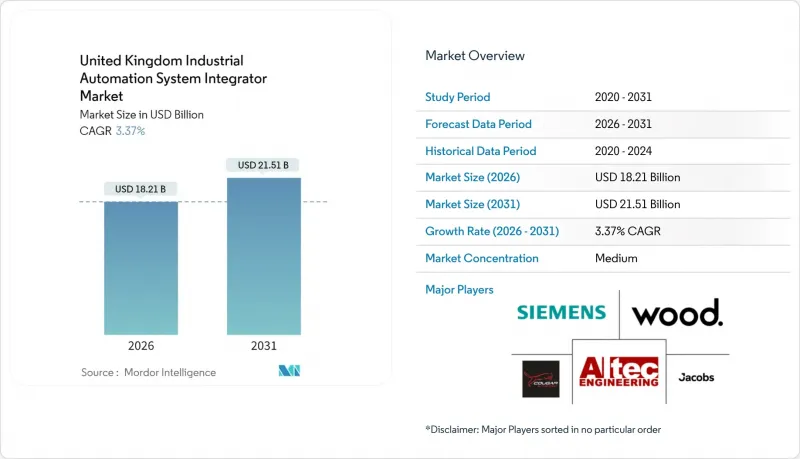

United Kingdom Industrial Automation System Integrator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom industrial automation system integrator market size in 2026 is estimated at USD 18.21 billion, growing from 2025 value of USD 17.62 billion with 2031 projections showing USD 21.51 billion, growing at 3.37% CAGR over 2026-2031.

This expansion arises from government-backed digital programs, Brexit-related labor shortages that sharpen the focus on productivity, and a stepped-up shift to Industry 4.0 platforms across discrete and process industries. Manufacturers view full-plant connectivity, cloud analytics, and remote support as the fastest route to resilience in an export-heavy economy. Investment momentum is strongest among mid-sized firms that now access Made Smarter grants for digital readiness assessments, while large enterprises accelerate multi-year retrofit schedules to protect export share in the post-pandemic environment. The policy push combines with private capital to keep automation pipelines healthy even during macroeconomic turbulence, tempering the market's historical dependence on automotive and food processing procurement cycles.

United Kingdom Industrial Automation System Integrator Market Trends and Insights

Digital Transformation and Industry 4.0 Adoption

Manufacturers have shifted from isolated automation islands to integrated plantwide upgrades that blend operational and enterprise data. The Made Smarter national rollout allocated GBP 16 million (USD 20.3 million) in 2024 to support 1,000 factories with diagnostics, implementation roadmaps, and talent coaching. Firms adopt common data models and secure cloud gateways, allowing shop-floor sensors to link directly to enterprise resource planning suites. Small and medium enterprises benefit most because program advisers streamline vendor selection and standards compliance. Machine builders now preload ISO 23247-aligned, cyber-secure templates, reducing engineering cycles and ensuring interoperability within diverse brownfield sites. As more plants reach digital maturity, integrators win multi-site contracts that bundle PLC replacement, SCADA revamps, and managed analytics into a single service envelope.

Rising Demand for Productivity Amid UK Labor Shortages

UK data shows 124,000 factory vacancies in 2024, and pay inflation near 6% drives a rapid pivot to automated inspection, robotic palletizing, and predictive maintenance, which trims overtime costs. Financial modeling places current automation paybacks at 18-24 months, compared with the five-year horizons that were common before Brexit. Logistics operators reinforce the trend; autonomous mobile robots in fulfillment centers maintain stable output even when seasonal worker pools shrink. Skills councils retrain incumbents for supervisory roles that oversee fleets of robots, rather than manual work centers. Integrators seize service contracts that guarantee uptime targets, absorbing staffing risks on behalf of overstretched customers.

High Initial Capex and Integration Costs

Project audits reveal overruns average 30% because legacy asset mapping uncovers undocumented code, obsolete fieldbuses, and nonstandard motor controls. Currency fluctuations since Brexit have increased the prices of imported hardware, while domestic suppliers struggle with small production runs that keep per-unit costs high. Integrators provide service packages financed over milestones, aligning cash outflows with realized gains. Still, many SMEs defer full digitization, opting for sensor retrofits rather than holistic upgrades, which slows the momentum of the total United Kingdom industrial automation system integrator market.

Other drivers and restraints analyzed in the detailed report include:

- Accelerated Robotics Uptake in Automotive Re-tooling for EVs

- Network Rail Target 190plus Digital Signaling Rollout

- Scarcity of Skilled Automation Engineers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PLCs retained a 32.25% share of the United Kingdom industrial automation system integrator market size in 2025, underscoring their role as the default control backbone in batch and discrete lines. Robot cells and machine-vision pick-checks lead the growth slate at a 5.45% CAGR, propelled by EV power-train assembly and end-of-line packaging. Distributed control systems remain dominant in the chemicals and refining industries, where uninterrupted processing and high-availability architectures justify premium spending. SCADA extensions gain traction in utilities undergoing digitization to support real-time asset health dashboards.

Interoperability pressure nudges OEMs to expose open APIs, enabling integrators to blend PLC, robot, vision, and sensor layers into a single digital twin. Customers favor hardware certified to IEC 61508 and EMC directives, minimizing re-approval cycles. The converged control stack underpins the expansion of the United Kingdom industrial automation system integrator market, because customers award bundled upgrades instead of piecemeal panel changes.

Design and engineering services accounted for 34.15% of 2025 revenue, as greenfield projects require simulation, hazard analysis, and proof-of-concept rigs. Managed services, combined with remote monitoring, exhibit the fastest trajectory at a 5.05% CAGR, converting project pipelines into annuities and increasing lifetime customer value. Installation and commissioning remain essential, but they shrink in proportion as modular plug-and-play hardware reduces on-site effort. Upgrades and retrofits increase because plant owners extend the service life of installed controls through drop-in I/O modules and cloud firmware updates.

Edge-enabled gateways stream encrypted telemetry to service-provider analytics centers that detect bearing wear or signal drift ahead of failure, enabling outcome-based contracts. Integrators now negotiate key performance indicators tied to throughput or scrap reduction, rather than hours billed, reinforcing trust and justifying premium pricing. The service shift anchors recurring revenue streams that stabilize the United Kingdom industrial automation system integrator industry against cyclical capex swings.

The UK Industrial Automation System Integrator Market is Segmented by Component (PLC, DCS, and More), Service Type (Design and Engineering, Installation and Commissioning, and More), End-User Industry (Automotive, Food and Beverage, and More), Technology (Industrial Internet of Things (IIoT) Platforms, Artificial Intelligence and Predictive Analytics, and More), and Region. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Wood PLC

- Jacobs U.K. Limited

- Siemens Mobility Limited

- Altec Engineering Limited

- Cougar Automation Limited

- Adsyst Automation Limited

- Au Automation Limited

- Emerson Process Management Limited

- Applied Automation (U.K.) Limited

- Automated Control Solutions Limited

- Cully Automation Limited

- ABB Limited

- Honeywell Control Systems Limited

- Rockwell Automation U.K. Limited

- Schneider Electric Systems U.K. Limited

- Mitsubishi Electric Europe B.V. (U.K. Branch)

- Yokogawa United Kingdom Limited

- Hitachi Rail STS U.K. Limited

- Linbrooke Services Limited

- Adelphi Automation Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digital Transformation and Industry 4.0 Adoption

- 4.2.2 Rising Demand for Productivity Amid UK Labor Shortages

- 4.2.3 Accelerated Robotics Uptake in Automotive Re-Tooling for EVs

- 4.2.4 Network Rail's Target 190plus Digital Signaling Rollout

- 4.2.5 Food and Drink "Vanishing-Horizon" Automation Funding

- 4.2.6 Regional 'Smart Machine Hubs' Backed by UK Government

- 4.3 Market Restraints

- 4.3.1 High Initial Capex and Integration Costs

- 4.3.2 Scarcity of Skilled Automation Engineers

- 4.3.3 OEM-Locked Intellectual-Property Barriers in Rail Signaling

- 4.3.4 Fragmented Legacy OT-IT Cybersecurity Standard

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Threat of New Entrants

- 4.8.2 Bargaining Power of Suppliers

- 4.8.3 Bargaining Power of Buyers

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

- 4.9 Key Use-cases Across Different Verticals

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Programmable Logic Controllers (PLC)

- 5.1.2 Distributed Control Systems (DCS)

- 5.1.3 Supervisory Control and Data Acquisition (SCADA)

- 5.1.4 Human-Machine Interface (HMI)

- 5.1.5 Industrial Robots and Machine Vision

- 5.1.6 Industrial Sensors and Networks

- 5.2 By Service Type

- 5.2.1 Design and Engineering

- 5.2.2 Installation and Commissioning

- 5.2.3 Maintenance and Support

- 5.2.4 Upgrades and Retrofits

- 5.2.5 Managed Services and Remote Monitoring

- 5.3 By End-user Industry

- 5.3.1 Automotive

- 5.3.2 Food and Beverage

- 5.3.3 Pharmaceuticals and Medical Devices

- 5.3.4 Energy and Power

- 5.3.5 Water and Wastewater

- 5.3.6 Metals and Mining

- 5.3.7 Electronics and Semiconductors

- 5.3.8 Oil and Gas

- 5.3.9 Other End-user Industries

- 5.4 By Technology

- 5.4.1 Industrial Internet of Things (IIoT) Platforms

- 5.4.2 Artificial Intelligence and Predictive Analytics

- 5.4.3 Digital Twin and Simulation

- 5.4.4 Edge Computing and 5G Connectivity

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Wood PLC

- 6.4.2 Jacobs U.K. Limited

- 6.4.3 Siemens Mobility Limited

- 6.4.4 Altec Engineering Limited

- 6.4.5 Cougar Automation Limited

- 6.4.6 Adsyst Automation Limited

- 6.4.7 Au Automation Limited

- 6.4.8 Emerson Process Management Limited

- 6.4.9 Applied Automation (U.K.) Limited

- 6.4.10 Automated Control Solutions Limited

- 6.4.11 Cully Automation Limited

- 6.4.12 ABB Limited

- 6.4.13 Honeywell Control Systems Limited

- 6.4.14 Rockwell Automation U.K. Limited

- 6.4.15 Schneider Electric Systems U.K. Limited

- 6.4.16 Mitsubishi Electric Europe B.V. (U.K. Branch)

- 6.4.17 Yokogawa United Kingdom Limited

- 6.4.18 Hitachi Rail STS U.K. Limited

- 6.4.19 Linbrooke Services Limited

- 6.4.20 Adelphi Automation Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment