PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940726

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940726

Southeast Asia Advertising - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

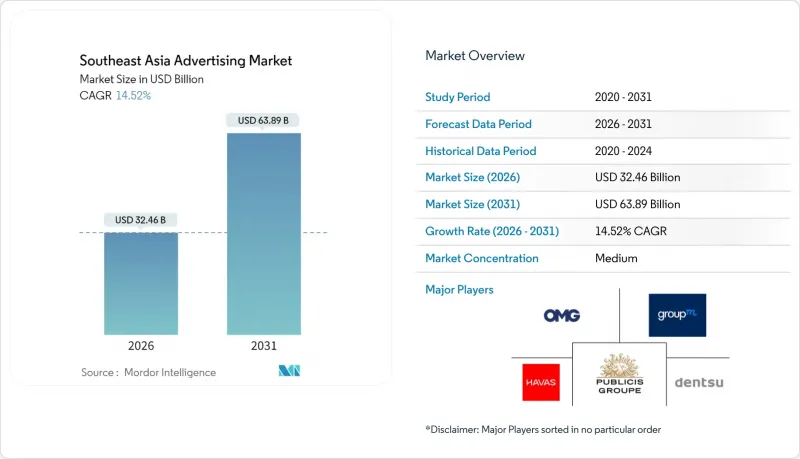

The South East Asia Advertising market was valued at USD 28.34 billion in 2025 and estimated to grow from USD 32.46 billion in 2026 to reach USD 63.89 billion by 2031, at a CAGR of 14.52% during the forecast period (2026-2031).

Revenue growth rides on rapid mobile-first digital adoption, AI-enabled campaign optimization, and government grants that help small businesses advertise online. While traditional channels still concentrate spending, the shift toward automated, data-rich formats is unmistakable, especially as monthly mobile data usage per smartphone is set to climb from 13 GB in 2023 to 59 GB by 2030. Super-app ecosystems, expanding retail media networks, and stronger measurement standards for Digital Out-of-Home (DOOH) are widening the channel mix and enhancing return on ad spend for brands across the region.

Southeast Asia Advertising Market Trends and Insights

Rising Mobile Broadband Penetration

Mobile connectivity is redefining ad reach across the Southeast Asia Advertising market. GSMA projects that monthly data usage will surge more than fourfold by 2030, opening space for high-bit-rate video and immersive formats that were previously bandwidth-constrained. With Indonesia's fixed broadband penetration below 20%, mobile is the default digital gateway, prompting advertisers to adopt location-based targeting and video-first creative. Faster speeds also enrich the data available to programmatic platforms, turning real-time engagement metrics into the primary mechanism for buying and optimizing inventory.

Accelerated Uptake of Programmatic DOOH

Digital billboards now stream dynamic ads shaped by live weather or traffic feeds. A July 2024 deal between Moving Walls and GroupM gave Malaysian buyers verified DOOH inventory, mitigating historical viewability doubts. In dense Singapore and Bangkok, algorithmic scheduling lets brands rotate creative by daypart, congested routes, or in-market behaviors pulled from mobile devices. Standard-setting bodies such as the Open Measurement in Out-of-Home Group released open-source impression frameworks, bringing the accountability that advertisers expect from online channels.

High Fragmentation of Publisher Inventory

Malaysia counts more than 300 billboard owners, forcing buyers to stitch together campaigns piecemeal. CtrlShift's AMP marketplace now aggregates inventory from seven major publishers, but scale remains limited. Smaller digital publishers across Indonesia and the Philippines compound the problem, lacking common ad-tech stacks or transparency in pricing. Fragmentation raises transaction costs, deters new entrants, and slows the growth trajectory of programmatic spend within the Southeast Asia Advertising market.

Other drivers and restraints analyzed in the detailed report include:

- Government-Led Digital-First SME Incentives

- AI-Driven Dynamic Creative Optimization

- Opaque Agency Rebate Practices

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Traditional channels retained a 60.12% share of the South East Asia Advertising market in 2025, buoyed by entrenched TV viewership among rural and older audiences. Yet the segment's modest growth contrasts with digital media's 15.05% CAGR, signaling an irreversible consumption pivot fueled by smartphones and cheaper data plans. Rapid gains stem from programmatic buying efficiencies and granular targeting that television or print cannot match. Thailand marked a pivotal moment in 2024 when digital ad spend surpassed TV, taking 45% versus 35%, underlining consumer migration to online video and social feeds.

Digital's advance is accelerated further by cross-border e-commerce campaigns demanding real-time localization, a capability only algorithmic channels can deliver. Meanwhile, cinema and classic outdoor formats remain relevant in dense metros, where premium audiences value immersive, brand-safe settings. Still, the differential in performance metrics, attribution, and audience data tilts budgets heavily toward digital, reinforcing a feedback loop that reshapes the spending mix of the Southeast Asia Advertising market over the forecast period.

Television's 29.35% stake in 2025 still positions it as the most lucrative single medium, reflecting both legacy habit and mass-reach efficiency. However, Digital Out-of-Home exhibits the highest trajectory at 15.72% CAGR, aided by falling screen costs, 5G connectivity, and standardized impression counting frameworks. Advertisers appreciate DOOH's ability to refresh creative by daypart or trigger ads based on localized stimuli such as weather or traffic congestion.

Traditional print and radio keep niche appeal, newspaper inserts among older readers, and commuter-time radio ads on high-congestion routes, but their share contracts as measurement gaps widen. Cinema capitalizes on blockbuster releases for premium placements, yet venue capacity caps growth. Digital advertising covering search, social, display, and OTT video continues to siphon dollars from broadcast budgets, riding on better attribution models and AI-enhanced creative testing that optimize in-flight performance for brands across the Southeast Asia Advertising market.

The South East Asia Advertising Market Report is Segmented by Channel Type (Traditional Media and Digital Media), Advertising Medium (Television, Digital Advertising, Print, and More), Transaction Type (Programmatic and Non-Programmatic), End-User Industry (FMCG, Retail and E-Commerce, Automotive, BFSI, Telecom and IT, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Dentsu International Asia Pte. Ltd.

- GroupM Asia Pacific Holdings Ltd.

- Omnicom Media Group Asia Pacific Pte. Ltd.

- Publicis Groupe SA

- Havas Media Asia Pacific Pte. Ltd.

- IPG Mediabrands Singapore Pte. Ltd.

- JCDecaux Singapore Pte. Ltd.

- Clear Channel Singapore Pte. Ltd.

- XCO Media Pte. Ltd.

- Mediacorp OOH Media Pte. Ltd.

- Moove Media Pte. Ltd.

- SPH Media Limited (SPHMBO)

- Moving Walls Sdn. Bhd.

- Spectrum Outdoor Sdn. Bhd.

- TAC Media Sdn. Bhd.

- VGI Global Media Public Co. Ltd.

- Sea Digital Media Pte. Ltd.

- AdColony (Digital Turbine Singapore Pte. Ltd.)

- GrabAds Holdings Pte. Ltd.

- Gojek Ads (PT Dompet Anak Bangsa)

- Kantar Media Singapore Pte. Ltd.

- Innity Corporation Berhad

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising mobile broadband penetration

- 4.2.2 Accelerated uptake of programmatic DOOH

- 4.2.3 Government-led digital-first SME incentives

- 4.2.4 AI-driven dynamic creative optimisation

- 4.2.5 Super-app advertising ecosystems (Grab, Gojek)

- 4.2.6 Cross-border e-commerce boom

- 4.3 Market Restraints

- 4.3.1 High fragmentation of publisher inventory

- 4.3.2 Opaque agency rebate practices

- 4.3.3 Stringent personal-data regulations (PDPA variants)

- 4.3.4 Limited measurement standards for DOOH

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Channel Type

- 5.1.1 Traditional Media

- 5.1.2 Digital Media

- 5.2 By Advertising Medium

- 5.2.1 Television

- 5.2.2 Digital Advertising

- 5.2.3 Print

- 5.2.4 Radio

- 5.2.5 Cinema

- 5.2.6 Out-of-Home (OOH)

- 5.2.7 Digital OOH (DOOH)

- 5.3 By Transaction Type

- 5.3.1 Programmatic

- 5.3.2 Non-Programmatic

- 5.4 By End-User Industry

- 5.4.1 Fast-Moving Consumer Goods (FMCG)

- 5.4.2 Retail and E-commerce

- 5.4.3 Automotive

- 5.4.4 BFSI

- 5.4.5 Telecom and IT

- 5.4.6 Healthcare and Pharma

- 5.4.7 Travel and Tourism

- 5.4.8 Other End-User Industries

- 5.5 By Country

- 5.5.1 Singapore

- 5.5.2 Malaysia

- 5.5.3 Indonesia

- 5.5.4 Thailand

- 5.5.5 Vietnam

- 5.5.6 Philippines

- 5.5.7 Other Countries (Cambodia, Laos, Myanmar, Brunei, Timor-Leste)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Dentsu International Asia Pte. Ltd.

- 6.4.2 GroupM Asia Pacific Holdings Ltd.

- 6.4.3 Omnicom Media Group Asia Pacific Pte. Ltd.

- 6.4.4 Publicis Groupe SA

- 6.4.5 Havas Media Asia Pacific Pte. Ltd.

- 6.4.6 IPG Mediabrands Singapore Pte. Ltd.

- 6.4.7 JCDecaux Singapore Pte. Ltd.

- 6.4.8 Clear Channel Singapore Pte. Ltd.

- 6.4.9 XCO Media Pte. Ltd.

- 6.4.10 Mediacorp OOH Media Pte. Ltd.

- 6.4.11 Moove Media Pte. Ltd.

- 6.4.12 SPH Media Limited (SPHMBO)

- 6.4.13 Moving Walls Sdn. Bhd.

- 6.4.14 Spectrum Outdoor Sdn. Bhd.

- 6.4.15 TAC Media Sdn. Bhd.

- 6.4.16 VGI Global Media Public Co. Ltd.

- 6.4.17 Sea Digital Media Pte. Ltd.

- 6.4.18 AdColony (Digital Turbine Singapore Pte. Ltd.)

- 6.4.19 GrabAds Holdings Pte. Ltd.

- 6.4.20 Gojek Ads (PT Dompet Anak Bangsa)

- 6.4.21 Kantar Media Singapore Pte. Ltd.

- 6.4.22 Innity Corporation Berhad

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment