PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940734

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940734

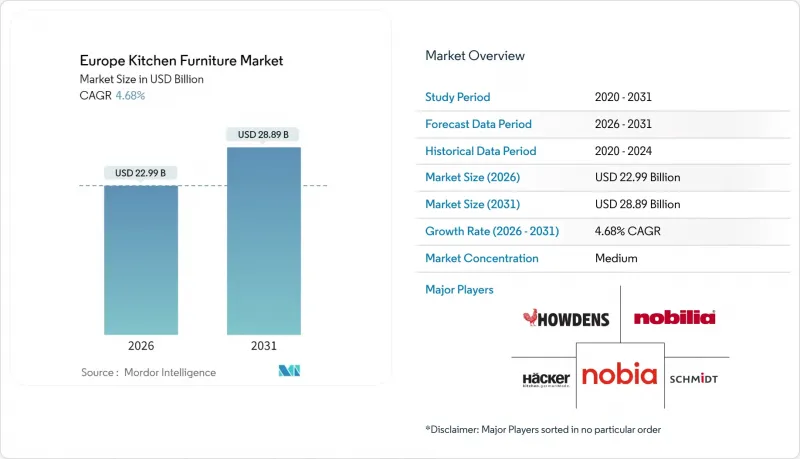

Europe Kitchen Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe kitchen furniture market size in 2026 is estimated at USD 22.99 billion, growing from 2025 value of USD 21.96 billion with 2031 projections showing USD 28.89 billion, growing at 4.68% CAGR over 2026-2031.

Modular remodeling, sustainability mandates, and digital buying journeys underpin this steady trajectory even as residential construction weakens across several member states. Demand tilts toward space-saving formats that merge cooking, dining, and storage zones; meanwhile, retailers strengthen omnichannel pipes to shorten design-to-delivery times and lift conversion. Manufacturers race to secure certified wood and recyclable metals, buffering regulatory risk while using eco-labels as price-premium levers. Competitive intensity remains moderate: established German, Italian, and Nordic brands wield vertical integration, whereas Asian importers play the low-price card. Long-run opportunities concentrate around smart-kitchen dock integration, circular take-back programs, and project-based commercial renovations that value turnkey performance over unit cost.

Europe Kitchen Furniture Market Trends and Insights

Rising Demand for Modular Kitchens & Remodeling Activity

Renovation now buffers the Europe kitchen furniture market against sluggish new housing. Remodeling captured 30.3% of all construction outlays in 2023, enabling cabinet producers to balance factory loads and stabilize margins. Mid-market brands exploit modularity to mass-customize without high scrap, while kitchen islands evolve into multifunction hubs that hold induction panels, downdraft vents, and charging docks. German suppliers note higher order conversion when installers can finish a 12-unit apartment block in two workdays, highlighting the time-saving halo around factory-finished modules. The practice also expands aftermarket potential because damaged door fronts or drawer boxes can be swapped without dismantling the full layout, creating annuity-style revenue streams.

Urban Smaller Households Driving Compact & Space-Saving Designs

Average EU household size slipped below 2.2 persons in 2024, a demographic twist magnifying the quest for collapsing tables, pocket doors, and pull-out pantries. Milan and Paris apartments under 55 m2 often specify full-height monolithic fronts that hide appliances, turning the kitchen into a seamless continuation of the living zone. Hardware innovators such as Hawa report double-digit sales growth for pivot-sliding tracks that let doors disappear into cabinetry walls, freeing critical circulation space . The space challenge also spurs growth in integrated downdraft ventilation and combination steam ovens, both of which eliminate overhead hoods and separate cooking appliances. Manufacturers that bundle these solutions with compact cabinets capture incremental margin while solving a tangible floor-plan pain point.

Volatile Wood & Panel Prices Amid Supply Constraints

Producer price indices in Germany show cumulative 50% jumps for particleboard since late 2020, crimping gross margins and making six-month fixed quotes risky. Smaller Italian studios now schedule quarterly price reviews with dealers to dodge currency and commodity mismatches. Some firms hedge by substituting plywood back panels with honeycomb aluminum, but face learning curves on adhesive selection and screw pull-out strength. Exporters to the United Kingdom also juggle new phytosanitary checks that add port dwell costs, further inflating landed prices. Wider adoption of long-term wood futures contracts is under discussion but limited by liquidity concerns.

Other drivers and restraints analyzed in the detailed report include:

- Growth of E-Commerce & Omnichannel Retail for Furniture

- Consumer Shift to Eco-Friendly Certified Wood Under EU Green Deal

- Increasing Low-Cost Imports from Asia Intensifying Price Pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, cabinets accounted for 58.64% of the European kitchen furniture market, primarily due to their high ticket values and frequent replacement cycles. The segment benefits from modular grid systems, which support 'batch-size-1' production. This approach minimizes inventory excess and enables factories to fulfill custom orders within days rather than weeks. Smart-ready cabinets equipped with concealed power rails are sold at double-digit premiums, reflecting their growing demand. Additionally, luxury product lines have introduced biometric drawers, further enhancing the appeal of high-end cabinets. Chairs, although a smaller segment, are experiencing the fastest growth, with a compound annual growth rate (CAGR) of 5.08%. This growth is attributed to the increasing popularity of open-plan layouts, which blur the boundaries between dining and preparation areas.

The persistence of remote work has also influenced market trends. Dining tables are now frequently doubling as workstations, driving steady sales of multifunctional table designs. These tables cater to the evolving needs of consumers who require versatile furniture for both professional and personal use. The shift in consumer preferences highlights the importance of adaptability in kitchen furniture design. Overall, the European kitchen furniture market is witnessing significant innovation and growth. Manufacturers are leveraging advanced production techniques and integrating smart features to meet changing consumer demands. The focus on customization, functionality, and premium offerings is shaping the competitive landscape of the market in 2025.

Wood holds 65.85% of the value attributed to tactile warmth and certified sourcing. Oak, ash, and walnut veneers dominate the market, often finished with water-borne lacquers to comply with VOC regulations. Composite plywood substrates are increasingly favored due to their cost-effectiveness and stability, supporting the transition to recyclable furniture frameworks. These materials align with sustainability goals while maintaining functionality and aesthetic appeal, making them a preferred choice for manufacturers and consumers alike.

Metal components are experiencing robust growth, with a 5.98% CAGR driven by brushed-aluminum frames and stainless-steel worktops, valued for their industrial design and hygienic properties. Manufacturers are diversifying offerings by introducing powder-coated steel legs and anodized trims, which provide color variety without compromising durability. Mixed-material designs, such as walnut fronts framed in aluminum, are gaining traction as they help brands mitigate risks from commodity price fluctuations while expanding style options. This combination of materials allows manufacturers to cater to evolving consumer preferences and maintain a competitive edge in the market.

The Europe Kitchen Furniture Market Report is Segmented by Product (Kitchen Cabinets, Kitchen Chairs, Kitchen Tables, Other Products), Material (Wood, Metal, Plastic & Polymer, Other Materials), End-User (Residential, Commercial), Distribution Channel (B2C/Retail, B2B/Project), and Geography (UK, Germany, France, Spain, Italy, BENELUX, NORDICS, Rest of Europe). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Nobilia

- Howdens Joinery Group

- Schmidt Groupe

- Hacker Kuchen

- Nobia AB

- IKEA

- Scavolini

- Snaidero Group

- Leicht Kuchen

- SieMatic

- Wren Kitchens

- Poggenpohl

- Bulthaup

- Nolte Kuchen

- Veneta Cucine

- Ballerina Kuchen

- Magnet

- Kvik

- Doca

- Lago

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising demand for modular kitchens & remodeling activity

- 4.2.2 Urban smaller households driving compact & space-saving designs

- 4.2.3 Growth of e-commerce & omnichannel retail for furniture

- 4.2.4 Consumer shift to eco-friendly certified wood under EU Green Deal

- 4.2.5 Emergence of circular refurbish & take-back kitchen modules

- 4.2.6 Manufacturer inventory build-up ahead of EU deforestation & plywood tariffs

- 4.3 Market Restraints

- 4.3.1 Volatile wood & panel prices amid supply constraints

- 4.3.2 Increasing low-cost imports from Asia intensifying price pressure

- 4.3.3 Weak housing starts & discretionary spending in key EU economies

- 4.3.4 Compliance costs for upcoming EU recyclability regulations

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Bargaining Power of Buyers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Insights into the Latest Trends and Innovations in the Market

- 4.7 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Industry

5 Market Size & Growth Forecasts (Value in USD)

- 5.1 By Product

- 5.1.1 Kitchen Cabinets

- 5.1.2 Kitchen Chairs

- 5.1.3 Kitchen Tables

- 5.1.4 Other Products (trolley, cart, pantry shelves)

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Other Materials

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Distribution Channel

- 5.4.1 B2C / Retail

- 5.4.1.1 Home Centers

- 5.4.1.2 Specialty Furniture Stores

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B / Project

- 5.4.1 B2C / Retail

- 5.5 By Country

- 5.5.1 United Kingdom

- 5.5.2 Germany

- 5.5.3 France

- 5.5.4 Spain

- 5.5.5 Italy

- 5.5.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Nobilia

- 6.4.2 Howdens Joinery Group

- 6.4.3 Schmidt Groupe

- 6.4.4 Hacker Kuchen

- 6.4.5 Nobia AB

- 6.4.6 IKEA

- 6.4.7 Scavolini

- 6.4.8 Snaidero Group

- 6.4.9 Leicht Kuchen

- 6.4.10 SieMatic

- 6.4.11 Wren Kitchens

- 6.4.12 Poggenpohl

- 6.4.13 Bulthaup

- 6.4.14 Nolte Kuchen

- 6.4.15 Veneta Cucine

- 6.4.16 Ballerina Kuchen

- 6.4.17 Magnet

- 6.4.18 Kvik

- 6.4.19 Doca

- 6.4.20 Lago

7 Market Opportunities & Future Outlook

- 7.1 Expansion of Cross-Border E-Commerce Platforms for Customized Kitchens

- 7.2 Rising Adoption of Compact, Flexible Kitchen Islands in Urban Renovations