PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940735

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940735

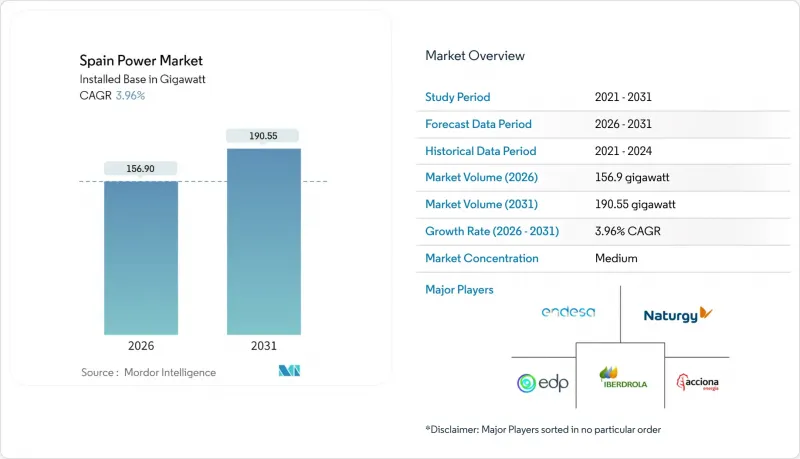

Spain Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Spain Power Market is expected to grow from 150.93 gigawatt in 2025 to 156.9 gigawatt in 2026 and is forecast to reach 190.55 gigawatt by 2031 at 3.96% CAGR over 2026-2031.

The expansion is propelled by the country's accelerated renewables build-out, EU decarbonization mandates, and strong corporate appetite for clean power purchase agreements. Solar PV became the nation's single largest power source in 2024, confirming Spain's pivot toward low-carbon generation. A grid-modernization agenda that prioritizes extra-high-voltage corridors, alongside EU-backed storage funding, is enabling ever-larger volumes of intermittent output to connect. Meanwhile, industrial electrification, e-mobility incentives, and data-center development are reshaping load profiles and sustaining demand for grid-connected renewables. Finally, the reversal of the nuclear phase-out adds baseload resilience and delays capacity-adequacy concerns while transmission upgrades catch up.

Spain Power Market Trends and Insights

Accelerating Grid-Connected Solar PV Build-Out

Spain's solar segment set a watershed in 2024 when it overtook gas and wind as the country's top power source. Authorities cleared 26,159.2 MW of renewable construction in 2024, 22,326.1 MW of which is PV, underscoring cost declines, streamlined permitting, and corporate REC demand. Castilla y Leon, Aragon, and Castilla-La Mancha garnered the largest quotas, benefiting from superior irradiation and land availability. Distributed rooftop systems are likewise proliferating across industrial estates, cutting energy bills and Scope-2 emissions. Together, utility-scale and on-site arrays are raising the Spain electricity market's renewable penetration, easing compliance with the 81% green-power target for 2030.

Corporate PPAs Led by Hyperscale Data-Center Entrants

Demand from hyperscale platforms is reshaping revenue models in the Spain electricity market. Google's 35 MW, 10-year wind PPA, Amazon's 469 MW solar commitment, and Apple's 105 MW deal illustrate a shift toward developer-financed build-outs backstopped by tech majors. Data-center capacity could hit 600 MW in 2026 and 3,000 MW by 2030, sustaining multi-gigawatt renewable pipelines. PPAs provide bankable cash flows, lower financing costs, and dovetail with hyperscalers' net-zero strategies, accelerating installations beyond traditional utility procurement volumes.

Escalating Transmission Upgrade CAPEX

Red Electrica budgets EUR 6.5 billion for reinforcements through 2026, yet identifies a EUR 10 billion need by 2030, leaving a EUR 3.5 billion gap. Tariff caps limit annual hikes to 15%, throttling cost recovery. Substation builds face land disputes, with 8 of 15 400-kV facilities delayed two years by legal appeals. Steel and copper inflation pushed line costs from EUR 1.2 million /km in 2020 to EUR 1.8 million /km in 2024. Absent reform, 5 TWh of renewable output could be shed each year by 2028, trimming effective solar utilization to 22%.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Electrification of Mobility & Heating

- EU Fit-for-55 & NECP-2030 Decarbonisation Mandates

- Lengthy Environmental & Municipal Permitting

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Renewables accounted for 67.10% of installed capacity in 2025, and their 6.95% yearly advance ensures the Spain power market size for clean sources rises from 101.27 GW in 2025 to 150.66 GW in 2031. Solar photovoltaic eclipsed wind at 32.0 GW versus 32.0 GW in January 2025, propelled by low auction tariffs and 24% capacity factors. Repowering lifts onshore wind productivity without new land, while 2 GW of floating offshore leases open an untapped marine resource. Hydropower remains steady at 17 GW but suffers from lower reservoir levels that curb peak-shaving ability. Coal's exit by 2027 and gas's shift to peaking duty-free capacity for renewables will yet tighten reserve margins on low-wind, low-sun days.

Thermal fleets fell to 25.80% of capacity in 2025. Endesa's coal phase-out removed 2 GW, slashing 12 million tpy of CO2. Combined-cycle gas totals 24 GW but runs fewer hours as renewables scale, with hybrid storage enabling four-hour ramps. Nuclear stays flat at 7.1 GW through 2035, after which closures leave a 50 TWh gap to fill with imports or batteries. Biomass grows from 1.2 GW to a projected 1.8 GW by 2030 under circular-economy incentives. Together, this transformation underlines how the Spain power market pivots toward carbon-free technologies even as grid flexibility challenges mount.

The Spain Power Market Report is Segmented by Power Source (Thermal, Nuclear, and Renewables) and End-User (Utilities, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Endesa S.A.

- Iberdrola S.A.

- Naturgy Energy Group S.A.

- EDP Group (EDP HC Energia)

- Acciona Energia

- Repsol Electricidad y Gas

- Grupo Red Electrica

- Siemens Gamesa Renewable Energy

- Nordex SE

- TotalEnergies SE

- Enel Green Power Espana

- Vestas Mediterranean

- ABO Wind AG

- Engie Espana

- Capital Energy

- Forestalia Renovables

- Grenergy Renovables

- Hive Energy Spain

- Solarpack Corporacion Tecnologica

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating grid-connected solar PV build-out

- 4.2.2 Repowering of 1990s-2000s wind farms

- 4.2.3 Corporate PPAs led by hyperscale data-centre entrants

- 4.2.4 EU Fit-for-55 & NECP-2030 decarbonisation mandates

- 4.2.5 Rapid electrification of mobility & heating

- 4.2.6 EU funding for cross-border HVDC links

- 4.3 Market Restraints

- 4.3.1 Escalating transmission upgrade CAPEX

- 4.3.2 Lengthy environmental & municipal permitting

- 4.3.3 Rising curtailment risk in resource-rich regions

- 4.3.4 Local opposition to on-shore wind siting

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Power Source

- 5.1.1 Thermal (Coal, Natural Gas, Oil and Diesel)

- 5.1.2 Nuclear

- 5.1.3 Renewables (Solar, Wind, Hydro, Geothermal, Biomass & Waste, Tidal)

- 5.2 By End User

- 5.2.1 Utilities

- 5.2.2 Commercial and Industrial

- 5.2.3 Residential

- 5.3 By T&D Voltage Level (Qualitative Analysis only)

- 5.3.1 High-Voltage Transmission (Above 230 kV)

- 5.3.2 Sub-Transmission (69 to 161 kV)

- 5.3.3 Medium-Voltage Distribution (13.2 to 34.5 kV)

- 5.3.4 Low-Voltage Distribution (Up to 1 kV)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Endesa S.A.

- 6.4.2 Iberdrola S.A.

- 6.4.3 Naturgy Energy Group S.A.

- 6.4.4 EDP Group (EDP HC Energia)

- 6.4.5 Acciona Energia

- 6.4.6 Repsol Electricidad y Gas

- 6.4.7 Grupo Red Electrica

- 6.4.8 Siemens Gamesa Renewable Energy

- 6.4.9 Nordex SE

- 6.4.10 TotalEnergies SE

- 6.4.11 Enel Green Power Espana

- 6.4.12 Vestas Mediterranean

- 6.4.13 ABO Wind AG

- 6.4.14 Engie Espana

- 6.4.15 Capital Energy

- 6.4.16 Forestalia Renovables

- 6.4.17 Grenergy Renovables

- 6.4.18 Hive Energy Spain

- 6.4.19 Solarpack Corporacion Tecnologica

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment