PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940789

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940789

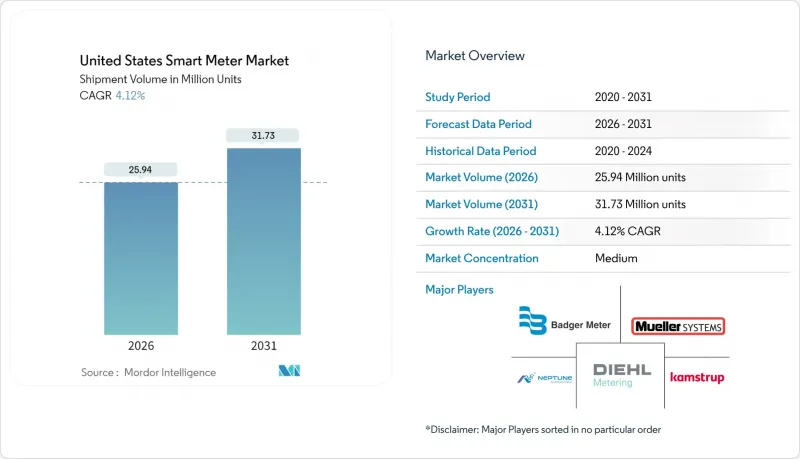

United States Smart Meter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States smart meter market size in 2026 is estimated at 25.94 million units, growing from 2025 value of 24.91 million units with 2031 projections showing 31.73 million units, growing at 4.12% CAGR over 2026-2031.

The surge is being underpinned by federal infrastructure spending, state-level renewable mandates, and a utility pivot away from legacy analog equipment. Hardware still captures most capital outlay, yet recurring service revenues are rising as data management, cyber-security monitoring, and advanced analytics shift to subscription models. Investor-owned utilities account for the bulk of new installations, but rural electric cooperatives are rapidly closing the gap after gaining direct access to federal funds. Communication technologies are diversifying-RF mesh remains the anchor, although cellular and NB-IoT connections are accelerating in sparsely populated service territories. Collectively, these threads indicate a market in transition from device deployment to data-driven grid orchestration, with customer engagement applications poised to unlock the next wave of value creation.

United States Smart Meter Market Trends and Insights

Higher Consumer Awareness and Federal Mandates

Federal infrastructure legislation has re-ordered utility investment priorities. The Infrastructure Investment and Jobs Act allocates USD 65 billion for grid resilience, positioning smart meters as foundational assets rather than optional upgrades. Consumer attitudes have flipped from skepticism to demand as extreme weather events spotlight grid fragility. State commissions increasingly embed Advanced Metering Infrastructure (AMI) requirements into rate cases, cutting the red tape that previously delayed rollouts. The DOE Grid Resilience and Innovation Partnerships program reserves USD 10.9 billion for projects that pair smart meters with flexibility solutions, while Massachusetts approved USD 1.17 billion of AMI spend across three utilities in 2024. This alignment eliminates stranded-asset risk and fast-tracks statewide installation schedules.

Expansion of Advanced Metering Infrastructure Funding Programs

The market is benefiting from a shift toward formula-based federal allocations that guarantee multi-year capital availability, easing balance-sheet pressure for regulated utilities. GRIP grants now rank cyber-security compliance and open-standards interoperability as scoring criteria, tilting awards toward vendors with hardened architectures. Rural electric cooperatives are new power players, pooling demand under joint procurement groups to draw bulk discounts for meters and cellular modules. State match-funding-such as California's Self-Generation Incentive Program-further leverages federal dollars, while domestic-content rules channel spending to manufacturers like Badger Meter that operate U.S. plants. The predictable funding pipeline encourages larger, contiguous deployment blocks, accelerating network effects and data monetization potential.

Cyber-Security and Privacy Concerns in AMI Networks

The biggest near-term drag on rollouts is the heightened focus on supply-chain integrity. NIST Cyber-Security Framework 2.0 elevates vendor vetting from a checklist to a board-level governance issue. Utilities are commissioning third-party penetration tests before signing purchase orders, adding months to procurement cycles. State commissions now require formal cyber-risk mitigation plans in AMI filings; NARUC guidance specifically calls out encryption, key management, and incident-response playbooks. Utilities will not completely halt deployments, but the added controls slow volume ramps and raise non-hardware costs.

Other drivers and restraints analyzed in the detailed report include:

- Utility Decarbonization and Electrification Roadmaps

- Rise of Time-of-Use Tariffs Driving Real-Time Metering Needs

- Supply-Chain Disruptions for Semiconductor Components

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart electricity meters retained a 68.02% share of the United States smart meter market in 2025. They rode on regulatory mandates, cost-recovery guarantees, and field-proven ROI from outage management and remote connect or disconnect functions. The segment's entrenched vendor ecosystem allows utilities to negotiate favorable pricing, which, in turn, supports large-block tenders in rural territories. The United States smart meter market size for electricity deployments is expected to reach 21.66 million units by 2031, expanding in lockstep with grid-edge automation upgrades.

Growth in water metering is accelerating because municipalities face mounting leakage fines and drought-related conservation goals. Although unit prices are higher than for electric meters, rising water tariffs improve the payback calculus. Cellular modules are frequently specified to avoid RF signal loss inside subterranean vaults, and cloud analytics pinpoint non-revenue water. Consequently, the water segment is projected to add 1.14 million new nodes between 2026 and 2031, closing part of the volume gap with electricity meters. Gas and heat meters trail in both absolute and relative terms because safety codes and complex installation rules extend project timelines. Still, advances in LPWAN and explosion-proof enclosures could invigorate rural gas deployments in the latter half of the decade.

The residential segment accounted for 71.74% of installations in 2025, reflecting wrap-around utility programs that combine meter rollout, customer portals, and demand response enrollment. Because installation crews can move house-to-house with standardized processes, per-unit labor costs are low, reinforcing the segment's leadership in the United States smart meter market. The United States smart meter market share for residential users is unlikely to drop below 70% before 2031, even as other end-users accelerate deployments.

Utility-owned operational meters-installed on transformers, capacitor banks, and distribution feeders-represent the fastest-growing slice, advancing at a 4.78% CAGR. These devices deliver visibility into loading profiles, voltage deviations, and phase imbalances. Utilities deploy them in tandem with DER hosting-capacity studies to defer capital upgrades. Commercial and industrial adoption remains healthy but not spectacular; many large facilities already sport building-management systems that substitute for utility-supplied meters. Still, the push toward carbon disclosure standards is nudging corporations toward utility-grade data for audit trails and Scope 2 reporting.

The United States Smart Meter Market Report is Segmented by Type (Smart Electricity Meters, Smart Gas Meters, Smart Water Meters, and Smart Heat Meters), End-User (Residential, Commercial, Industrial, and Utilities), Communication Technology (RF Mesh, Power Line Communication [PLC}, Cellular, and More), Component (Hardware, Software, and Services), and Geography. The Market Forecasts are Provided in Terms of Volume (Units).

List of Companies Covered in this Report:

- Badger Meter Inc.

- Mueller Water Products Inc. (Mueller Systems LLC)

- Diehl Metering LLC

- Kamstrup A/S

- Neptune Technology Group Inc.

- General Electric Company

- Itron Inc.

- Sensus USA Inc. (Xylem Inc.)

- Elster American Meter LLC (Honeywell International Inc.)

- Landis+Gyr AG

- Aclara Technologies LLC

- Schneider Electric SE

- Siemens AG

- Silver Spring Networks Inc. (Itron)

- Zenner USA

- EDMI Limited

- Oracle Corporation

- Trilliant Holdings Inc.

- Sense Labs Inc.

- Ossiaco Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Higher consumer awareness and federal mandates

- 4.2.2 Expansion of Advanced Metering Infrastructure funding programs

- 4.2.3 Utility decarbonization and electrification roadmaps

- 4.2.4 Rise of Time-of-Use tariffs driving real-time metering needs

- 4.2.5 5G and NB-IoT rollout improving meter connectivity

- 4.2.6 Integration of distributed energy resources and V2G ecosystems (under-reported)

- 4.3 Market Restraints

- 4.3.1 Cyber-security and privacy concerns in AMI networks

- 4.3.2 Supply-chain disruptions for semiconductor components (under-reported)

- 4.3.3 Slower smart gas meter cost-benefit realization

- 4.3.4 Inter-utility data standardization gaps (under-reported)

- 4.4 Industry Ecosystem Analysis

- 4.5 Regulatory Landscape

- 4.6 Smart Grid Initiatives Analysis

- 4.7 Impact of Macroeconomic Factors

- 4.8 Technological Outlook

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Intensity of Competitive Rivalry

- 4.9.5 Threat of Substitutes

5 MARKET SIZE AND GROWTH FORECASTS (SHIPMENT VOLUME)

- 5.1 By Type

- 5.1.1 Smart Electricity Meters

- 5.1.2 Smart Gas Meters

- 5.1.3 Smart Water Meters

- 5.1.4 Smart Heat Meters

- 5.2 By End-User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.2.4 Utilities

- 5.3 By Communication Technology

- 5.3.1 RF Mesh

- 5.3.2 Power Line Communication (PLC)

- 5.3.3 Cellular (3G/4G/5G, NB-IoT)

- 5.3.4 Other Communication Technologies (Wi-SUN, ZigBee, LoRa)

- 5.4 By Component

- 5.4.1 Hardware (Meters, Communication Modules)

- 5.4.2 Software (MDM, Analytics)

- 5.4.3 Services (Deployment, Managed Services)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Vendor Market Share Analysis

- 6.5 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.5.1 Badger Meter Inc.

- 6.5.2 Mueller Water Products Inc. (Mueller Systems LLC)

- 6.5.3 Diehl Metering LLC

- 6.5.4 Kamstrup A/S

- 6.5.5 Neptune Technology Group Inc.

- 6.5.6 General Electric Company

- 6.5.7 Itron Inc.

- 6.5.8 Sensus USA Inc. (Xylem Inc.)

- 6.5.9 Elster American Meter LLC (Honeywell International Inc.)

- 6.5.10 Landis+Gyr AG

- 6.5.11 Aclara Technologies LLC

- 6.5.12 Schneider Electric SE

- 6.5.13 Siemens AG

- 6.5.14 Silver Spring Networks Inc. (Itron)

- 6.5.15 Zenner USA

- 6.5.16 EDMI Limited

- 6.5.17 Oracle Corporation

- 6.5.18 Trilliant Holdings Inc.

- 6.5.19 Sense Labs Inc.

- 6.5.20 Ossiaco Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment