PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940795

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940795

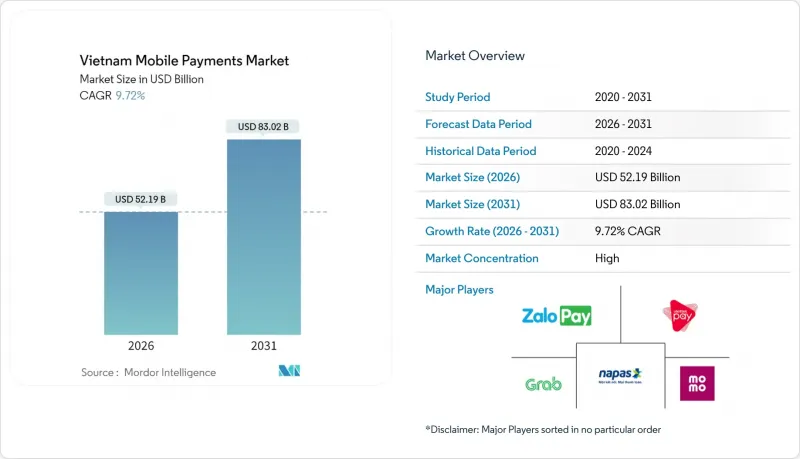

Vietnam Mobile Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Vietnam mobile payments market was valued at USD 47.56 billion in 2025 and estimated to grow from USD 52.19 billion in 2026 to reach USD 83.02 billion by 2031, at a CAGR of 9.72% during the forecast period (2026-2031).

Widespread smartphone ownership, 5G rollouts, and a policy mandate for 80% cashless public-service transactions create sustained demand for real-time digital payments [sbv.gov.vn]. Remote payment dominance, cross-border QR interoperability with Thailand, Singapore, Cambodia, and Laos, and aggressive super-app expansion collectively reinforce Vietnam's position as Southeast Asia's payment integration hub. Extension of the Mobile Money pilot program, the July 2025 legal recognition of e-wallets, and an 86.97% bank-account penetration rate reduce structural adoption barriers. Intensifying proximity transaction growth, led by Apple Pay's arrival and 75% contactless penetration on Visa rails, signals a shift from remote-only habits toward omnichannel payment behaviour. Meanwhile, biometric authentication cuts fraud by up to 57%, supporting consumer trust and widening the use-case spectrum across retail, transport, utilities, and government services.

Vietnam Mobile Payments Market Trends and Insights

Government Push for Cashless Economy

Vietnam's National Digital Transformation Program requires 80% cashless settlement for all public-service fees by 2030, obliging ministries and provincial agencies to integrate mobile payment rails. Mandatory VNeID linkage with major e-wallets simplifies tax, licensing, and welfare disbursement payments. ZaloPay's education-fee solution illustrates regulatory alignment that opens cross-border tuition flows previously constrained by manual wire transfers. The fintech sandbox hosts 15 licensed firms, shortening go-to-market cycles for novel payment models. Policy continuity sets Vietnam mobile payments market on a region-leading modernization path and influences peer ASEAN regulators.

Surge in E-commerce Spend

Online transaction values exceeded USD 18.2 billion in 2024; 73% cleared via mobile wallets integrated into super-apps that bundle shopping, delivery, and payments. ShopeePay's automated VAT reporting eliminates manual uploads, boosting merchant compliance and loyalty. Buy-now-pay-later (BNPL) via Cake by VPBank increases average ticket sizes among 25-35-year-olds, who form 68% of BNPL users. Cross-platform loyalty earning Grab ride credits redeemable on Zalo storesdrives higher purchase frequency than siloed apps. The momentum sustains remote volumes while funnelling incremental demand into proximity contexts such as pop-up kiosks and live-commerce events.

Cyber-fraud and Phishing Incidents

The BianLian trojan compromised 12,000 accounts in early 2025, spiking fraudulent volumes 34% year-over-year in Q1 2025. Subsequent mandates for biometric sign-in and device-level tokenization cut successful fraud attempts by up to 57%, yet compliance costs pressure small wallets running thin margins. Publicized breaches briefly dented trust among users over 45, who make up 23% of potential adopters, causing temporary slowdowns in new registrations. Annual security audits and real-time monitoring, now compulsory under State Bank directives, heighten operational outlays.

Other drivers and restraints analyzed in the detailed report include:

- Super-app Ecosystem Partnerships

- Cross-border QR Linkage with Thailand and Singapore

- Low Financial-literacy Pockets in Rural Areas

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Remote payments accounted for 68.72% Vietnam mobile payments market share in 2025 and continue scaling through one-click checkout on Shopee and Tiki. Vietnam's mobile payments market size for proximity transactions will grow at a 13.58% CAGR to 2031 as NFC infrastructure spreads across 100,000 new terminals in supermarkets, convenience stores, and metro turnstiles. Contactless Visa transactions already reach 75%, indicating readiness for face-to-face adoption. Remote volume growth now funnels into rural e-commerce, aided by simplified user interfaces and local-language support, while proximity gains urban mindshare in transport and quick-service retail.

Expanding proximity usage is underpinned by Apple Pay's December 2024 launch through Vietcombank, Techcombank, and VPBank, which accelerated merchant upgrades to NFC readers. Public-transport operators in Ho Chi Minh City observe 70% cashless ridership, cutting boarding times. Remote payment providers broaden into subscription billing and charity donations, keeping penetration high even as proximity narrows the gap.

QR transactions represented 54.88% of Vietnam mobile payments market size in 2025 thanks to VietQR, which unified disparate systems across 2.1 million merchants. The standard halves onboarding time for SMEs and ensures user familiarity with single flow scanning. NFC tap-to-pay, with a 12.96% projected CAGR, attracts premium-phone users accustomed to in-store convenience. USSD-based transfers sustain relevance in low-data environments, holding 8.62% share, particularly among basic-phone owners in mountainous provinces.

Mobile wallet transfers, at 22.45% share, capitalize on P2P culture and contain loyalty ecosystems that lock users in via cash-back and coupon rewards. July 2025 recognition of all payment modes under Circular 40/2024 removes legacy institutional skepticism, leading to wider acceptance among utilities and public sector agencies that previously limited themselves to bank transfers.

The Vietnam Mobile Payments Market Report is Segmented by Payment Type (Proximity Payment, Remote Payment), Payment Mode (NFC Tap-To-Pay, QR Code, USSD/SMS, Mobile Wallet App Balance Transfer), End-User (Retail and Consumer Goods, Transport and Ticketing, Utilities and Public Services, Hospitality and Entertainment), Transaction Type (P2P, P2B, B2B), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- MoMo (M-Service JSC)

- Viettel Digital Services Corporation (ViettelPay)

- ZION JSC (ZaloPay)

- Grab Financial Group Vietnam Co., Ltd. (GrabPay by Moca)

- National Payments Corporation of Vietnam (NAPAS)

- OnePAY Payment Gateway JSC

- PayPal Vietnam Co., Ltd.

- Vietnam Payment Solution JSC (VNPay)

- ShopeePay Vietnam (SeaMoney)

- Moca Technology and Service JSC

- VNPT Media Corporation (VNPT Pay)

- Viet Union Corporation (Payoo)

- G Payment Joint Stock Company (Gpay)

- Foxpay Joint Stock Company (Foxpay)

- Smartnet Joint Stock Company (SmartPay)

- VTC Technology and Digital Content Company (VTC Pay)

- 9Pay Joint Stock Company (9Pay)

- TrueMoney Vietnam Co., Ltd.

- Be Group Joint Stock Company (beFinancial)

- SenPay Payment Service Joint Stock Company (SenPay)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising internet and smartphone penetration

- 4.2.2 Government push for cashless economy

- 4.2.3 Surge in e-commerce spend

- 4.2.4 Super-app ecosystem partnerships

- 4.2.5 Rapid QR-code merchant onboarding via VNPay24

- 4.2.6 Cross-border QR linkage with Thailand and Singapore

- 4.3 Market Restraints

- 4.3.1 Cyber-fraud and phishing incidents

- 4.3.2 Low financial-literacy pockets in rural areas

- 4.3.3 Fragmented QR-code standards pre-VietQR

- 4.3.4 High interchange fees on small-ticket proximity payments

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Pricing Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Payment Type

- 5.1.1 Proximity Payment

- 5.1.2 Remote Payment

- 5.2 By Payment Mode

- 5.2.1 NFC Tap-to-Pay

- 5.2.2 QR Code (VietQR, VNPay)

- 5.2.3 USSD / SMS

- 5.2.4 Mobile Wallet App Balance Transfer

- 5.3 By End-User

- 5.3.1 Retail and Consumer Goods

- 5.3.2 Transport and Ticketing

- 5.3.3 Utilities and Public Services

- 5.3.4 Hospitality and Entertainment

- 5.4 By Transaction Type

- 5.4.1 Person-to-Person (P2P)

- 5.4.2 Person-to-Business (P2B)

- 5.4.3 Business-to-Business (B2B)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 MoMo (M-Service JSC)

- 6.4.2 Viettel Digital Services Corporation (ViettelPay)

- 6.4.3 ZION JSC (ZaloPay)

- 6.4.4 Grab Financial Group Vietnam Co., Ltd. (GrabPay by Moca)

- 6.4.5 National Payments Corporation of Vietnam (NAPAS)

- 6.4.6 OnePAY Payment Gateway JSC

- 6.4.7 PayPal Vietnam Co., Ltd.

- 6.4.8 Vietnam Payment Solution JSC (VNPay)

- 6.4.9 ShopeePay Vietnam (SeaMoney)

- 6.4.10 Moca Technology and Service JSC

- 6.4.11 VNPT Media Corporation (VNPT Pay)

- 6.4.12 Viet Union Corporation (Payoo)

- 6.4.13 G Payment Joint Stock Company (Gpay)

- 6.4.14 Foxpay Joint Stock Company (Foxpay)

- 6.4.15 Smartnet Joint Stock Company (SmartPay)

- 6.4.16 VTC Technology and Digital Content Company (VTC Pay)

- 6.4.17 9Pay Joint Stock Company (9Pay)

- 6.4.18 TrueMoney Vietnam Co., Ltd.

- 6.4.19 Be Group Joint Stock Company (beFinancial)

- 6.4.20 SenPay Payment Service Joint Stock Company (SenPay)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment