PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940809

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940809

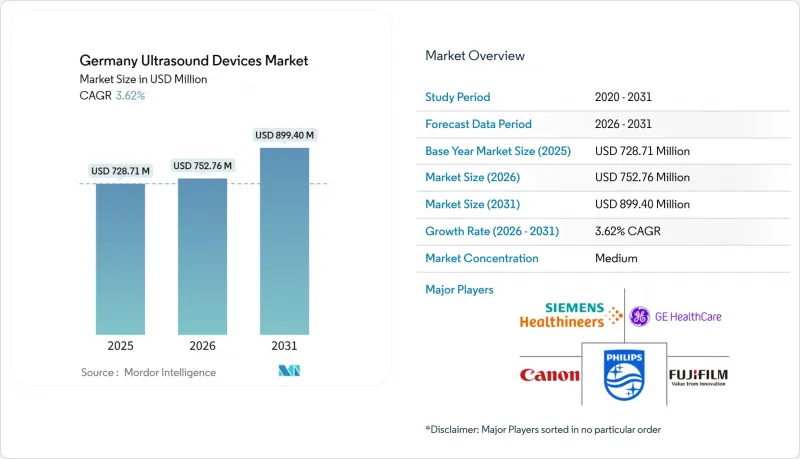

Germany Ultrasound Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Germany Ultrasound Devices market size in 2026 is estimated at USD 751.73 million, growing from 2025 value of USD 728.71 million with 2031 projections showing USD 876.88 million, growing at 3.16% CAGR over 2026-2031.

This moderate expansion is rooted in the country's mature hospital infrastructure, an aging population that lifts imaging demand, and a steady shift toward portable platforms that support distributed care. Hospital replacement cycles funded through the Hospital Future Act, wider reimbursement for point-of-care ultrasound, and AI-enabled automation all work together to offset pricing pressure from new entrants. Tight Medical Device Regulation (MDR) timelines still lengthen certification but also push providers to favor newer, easier-to-comply systems, keeping value growth ahead of unit growth. As a result, the Germany ultrasound devices market builds on existing volume while pivoting toward advanced 3D/4D consoles and therapeutic HIFU equipment that answer oncology and cardiometabolic needs.

Germany Ultrasound Devices Market Trends and Insights

Age-Linked Surge in Cardio-Metabolic & Oncology Imaging Demand

Germany's share of residents aged 65 and above climbed to 22% in 2025, pushing ultrasound volumes in cardiology, oncology, and preventive vascular screening. New statutory coverage for abdominal aortic aneurysm scans in 65-plus men has already lifted annual vascular studies, and oncology centers now employ US-guided HIFU to treat inoperable pancreatic tumors, as confirmed by clinical work at University Hospital Bonn. Family physicians are adding handheld probes to comply with WONCA Europe guidance on primary-care imaging, and these distributed screenings sustain procedure growth even while device ASPs fall. The demographic tilt therefore underwrites a multi-year baseline of examination demand that cushions the Germany ultrasound devices market against import-driven price cuts.

Rapid Hospital Refresh Cycles for Premium 3D/4D Consoles

Federal modernization grants under KHZG accelerate replacement of aging consoles. University hospitals deploy Siemens Healthineers' Acuson Sequoia 3.5 units that auto-label abdominal organs and shorten scan times. Hospitals also face competitive quality audits-40.1% of breast-care facilities lacked oncology society certification in 2024-so administrators invest in high-resolution 3D/4D platforms to safeguard accreditation. The MDR makes recertifying legacy systems costly, nudging procurement toward newly cleared models. Together, regulation, funding, and quality benchmarks support a step-up cycle that favors premium consoles and increases the average selling price within the Germany ultrasound devices market.

MDR-Induced Certification Bottlenecks & Cost Overruns

After full MDR application, notified-body queues grew to 24 months for renewals. A MedTech Europe survey found 50% of companies planning to drop product lines, and German-specific MPDG rules add native-language labeling and extra trial oversight. These overheads raise per-unit costs, discourage SME entrants, and could suppress the total available models on the Germany ultrasound devices market until 2028.

Other drivers and restraints analyzed in the detailed report include:

- Growing Reimbursement for Point-of-Care Ultrasound (POCUS)

- AI-Enabled Auto-Measurement & Workflow Automation

- Intensifying Price Competition from Chinese OEMs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Radiology owned 38.72% of the Germany ultrasound devices market in 2025, anchored by comprehensive imaging suites in hospital settings. Critical care now advances fastest at 5.39% CAGR, fueled by structured emergency protocols and a high correlation between ultrasound triage and final diagnosis. Pre-hospital studies in Nuremberg registered a 79.5% match rate, convincing funders to reimburse mobile scans. Gynecology and obstetrics keep volumes brisk under updated DEGUM prenatal screening, while cardiology gains productivity from AI auto-measurements that add 5,600 datapoints during a single echo session. Musculoskeletal and vascular niches continue to grow in outpatient clinics, riding reimbursement expansion for soft-tissue and aneurysm screening. Collectively, these trends diversify demand sources and help the Germany ultrasound devices market remain resilient to unit price compression.

Aging demographics and early cancer detection policies keep radiology dominant, yet every emergency department now budgets for handheld scanners. Critical care physicians value ultrasound for rapid fluid assessment, and rural ICUs depend on remote read-outs to compensate workforce gaps. Oncology centers test HIFU on pancreatic and prostate lesions, reinforcing therapeutic use cases that extend beyond pure diagnostics. Each application cluster lays unique requirements on image quality, portability, and AI overlay, encouraging vendors to broaden their line-ups and thereby grow the Germany ultrasound devices market size across hospital and ambulatory environments.

3D & 4D imaging delivered 44.85% of 2025 revenue thanks to high-resolution obstetric, cardiac, and abdominal studies. The next wave belongs to HIFU, projected to expand 4.92% CAGR through 2031 as consensus protocols emerge for non-invasive tumor ablation. University Hospital Bonn's data on pancreatic lesions lead adoption and support reimbursement dossiers. Doppler and contrast-enhanced modes persist for vascular mapping, while elastography gains traction in liver clinics monitoring steatosis. Regulatory dossiers for HIFU benefit from accumulated European safety evidence, easing MDR hurdles relative to first-time submissions.

Therapeutic platforms raise average selling prices up to fourfold versus diagnostic units, enhancing value growth within the Germany ultrasound devices market size. Even so, 2D systems stay relevant where budgets are tight or procedures standardized. Vendors answer by modular designs that let hospitals add HIFU heads to existing consoles. Bundle strategies soften capital cost spikes and keep upgrade paths open, supporting long-run revenue stability within the Germany ultrasound devices market.

The Germany Ultrasound Devices Market Report is Segmented by Application (Anesthesiology, Cardiology, Gynecology/Obstetrics, Musculoskeletal, Radiology, and More), Technology (2D Ultrasound Imaging, 3D & 4D Ultrasound Imaging, and More), Portability (Stationary Systems, and More), and End User (Hospitals, Diagnostic Centers, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Siemens Healthineers

- GE Healthcare

- Koninklijke Philips

- Canon

- FUJIFILM

- Samsung Group

- Mindray Medical Intl. Ltd

- Esaote

- Hologic

- SonoScape Medical Corp.

- Hitachi

- Butterfly Network Inc.

- Clarius Mobile Health Corp.

- CHISON Medical Technologies

- Terason (Teratech Corp.)

- Analogic

- Telemed Lithuania

- Alpinion Medical Systems

- Carestream Health

- Shenzhen Kaipud Medical

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Age-Linked Surge in Cardio-Metabolic & Oncology Imaging Demand

- 4.2.2 Rapid Hospital Refresh Cycles for Premium 3D/4D Consoles

- 4.2.3 Growing Reimbursement for Point-of-Care Ultrasound (POCUS)

- 4.2.4 AI-Enabled Auto-Measurement & Workflow Automation

- 4.2.5 Emergency Services Mandate for Mobile Sonography

- 4.2.6 Defense-Sector Procurement of Ruggedized Handheld Scanners

- 4.3 Market Restraints

- 4.3.1 MDR-Induced Certification Bottlenecks & Cost Overruns

- 4.3.2 Intensifying Price Competition from Chinese OEMs

- 4.3.3 Shortfall of DEGUM-Certified Sonographers in Rural States

- 4.3.4 Data Privacy Limits on AI Cloud-Based Image Analytics

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value & Volume)

- 5.1 By Application

- 5.1.1 Anesthesiology

- 5.1.2 Cardiology

- 5.1.3 Gynecology / Obstetrics

- 5.1.4 Musculoskeletal

- 5.1.5 Radiology

- 5.1.6 Critical Care

- 5.1.7 Urology

- 5.1.8 Vascular

- 5.1.9 Other Applications

- 5.2 By Technology

- 5.2.1 2D Ultrasound Imaging

- 5.2.2 3D & 4D Ultrasound Imaging

- 5.2.3 Doppler Imaging

- 5.2.4 High-Intensity Focused Ultrasound

- 5.2.5 Other Technologies

- 5.3 By Portability

- 5.3.1 Stationary Systems

- 5.3.2 Portable Cart-based Systems

- 5.3.3 Hand-held / Pocket Devices

- 5.4 By End User

- 5.4.1 Hospitals

- 5.4.2 Diagnostic Centers

- 5.4.3 Ambulatory Surgical Centers

- 5.4.4 Home Healthcare Settings

- 5.4.5 Other End Users

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.3.1 Siemens Healthineers AG

- 6.3.2 GE Healthcare

- 6.3.3 Koninklijke Philips N.V.

- 6.3.4 Canon Medical Systems Corporation

- 6.3.5 Fujifilm Holdings Corporation

- 6.3.6 Samsung Medison Co. Ltd

- 6.3.7 Mindray Medical Intl. Ltd

- 6.3.8 Esaote SpA

- 6.3.9 Hologic Inc.

- 6.3.10 SonoScape Medical Corp.

- 6.3.11 Hitachi Ltd

- 6.3.12 Butterfly Network Inc.

- 6.3.13 Clarius Mobile Health Corp.

- 6.3.14 CHISON Medical Technologies

- 6.3.15 Terason (Teratech Corp.)

- 6.3.16 Analogic Corporation

- 6.3.17 Telemed Lithuania

- 6.3.18 Alpinion Medical Systems

- 6.3.19 Carestream Health

- 6.3.20 Shenzhen Kaipud Medical

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment