PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940822

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940822

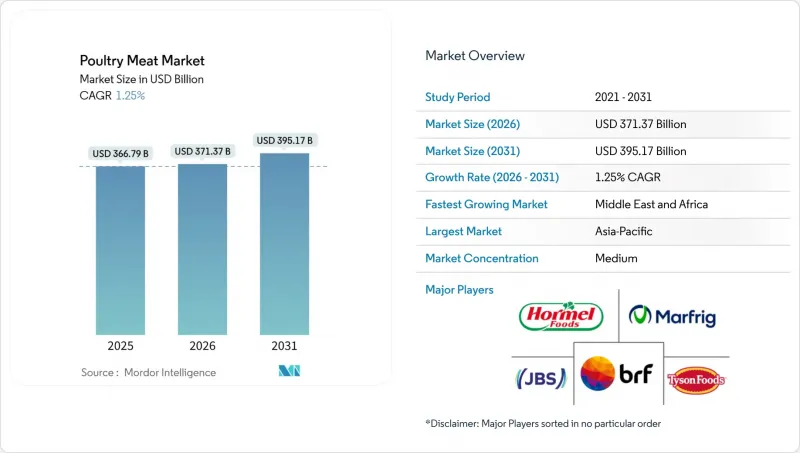

Poultry Meat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The poultry meat market is expected to grow from USD 366.79 billion in 2025 to USD 371.37 billion in 2026 and is forecast to reach USD 395.17 billion by 2031 at 1.25% CAGR over 2026-2031.

Poultry's appeal lies in its affordability and protein density, especially when compared to red meat. This quality resonates strongly with households navigating food inflation and seeking cost-effective nutrition. The Asia-Pacific region, which accounts for nearly half of the global demand, benefits from its vast population base and increasing disposable incomes. Additionally, technological advancements in production processes are driving productivity improvements, stabilizing prices, and enhancing supply capacity to meet growing demand. Food service operators are increasingly prioritizing branded, value-added poultry formats, which emphasize convenience and contribute to margin growth. Furthermore, heightened consumer awareness regarding animal welfare and sustainable sourcing is fostering the development of a premium segment within the market. However, despite this emerging trend, conventional production methods continue to dominate and define the volume core of the poultry meat market.

Global Poultry Meat Market Trends and Insights

Rising global demand for affordable and protein-rich meat

The rising global demand for affordable and protein-rich meat is a key driver of the poultry meat market, fueled by population growth, increasing disposable incomes, and shifting dietary preferences toward healthier protein sources. Poultry, particularly chicken, is favored due to its lower cost, higher protein-to-fat ratio, and versatility in cooking across diverse cuisines. A critical factor reinforcing this demand is urbanization, especially in Asia, which is home to 54% of the world's urban population-more than 2.2 billion people, according to a UN-Habitat report. Projections indicate that by 2050, Asia's urban population will increase by another 1.2 billion, marking a 50% rise . This rapid urban growth drives a shift in consumption patterns, as urban dwellers tend to demand convenient, affordable, and nutritious protein sources, propelling poultry meat consumption significantly. The increase in Asia's urban population, combined with the region's economic growth and rising middle class, shapes the expanding consumption trends favoring poultry. Urban life brings changes in lifestyle and food preferences, with consumers seeking accessible and sustainable protein alternatives that align with their health and convenience needs.

Technological advancements in poultry farming and processing

Technological advancements in poultry farming and processing are significant drivers of market growth, enabling producers to enhance efficiency, animal welfare, and product quality. Innovations such as automated feeding systems, sensor-based monitoring, climate-controlled housing, and AI-powered health surveillance allow farmers to optimize feed utilization, detect diseases early, and improve overall flock management. Advanced processing technologies, including robotic slaughtering, data-driven evisceration lines, and automated packaging, enhance throughput and ensure consistent product quality while meeting stringent food safety standards. Integration of blockchain and real-time tracking increases supply chain transparency, responding to consumer demands for traceability and sustainability. Moreover, these technologies contribute to reducing waste, energy consumption, and carbon footprints across poultry operations.

High cost of feed and supply chain challenges

The poultry meat market faces significant restraints due to the high cost of feed and ongoing supply chain challenges. Feed expenses constitute the largest portion of poultry production costs, often accounting for 65-75%, with key ingredients like maize and soybean experiencing sharp price increases driven by supply shortages, climate impacts, and global demand from multiple sectors such as ethanol production. These rising feed costs directly squeeze farmers' profitability, forcing many to reduce production or exit the market, especially small- and medium-sized enterprises (SMEs) that are more vulnerable to price volatility. Additionally, supply chain disruptions related to transportation, geopolitical tensions, and limited infrastructure further exacerbate these challenges by increasing lead times and costs. Industry stakeholders are actively seeking solutions through alternative feed sources, improved feed efficiency, and advocating for policy interventions such as the import of genetically modified feed grains to stabilize supply and costs. Nevertheless, until these issues are effectively addressed, the feed cost burden remains a critical constraint limiting growth and sustainability in the poultry meat market worldwide.

Other drivers and restraints analyzed in the detailed report include:

- Growing preference for convenience and ready-to-eat poultry products

- Government support and investments in poultry industry

- Stringent government regulations on food safety and animal welfare

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Chicken dominated the global poultry meat market in 2025, accounting for an impressive 82.05% share, underscoring its long-standing position as the most consumed and widely available poultry type worldwide. This dominance stems from decades of advances in selective breeding, feed optimization, and processing efficiencies that have significantly reduced production costs while ensuring consistent quality. The versatility of chicken across cuisines, coupled with its relatively lower price compared to other meats, has reinforced its widespread consumer acceptance across both developed and emerging markets. Moreover, strong integration across supply chains from hatcheries to distribution has allowed leading producers to maintain a steady supply and meet diverse regional demands. Chicken's short production cycle and adaptability to value-added product forms such as ready-to-cook and marinated cuts further enhance its market appeal.

In contrast, turkey has emerged as the fastest-growing segment in the poultry meat market, projected to expand at a compound annual growth rate (CAGR) of 2.32% through 2031. This growth reflects a gradual but steady shift in consumer preferences toward more diverse and premium protein options beyond the traditional chicken-based diets. While turkey consumption has historically been tied to specific holidays and festive occasions, increasing awareness of its nutritional value and lower fat content is driving year-round demand. Foodservice innovations and the introduction of convenient, portioned turkey products are also expanding its consumer base, particularly in urban and health-conscious segments. Producers are investing in marketing and product development to position turkey as a versatile protein suitable for everyday meals.

The frozen poultry meat segment held the largest market share in 2025, accounting for 47.60% of the global market, supported by its strong integration with efficient supply chains and global trade networks. Frozen products offer a key advantage in terms of extended shelf life, minimizing spoilage and food waste throughout distribution and retail channels. This feature is particularly valuable for exporters and large retailers who rely on longer storage and transportation timelines. The continued expansion of cold chain infrastructure across emerging markets has further facilitated access to frozen poultry, enhancing affordability and product consistency. Additionally, the frozen segment benefits from evolving consumer lifestyles that favor bulk purchases and convenience-driven meal planning.

Meanwhile, the processed poultry segment is projected to record the fastest growth, expanding at a compound annual growth rate (CAGR) of 1.93% through 2031. This growth reflects shifting consumer preferences toward convenience-oriented products that reduce preparation time while maintaining taste and nutritional quality. Foodservice operators are also increasingly adopting processed poultry such as breaded fillets, nuggets, and pre-cooked cuts to streamline operations and offset higher labor costs. Technological advancements in processing and packaging are supporting better quality retention, product variety, and customization across both retail and foodservice channels. Additionally, the rising popularity of quick-service restaurants (QSRs) and ready-to-eat meals is fuelling demand for value-added poultry offerings.

The Poultry Meat Market Report is Segmented by Product Type (Chicken, Turkey, Others), Form (Fresh/Chilled, Frozen, Canned, Processed), Category (Conventional Meat, Organic Meat), Distribution Channel (On-Trade, Off-Trade), and Geography (North America, Europe, Asia-Pacific, South America, Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

In 2025, Asia-Pacific commands a 47.62% market share, buoyed by its demographic advantages, rising disposable incomes, and a cultural tilt towards poultry across various meals and cooking styles. Urbanization in China fuels a demand for convenient protein sources, while India's burgeoning middle class drives consistent growth, even amidst occasional supply hiccups due to disease. Established production infrastructures in Thailand, Indonesia, and Vietnam cater to both local and global appetites. Japan and South Korea, with their mature markets, eye premium positioning, whereas Australia balances its integrated production systems between local consumption and exports. Government investments bolster the region's growth, enhancing cold chain infrastructures, expanding processing capacities, and fortifying biosecurity, all to boost domestic consumption and export competitiveness.

Middle East and Africa, with a projected 2.72% CAGR through 2031, is the fastest-growing region, spurred by urbanization, population growth, and economic strides that elevate protein consumption across income brackets. High per capita consumption and import reliance in Saudi Arabia and UAE present golden opportunities for exporters like Brazil and Thailand. While Nigeria and South Africa boast sizable domestic markets ripe for growth, Morocco and Egypt's strategic locations grant them a foothold in both African and European markets. Despite grappling with infrastructure hurdles, notably in cold chain and processing, the region is witnessing a turnaround largely due to strategic investments and tech transfers. Turkey, straddling Europe and Asia, not only diversifies its market access but also meets both regional consumption and export demands.

North America showcases a mature market with ingrained consumption habits and production systems that prioritize efficiency. The U.S. stands tall with its advanced processing and robust domestic demand, while Canada carves a niche with premium and sustainable practices. Europe's mature landscape grapples with stringent regulations and a consumer base that champions animal welfare, sustainability, and food safety. Leading the charge in consumption are Germany, the U.K., and France, backed by established retail and foodservice networks, while Poland has carved out a significant role as a producer for both domestic and export markets. In South America, Brazil's stature as a global exporter is complemented by the robust domestic markets of Argentina, Colombia, and Chile, fueling regional consumption growth.

- Tyson Foods, Inc.

- BRF S.A.

- Hormel Foods Corporation

- JBS S.A.

- Marfrig Global Foods S.A.

- Maple Leaf Foods

- Cargill, Incorporated

- Charoen Pokphand Foods Public Co. Ltd

- Continental Grain Company

- Fujian Sunner Development Co. Ltd

- Industrias Bachoco SA de CV

- Koch Foods Inc.

- New Hope Liuhe Co. Ltd

- Sysco Corporation

- LDC Group

- Wen's Food Group Co. Ltd

- Al-Watania Poultry

- Sunbulah Group

- Suguna Foods

- Foster Farms

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising global demand for affordable and protein-rich meat

- 4.2.2 Technological advancements in poultry farming and processing

- 4.2.3 Growing preference for convenience and ready-to-eat poultry products

- 4.2.4 Government support and investments in poultry industry

- 4.2.5 Expansion of foodservice and retail distribution channels

- 4.2.6 Increasing exports and international trade of poultry meat

- 4.3 Market Restraints

- 4.3.1 High cost of feed and supply chain challenges

- 4.3.2 Stringent government regulations on food safety and animal welfare

- 4.3.3 Increasing competition from alternative protein sources (plant-based/meat substitutes)

- 4.3.4 Outbreaks of avian diseases such as avian influenza

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 By Product Type

- 5.1.1 Chicken

- 5.1.2 Turkey

- 5.1.3 Others

- 5.2 By Form

- 5.2.1 Fresh / Chilled

- 5.2.2 Frozen

- 5.2.3 Canned

- 5.2.4 Processed

- 5.2.4.1 Nuggets

- 5.2.4.2 Deli Meats

- 5.2.4.3 Sausages

- 5.2.4.4 Tenders/Marinated

- 5.2.4.5 Meatballs

- 5.2.4.6 Others

- 5.3 By Category

- 5.3.1 Conventional Meat

- 5.3.2 Organic Meat

- 5.4 By Distribution Channel

- 5.4.1 On-Trade

- 5.4.1.1 Hotels

- 5.4.1.2 Restaurants

- 5.4.1.3 Catering

- 5.4.2 Off-Trade

- 5.4.2.1 Supermarkets/ Hypermarkets

- 5.4.2.2 Convenience Stores

- 5.4.2.3 Online Retail Channel

- 5.4.2.4 Other Distribution Channel

- 5.4.1 On-Trade

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 Form

- 5.5.1.2 Distribution Channel

- 5.5.1.3 Country

- 5.5.1.3.1 United States

- 5.5.1.3.2 Canada

- 5.5.1.3.3 Mexico

- 5.5.1.3.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Form

- 5.5.2.2 Distribution Channel

- 5.5.2.3 Country

- 5.5.2.3.1 Germany

- 5.5.2.3.2 United Kingdom

- 5.5.2.3.3 Italy

- 5.5.2.3.4 France

- 5.5.2.3.5 Spain

- 5.5.2.3.6 Netherlands

- 5.5.2.3.7 Poland

- 5.5.2.3.8 Belgium

- 5.5.2.3.9 Sweden

- 5.5.2.3.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 Form

- 5.5.3.2 Distribution Channel

- 5.5.3.3 Country

- 5.5.3.3.1 China

- 5.5.3.3.2 India

- 5.5.3.3.3 Japan

- 5.5.3.3.4 Australia

- 5.5.3.3.5 Indonesia

- 5.5.3.3.6 South Korea

- 5.5.3.3.7 Thailand

- 5.5.3.3.8 Singapore

- 5.5.3.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Form

- 5.5.4.2 Distribution Channel

- 5.5.4.3 Country

- 5.5.4.3.1 Brazil

- 5.5.4.3.2 Argentina

- 5.5.4.3.3 Colombia

- 5.5.4.3.4 Chile

- 5.5.4.3.5 Peru

- 5.5.4.3.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Form

- 5.5.5.2 Distribution Channel

- 5.5.5.3 Country

- 5.5.5.3.1 South Africa

- 5.5.5.3.2 Saudi Arabia

- 5.5.5.3.3 United Arab Emirates

- 5.5.5.3.4 Nigeria

- 5.5.5.3.5 Egypt

- 5.5.5.3.6 Morocco

- 5.5.5.3.7 Turkey

- 5.5.5.3.8 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)}

- 6.4.1 Tyson Foods, Inc.

- 6.4.2 BRF S.A.

- 6.4.3 Hormel Foods Corporation

- 6.4.4 JBS S.A.

- 6.4.5 Marfrig Global Foods S.A.

- 6.4.6 Maple Leaf Foods

- 6.4.7 Cargill, Incorporated

- 6.4.8 Charoen Pokphand Foods Public Co. Ltd

- 6.4.9 Continental Grain Company

- 6.4.10 Fujian Sunner Development Co. Ltd

- 6.4.11 Industrias Bachoco SA de CV

- 6.4.12 Koch Foods Inc.

- 6.4.13 New Hope Liuhe Co. Ltd

- 6.4.14 Sysco Corporation

- 6.4.15 LDC Group

- 6.4.16 Wen's Food Group Co. Ltd

- 6.4.17 Al-Watania Poultry

- 6.4.18 Sunbulah Group

- 6.4.19 Suguna Foods

- 6.4.20 Foster Farms

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK