PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940824

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940824

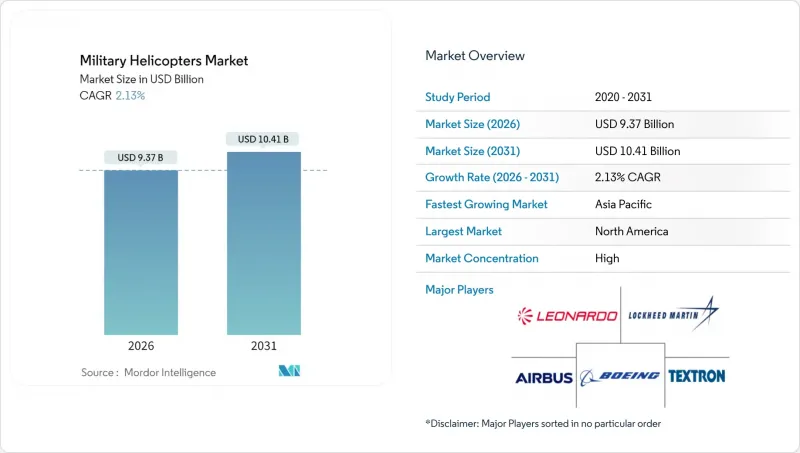

Military Helicopters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Military Helicopters Market was valued at USD 9.17 billion in 2025 and estimated to grow from USD 9.37 billion in 2026 to reach USD 10.41 billion by 2031, at a CAGR of 2.13% during the forecast period (2026-2031).

Demand is concentrated in North America, where fleet-modernization contracts and service-life extension programs sustain procurement momentum. At the same time, Asia-Pacific registers the steepest ascent as regional powers field new indigenous platforms and boost sortie availability. Next-generation projects such as Future Vertical Lift (FVL), tiltrotors, and manned-unmanned teaming concepts keep technological barriers high, allowing prime contractors to protect margins through intellectual-property control and performance-based logistics. However, elevated life-cycle costs, rising anti-access/area-denial (A2/AD) threats, and the growing competence of armed unmanned aerial vehicles (UAVs) introduce headwinds that temper large-scale acquisitions. Against this backdrop, the military helicopter market continues to favor versatile multi-mission designs that lower overall fleet counts and simplify sustainment.

Global Military Helicopters Market Trends and Insights

Accelerated Rotorcraft Modernization Programs

Helicopter fleets across the US, Europe, and key Asia-Pacific allies are aging fast, prompting ministries to allocate funds toward structural refurbishments, avionics refresh, and power-plant upgrades. The US Army's USD 70 billion Future Long-Range Assault Aircraft initiative underscores how recapitalization overrides short-term fiscal limitations. European collaboration via the USD 16.36 billion Next Generation Rotorcraft Capability mirrors that urgency, allowing partners to share R&D risk and align logistics chains. These multi-year frameworks underpin predictable procurement volumes that safeguard industrial employment and sustain specialized supply networks, ensuring the military helicopters market benefits from firm order backlogs even when annual budgets fluctuate. Interoperability clauses embedded in NATO standardization agreements further harmonize requirements, accelerating component commonality and compressing certification cycles.

Shift Toward Multi-Mission Modular Platforms

Defense departments are pivoting from niche airframes to configurable workhorses that accept plug-and-play mission kits. Leonardo's AW249 illustrates this mindset; field crews can swap sensor or weapon suites within hours, enabling a single squadron to pivot from reconnaissance to CASEVAC without additional hulls. The US Marine Corps experience with the AH-1Z and UH-1Y, which share 84% parts commonality, validates lower training loads, leaner spares inventories, and reduced lifecycle cost outcomes that resonate with lawmakers monitoring sustainment bills. As doctrines emphasize agile force packages, modularity simplifies coalition operations because allied forces can borrow kits instead of entire aircraft, helping the military helicopters market defend relevance against UAV encroachment in contested airspace.

High Total-life-cycle Cost and Stretched Defense Budgets

A single heavy-lift platform can cost as much as USD 80 million to buy and sustain over 30 years, making helicopters prime targets when finance ministries hunt for savings. The US Navy's CH-53K price tag forced procurement cuts, while Germany postponed H145M orders to comply with NATO spending ceilings. In response, services experiment with power-by-the-hour contracts where manufacturers retain ownership and guarantee availability. This shift alters top-line booking patterns but ensures predictable out-years cash flows for the military helicopters market.

Other drivers and restraints analyzed in the detailed report include:

- FVL and Similar Next-gen Initiatives

- Rapid Adoption of MUM-T concepts

- Competition from Armed UAVs for Attack/ISR Missions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Multi-mission helicopters generated 51.05% of the military helicopters market size in 2025, validating defense planners' preference for a single adaptable airframe across multiple roles. Demand stems from logistics simplification, reduced training load, and lower spares commonality. The UH-60M's widespread adoption exemplifies this logic; variants cover medevac, special operations, and troop lift without changing power-plants. From 2026 to 2031, the segment is set to expand gradually as export customers upgrade avionics and weapon integration to NATO standards. Conversely, dedicated electronic-warfare and SAR helicopters keep stable but niche volumes, protected by mission-specific sensor payloads commanding premium margins.

Although transport helicopters have a smaller base, they are forecasted to post the fastest 5.64% CAGR, reflecting the lessons-learned emphasis on rapid troop deployment and disaster relief. The influx of disaster-response funding in the Asia-Pacific after typhoon seasons and earthquake events directly supports incremental procurements. While multi-mission platforms continue to dominate specifications, new transport programs often plug into broader amphibious and airborne logistics concepts, reinforcing the overall military helicopters market through follow-on spares and depot-level upgrades.

Army aviation contributed 42.35% to 2025 revenue, confirming ground forces' reliance on rotorcraft for maneuver and fire support. Battalion-level acquisition plans in Poland, Australia, and India sustain volume as each nation replaces 1970s-era fleets with digital cockpits and network-centric mission suites. Air force orders, though smaller, register the strongest 4.18% CAGR through 2031 as personnel recovery, special operations, and nuclear security missions migrate from fixed-wing to rotary assets to gain hover and vertical-lift advantages.

Naval and marine corps users continue ordering maritime-optimized airframes featuring folding blades, corrosion protection, and shipboard avionics. Meanwhile, paramilitary and coast-guard agencies capture rising budgets tied to domestic security threats, allowing manufacturers to repackage military airframes into lower-spec public-order configurations without costly redesign. Together, these dynamics widen the total military helicopters market share obtainable by primes that tailor variants to diverse doctrinal needs.

The Military Helicopters Market Report is Segmented by Helicopter Type (Multi-Mission Helicopter, Transport Helicopter, and Other Helicopter), End-User Service (Air Force, Army Aviation, Naval/Marine Corps Aviation, and More), Engine Type (Single Engine and Twin Engine), Application (Combat and Close Air Support, and More), and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America captured 44.80% of 2025 spending, anchored by multibillion-dollar CH-53K, UH-60M, and CH-47F orders underway at the US Army, Navy, and Marine Corps. Robust industrial depth supports quick retrofit campaigns, reinforcing aftermarket dominance that shapes global standard-setting across avionics, armament, and cybersecurity. Canada supplements demand with CH-148 Cyclone maritime units, while Mexico's procurement of light utility models for border patrol increases cross-border MRO cooperation.

Asia-Pacific, the fastest-growing geography at 5.57% CAGR, accelerates on indigenous efforts such as China's Z-20, India's IMRH, and South Korea's Surion line. Regional tensions in the East and South China Seas push air forces to maintain high readiness, prompting service-life extensions and block upgrades that embed local content mandates. Australia's MRH-90 replacement and Japan's UH-2 license-build illustrate how allied nations hedge supply-chain risk by co-producing under offset agreements, thereby enlarging regional economic multipliers tied to the military helicopters market. Europe remains a stable yet budget-constrained buyer focused on collaborative platforms like NH90 and Tiger to maximize interoperability and spread R&D outlays. The EUR 14 billion (USD 16.27 billion) NGRC roadmap ensures that partner states sustain joint research into advanced propulsion, material science, and digital cockpits, though actual unit orders may lag parliamentary appropriations. The Middle East and Africa continue opportunistic purchases funded by hydrocarbon revenues or external security grants, typically favoring off-the-shelf US or European models that deliver quick capability boosts. South American demand stays moderate, driven by counter-narcotics and SAR needs that lean on rugged, multi-mission airframes assembled through local final-assembly lines when possible.

- Airbus SE

- Lockheed Martin Corporation

- The Boeing Company

- Leonardo S.p.A.

- Textron Inc.

- Rostec

- Hindustan Aeronautics Limited

- Korea Aerospace Industries Ltd.

- Aviation Industry Corporation of China

- Kawasaki Heavy Industries, Ltd.

- Turkish Aerospace Industries, Inc.

- MD Helicopters, LLC

- Mitsubishi Heavy Industries, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 KEY INDUSTRY TRENDS

- 4.1 Gross Domestic Product

- 4.1.1 North America

- 4.1.2 Europe

- 4.1.3 Asia-Pacific

- 4.1.4 South America

- 4.1.5 Middle East and Africa

- 4.2 Active Fleet Data

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia-Pacific

- 4.2.4 South America

- 4.2.5 Middle East and Africa

- 4.3 Defense Spending

- 4.3.1 North America

- 4.3.2 Europe

- 4.3.3 Asia-Pacific

- 4.3.4 South America

- 4.3.5 Middle East and Africa

5 MARKET LANDSCAPE

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Accelerated rotorcraft modernization programs

- 5.2.2 Shift toward multi-mission modular platforms

- 5.2.3 Future Vertical Lift (FVL) and similar next-gen initiatives

- 5.2.4 Rapid adoption of manned-unmanned teaming (MUM-T) concepts

- 5.2.5 Fleet-wide demand for predictive maintenance and health monitoring

- 5.2.6 Push for hybrid-electric propulsion to cut logistic fuel burden

- 5.3 Market Restraints

- 5.3.1 High total-life-cycle cost and stretched defense budgets

- 5.3.2 Stringent export-control and technology-transfer constraints

- 5.3.3 Growing lethality of anti-access/area-denial (A2/AD) threats

- 5.3.4 Competition from armed UAVs for attack/ISR missions

- 5.4 Value Chain Analysis

- 5.5 Regulatory Landscape

- 5.6 Technological Outlook

- 5.7 Porter's Five Forces Analysis

- 5.7.1 Bargaining Power of Suppliers

- 5.7.2 Bargaining Power of Buyers

- 5.7.3 Threat of New Entrants

- 5.7.4 Threat of Substitutes

- 5.7.5 Intensity of Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Helicopter Type

- 6.1.1 Multi-mission Helicopter

- 6.1.2 Transport Helicopter

- 6.1.3 Other Helicopter

- 6.2 By End-User Service

- 6.2.1 Air Force

- 6.2.2 Army Aviation

- 6.2.3 Naval/Marine Corps Aviation

- 6.2.4 Joint/Special Operations

- 6.2.5 Paramilitary and Coast Guard

- 6.3 By Engine Type

- 6.3.1 Single Engine

- 6.3.2 Twin Engine

- 6.4 By Application

- 6.4.1 Combat and Close Air Support

- 6.4.2 Troop Transport

- 6.4.3 Humanitarian and Disaster Relief

- 6.4.4 Pilot Training

- 6.5 By Geography

- 6.5.1 North America

- 6.5.1.1 United States

- 6.5.1.2 Canada

- 6.5.1.3 Mexico

- 6.5.2 Europe

- 6.5.2.1 United Kingdom

- 6.5.2.2 France

- 6.5.2.3 Germany

- 6.5.2.4 Italy

- 6.5.2.5 Spain

- 6.5.2.6 Russia

- 6.5.2.7 Rest of Europe

- 6.5.3 Asia-Pacific

- 6.5.3.1 China

- 6.5.3.2 India

- 6.5.3.3 Japan

- 6.5.3.4 South Korea

- 6.5.3.5 Indonesia

- 6.5.3.6 Australia

- 6.5.3.7 Rest of Asia-Pacific

- 6.5.4 South America

- 6.5.4.1 Brazil

- 6.5.4.2 Rest of South America

- 6.5.5 Middle East and Africa

- 6.5.5.1 Middle East

- 6.5.5.1.1 Saudi Arabia

- 6.5.5.1.2 United Arab Emirates

- 6.5.5.1.3 Qatar

- 6.5.5.1.4 Rest of Middle East

- 6.5.5.2 Africa

- 6.5.5.2.1 South Africa

- 6.5.5.2.2 Nigeria

- 6.5.5.2.3 Rest of Africa

- 6.5.5.1 Middle East

- 6.5.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 Airbus SE

- 7.4.2 Lockheed Martin Corporation

- 7.4.3 The Boeing Company

- 7.4.4 Leonardo S.p.A.

- 7.4.5 Textron Inc.

- 7.4.6 Rostec

- 7.4.7 Hindustan Aeronautics Limited

- 7.4.8 Korea Aerospace Industries Ltd.

- 7.4.9 Aviation Industry Corporation of China

- 7.4.10 Kawasaki Heavy Industries, Ltd.

- 7.4.11 Turkish Aerospace Industries, Inc.

- 7.4.12 MD Helicopters, LLC

- 7.4.13 Mitsubishi Heavy Industries, Ltd.

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 8.1 White-space and Unmet-need Assessment

9 KEY STRATEGIC QUESTIONS FOR MILITARY HELICOPTER OEM CEOS