PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940835

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940835

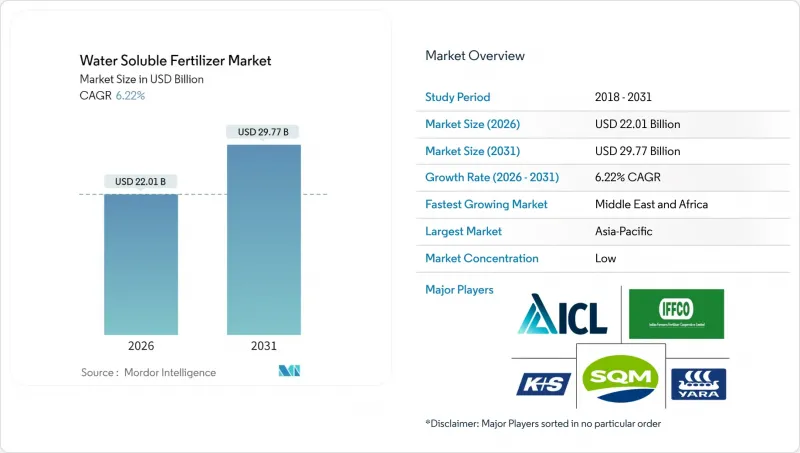

Water Soluble Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The water soluble fertilizer market is expected to grow from USD 20.72 billion in 2025 to USD 22.01 billion in 2026 and is forecast to reach USD 29.77 billion by 2031 at 6.22% CAGR over 2026-2031.

Strong demand stems from farmers' shift to precision nutrient delivery that conserves water while sustaining yield in increasingly arid regions. Mounting government subsidies for micro-irrigation systems, expanding greenhouse acreage, and rising carbon-credit opportunities further accelerate the adoption of specialized formulations across the water soluble fertilizer market. Competitive pressure pushes suppliers to bundle agronomic advice with digital tools so growers can monitor nutrient uptake in real time, a tactic that strengthens brand loyalty within the water soluble fertilizer market. Volatile raw-material pricing, especially for chelated micronutrients, and logistical challenges posed by hygroscopic salts temper growth but have not derailed the long-term expansion trajectory of the water soluble fertilizer market.

Global Water Soluble Fertilizer Market Trends and Insights

Rising Adoption of Fertigation Systems in High-Value Crops

Global installations of fertigation equipment are growing 23% each year as regulators tighten water use thresholds and farmers aim for higher returns per hectare. Israel's experience shows that fertigation boosts citrus and avocado yields by up to 40% while lowering water consumption by 30%. Automated dosing platforms cut labor requirements and synchronize nutrient release with plant development, enhancing both efficiency and compliance with mandates such as California's Sustainable Groundwater Management Act. Although a full system costs USD 2,000-4,000 per hectare, financing programs and performance-linked subsidies help offset the upfront burden, widening access for mid-size producers across the water soluble fertilizer market.

Need for Precise Nutrient Management in Greenhouse Farming

The global greenhouse area is expanding at an annual rate of 8.2% as growers pursue year-round supply resilience. Dutch operators routinely achieve nutrient use efficiency above 95% through closed-loop fertigation, enabling tomato yields of 500-600 tonnes per hectare, which is six times the output of open-field farming. Such performance validates the premium purchases of soluble blends, which are customized for specific crop stages. Asia-Pacific countries are replicating the model to bolster food security, with Singapore aiming to achieve 30% domestic output by 2030. Certification schemes that require documented nutrient protocols further boost demand for traceable products within the water soluble fertilizer market.

High Initial Cost Versus Conventional Granular Fertilizers

Price premiums of 40-60% deter adoption among price-sensitive growers. Brazilian soybean farmers, for instance, limit their usage to below 15% of the acreage despite the yield benefits. However, when labor savings and 10-20% yield gains are factored in, lifecycle economics can tip in favor of soluble inputs. Suppliers now offer harvest-aligned payment schedules, and subsidies partially close the cost gap in several Asia-Pacific programs.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Drip Irrigation Acreage Worldwide

- Government Subsidies Promoting Water-Efficient Fertilizers

- Volatility in Chelated Micronutrient Raw Material Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Straight products accounted for 52.74% of the water-soluble fertilizer market in 2025, reflecting their cost-effectiveness and versatility across various crops. Potassium nitrate and potassium sulfate dominate this category due to their compatibility with typical fertigation setups. The straight segment benefits from flexible dosing, which allows growers to adjust individual nutrients in response to real-time soil tests, a key practice within the water-soluble fertilizer market. Despite pricing sensitivity, sustained adoption in field crops continues to keep volumes high.

Complex formulations are gaining ground at a 6.38% CAGR through 2031 as growers demand convenience and crop-specific nutrient profiles. Micronutrient-enriched blends are the fastest-growing subset, leveraging controlled-release coatings to extend nutrient availability. European Union registration rules favor standardized complex products, encouraging consolidation around branded solutions that command 20-30% premiums and boost margins within the water-soluble fertilizer market.

The Water Soluble Fertilizer Market Report is Segmented by Type (Complex and Straight), Application Mode (Fertigation and Foliar), Crop Type (Field Crops, Horticultural Crops, and Turf and Ornamental), and Geography (Asia-Pacific, Europe, Middle East and Africa, North America, South America). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

Asia-Pacific commanded 41.05% of the water soluble fertilizer market share in 2025 and is projected to post a 6.55% CAGR to 2031. China's controlled environment acreage has grown at a 25% annual rate, while India has budgeted USD 1.8 billion for micro-irrigation expansion that addresses soluble nutrition demand. Local manufacturers, such as Kingenta and Coromandel International, continue to expand their capacity, keeping prices competitive and ensuring supply continuity.

Europe ranks second, driven by the Netherlands, Spain, and Italy. Dutch greenhouse operations achieve 95% nutrient use efficiency, relying heavily on high-purity soluble inputs. Spain's mandated drip systems in olive and citrus groves sustain potassium demand, and Italy's organic farmers increasingly choose certified water soluble products to meet consumer preference for sustainable production. The Farm to Fork initiative, targeting a 20% fertilizer-use reduction, indirectly favors high-efficiency solutions in the water soluble fertilizer market.

North America maintains robust momentum, led by the adoption of precision agriculture. California's nutrient management mandates, combined with carbon offset programs, reward farmers who deploy validated soluble regimens. Canadian grain producers utilize variable-rate technologies to fine-tune their applications, while Mexico's greenhouse vegetable exports drive demand for premium blends specifically designed for Dutch-style structures. Strong extension services and digital advisory platforms support sophisticated usage patterns within the water soluble fertilizer market.

- Yara International ASA

- Sociedad Quimica y Minera de Chile SA

- Nutrien Ltd.

- Haifa Chemicals Ltd.

- ICL Group Ltd.

- K+S Aktiengesellschaft

- EuroChem Group AG

- Omnia Holdings Ltd.

- AgroLiquid Inc.

- Coromandel International Ltd.

- Grupa Azoty S.A.

- Valagro S.p.A. (Syngenta Group)

- Kingenta Ecological Engineering Group Co., Ltd.

- Helena Agri-Enterprises, LLC (Marubeni Corporation)

- FoxFarm Soil and Fertilizer Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

- 4.6 Market Drivers

- 4.6.1 Rising adoption of fertigation systems in high-value crops

- 4.6.2 Need for precise nutrient management in greenhouse farming

- 4.6.3 Expansion of drip irrigation acreage worldwide

- 4.6.4 Government subsidies promoting water-efficient fertilizers

- 4.6.5 Surge in soluble specialty blends for hydroponics

- 4.6.6 Carbon-credit linked fertilizer programs

- 4.7 Market Restraints

- 4.7.1 High initial cost versus conventional granular fertilizers

- 4.7.2 Logistical challenges in bulk handling of soluble salts

- 4.7.3 Ion-specific salinity build-up in closed irrigation loops

- 4.7.4 Volatility in chelated micronutrient raw-material supply

5 MARKET SIZE & GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Type

- 5.1.1 Complex

- 5.1.2 Straight

- 5.1.2.1 By Nutrient

- 5.1.2.1.1 Micronutrients

- 5.1.2.1.2 Nitrogenous

- 5.1.2.1.3 Phosphatic

- 5.1.2.1.4 Potassic

- 5.1.2.1.5 Secondary Macronutrients

- 5.1.2.1 By Nutrient

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Region

- 5.4.1 Asia-Pacific

- 5.4.1.1 Australia

- 5.4.1.2 Bangladesh

- 5.4.1.3 China

- 5.4.1.4 India

- 5.4.1.5 Indonesia

- 5.4.1.6 Japan

- 5.4.1.7 Pakistan

- 5.4.1.8 Philippines

- 5.4.1.9 Thailand

- 5.4.1.10 Vietnam

- 5.4.1.11 Rest of Asia-Pacific

- 5.4.2 Europe

- 5.4.2.1 France

- 5.4.2.2 Germany

- 5.4.2.3 Italy

- 5.4.2.4 Netherlands

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 Ukraine

- 5.4.2.8 United Kingdom

- 5.4.2.9 Rest of Europe

- 5.4.3 Middle East & Africa

- 5.4.3.1 Nigeria

- 5.4.3.2 Saudi Arabia

- 5.4.3.3 South Africa

- 5.4.3.4 Turkey

- 5.4.3.5 Rest of Middle East & Africa

- 5.4.4 North America

- 5.4.4.1 Canada

- 5.4.4.2 Mexico

- 5.4.4.3 United States

- 5.4.4.4 Rest of North America

- 5.4.5 South America

- 5.4.5.1 Argentina

- 5.4.5.2 Brazil

- 5.4.5.3 Rest of South America

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Yara International ASA

- 6.4.2 Sociedad Quimica y Minera de Chile SA

- 6.4.3 Nutrien Ltd.

- 6.4.4 Haifa Chemicals Ltd.

- 6.4.5 ICL Group Ltd.

- 6.4.6 K+S Aktiengesellschaft

- 6.4.7 EuroChem Group AG

- 6.4.8 Omnia Holdings Ltd.

- 6.4.9 AgroLiquid Inc.

- 6.4.10 Coromandel International Ltd.

- 6.4.11 Grupa Azoty S.A.

- 6.4.12 Valagro S.p.A. (Syngenta Group)

- 6.4.13 Kingenta Ecological Engineering Group Co., Ltd.

- 6.4.14 Helena Agri-Enterprises, LLC (Marubeni Corporation)

- 6.4.15 FoxFarm Soil and Fertilizer Company

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS