PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940863

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940863

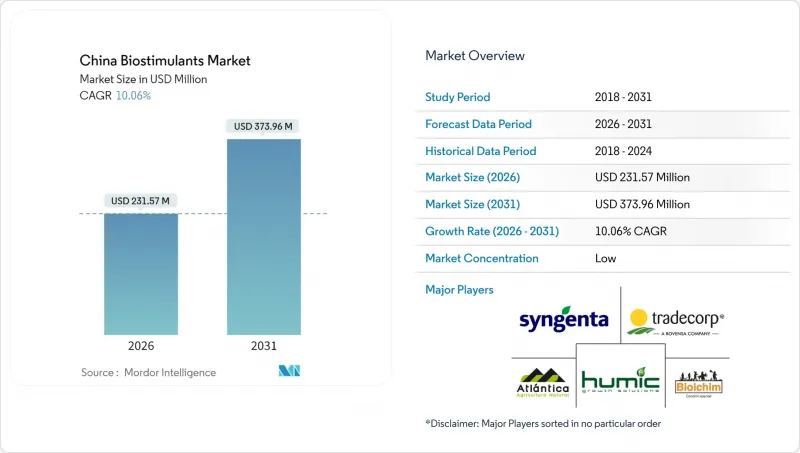

China Biostimulants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

China biostimulants market size in 2026 is estimated at USD 231.57 million, growing from 2025 value of USD 210.4 million with 2031 projections showing USD 373.96 million, growing at 10.06% CAGR over 2026-2031.

Accelerated policy support for fertilizer-use efficiency, a robust protected-horticulture footprint, and a nationwide push for smart agriculture create favorable demand conditions. Seaweed extract leadership, rising amino-acid adoption in greenhouses, and soil-health degradation mitigation need further reinforcement. Competitive differentiation centers on quality assurance, raw-material integration, and digital application guidance. Intensifying patent filings and foreign direct investment signal an innovation-driven growth path that aligns with China's dual goals of food-security resilience and ag-input emission reduction.

China Biostimulants Market Trends and Insights

Government Incentives for Sustainable-Input Adoption

New ecological-protection compensation rules implemented in 2024 reimburse 30%-50% of biostimulant costs in eco-sensitive zones, closing price gaps with bulk fertilizers. Streamlined registration now completes within 12 months, accelerating market entry for compliant formulations. National carbon-neutrality commitments elevate biostimulants as low-emission substitutes for urea and compound fertilizers. Provincial pools totaling CNY 15 billion (USD 2.1 billion) per year provide concessional loans and tax credits that reduce working-capital stress for retailers and large farms. Parallel research grants foster domestic innovation that tailors products to China's diverse soils, reinforcing local manufacturing competitiveness.

Rising Domestic Demand for Organic Produce

Organic farmland expanded 18% in 2023 to 2.4 million hectares as food-safety concerns reshape urban purchasing patterns. Retail premiums of 200%-300% on organic vegetables in Shanghai and Shenzhen justify higher input costs, positioning biostimulants as certification-compliant nutrition tools. E-commerce platforms reported 40% year-over-year organic sales growth, led by millennial and Generation Z consumers who value traceability. Mandatory adherence to national organic standard GB/T 19630 forces growers to substitute synthetic fertilizers with bio-derived inputs, sustaining biostimulant demand across fresh and processed segments. Continuous urbanization widens the consumer base, converting preference into structural market demand.

High Price Premium Versus Conventional Fertilizers

Typical biostimulant prices exceed chemical fertilizers by two to five times, with amino-acid products at the upper band due to complex hydrolysis processes and imported substrates. Smallholder farmers averaging 0.6 hectares show limited budget flexibility, dampening uptake in western provinces where farm incomes trail coastal counterparts by 40%-50%. Yuan depreciation inflates costs for imported raw materials, amplifying volatility and compressing distributor margins. Province-level subsidy programs partially alleviate burdens but vary in coverage, creating uneven market penetration. Demonstrated return on investment remains critical, lack of extension training slows perception shifts that could offset sticker-shock concerns.

Other drivers and restraints analyzed in the detailed report include:

- Soil-Health Degradation and Fertilizer-Use-Efficiency Targets

- Expansion of Seaweed-Farming Capacity Along China's Coast

- Lack of Harmonized Efficacy Standards and Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Seaweed extracts held 38.15% of the China biostimulants market share in 2025, anchored by Shandong's integrated cultivation-to-extraction clusters that lower logistics costs and assure freshness. The category benefits from consumer preference for marine-derived inputs aligned with China's traditional kelp consumption culture. The China biostimulants market size for seaweed extracts is forecast to expand steadily as processors upgrade enzyme-assisted extraction lines to boost cytokinin and auxin concentrations. Amino acids, while representing a smaller revenue base, post a 13.09% CAGR through 2031, fueled by greenhouse vegetables where precision fertigation magnifies yield responses. Humic and fulvic acids enjoy stable demand from soil-remediation programs in Heilongjiang and Inner Mongolia. Protein hydrolysates attract niche demand in fruit orchards and berry plantations that seek quality premiums. Emerging chitosan and microbial consortium products occupy pilot-stage trials, pending regulatory pathways that can unlock future growth.

Amino-acid manufacturers invest in fermentation technologies to localize production, trimming dependency on imported feather meal substrates. Qingdao Seawin Biotech Group unveiled a multi-phase enzymatic line that cuts processing time 25% and raises free-amino-acid content, differentiating its foliar nutrient range. Competitive intensity prompts tier-two players to pursue OEM partnerships with coastal processors, cross-leveraging raw-material access and nationwide distributor networks. Wider digital-platform integration enables precise dosing, enhancing perceived value relative to fertilizers and supporting gradual premium retention.

The China Biostimulants Market Report is Segmented by Form (Amino Acids, Fulvic Acid, Humic Acid, Protein Hydrolysates, Seaweed Extracts, and More) and Crop Type (Horticultural Crops, Row Crops, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

List of Companies Covered in this Report:

- Qingdao Seawin Biotech Group Co. Ltd.

- Beijing Leili Marine BioIndustry Inc. (Leili Group)

- Valagro (Syngenta)

- Trade Corporation International (Rovensa Group)

- Biolchim SpA (Hello Nature Group)

- Atlantica Agricola S.A.

- Humic Growth Solutions, Inc.

- Sinochem Holdings Corporation Ltd.

- Shandong Sukahan Bio-Technology Co. Ltd. (Sukahan Group)

- UPL Limited

- Corteva Agriscience

- Haifa Group

- Novonesis Group

- Koppert B.V.

- BASF SE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

- 1.3 Research Methodology

2 REPORT OFFERS

3 EXECUTIVE SUMMARY AND KEY FINDINGS

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 China

- 4.4 Value Chain and Distribution Channel Analysis

- 4.5 Market Drivers

- 4.5.1 Government incentives for sustainable-input adoption

- 4.5.2 Rising domestic demand for organic produce

- 4.5.3 Soil-health degradation and fertilizer-use-efficiency targets

- 4.5.4 Expansion of seaweed-farming capacity along China's coast

- 4.5.5 Protected-horticulture boom driving high-value input demand

- 4.5.6 Integration of biostimulants into digital-farming platforms

- 4.6 Market Restraints

- 4.6.1 High price premium versus conventional fertilizers

- 4.6.2 Lack of harmonized efficacy standards and regulations

- 4.6.3 Seasonal volatility in seaweed raw-material supply

- 4.6.4 Channel destocking and tighter ag-input credit cycles

5 MARKET SIZE AND GROWTH FORECASTS (VALUE AND VOLUME)

- 5.1 Form

- 5.1.1 Amino Acids

- 5.1.2 Fulvic Acid

- 5.1.3 Humic Acid

- 5.1.4 Protein Hydrolysates

- 5.1.5 Seaweed Extracts

- 5.1.6 Other Biostimulants

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Qingdao Seawin Biotech Group Co. Ltd.

- 6.4.2 Beijing Leili Marine BioIndustry Inc. (Leili Group)

- 6.4.3 Valagro (Syngenta)

- 6.4.4 Trade Corporation International (Rovensa Group)

- 6.4.5 Biolchim SpA (Hello Nature Group)

- 6.4.6 Atlantica Agricola S.A.

- 6.4.7 Humic Growth Solutions, Inc.

- 6.4.8 Sinochem Holdings Corporation Ltd.

- 6.4.9 Shandong Sukahan Bio-Technology Co. Ltd. (Sukahan Group)

- 6.4.10 UPL Limited

- 6.4.11 Corteva Agriscience

- 6.4.12 Haifa Group

- 6.4.13 Novonesis Group

- 6.4.14 Koppert B.V.

- 6.4.15 BASF SE

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS