PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850383

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850383

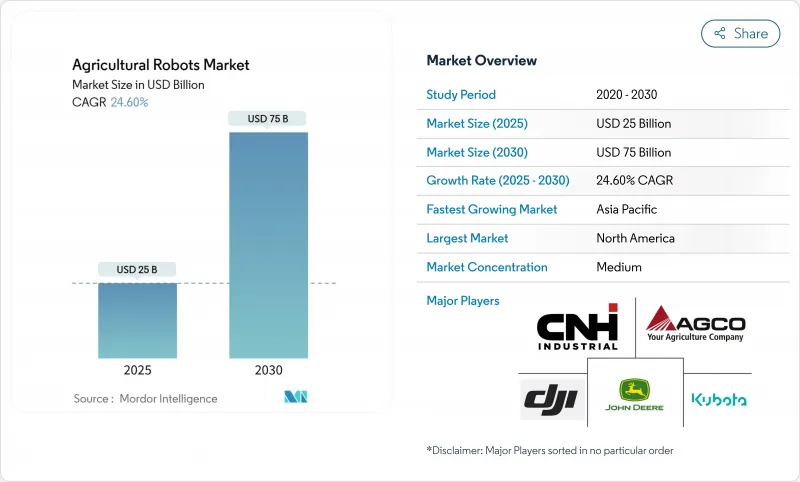

Agricultural Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The agricultural robots market is valued at USD 25 billion in 2025 and is forecast to climb to USD 75 billion by 2030, reflecting a 24.6% CAGR.

This growth stems from farmers' urgent need to offset labor shortages, raise yields, and cut input waste through autonomous machines that integrate artificial intelligence, computer vision, and precision sensors. Strong demand for flexible equipment that can operate day and night across broad-acre and specialty crops keeps capital flowing toward new field-ready platforms while falling component prices make once-premium technologies affordable to mid-sized producers. Hardware remains the revenue anchor today, yet recurring software subscriptions and service agreements expand rapidly as growers prioritize integrated decision support, predictive maintenance, and cloud-based fleet coordination. Venture and corporate investors view the agricultural robots market as a core pillar of the wider AgTech ecosystem and continue financing start-ups that solve specific pain points, such as chemical-free weeding, selective harvesting, and data fusion across disparate farm assets. Finally, government subsidies that reward sustainable practices accelerate adoption by absorbing part of the upfront cost and by clarifying safety rules for autonomous machines.

Global Agricultural Robots Market Trends and Insights

Chronic Labor Shortages and Aging Farmer Population

Labor scarcity has risen to a structural challenge as experienced workers retire and younger generations pursue non-farm careers. In the United States, 60% of agribusinesses postponed projects during 2024 because they could not secure seasonal crews, and labor already accounts for 40% of production costs on high-value California farms. Autonomous robots provide a consistent workforce that operates around the clock without overtime, improving field-work continuity and mitigating wage inflation pressures. Suppliers now emphasize ease of deployment to help growers integrate robotic units with minimal training, further lowering the barrier to entry.

Rising Venture and Corporate Investments in Ag-Robotics

Despite a dip in broader AgTech funding, capital committed to farm robotics rose 9% in 2024, underscoring investor conviction in scalable automation solutions. New Holland partnered with Bluewhite to retrofit specialty tractors, a collaboration expected to trim operating costs by up to 85% for orchard and vineyard owners. Verdant Robotics, Fieldwork Robotics, and other start-ups have secured multi-million-dollar rounds that shorten product-development cycles and accelerate international launches. The resulting innovation wave keeps the agricultural robot market highly dynamic and competitive.

High Upfront Cost and Uncertain ROI for Smallholders

A fully automated milking parlor can cost USD 10,000 per cow, translating into nearly USD 2 million for a 180-cow dairy. Many smallholders cannot access affordable finance or lease programs, and fluctuating commodity prices lengthen the payback horizon. Modular designs and cooperative ownership models have emerged to spread capital burdens, yet economic feasibility remains a hurdle in price-sensitive regions.

Other drivers and restraints analyzed in the detailed report include:

- Government Incentives for Smart Farming Automation

- Rapid Advances in AI, Vision, and LIDAR Technologies

- Fragmented Certification for Autonomous Machinery

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

UAVs retained 35% of the agricultural robots market share in 2024 as growers relied on aerial imagery, variable-rate spraying, and crop-stress detection to raise input efficiency. DJI reported more than 400,000 drones treating 500 million hectares worldwide, confirming drones' role as an early-stage automation gateway. The agricultural robots market size tied to UAV hardware and associated software subscriptions is forecast to expand steadily as national airspace authorities refine rules that permit beyond-visual-line-of-sight missions.

Automated harvesters log the fastest 26% CAGR because fruit and vegetable producers confront severe picker shortages and tight harvest windows. Fieldwork Robotics' raspberry unit already matches human throughput at 150 to 300 berries per hour and promises continuous operation through night shifts. Driverless tractors also gain momentum at a 27% growth clip as OEMs retrofit existing fleets with perception kits that manage tillage, seeding, and grain-cart duties.

The Agricultural Robots Market Report is Segmented by Type (Unmanned Aerial Vehicles (Drones), Milking Robots, Driverless Tractors, and More), Application (Broad Acre Applications, Dairy Farm Management, Aerial Data Collection, and More), Offering (Hardware, Software, and Services), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 37% of the agricultural robots market in 2024 due to large farm sizes, supportive regulatory sandboxes, and deep venture capital pools. Carbon Robotics raised USD 70 million to scale its second-generation LaserWeeder, reflecting investor confidence in chemical-free weed control. The United States reviews safety rules for driverless tractors, signaling a path toward mainstream field autonomy. Canada and Mexico add demand through grains and high-value horticulture, respectively, broadening the region's adoption base.

Asia-Pacific posts the fastest 25.5% CAGR as China funds domestic robotics champions and monitors food-security objectives. The Japanese government subsidizes autonomous orchard solutions for an aging farming population, while Australia's National Robotics Strategy targets AUD 600 billion (USD 420 billion) in GDP gains from wider automation. India explores low-cost weeding and spraying robots tailored to smallholder budgets, though connectivity and financing remain obstacles.

Europe advances steadily, spurred by labor shortages, sustainability regulation, and high crop protection standards. The European Union's Machinery Regulation includes new provisions for autonomous mobile machines, giving manufacturers a clearer compliance roadmap. Germany pilots the fully electric Fendt e100 Vario tractor, proving zero-emission field work over four to seven hours of operation on a single 100 kWh battery. The United Kingdom's grant program offsets robotics purchases, and France and Spain test multi-robot weeders in vineyards and olive groves.

- Agrobot

- Harvest Automation Inc. (Tertill)

- AGCO Corporation

- Lely International N.V

- Naio Technologies SAS

- Deere & Company

- AgEagle Aerial Systems Inc.

- CNH Industrial N.V.

- Yanmar Holdings Co., Ltd.

- GEA Group AG

- Kubota Corporation

- SZ DJI Technology Co., Ltd.

- BouMatic LLC

- Topcon Corporation

- Yamaha Agriculture Inc., (Yamaha Motor)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Chronic labor shortages and an aging farmer population

- 4.2.2 Rising venture and corporate investments in ag-robotics

- 4.2.3 Government incentives for smart farming automation

- 4.2.4 Rapid advances in AI, vision, and LIDAR technologies

- 4.2.5 Night-time autonomous operations to avoid heat stress

- 4.2.6 Demand for pesticide-free laser weeding solutions

- 4.3 Market Restraints

- 4.3.1 High upfront cost and uncertain ROI for smallholders

- 4.3.2 Gaps in rural connectivity for real-time control

- 4.3.3 Ethical concerns over animal-robot interaction

- 4.3.4 Fragmented certification for autonomous machinery

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Unmanned Aerial Vehicles (Drones)

- 5.1.2 Milking Robots

- 5.1.3 Driverless Tractors

- 5.1.4 Automated Harvesting Systems

- 5.1.5 Multi-purpose Field Robots

- 5.1.6 Sorting and Packaging Robots

- 5.2 By Application

- 5.2.1 Broad Acre Applications

- 5.2.1.1 Field Mapping

- 5.2.1.2 Seeding and Planting

- 5.2.1.3 Fertilizing and Irrigation

- 5.2.1.4 Intercultural Operations

- 5.2.1.5 Picking and Harvesting

- 5.2.2 Dairy Farm Management

- 5.2.2.1 Milking

- 5.2.2.2 Shepherding and Herding

- 5.2.3 Aerial Data Collection

- 5.2.4 Weather Tracking and Forecasting

- 5.2.5 Inventory Management

- 5.2.6 Greenhouse Automation

- 5.2.7 Fruit Orchard Operations

- 5.2.1 Broad Acre Applications

- 5.3 By Offering

- 5.3.1 Hardware

- 5.3.1.1 Autonomous Navigation Systems

- 5.3.1.2 Sensors and Vision Systems

- 5.3.1.3 Robotic Arms and End Effectors

- 5.3.2 Software

- 5.3.2.1 Robot Operating Systems

- 5.3.2.2 Farm Management Platforms

- 5.3.2.3 Data Analytics and AI Algorithms

- 5.3.3 Services

- 5.3.3.1 Integration and Deployment

- 5.3.3.2 Maintenance and Upgrades

- 5.3.3.3 Data-as-a-Service

- 5.3.1 Hardware

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Russia

- 5.4.3.7 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 Japan

- 5.4.4.3 India

- 5.4.4.4 Australia

- 5.4.4.5 South Korea

- 5.4.4.6 Rest of Asia-Pacific

- 5.4.5 Middle East

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 United Arab Emirates

- 5.4.5.3 Rest of Middle East

- 5.4.6 Africa

- 5.4.6.1 South Africa

- 5.4.6.2 Egypt

- 5.4.6.3 Rest of Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Agrobot

- 6.4.2 Harvest Automation Inc. (Tertill)

- 6.4.3 AGCO Corporation

- 6.4.4 Lely International N.V

- 6.4.5 Naio Technologies SAS

- 6.4.6 Deere & Company

- 6.4.7 AgEagle Aerial Systems Inc.

- 6.4.8 CNH Industrial N.V.

- 6.4.9 Yanmar Holdings Co., Ltd.

- 6.4.10 GEA Group AG

- 6.4.11 Kubota Corporation

- 6.4.12 SZ DJI Technology Co., Ltd.

- 6.4.13 BouMatic LLC

- 6.4.14 Topcon Corporation

- 6.4.15 Yamaha Agriculture Inc., (Yamaha Motor)

7 Market Opportunities and Future Outlook