Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685946

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685946

Soil Treatment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 323 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

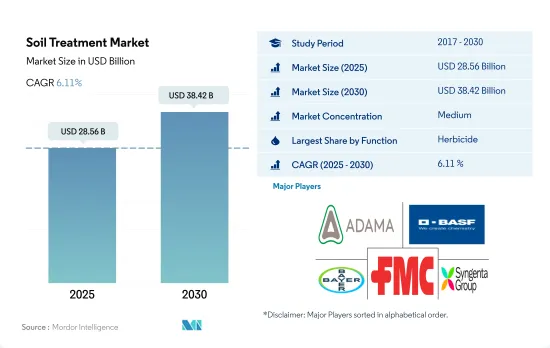

The Soil Treatment Market size is estimated at 28.56 billion USD in 2025, and is expected to reach 38.42 billion USD by 2030, growing at a CAGR of 6.11% during the forecast period (2025-2030).

Herbicides dominate the market due to their effectiveness through soil treatment methods

- Herbicides accounted for the highest share of 72.8% in the utilization of soil treatment methods in 2022. These herbicides specifically target weed seeds, impeding their germination even prior to crop sowing. This approach has gained popularity due to its ability to proactively manage weed populations proactively, ensuring better crop establishment and overall weed control.

- There is a growing trend toward adopting modern farming practices, including no-till and minimum-till farming. Herbicides may be applied through the soil treatment method with precision, targeting specific areas in the field where weed pressure is high, thereby optimizing herbicide use and reducing costs. These factors are driving the adoption of soil treatment for herbicide applications.

- Insecticides accounted for a share of 12.8% of the global soil treatment market in 2022. Although the pupae and eggs in the soil are not affected by the normal doses of pesticides, larval and adult stages may be controlled by soil treatment. Pests like white grubs, wireworms, fungus gnats, and soil mealybugs may effectively be managed by soil application.

- The utilization of soil treatment fungicides was predominantly focused on grains and cereals, representing the largest value share of 45.4% in the market. This preference is driven by the effectiveness of fungicides in protecting the quality of grains and cereals, as they help prevent or reduce fungal infections.

- The soil treatment of nematicides like aldicarb, fenamiphos, and oxamyl may effectively be employed in controlling microscopic nematodes like Meloidogyne incognita and Pratylenchus brachyurus that are known to cause significant losses in various crops.

- Owing to the aforementioned factors, the market for soil treatment is anticipated to grow.

The rise in yield losses in major countries due to pests is driving the use of soil treatment

- Soil-borne pests may have a significant global impact on agriculture and ecosystems. These pests include nematodes, fungi, bacteria, and insects that live in the soil and can damage crops, reduce yields, and disrupt ecosystems. Managing pests effectively is essential for ensuring food security and maintaining a stable food supply.

- In 2022, the soil treatment segment in South America held a substantial 34.2% share of the global market. From 2017 to 2022, the region witnessed a noteworthy increase in market value, accounting for USD 8,568.9 million in 2022. Growers commonly employ soil drenching, broadcast, and furrow application techniques for soil treatment. Enhancing the control of soil-borne diseases and pests through these methods improves crop yields. The growing emphasis on preserving soil health has prompted farmers to embrace these soil treatment approaches.

- North America is the second leading country, holding a substantial 29.6% global market share. Soil-borne diseases are considered a major limitation of crop production. Soil-borne plant pathogens such as Rhizoctonia spp., Fusarium spp., Verticillium spp., Sclerotinia spp., Pythium spp., and Phytophthora spp. can cause 50% to 75% yield loss for many crops such as wheat, cotton, maize, vegetables, fruits, and ornamentals.

- Therefore, the global soil treatment market value is expected to register a CAGR of 5.0% during 2023-2029 and is anticipated to witness significant growth in all crop types due to the changing climate and rising crop losses due to pest infestation.

Global Soil Treatment Market Trends

The increasing infestation of soil borne pest, diseases, and weeds, the per hectare consumption of soil treatment of pesticides is likely to increase globally

- The global average consumption of crop protection chemicals through soil application mode was recorded as 2,345.0 g per ha of agricultural land in 2022, which increased by 13.6% compared to 2017, which was 2,065.0 g per ha.

- The growing trend toward the adoption of modern farming practices, including no-till and minimum-till farming, is increasing the pest population in the soil, necessitating the soil application of pesticides to control pests, weeds, and soil-borne diseases.

- Herbicides, specifically pre-emergent herbicides, are generally applied to soil as they specifically target weed seeds, impeding their germination even prior to crop sowing. This approach has gained popularity due to its ability to proactively manage weed populations proactively, ensuring better crop establishment and overall weed control.

- The white grub infestation reduced the root system by approximately 25% in soybeans and 64% in maize. It was observed that Phyllophaga capillata and Aegopsis bolboceridus damaged all evaluated variables, reducing overall soybean productivity by 58.62% and maize productivity by 59.76% in South American countries like Brazil. All these soil-borne pests may effectively be controlled by soil application of insecticides.

- Similarly, nematodes like Meloidogyne incognita and Pratylenchus brachyurus cause significant losses in fruit and vegetable crops. For instance, carrots are susceptible to considerable losses, averaging up to 20.0%. As these parasitic nematodes are soil-dwelling organisms, it is important to treat the soil with nematicides to kill these organisms.

Soil treatment pesticide usage is increasing with the need for controlling soil-borne diseases

- Amid the dynamic landscape of the pesticide market, soil treatment pesticides stand out as crucial components. These specialized chemicals play a pivotal role in fostering healthy crop growth, effective pest and disease control, and sustainable agricultural practices.

- Cypermethrin is a pyrethroid insecticide that may be used as a soil treatment pesticide. When applied to the soil, it provides effective control against a variety of soil-borne pests, including termites and root maggots. Cypermethrin's mode of action involves targeting the nervous system of the pests upon contact, leading to paralysis and eventual death. It was priced at USD 21.0 thousand per metric ton in 2022.

- Atrazine is an herbicide commonly used as a soil treatment to control various broadleaf and grassy weeds in agricultural fields and non-crop areas. It is particularly effective in managing weed populations that compete with crops for nutrients, water, and sunlight. In 2022, it was priced at USD 13.8 thousand per metric ton.

- Malathion is an organophosphate insecticide used as a soil treatment to control a variety of insect pests in agricultural fields and non-crop areas. It is effective in managing both flying and crawling insects that may cause damage to crops and other plants. Malathion was priced at USD 12.5 thousand per metric ton.

- Mancozeb is a fungicide and soil treatment used to control various fungal diseases such as damping-off, blight, and downy mildew. It belongs to the class of dithiocarbamates and is known for its broad-spectrum activity against a wide range of plant pathogens. In 2022, it was priced at USD 7.8 thousand per metric ton.

Soil Treatment Industry Overview

The Soil Treatment Market is moderately consolidated, with the top five companies occupying 44.67%. The major players in this market are ADAMA Agricultural Solutions Ltd, BASF SE, Bayer AG, FMC Corporation and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49722

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 Chile

- 4.3.6 China

- 4.3.7 France

- 4.3.8 Germany

- 4.3.9 India

- 4.3.10 Indonesia

- 4.3.11 Italy

- 4.3.12 Japan

- 4.3.13 Mexico

- 4.3.14 Myanmar

- 4.3.15 Netherlands

- 4.3.16 Pakistan

- 4.3.17 Philippines

- 4.3.18 Russia

- 4.3.19 South Africa

- 4.3.20 Spain

- 4.3.21 Thailand

- 4.3.22 Ukraine

- 4.3.23 United Kingdom

- 4.3.24 United States

- 4.3.25 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 South Africa

- 5.3.1.1.2 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Myanmar

- 5.3.2.1.7 Pakistan

- 5.3.2.1.8 Philippines

- 5.3.2.1.9 Thailand

- 5.3.2.1.10 Vietnam

- 5.3.2.1.11 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Ukraine

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.4 North America

- 5.3.4.1 By Country

- 5.3.4.1.1 Canada

- 5.3.4.1.2 Mexico

- 5.3.4.1.3 United States

- 5.3.4.1.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 By Country

- 5.3.5.1.1 Argentina

- 5.3.5.1.2 Brazil

- 5.3.5.1.3 Chile

- 5.3.5.1.4 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd

- 6.4.2 American Vanguard Corporation

- 6.4.3 BASF SE

- 6.4.4 Bayer AG

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 PI Industries

- 6.4.8 Rallis India Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.