PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441592

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1441592

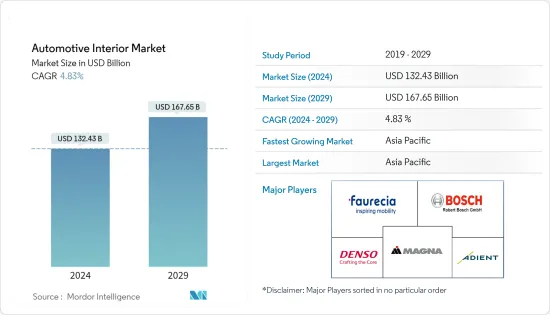

Automotive Interior - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Automotive Interior Market size is estimated at USD 132.43 billion in 2024, and is expected to reach USD 167.65 billion by 2029, growing at a CAGR of 4.83% during the forecast period (2024-2029).

The COVID-19 pandemic has hindered the growth of the automotive interior market due to its impact on vehicle production. However, a steady recovery post-2020 in vehicle production will support the development of this market in the coming years. For instance, Marelli had a significant impact on COVID-19 on its overall production in the first two quarters of 2020. The company had to shut its facilities for around two weeks in the country after the nationwide lockdown, which started in March 2020. However, the company resumed its operations in April 2020 with the necessary measures.

There have been several technological dominance followed in-vehicle infotainment systems, which has provided a significant boost to the automotive interiors market growth. For instance:

Key Highlights

- There is a rise in smartphone functions built into in-vehicle infotainment systems. In North America and Europe, over 90% of adults have access to the internet through their mobile phones, which is also among the highest among other regions. As mobile phone use has risen, smartphones for the same purposes in their cars have also increased.

- Manufacturers are introducing a touchscreen infotainment system, which has completely changed the in-house cabin experience. Today, after several new advancements seen by the touch screen infotainment system, manufacturers have introduced a predictive touchscreen feature that shall follow the instruction without actually touching the screen. This has improved drivers' comfort and ease, thus gaining momentum.

Increasing consumer safety concerns, rising technological advancements, and a surge in demand for luxurious vehicles are expected to boost the market growth. Government support for lightweight and safe vehicles will likely surge the market growth.

Asia-Pacific accounted for the largest share in terms of consumption in the automotive interior materials market. Japan and China will be the primary support for the region's increasing demand. Moreover, an improved outlook for product demand in India is another potential factor for growth. With its sizeable OEM base of automobile manufacturers, Europe will also add to the order in the interior material market.

Automotive Interior Market Trends

Infotainment System Expected to Dominate the Automotive Interiors Market

The infotainment system is the largest segment in the automotive interiors market. Earlier, cars were offered only one infotainment screen, but as technology advances, the number and dimension of infotainment screens are also increasing.

As such, the infotainment screens have become the main focal point for every automaker, and these screens are packed with the latest technology capabilities, as In 2022, Mercedes-Benz launched its S-class fleet for the Indian market, namely, S350d and S450 importing 150 new cars. The infotainment system in the vehicle amazes the consumer; with 64-colour ambient lighting and rear seat infotainment screens, the car offers ultimate comfort and luxury.

Automakers constantly upgrade their infotainment systems to provide their customers with the best features and technologies. Some of the recent launches and models are:

- In 2022, Jeep also proposed that Jeep Grand Cherokee 2022 model may have two rear seat infotainment screens with a screen in the dashboard for the front-seat passenger to interact with the driver's navigation system.

- In 2022, Toyota launched its new segment Tundra TRD truck, powered by the 3.5-liter V6 twin-turbo hybrid engine. The pickup truck's interior seems promising from a consumer's point of view. It is equipped with the in-dash infotainment system, which changes brightness randomly without a change in natural lighting.

- In 2022, Rivian launched its new electric pickup truck considering all the requirements of critical consumers. This newly launched pickup truck is equipped with decorated ash wood on the dash infotainment system board. The system comprises of 12.3 landscape-oriented screen inbuilt placed just above the HVAC vents of the car.

As the cars come with more connected features, the telecom and technology players are partnering with major automotive players to develop the best connectivity and infotainment solutions for the customers.

Considering all the factors above and the development of in-vehicle infotainment systems, the automotive interiors market is expected to witness prosperity in the forecast period.

Asia-Pacific is Leading the Automotive Interiors Market

The Asian-Pacific market is driven by the small/economy car segment, which accounts for higher adoption of interior components. Leading automakers in this region, such as Toyota, Honda, and Hyundai, are embracing the advantages of advanced seating systems, lighting, electronics, and various safety systems, making them essential features across their car models. The emergence of electric vehicles in major economies, including Japan, China, and India, further supports the market value.

In April 2022, Chinese passenger car production reached 996,000 units, with sales registering 965,000 units. This accounts for the downfall of 41.9% and 43.4% respectively in production and sales compared to the previous year. In 2022, from January to April, passenger car production decreased by 2.6% year-on-year, registering 6,494 million units.

In China, local players are collaborating to produce the best interior products. For instance, BAIC Yunxiang Automobile Co. Ltd collaborated with ADAYO to develop vehicle infotainment systems. This partnership will build new platforms for BAIC Yinxiang and helps to restructure the platform production mode for intelligent vehicle manufacturing. Chinese players are debuting in the market with a new vision to provide growth to the market. For instance, In November 2021, China's leading automotive supplier for interior components, Yanfeng Automotive Interiors (YFAI), introduced an industry-first camera under panel onboard intelligent screen, which is co-developed with TCL and its subsidiary TCL CSOT.

The demand for premium interiors, comfort, and new and innovative features, like head-up displays and navigation systems, along with the growing focus on sufficing the safety standards, is driving the market in the region. Major countries in this region, such as China, Japan, India, and South Korea, are anticipated to witness the rapid adoption of new technologies. Due to its high vehicle production capacity, China is expected to contribute to Asia-Pacific's market growth significantly.

In Asia-Pacific, government initiatives, such as subsidies and tax concessions, across various countries are attracting automotive OEMs to build their regional manufacturing plants.

Automotive Interior Industry Overview

Key automotive interior market participants are Continental AG, Magna International Inc., Denso Corporation, Faurecia, Adient, and Others. The automotive interiors market is likely to expect competition in the coming years, owing to various strategies, such as focused research and development activities, new product developments, acquisitions, etc., by significant product manufacturers to gain a competitive advantage. For instance,

- In May 2022, Lear Corporation, an automotive technology, announced that it is acquiring I.G. Bauerhin, a seat heating supplier, active cooling, seat sensor, and other interior components.

- In September 2021, Adient will begin using cardyon; a polyol made using Covestro's CO2 technology, as a sustainable feedstock for the production of hot cure molded polyurethane foam in November 2021, according to Covestro. These foams are used as cushioning in Adient's cutting-edge automotive seating systems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size in Value USD Billlion)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 By Component Type

- 5.2.1 Instrument Panels

- 5.2.2 Infotainment Systems

- 5.2.3 Interior Lighting

- 5.2.4 Body Panels

- 5.2.5 Other Component Types

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.1 North America

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 South Africa

- 5.3.5.4 Rest of Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Adient PLC

- 6.2.2 Grupo Antolin

- 6.2.3 Panasonic Corp.

- 6.2.4 Faurecia

- 6.2.5 Magna International

- 6.2.6 Toyota Boshuku Corporation

- 6.2.7 Hyundai Mobis Co.

- 6.2.8 Pioneer Corporation

- 6.2.9 JVCKENWOOD Corporation

- 6.2.10 Robert Bosch GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS