Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693526

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1693526

Specialty Fertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 351 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

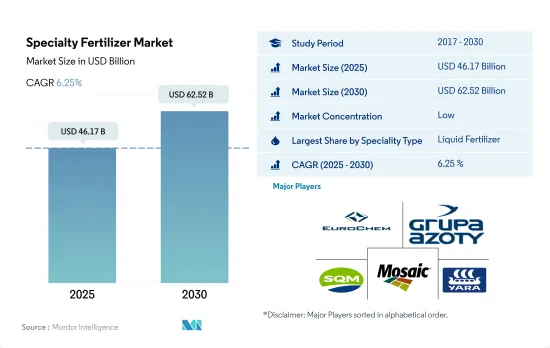

The Specialty Fertilizer Market size is estimated at 46.17 billion USD in 2025, and is expected to reach 62.52 billion USD by 2030, growing at a CAGR of 6.25% during the forecast period (2025-2030).

The demand for high nutrient-efficient fertilizers is driving the demand for specialty fertilizers

- In 2022, the global specialty fertilizers market represented approximately 12.0% of the total global fertilizer market, with a valuation of around USD 51.74 billion. Over the study period, the market witnessed a robust growth of 83.8%. This surge can be attributed to the rising environmental concerns, which are anticipated to propel the specialty fertilizer market during 2023-2030.

- Water-soluble fertilizers, constituting roughly 44.6% of the market value, are predominantly dominated by Asia-Pacific and North America. Together, these regions commanded over 70.3% of the global water-soluble fertilizer market in 2022.

- Between 2023 and 2030, the consumption of slow-release fertilizers is projected to witness a notable uptick, with a CAGR of 3.7%. Simultaneously, the market value for these fertilizers is expected to register a CAGR of 6.1%. This shift is driven by farmers and growers recognizing the benefits of slow-release fertilizers in enhancing crop yields and quality while minimizing environmental impact.

- Moreover, there is a discernible shift toward liquid fertilizers, driven by their ease of application, uniform distribution, and cost-effectiveness. These factors are projected to fuel the liquid fertilizer market, with an estimated CAGR of 5.8% during 2023-2030.

- Key drivers for the global specialty fertilizer market in the forecast period include heightened fertilizer-use efficiency, a surge in specialty fertilizer adoption, and an increasing preference for sprinklers or micro-irrigation systems across agricultural lands.

Asia-Pacific region is the largest market for specialty fertilizers.

- In 2022, Asia-Pacific held the largest share of the specialty fertilizer market, accounting for 45.8% of its total value. Field crops dominated the region's specialty fertilizer consumption, representing 83.5% of the volume. Horticultural crops followed at 13.7%, while turf and ornamental crops lagged behind at under 1%.

- China led the pack in the field crops segment, commanding 43.04% of the specialty fertilizer market's value. India trailed at 17.15%, with Japan at roughly 16.35%, and Indonesia at 5.67%. Australia secured a 4.07% share of the Asia-Pacific specialty fertilizer market in 2022.

- North America emerged as the second-largest specialty fertilizer market globally, capturing 24.8% of its total value, amounting to approximately USD 12.59 billion in 2022. Field crops dominated the North American market, accounting for 86.8% of the consumption, while turf and ornamental crops held a 7.6% share, and horticultural crops claimed 6.2%.

- South America contributed around 18.48% to the global specialty fertilizer market, valued at roughly USD 3.04 billion in 2021. Brazil stood out as the dominant player in the South American market, with its specialty fertilizer market reaching USD 1.75 billion in 2022, and a consumption volume of 2.0 million metric tons.

- The specialty fertilizer market witnessed a consistent growth in volume and value, barring a dip in 2020 due to supply chain disruptions triggered by the COVID-19 pandemic.

- Mounting concerns over fertilizer pollution, stemming from global overuse, are poised to propel the global specialty fertilizer market in the coming years.

Global Specialty Fertilizer Market Trends

Field crops being the staple food across the globe, area under field crops will grow in the coming years.

- The global agricultural sector is facing many challenges. According to the UN, the world population will likely exceed nine billion by 2050. This population growth may overburden the agricultural industry, which is already experiencing an output loss due to a lack of laborers and the shrinkage of agricultural fields caused by rising urbanization. According to the Food and Agriculture Organization, 70% of the global population is expected to live in cities by 2050. Due to the global loss of arable land, farmers now need to utilize more fertilizers to increase crop yields.

- Asia-Pacific is the world's largest producer of agricultural products. Agriculture is critical to the region's economy, as it employs about 20% of the total available workforce. Field crop cultivation dominates the region, accounting for about more than 95% of the total crop area in the region. Rice, wheat, and corn are the major field crops produced in the region, together accounting for about 24.3% of the total crop area in 2022.

- North America is the second-largest arable region of the total agricultural land area in the world. Diverse varieties of crops are grown in North American farms, primarily field crops. As per the USDA, corn, cotton, rice, soybean, and wheat are among the region's dominant field crops. The United States dominated the market by accounting for 46.2% of the total area under crop cultivation in 2022 of the overall North American area under cultivation. Crop acreage in the country fell significantly between 2017 and 2019, primarily due to unfavorable environmental conditions that resulted in heavy floods in areas such as Texas and Houston.

Among all nutrients, primary nutrients (N, P, and K) have the highest average application rate at 164.3 kg/hectares.

- Corn/maize, rapeseed/canola, cotton, sorghum, rice, wheat, and soybean rank among the primary nutrient-intensive crops globally. The application rates for primary nutrients in these crops were as follows: corn/maize - 230.57 kg/ha, rapeseed/canola - 255.75 kg/ha, cotton - 172.70 kg/ha, sorghum - 158.46 kg/ha, rice - 154.49 kg/ha, wheat - 135.35 kg/ha, and soybean - 120.97 kg/ha. Primary nutrient fertilizers are pivotal for crop growth, facilitating vital plant metabolic processes and aiding in the formation of crucial plant tissues like cells, cell membranes, and chlorophyll. Phosphorus is particularly vital for cultivating high-quality crops, while potassium plays a key role in activating enzymes essential for plant growth.

- The global average application rate for nitrogen, potassium, and phosphorus in field crops stands at 164.31 kg/ha. Nitrogen emerges as the most widely used primary nutrient fertilizer, with an average application rate of 224.6 kg/ha, followed by potassic fertilizers at 150.3 kg/ha. Phosphorus ranks third, with an average application rate of 117.9 kg/ha in 2022.

- In 2022, rapeseed recorded the highest nitrogen application rate at 347.4 kg/ha, while corn/maize led in phosphorus application at 156.3 kg/ha. Canola took the lead in potassium application, with a rate of 248.6 kg/ha. The global cultivation area for field crops is on the rise, with South America and Asia-Pacific witnessing notable growth. These regions are emerging as potential markets for fertilizers. Developed regions like Europe and North America, along with areas grappling with nutrient deficiencies, are increasingly turning to specialty fertilizers for their efficacy. These trends are expected to propel the primary nutrient fertilizers market during 2023-2030.

Specialty Fertilizer Industry Overview

The Specialty Fertilizer Market is fragmented, with the top five companies occupying 30.38%. The major players in this market are EuroChem Group, Grupa Azoty S.A. (Compo Expert), Sociedad Quimica y Minera de Chile SA, The Mosaic Company and Yara International ASA (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 92590

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Acreage Of Major Crop Types

- 4.1.1 Field Crops

- 4.1.2 Horticultural Crops

- 4.2 Average Nutrient Application Rates

- 4.2.1 Micronutrients

- 4.2.1.1 Field Crops

- 4.2.1.2 Horticultural Crops

- 4.2.2 Primary Nutrients

- 4.2.2.1 Field Crops

- 4.2.2.2 Horticultural Crops

- 4.2.3 Secondary Macronutrients

- 4.2.3.1 Field Crops

- 4.2.3.2 Horticultural Crops

- 4.2.1 Micronutrients

- 4.3 Agricultural Land Equipped For Irrigation

- 4.4 Regulatory Framework

- 4.5 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Speciality Type

- 5.1.1 CRF

- 5.1.1.1 Polymer Coated

- 5.1.1.2 Polymer-Sulfur Coated

- 5.1.1.3 Others

- 5.1.2 Liquid Fertilizer

- 5.1.3 SRF

- 5.1.4 Water Soluble

- 5.1.1 CRF

- 5.2 Application Mode

- 5.2.1 Fertigation

- 5.2.2 Foliar

- 5.2.3 Soil

- 5.3 Crop Type

- 5.3.1 Field Crops

- 5.3.2 Horticultural Crops

- 5.3.3 Turf & Ornamental

- 5.4 Region

- 5.4.1 Asia-Pacific

- 5.4.1.1 Australia

- 5.4.1.2 Bangladesh

- 5.4.1.3 China

- 5.4.1.4 India

- 5.4.1.5 Indonesia

- 5.4.1.6 Japan

- 5.4.1.7 Pakistan

- 5.4.1.8 Philippines

- 5.4.1.9 Thailand

- 5.4.1.10 Vietnam

- 5.4.1.11 Rest of Asia-Pacific

- 5.4.2 Europe

- 5.4.2.1 France

- 5.4.2.2 Germany

- 5.4.2.3 Italy

- 5.4.2.4 Netherlands

- 5.4.2.5 Russia

- 5.4.2.6 Spain

- 5.4.2.7 Ukraine

- 5.4.2.8 United Kingdom

- 5.4.2.9 Rest of Europe

- 5.4.3 Middle East & Africa

- 5.4.3.1 Nigeria

- 5.4.3.2 Saudi Arabia

- 5.4.3.3 South Africa

- 5.4.3.4 Turkey

- 5.4.3.5 Rest of Middle East & Africa

- 5.4.4 North America

- 5.4.4.1 Canada

- 5.4.4.2 Mexico

- 5.4.4.3 United States

- 5.4.4.4 Rest of North America

- 5.4.5 South America

- 5.4.5.1 Argentina

- 5.4.5.2 Brazil

- 5.4.5.3 Rest of South America

- 5.4.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 Coromandel International Ltd.

- 6.4.2 EuroChem Group

- 6.4.3 Grupa Azoty S.A. (Compo Expert)

- 6.4.4 Haifa Group

- 6.4.5 Kingenta Ecological Engineering Group Co., Ltd.

- 6.4.6 Koch Industries Inc.

- 6.4.7 Nutrien Ltd.

- 6.4.8 Sociedad Quimica y Minera de Chile SA

- 6.4.9 The Mosaic Company

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FERTILIZER CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.