PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851480

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851480

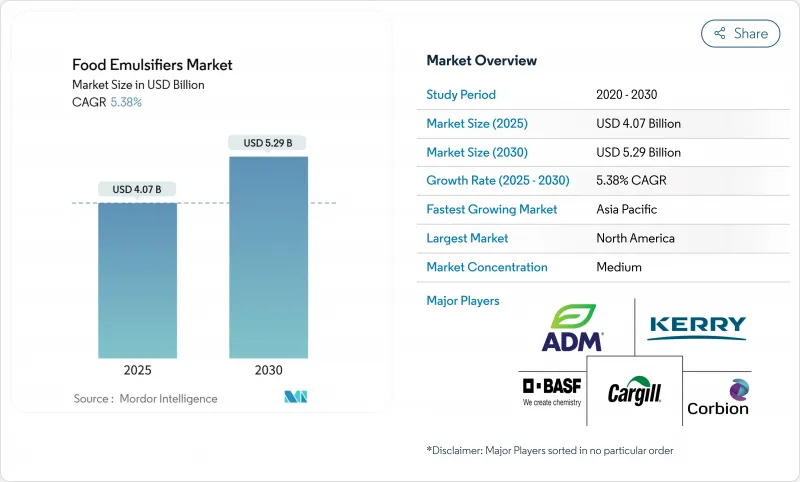

Food Emulsifiers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Food Emulsifiers Market size is estimated at USD 4.07 billion in 2025, and is expected to reach USD 5.29 billion by 2030, at a CAGR of 5.38% during the forecast period (2025-2030).

The growing demand for clean-label formulations, coupled with the increasing adoption of plant-based products, is reshaping the food and beverage market. The FDA's 2025 GRAS streamlining initiative has further accelerated this transformation by expanding the customer base and significantly reducing the time-to-market for new product blends. According to a survey conducted by the International Food Information Council (IFIC), 11% of Americans reported practicing clean eating, while 3% identified as following a plant-based diet. These trends highlight a shift in consumer preferences toward healthier and more sustainable options. Leading manufacturers are investing in the advancement of mono-diglyceride technologies to enhance heat stability in shelf-stable foods. To align with consumer demand for natural-origin claims, these technologies are often paired with lecithin. Multinational corporations with integrated supply chains are also scaling up their technical-service programs to support regional processors in overcoming formulation challenges, particularly in replicating textures for dairy alternatives.

Global Food Emulsifiers Market Trends and Insights

Surging demand for shelf-stable and ready-to-eat products

The increasing demand for shelf-stable and ready-to-eat products is driving significant shifts in emulsifier requirements. Manufacturers are focusing on developing formulations that ensure texture stability over extended storage periods. This trend is further accelerated by supply chain disruptions, which have highlighted the strategic importance of extended shelf-life products. The transition toward shelf-stable formats is fostering advancements in emulsifier technologies, with a strong emphasis on heat-resistant formulations capable of withstanding retort processing while maintaining sensory quality. For instance, Ingredion Incorporated offers EVANESSE CB6194, a vegan chickpea broth that matches the emulsification performance of traditional additives while serving as a clean-label emulsifier for creating shelf-stable vegan food products. Modern emulsifier systems now combine traditional mono-diglycerides with innovative plant-based alternatives, offering enhanced stability. This evolution presents a strategic opportunity for suppliers to deliver comprehensive solutions that effectively address both stability and clean-label requirements.

Growing use of emulsifiers in bakery and confectionary application

Manufacturers in the bakery and confectionery market are increasingly adopting advanced emulsifier systems to enhance texture and extend shelf life. The shift toward clean-label formulations is driving demand for lecithin-based and plant-derived alternatives that replicate synthetic functionality. For example, AAK offers Akolec and claims that the product line is derived from sunflower and soybean oils, supports improved nutrition, functionality, and processing across baked goods, confectionery, and plant-based dairy and meat alternatives. The European Food Safety Authority continues to validate the safety of traditional emulsifiers like polysorbates, giving manufacturers confidence in existing formulations while exploring natural options. Innovation is focusing on dual-functionality emulsifiers that stabilize and offer added benefits like dough conditioning and anti-staling. Enzyme-modified emulsifiers are emerging as key growth drivers, enhancing performance in high-moisture bakery products while maintaining clean-label appeal.

Consumer concern over chemical additives in packaged foods

Rising consumer skepticism toward synthetic additives is significantly driving the demand for natural alternatives in the emulsifiers market. Despite this shift, regulatory validations continue to reinforce the market position of traditional emulsifiers in specific applications. In 2023, research identified a potential link between food additive emulsifiers and an increased risk of type 2 diabetes (T2D), with ultra-processed fruits and vegetables, cakes, biscuits, and dairy products contributing 18.5%, 14.7%, and 10% of total emulsifier intake, respectively. The study revealed a positive correlation between higher emulsifier consumption and T2D risk, raising consumer concerns. To address these issues, the European Food Safety Authority (EFSA) recently re-evaluated food additives, including silicon dioxide and guar gum, and reaffirmed their safety with updated guidelines. This regulatory clarity allows manufacturers to alleviate consumer concerns while maintaining product functionality. Simultaneously, the industry's focus on transparency is driving investments in alternative emulsification technologies, such as protein-based and plant-derived systems, which offer comparable performance with greater consumer appeal.

Other drivers and restraints analyzed in the detailed report include:

- Increased demand for texture-mimicking solution in plant-based meat alternative

- Rapid development of tailor-made emulsifier blends for ethnic and regional foods

- Increasing demand for additive-free products impacting market growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mono-diglycerides controlled 33.74% of the food emulsifiers market in 2024, reflecting their robust compatibility across both oil-in-water and water-in-oil systems. Consistent regulatory acceptance and heat stability keep them embedded in high-moisture bakery, ready-to-eat meals, and powdered beverage creamers. Demand for shelf-stable sauces has reinforced volume, especially in the Middle East and Africa distribution channels that lack cold chains. Suppliers continue to refine acyl-chain distribution to elevate aeration control without compromising label friendliness.

Lecithin, growing at a 5.87% CAGR, is gaining market share in vegan confectionery coatings and nutritional beverages, driven by the premium pricing of non-GMO sourcing. Enzymatic modifications are improving their dispersibility in high-protein formulations, displacing synthetic esters in sports nutrition products. Sorbate esters cater to a niche demand in fat-rich spreads requiring oxidative stability, while protein-based emulsifiers are being integrated into plant-based meat alternatives. Patent filings at the USPTO reflect significant research and development efforts focused on combining lecithin with bio-polyphenols to deliver antioxidant co-benefits.

In 2024, powdered grades accounted for a significant 64.84% share of the food emulsifiers market and are advancing at a 6.45% CAGR, driven by their extended shelf-life of up to 24 months and reduced freight weight compared to liquid alternatives. These attributes make powdered emulsifiers a preferred choice for bakery premix suppliers, who benefit from their compatibility with automated silo systems and low microbial load. Advancements in spray-drying technology, such as the development of agglomerated particles coated with flow-aids, have further enhanced their functionality by minimizing dusting and improving wettability. This has expanded their adoption in high-speed beverage production lines, where efficiency and consistency are critical.

Although liquids hold a secondary position in the market, they remain indispensable in applications requiring rapid hydration, such as ready-to-drink protein shakes and low-viscosity sauces. To address challenges related to shelf-life and shipping costs, there is an increasing investment in concentrated paste formats, which reduce water content and shipping weight. Furthermore, USDA-supported encapsulation projects are exploring matrix-protected powders that mimic the dispersion properties of liquids upon hydration. This innovation enables manufacturers to streamline inventory management by utilizing a single SKU across multiple production lines, enhancing operational efficiency and reducing complexity.

The Food Emulsifiers Market is Segmented by Product Type (Mono-Di-Glycerides and Derivatives, Lecithin, Sorbate Esters, and Other Emulsifiers), Form (Powder and Liquid), Source (Plant, Synthetic/Bio-based, and Animal), Application (Bakery and Confectionery, Dairy and Desserts, Meat and Meat Products, and More), and Geography ((North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, North America maintained its position as the largest regional contributor, capturing 31.86% of global revenue. This leadership stems from advanced manufacturing capabilities and the FDA's efficient GRAS notification pathway, which accelerates the commercialization of innovative systems. U.S.-based multinational corporations continue to drive global innovation through significant R&D investments, resulting in advancements like enzyme-modified lecithin that enhances stability in functional beverages by tolerating pH fluctuations. Additionally, the expansion of Hispanic bakery chains is fueling demand for customized emulsifier blends that replicate traditional textures while adhering to USDA sodium-reduction guidelines. These factors highlight North America's ability to lead in innovation while addressing evolving consumer and regulatory requirements.

Asia-Pacific is projected to grow at a strong 6.81% CAGR through 2030, driven by rising disposable incomes and increasing demand for convenience foods in key markets such as China, India, Indonesia, and Vietnam. Regional processors are adapting Western bakery frameworks to cater to local preferences, such as softer crumbs. In India, government subsidies for cold-chain infrastructure are boosting the adoption of frozen desserts, which rely on high-performance emulsifiers for quality and consistency. Meanwhile, Chinese ingredient manufacturers are scaling up sunflower lecithin production to mitigate risks associated with soybean supply volatility. These developments position Asia-Pacific as a dynamic and rapidly expanding market.

Europe, despite being a mature market, remains a hub of innovation, driven by stringent sustainability standards and growing consumer demand for natural ingredients. The EFSA's regulatory guidance is shaping safer exposure levels and encouraging gradual reformulations to meet evolving labeling requirements. Nordic countries are leading the adoption of rapeseed-based emulsifiers, reflecting a commitment to domestic feedstocks. Meanwhile, South America and the Middle East & Africa, though smaller contributors, are witnessing accelerated growth. Multinational bakeries are expanding operations in Brazil, Saudi Arabia, and South Africa, employing localization strategies such as developing powder blends capable of withstanding high storage temperatures in equatorial supply chains. These efforts underscore the adaptability of suppliers to regional challenges and opportunities.

- Cargill Inc.

- Archer Daniels Midland (ADM)

- Corbion N.V.

- Kerry Group

- Ingredion Inc.

- BASF SE

- International Flavors & Fragrances Inc.

- AAK AB

- Riken Vitamin Co. Ltd

- Palsgaard A/S

- Fine Organics

- Lasenor Emul S.L.

- Stepan Company (Food)

- KAO Chemicals

- Mitsubishi Chemical

- Oleon NV

- Evonik Industries AG

- Wilmar International Ltd

- Taiyo Kagaku Co.

- Lecilite Ingredients Pvt. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging demand for shelf stable and ready-to-eat food products

- 4.2.2 Growing use of emulsifiers in bakery and confectionary application

- 4.2.3 Increased demand for texture-mimiking solution in plant-based meat alternative

- 4.2.4 Rapid development of tailor-made emulfier blends for ethnic and regional foods

- 4.2.5 Emulsifier supporting clean label claims in 'free-from' products

- 4.2.6 Customized emulsifer blends addressing industry-specific needs

- 4.3 Market Restraints

- 4.3.1 Consumer concern over chemical additives in packaged foods

- 4.3.2 Increaseing demand for additive-free products impacting market growth

- 4.3.3 Technical challenges in formulating clear-label emulsions

- 4.3.4 Consumer pushback against palm-based ingredients in emulsifiers

- 4.4 Supply Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Mono- Di-Glycerides and Derivatives

- 5.1.2 Lecithin

- 5.1.3 Sorbate Esters

- 5.1.4 Other Emulsifier

- 5.2 By Form

- 5.2.1 Powder

- 5.2.2 Liquid

- 5.3 By Source

- 5.3.1 Plant

- 5.3.2 Synthetic/Bio-based

- 5.3.3 Animal

- 5.4 By Application

- 5.4.1 Bakery and Confectionery

- 5.4.2 Dairy and Desserts

- 5.4.3 Beverages

- 5.4.4 Meat and Meat Products

- 5.4.5 Soups, Sauces, and Dressings

- 5.4.6 Other Applications

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Cargill Inc.

- 6.4.2 Archer Daniels Midland (ADM)

- 6.4.3 Corbion N.V.

- 6.4.4 Kerry Group

- 6.4.5 Ingredion Inc.

- 6.4.6 BASF SE

- 6.4.7 International Flavors & Fragrances Inc.

- 6.4.8 AAK AB

- 6.4.9 Riken Vitamin Co. Ltd

- 6.4.10 Palsgaard A/S

- 6.4.11 Fine Organics

- 6.4.12 Lasenor Emul S.L.

- 6.4.13 Stepan Company (Food)

- 6.4.14 KAO Chemicals

- 6.4.15 Mitsubishi Chemical

- 6.4.16 Oleon NV

- 6.4.17 Evonik Industries AG

- 6.4.18 Wilmar International Ltd

- 6.4.19 Taiyo Kagaku Co.

- 6.4.20 Lecilite Ingredients Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK