PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444615

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444615

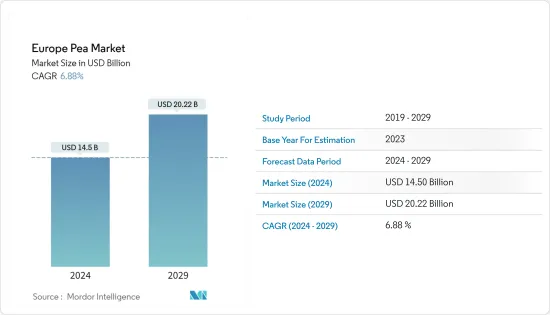

Europe Pea - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Pea Market size is estimated at USD 14.5 billion in 2024, and is expected to reach USD 20.22 billion by 2029, growing at a CAGR of 6.88% during the forecast period (2024-2029).

Key Highlights

- Pea is one of the nutritional crops grown in the European region, which is rich in protein content and can be produced quickly. Peas are a rich source of proteins, amino acids, and sugars. Also, they are relatively low in calories and contain several vitamins, minerals, and antioxidants. Peas, a rich source of protein along with their nitrogen-fixing capacity, increase their regional demand, driving the market.

- Dried peas are commercially traded in the region in different varieties, including dried yellow peas, Austrian Winter, and dried green peas. In Europe, the excellent climatic environment of the area supports the high peas production.

- Further, pea crops are grain legumes that produce high protein feed for animals and human nutrition. Favorable climatic conditions and suitable soils support the cultivation of grain peas for livestock feed in southeast Europe. Additionally, pea provides valuable plant protein that can reduce the use of imported protein in livestock feeding.

- The crop is cultivated for dual purposes in various countries within the region, such as Bulgaria: firstly, as forage, which is harvested green, and secondly, for grain. The crop is rotated to exploit its fertility-raising features. Therefore, the increasing livestock production has also favored the growth of the market in the region.

Europe Pea Market Trends

Growing Export Opportunity

Owing to their high nutritional qualities and increased western influence, pea proteins have gained popularity globally, even in developing countries, which has increased the potential for export from the region. According to the United Nations Commodity Trade Statistics Database, pea exports from the region increased by 15% in 2021. Netherlands, France, Germany, and Belgium account for the significant pea exporters in the area, accounting for nearly 30% of the total exports.

Further, the efforts of various governments to increase the acreage under pea production and the eventual growth in domestic production are anticipated to raise the scope for exports. For instance, in 2021, the Ministry of Agriculture Netherlands, which counts as one of the leading exporters in Europe, has initiated efforts to increase the area used to grow high-protein crops, including peas, by a factor of five. According to the ministry of Agriculture's National Protein Strategy, Dutch farmers should be using 100,000 hectares 10 years from now to grow legumes rich in protein, five times the area currently in use.

Moreover, the growing demand for peas from other countries encourages European exports. Turkey, India, Bangladesh, Pakistan, and the United Arab Emirates are some of the major export destinations for Europe. This growing export opportunity is driving the European pea market.

Russia to Dominate the Market in the Region

Russia dominates the pea market in Europe in terms of production. The favorable growth climate in the country has favored the rapid rise in production in recent years. Peas are traditionally grown in the southern parts of Russia, the Caucasus, and the Volga region. Due to growing production expenses for farmers and a decline in spring crop yields following unfavorable weather in 2021, the Volga region may expand production in the coming years. According to Russian statistics services data, the area under cultivation amounted to 1.45 million hectares in 2021. The country has become the largest producer of peas globally. According to the Global Pulse Confederation (GPC) article, Russia harvested a record 4.3 million metric ton of the crop in 2022, which tops the existing largest producer, Canada's estimated production of 3.59 million metric ton.

Further, the reduction in crops in the main pea-producing countries combined with the growing global interest in meat substitutes has resulted in higher exports of Russian peas. However, Russian pea exports slowed down in November, as farmers already sold a significant part of the 2021 crop against the background of high demand and attractive prices. In contrast to grains and oilseeds shipments, there is no export tax for this crop, which was attractive to Russian exporters. Also, high global demand opens new opportunities for Russian farmers and intensifies competition between exporters and processors in the short term. In addition, the high-value raw materials for the feed industry, that can be obtained through processing has also boosted the production and opened up a new dimension for the feed and pea industry in the country, in turn driving the market growth in the country.

Europe Pea Industry Overview

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Value Chain Analysis

- 4.5 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Russia

- 5.1.1 Production Analysis

- 5.1.1.1 Consumption Analysis and Market Value

- 5.1.1.2 Import Market Analysis (Volume and Value)

- 5.1.1.3 Export Market Analysis (Volume and Value)

- 5.1.1.4 Price Trend Analysis

- 5.1.2 Ukraine

- 5.1.2.1 Production Analysis

- 5.1.2.2 Consumption Analysis and Market Value

- 5.1.2.3 Import Market Analysis (Volume and Value)

- 5.1.2.4 Export Market Analysis (Volume and Value)

- 5.1.2.5 Price Trend Analysis

- 5.1.3 France

- 5.1.3.1 Production Analysis

- 5.1.3.2 Consumption Analysis and Market Value

- 5.1.3.3 Import Market Analysis (Volume and Value)

- 5.1.3.4 Export Market Analysis (Volume and Value)

- 5.1.3.5 Price Trend Analysis

- 5.1.4 Spain

- 5.1.4.1 Production Analysis

- 5.1.4.2 Consumption Analysis and Market Value

- 5.1.4.3 Import Market Analysis (Volume and Value)

- 5.1.4.4 Export Market Analysis (Volume and Value)

- 5.1.4.5 Price Trend Analysis

- 5.1.5 Netherlands

- 5.1.5.1 Production Analysis

- 5.1.5.2 Consumption Analysis and Market Value

- 5.1.5.3 Import Market Analysis (Volume and Value)

- 5.1.5.4 Export Market Analysis (Volume and Value)

- 5.1.5.5 Price Trend Analysis

- 5.1.6 Rest of Europe

- 5.1.6.1 Production Analysis

- 5.1.6.2 Consumption Analysis and Market Value

- 5.1.6.3 Import Market Analysis (Volume and Value)

- 5.1.6.4 Export Market Analysis (Volume and Value)

- 5.1.6.5 Price Trend Analysis

- 5.1.1 Production Analysis

6 MARKET OPPORTUNITIES AND FUTURE TRENDS