PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686586

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686586

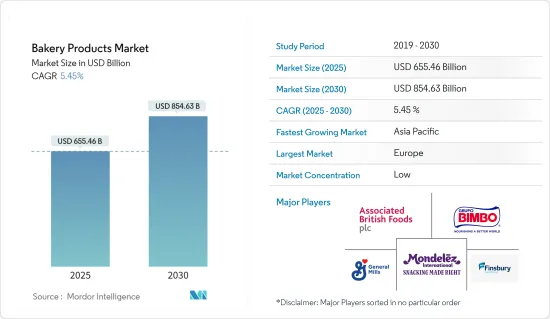

Bakery Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Bakery Products Market size is estimated at USD 655.46 billion in 2025, and is expected to reach USD 854.63 billion by 2030, at a CAGR of 5.45% during the forecast period (2025-2030).

Key Highlights

- Growing preference toward convenient foods, the rising ex-pat population, and changing lifestyles are escalating the demand for bakery products globally. A wide range of bakery products are being sold in the market, and the various innovations in the bakery products range suiting the demand of different segments of consumers are driving the market studied. For instance, bakery products like biscuits are being innovated and specifically produced to meet consumers' changing lifestyles and demands.

- Furthermore, bakery products (especially bread) have been a staple diet for people worldwide for centuries. The convenience, accessibility, and nutrition profile associated with them are the significant factors that have sustained these products in the modern market. Additionally, the rising trends of "natural nutrition," "healthy living," and "organic products" have significantly increased the demand for whole wheat, light (low calorie), natural, and additive-free bakery products. Furthermore, the demand for healthy food drives the need for whole grain, gluten-free, and multigrain bakery products. Therefore, manufacturers capitalize on customers' demand to increase their market share. For instance, in February 2022, Dr Schar UK Ltd., a gluten-free manufacturer, announced the acquisition of Glasgow-based bakery GDR Food Technology Ltd., t/a Just: Gluten Free Bakery. GDR specializes in gluten-free baked goods such as bread, rolls, teacakes, and flatbread. These factors are expected to boost the growth of this market over the forecast period.

Bakery Products Market Trends

Surge in Demand for 'Free-from' Food Products

- People with celiac disease and the general health-conscious population prefer free-from-food products (mainly gluten-free). The demand for gluten-free products arises from the belief that gluten-free and sugar-free edibles help overcome problems related to bloating, indigestion, obesity, diabetes, etc. Thus, bakery products, which claim to be fat-, sugar-, and gluten-free, are gaining popularity among health-conscious consumers.

- Additionally, celiac disease, sometimes called celiac sprue or gluten-sensitive enteropathy, is an immune reaction to eating gluten, a protein found in wheat, barley, and rye, used in making various bakery products. If one has celiac disease, eating gluten triggers an immune response in the small intestine.

- According to the Celiac Disease Foundation, in 2021, around 1 in 100 people worldwide were affected with celiac disease. Similarly, according to Beyond Celiac, in 2021, an estimated 1 in 133 Americans, or about 1% of the population, had celiac disease. Hence, this factor also drives the demand for gluten-free products.

- Furthermore, consumers prefer to consume natural, vegan, and free from artificial additives products, which has led to the launch of various free-from products globally. For instance, in May 2022, the United Kingdom-based natural confectionery company Prodigy introduced the "Phenomenons" line of plant-based chocolate biscuits. The plant-based biscuits are wheat-free and contain half the sugar of a standard chocolate biscuit. It also contains prebiotic fiber, zero palm oil, and no refined sugars. The biscuits are made in a "thins" format and are available in two variants, namely Prodigy Phenomenoms Chocolate Digestives and Prodigy Phenomenoms Chocolate Oaties.

Europe Dominates the Bakery Market

- Consumers' changing lifestyles induce them to opt for convenient and ready-to-eat food products such as bread, cookies, biscuits, frozen food products, and cakes. The development of new products in the European bakery market continues to be influenced by trends in health and well-being. Customers nowadays are demanding healthier alternatives with additional nutrition and clean-label ingredients.

- The European bakery products market is well-established in terms of the supply chain, product array, distribution channels, and consumer preferences. Innovations and new product developments are increasingly observed in the indulgence categories, like cakes, pastries, and cookies. The demand for bread containing fiber, whole grain, gluten-free bakery products, etc., supports the market growth.

- For instance, in April 2022, Warburtons, a United Kingdom bakery company, announced the debut of a new range of sliced loaves called Seeds & Grains, available in recyclable paper packaging. Big 21 contains 21 varieties of seeds and grains; Plant Power, a blend of pulses, grains, and seeds; and Make It Grain, which has Maris Otter barley malt grain, are the three new 700g loaves. The loaves are made entirely of wholemeal flour, are high in fiber and protein, and are low in saturated fat and sugar.

Bakery Products Industry Overview

The global bakery products market is highly competitive, particularly with the significant presence of numerous global and regional players. Finsbury Food Group Plc, Mondelez International, General Mills Inc., Associated British Foods Plc, and Grupo Bimbo are leading market players. The players in the market adopt strategies like acquisitions and expansions to penetrate the market. For instance, in January 2023, Mondelez India launched a new Cadbury Choco Bakes Choc Chip Cookies by expanding into the choco-chip cookie space.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables and Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Surge in Demand for 'Free-from' Food Products

- 4.1.2 Demand For Convenient And Healthy On-the-go Snacking Options

- 4.2 Market Restraints

- 4.2.1 Health Risk Associated with Certain Ingredients

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Cakes and Pastries

- 5.1.2 Biscuits

- 5.1.3 Bread

- 5.1.4 Morning Goods

- 5.1.5 Other Product Types

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Convenience/Grocery Stores

- 5.2.3 Speciality Stores

- 5.2.4 Online Retail Stores

- 5.2.5 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Russia

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 South Africa

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Finsbury Food Group Plc

- 6.3.2 Grupo Bimbo SAB de CV

- 6.3.3 Associated British Foods Plc

- 6.3.4 Mondelez International Inc.

- 6.3.5 General Mills Inc.

- 6.3.6 Kellogg Company

- 6.3.7 Britannia Industries Ltd

- 6.3.8 Walker's Shortbread Ltd

- 6.3.9 YIldIz Holding

- 6.3.10 McKee Foods Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS