PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432417

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432417

United States Aesthetic Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

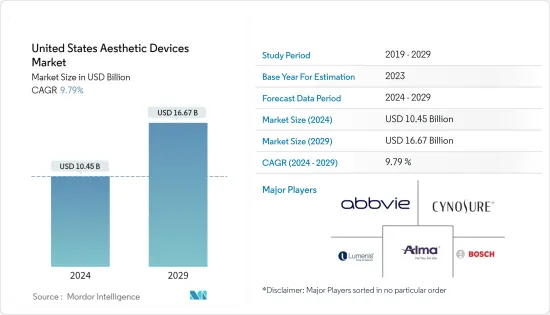

The United States Aesthetic Devices Market size is estimated at USD 10.45 billion in 2024, and is expected to reach USD 16.67 billion by 2029, growing at a CAGR of 9.79% during the forecast period (2024-2029).

The COVID-19 is expected to have a significant impact on the growth of the market. For instance the article titled ' Interest in aesthetics during COVID-19 pandemic: a google trends analysis' published in June mentioned that by late November and early December, the relative interest began to rise, reching earlier pre-COVID rates. Such rise in interest in Aesthetic procedures is expected to drive teh growth of the market.

There are certain factors that are affecting the market in a positive way, which include technological advancement in devices, increasing awareness regarding aesthetic procedures, rising adoption of minimally invasive devices, and increasing obese population.

Earlier, anyone seeking medical assistance with cosmetic issues had only intrusive surgical procedures to choose from. Owing to the advances in the field of aesthetics, this is no longer the case. Medical aesthetic technology has advanced rapidly over the past two decades. The highly advanced technologies have offered a wide range of products and solutions to patients seeking medical assistance. New technologies are being developed and introduced into the market, including the use of laser, dynamic pulse control, radiofrequency, and infrared technologies. In recent years, skin-tightening and non-invasive fat technologies have created a new niche in the medical aesthetic technology market. They have been proven financially lucrative, and they are expected to dominate in the near future.

Furthermore, the number of surgeries has increased in the region over recent years. For instance, according to a report published by the American Society of Plastic Surgeons 2020, 15.6 million cosmetic procedures were recorded in 2020, which included around 2.3 million cosmetic surgical and 13.2 million cosmetic minimally invasive procedures. However, in 2019 the cosmetic surgeries performed were 2,678,302.

In the area of cellulite reduction, some of the emerging technologies hint at a future of improved outcomes with a positive effect on the overall United States market. With such kind of innovations, the market for aesthetic device-based treatments continues to evolve. Furthermore, such advances are expected to make these aesthetic procedures affordable to the patient population, thereby reducing the number of patient visits and healthcare costs.

USA Aesthetic Devices Market Trends

The Breast Implants Sub-segment is Expected to Show Rapid Grow in the Implants Segment of the Market

Breast implants are the most common and popular aesthetic surgery procedure in the developed markets, particularly in the United States. Aesthetic surgical procedures include breast augmentation, removal, breast lift, and reduction. Silicone implants are mostly preferred in nearly 90% of cases and the remaining prefer saline implants. Its demand is also increasing among teen male breast reduction. In addition, breast reconstruction has observed the largest number of procedures, followed by breast reduction and breast implant removals. According to the International Society of Aesthetic Plastic Surgery Report 2020, breast augmentation procedures accounted for 371,997 in the United States.

As it is opted by several celebrities and individuals who seek to improve their external appearance, the demand is expected to increase among the population and drive the market at a modest rate over the forecast period.

USA Aesthetic Devices Industry Overview

The US aesthetic devices market is moderately competitive. Companies, such as Cynosure, Alma Lasers, Lumenis Inc., Bausch Health Companies Inc. (Solta Medical Inc.), and Abbvie, are performing well in the US market. With the rising demand for aesthetic corrections, more companies are entering the market and holding a substantial share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Obese Population

- 4.2.2 Increasing Awareness Regarding Aesthetic Procedures and Rising Adoption of Minimally Invasive Devices

- 4.2.3 Technological Advancement in Devices

- 4.3 Market Restraints

- 4.3.1 Social Stigma Concerns

- 4.3.2 Poor Reimbursement Scenario

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Type of Device

- 5.1.1 Energy-based Aesthetic Device

- 5.1.1.1 Laser-based Aesthetic Device

- 5.1.1.2 Radiofrequency (RF)-based Aesthetic Device

- 5.1.1.3 Light-based Aesthetic Device

- 5.1.1.4 Ultrasound Aesthetic Device

- 5.1.2 Non-energy-based Aesthetic Device

- 5.1.2.1 Botulinum Toxin

- 5.1.2.2 Dermal Fillers and Aesthetic Threads

- 5.1.2.3 Chemical Peels

- 5.1.2.4 Microdermabrasion

- 5.1.2.5 Implants

- 5.1.2.5.1 Facial Implants

- 5.1.2.5.2 Breast Implants

- 5.1.2.5.3 Other Implants

- 5.1.2.6 Other Aesthetic Devices

- 5.1.1 Energy-based Aesthetic Device

- 5.2 By Application

- 5.2.1 Skin Resurfacing and Tightening

- 5.2.2 Body Contouring and Cellulite Reduction

- 5.2.3 Hair Removal

- 5.2.4 Tattoo Removal

- 5.2.5 Breast Augmentation

- 5.2.6 Other Applications

- 5.3 By End User

- 5.3.1 Hospital

- 5.3.2 Clinics

- 5.3.3 Home Settings

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Cynosure

- 6.1.2 Alma Lasers

- 6.1.3 Lumenis Inc.

- 6.1.4 Syneron Medical Ltd

- 6.1.5 Sciton Inc.

- 6.1.6 Bausch Health Companies Inc. (Solta Medical Inc.)

- 6.1.7 Abbvie

- 6.1.8 El.en. (Asclepion Laser Technologies)

- 6.1.9 Cutera Inc.

- 6.1.10 Venus Concept

7 MARKET OPPORTUNITIES AND FUTURE TRENDS