PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849980

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849980

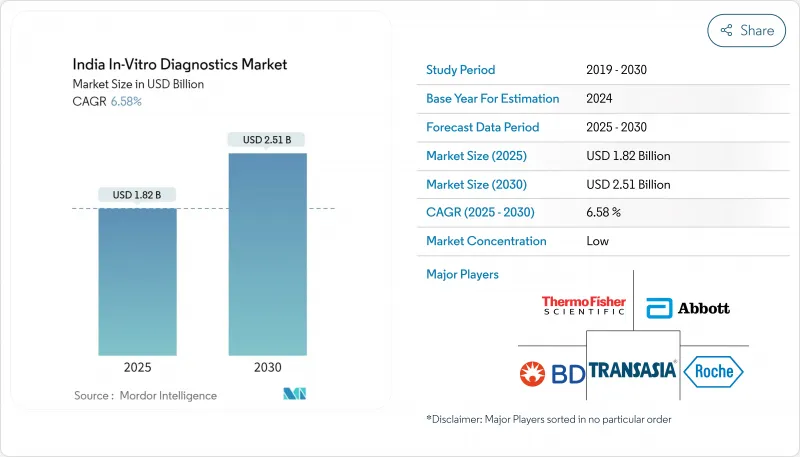

India In-Vitro Diagnostics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The India in-vitro diagnostics market is valued at USD 1.82 billion in 2025 and is forecast to reach USD 2.51 billion by 2030, growing at a 6.58% CAGR.

The expansion reflects stronger clinical focus on evidence-based care, wider health-insurance coverage, and public investments that are widening test availability. Rapid molecular methods, artificial intelligence-enabled automation, and digital health linkages are lifting laboratory productivity while shrinking turnaround times. At the same time, the dual burden of infectious and chronic diseases is broadening test menus, and organized diagnostic chains are rolling tier-2 and tier-3 city networks into hub-and-spoke systems that improve access and pricing. Constraints persist around cold-chain logistics, fragmented regulation, and heavy reliance on imported instruments, but technology transfer, Make-in-India incentives and portable cooling solutions are beginning to narrow these gaps across the India in-vitro diagnostics market.

India In-Vitro Diagnostics Market Trends and Insights

Rising Dual Burden of Communicable & Non-Communicable Diseases Necessitating Early Diagnostics

Tuberculosis still represents 27% of global cases traced to India, prompting a shift from microscopy to rapid molecular assays that offer higher sensitivity and same-day results. National Family Health Survey data show anemia prevalence of 57% among women and 67% among children under five, driving hematology test demand. Parallel growth of diabetes, now affecting 101 million citizens, and rising cardiovascular morbidity are pushing clinical chemistry and immunoassay volumes. Laboratories therefore broaden menus to run infectious disease panels alongside lipid, HbA1c, and cardiac marker testing on integrated platforms. Precision-oriented test adoption is accelerating in oncology as liquid biopsy assays identify actionable mutations without invasive biopsies, underlining why comprehensive diagnostics sit at the centre of India in-vitro diagnostics market development.

Expanding Health-Insurance Penetration & Disposable Incomes Enhancing Test Affordability

Insurance coverage has climbed from 25% to 51% of the population through flagship schemes such as Pradhan Mantri Jan Arogya Yojana. Reimbursement of laboratory procedures is lowering out-of-pocket spending and steering patients toward accredited sites. Growing volumes help labs amortise investments in high-throughput PCR, NGS, and chemiluminescence platforms, enabling price cuts that lure middle-income segments in tier-2 urban belts. Insurers are tightening quality criteria, compelling smaller centres to secure NABL accreditation or partner with organised chains. The resulting virtuous cycle of affordability, quality, and scale improves market depth across the India in-vitro diagnostics market.

Limited Cold-Chain & Logistics Infrastructure Restricting Rural Reagent Distribution

One-fifth of temperature-sensitive health products degrade because trucks and storage points cannot sustain 2-8°C. Portable battery-powered units like Phloton hold reagents at 4-6°C for 10 hours, but deployment is nascent. Widespread solar refrigeration roll-outs and passive insulated packaging are being tested to widen rural reach. Cold-chain gaps particularly hinder molecular and immunoassay expansion, slowing rural contribution to the India in-vitro diagnostics market.

Other drivers and restraints analyzed in the detailed report include:

- Government Investments in Public Laboratory Infrastructure under National Health Mission

- Adoption of High-Throughput Automation & AI in Laboratories Elevating Efficiency

- Fragmented Regulatory Approval Pathway Increasing Time-to-Market

For complete list of drivers and restraints, kindly check the Table Of Contents.

List of Companies Covered in this Report:

- Abbott Laboratories

- Roche

- Siemens Healthineers

- Transasia Bio-Medicals

- Thermo Fisher Scientific

- Beckton Dickinson

- bioMerieux

- Danaher

- Beckton Dickinson

- Arkray

- Bio-Rad Laboratories

- Agappe Diagnostics

- Mylab Discovery Solutions

- J Mitra & Co. Pvt Ltd

- HLL Lifecare Ltd (Hindlabs)

- SRL Diagnostics (Fortis Healthcare)

- Dr. Lal PathLabs Ltd

- Metropolis Healthcare Ltd

- Molbio Diagnostics (Truenat)

- Seegene

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Dual Burden of Communicable & Non-Communicable Diseases Necessitating Early Diagnostics

- 4.2.2 Expanding Health-Insurance Penetration & Disposable Incomes Enhancing Test Affordability

- 4.2.3 Government Investments in Public Laboratory Infrastructure under National Health Mission

- 4.2.4 Adoption of High-Throughput Automation & AI in Laboratories Elevating Efficiency

- 4.2.5 Integration of Digital Health Ecosystems (LIS, Telepathology) Broadening Access to Testing

- 4.2.6 Expansion of Private Lab Chains Driving Centralized Testing

- 4.3 Market Restraints

- 4.3.1 High Out-of-Pocket Healthcare Spending Creating Price Sensitivity

- 4.3.2 Dependence on Imported Instruments & Raw Materials Exposing Currency Risk

- 4.3.3 Limited Cold-Chain & Logistics Infrastructure Restricting Rural Reagent Distribution

- 4.3.4 Fragmented Regulatory Approval Pathway Increasing Time-to-Market

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Test Type

- 5.1.1 Clinical Chemistry

- 5.1.2 Immuno-Diagnostics

- 5.1.3 Haematology

- 5.1.4 Molecular Diagnostics

- 5.1.5 Coagulation

- 5.1.6 Microbiology

- 5.1.7 Others

- 5.2 By Technology

- 5.2.1 Polymerase Chain Reaction (PCR)

- 5.2.2 Reverse Transcription PCR (RT-PCR)

- 5.2.3 Next-Generation Sequencing

- 5.2.4 Enzyme-Linked Immunosorbent Assay (ELISA)

- 5.2.5 Chemiluminescence

- 5.2.6 Rapid Antigen / Lateral Flow

- 5.3 By Product

- 5.3.1 Instruments / Analysers

- 5.3.2 Reagents & Kits

- 5.3.3 Software & Services

- 5.4 By Usability

- 5.4.1 Disposable IVD Devices

- 5.4.2 Re-usable IVD Devices

- 5.5 By Testing Site

- 5.5.1 Central Laboratory Testing

- 5.5.2 Point-of-Care Testing

- 5.6 By Specimen Type

- 5.6.1 Blood

- 5.6.2 Urine

- 5.6.3 Saliva

- 5.6.4 Other Body Fluids

- 5.7 By Application

- 5.7.1 Infectious Disease

- 5.7.2 Diabetes

- 5.7.3 Cancer / Oncology

- 5.7.4 Cardiology

- 5.7.5 Auto-immune Disorders

- 5.7.6 Nephrology

- 5.7.7 Others

- 5.8 By End-user

- 5.8.1 Diagnostic Laboratories

- 5.8.2 Hospitals & Clinics

- 5.8.3 Home-care & Self-testing

- 5.8.4 Academic & Research Institutes

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Abbott Laboratories

- 6.3.2 F. Hoffmann-La Roche AG

- 6.3.3 Siemens Healthineers

- 6.3.4 Transasia Bio-Medicals Ltd

- 6.3.5 Thermo Fisher Scientific

- 6.3.6 Beckman Coulter, Inc.

- 6.3.7 bioMerieux SA

- 6.3.8 Danaher Corporation (Cepheid)

- 6.3.9 Becton, Dickinson & Company

- 6.3.10 Arkray, Inc.

- 6.3.11 Bio-Rad Laboratories, Inc.

- 6.3.12 Agappe Diagnostics

- 6.3.13 Mylab Discovery Solutions

- 6.3.14 J Mitra & Co. Pvt Ltd

- 6.3.15 HLL Lifecare Ltd (Hindlabs)

- 6.3.16 SRL Diagnostics (Fortis Healthcare)

- 6.3.17 Dr. Lal PathLabs Ltd

- 6.3.18 Metropolis Healthcare Ltd

- 6.3.19 Molbio Diagnostics (Truenat)

- 6.3.20 Seegene Inc.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment