PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851538

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851538

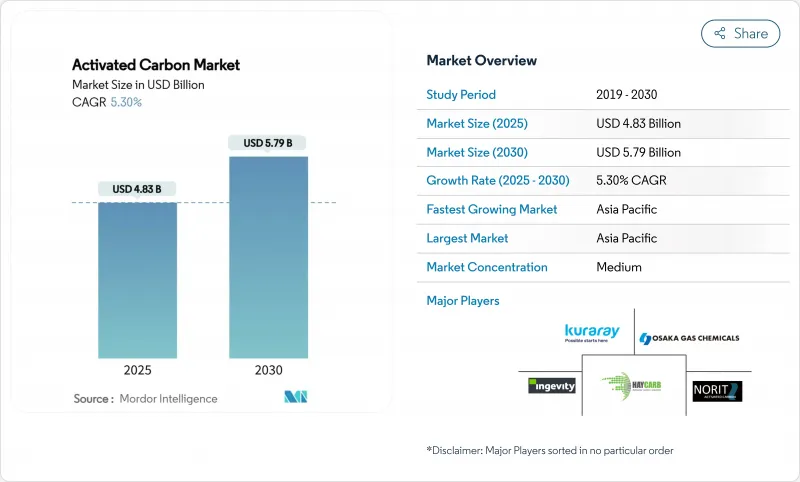

Activated Carbon - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Activated Carbon Market size is estimated at USD 4.83 billion in 2025, and is expected to reach USD 5.79 billion by 2030, at a CAGR of 5.30% during the forecast period (2025-2030).

Stringent water-quality rules, rapid industrialization in Asia-Pacific, and rising demand for specialty grades in pharmaceutical, mining, and advanced air-filtration processes propel growth. Coconut-shell feedstock remains the premium raw material for high-performance grades, yet tightening supply and volatile coal prices are spurring vertical integration and exploration of alternative precursors. Regulatory momentum anchors long-term demand for granular products, most notably the U.S. EPA's 2024 PFAS drinking-water standard naming granular activated carbon (GAC) as Best Available Technology. Simultaneously, powdered activated carbon (PAC) is pivotal in mercury-emission control for coal-fired utilities, while wood-based carbons attract investment through sustainable production breakthroughs. Manufacturers able to secure raw-material certainty, invest in reactivation capacity, and bundle digital monitoring services are best positioned to capture upcoming contracts.

Global Activated Carbon Market Trends and Insights

PFAS-Compliance Regulations for Drinking Water

The U.S. EPA's April 2024 National Primary Drinking Water Regulation capped six PFAS compounds and formally lists GAC as Best Available Technology, compelling all U.S. public water systems to start monitoring in 2027 and fully comply by 2029. The mandate next brings a projected USD 1.55 billion annual market for activated carbon systems, supported by validated removal efficiencies surpassing 99% for PFOA and PFOS. European utilities preparing for tighter PFAS and micro-pollutant thresholds have begun replicating these specifications, creating an export window for U.S. and Japanese suppliers. System retrofits frequently integrate GAC media, stainless-steel contactors, and on-site reactivation service contracts, locking in multi-year replacement volumes. Suppliers with rapid-turnaround reactivation kilns and digital bed-life analytics gain competitive headroom during bid evaluations.

Air-Pollution Control for Coal-Fired Utilities

More than 135 North American plants, representing over 55 GW of capacity, currently deploy powdered-carbon injection systems that achieve more than 90% mercury capture. The EPA's May 2024 technology review further narrows allowable mercury and particulate limits, making PAC the lowest-cost retrofit for owners unwilling to invest in wet-scrubber upgrades. Chinese regulators are also reshaping flue-gas norms, accelerating adsorption-based solutions for smaller boilers. Powder formulations tailored for elevated injection temperatures and strict loss-on-ignition thresholds are in short supply, enabling premium pricing for U.S. coconut-shell PAC grades that resist pore blocking.

Feedstock Supply Disruption for Coconut Shells

Tropical nations supply more than 80% of global coconut-shell char, and harvest setbacks caused by cyclones in the Philippines cut feedstock availability during 2024. Producers such as Carbon Activated Corporation accelerated vertical integration, opening a second char plant in Sri Lanka while lining up overflow supply agreements with Chinese shell-char exporters. Contingency plans involve qualifying hardwood chips and palm-kernel shells, yet such alternatives often produce broader pore distributions that reduce removal efficiency for PFAS and precious-metal ions.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Water-Purification Demand in Emerging Economies

- Gold Mining and Metal-Recovery Requirements

- Volatile Kiln-grade Coal Pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Coconut-shell products captured 36.5% of the activated carbon market in 2024, reflecting superior micropore distributions that excel at PFAS adsorption and gold-loading tasks. Hardness values exceeding 99% minimize fragmentation during backwashing, extending bed life in municipal filters. Asia-Pacific mill expansions, however, compete fiercely for shell char, and 2024 weather disruptions spotlighted the vulnerability of single-source procurement.

Wood-based carbons are the fastest-advancing alternative, rising at a 5.8% CAGR on the back of certified sustainable forestry programs and pyrolysis improvements that yield high iodine numbers. Coal-based variants remain cost-effective for flue-gas and solvent-recovery duties where tight micropore volume is less critical. Although promising, academic work on sludge- and sawdust-derived carbons is still at pilot scale, leaving mainstream producers dependent on legacy precursors.

Granular products held a commanding 50% share in 2024 and are forecast to record the highest 6.33% CAGR through 2030, thanks to their reactivation capability and consistent head-loss performance in packed beds. Extruded/pelletized carbons address applications such as solvent vapor adsorption, compressed-air drying, and automotive canisters where low pressure drop and high crush strength are paramount. GAC design considerations focus on uniform particle size to reduce channeling, while innovative vapor-phase GAC units integrate temperature swing adsorption that regenerates beds in situ with electric heaters.

Powdered grades, although less reusable, capture share in markets requiring high surface-area products delivered rapidly, illustrated by disaster-relief water packs capable of treating turbid sources within hours. Pelletized offerings are now pivoting toward biogas purification, with European landfill-gas operators procuring pellets infused with sulfur-impregnated additives for hydrogen-sulfide removal. Long-term, environmental disposal rules and carbon-footprint accounting may tilt economics further toward regenerable GAC systems, strengthening their outsized contribution to activated carbon market growth.

The Activated Carbon Market Report Segments the Industry by Raw Material (Coal-Based, Coconut-Shell-Based, and More), Form (Powdered Activated Carbon (PAC), Granular Activated Carbon (GAC), and Extruded/Pelletised Activated Carbon (EAC)), Application (Decolorization Treatment, Sugar Production, and More), End-User Industry (Water Treatment, Industrial Processing, and More), and Geography (Asia-Pacific, North America, and More).

Geography Analysis

Asia-Pacific held a dominant 63% revenue share in 2024 and is forecast to grow at a leading 6.11% CAGR to 2030, reinforcing its centrality to activated carbon market expansion. China anchors regional production with vertically integrated plants that convert coconut shells, coal, and sawdust into a broad portfolio of carbons tailored for domestic water utilities and export markets. India's Jal Jeevan mission, targeting universal rural-water access, is issuing tender documents that stipulate GAC filters for arsenic and fluoride removal, thereby opening procurement to both local mills and Japanese-owned subsidiaries.

North America is buoyed by regulatory certainty and high per-capita consumption. The 2024 EPA PFAS rule alone could double GAC demand by the end of the decade. Europe commands a smaller yet technologically sophisticated market. Research at the University of Cambridge yielded an electrified charcoal sponge that adsorbs CO2 directly from air with reduced energy input, hinting at future diversification into climate-mitigation applications.

South America and the Middle East, though accounting for modest volume, record rapid adoption of carbons for mining and gas-processing duties. Chilean gold miners specify coconut-shell carbons for CIL circuits, while Qatari LNG producers deploy pelletized carbons to meet stringent mercury spec contamination limits prior to cryogenic separation.

- Albemarle Corporation

- Arq, Inc.

- Carbon Activated Corporation

- CarboTech

- CPL

- Donau Carbon GmbH

- HAYCARB PLC

- Ingevity

- KALPAKA CHEMICALS

- KURARAY CO., LTD.

- MICBAC INDIA

- Nanping Yuanli Active Carbon Company

- Norit

- Osaka Gas Chemicals Co., Ltd

- Rotocarb

- Silcarbon Aktivkohle GmbH

- Suneeta Carbons

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Conformance to Stringent Environmental Regulations in Water Treatment Applications in the United States

- 4.2.2 Augmenting Prominence for Air Pollution Control (Especially Mercury Removal)

- 4.2.3 Growing Water Purification Demand

- 4.2.4 Gold Mining and Metal Recovery

- 4.2.5 High demand from Agriculture and Agrochemicals

- 4.3 Market Restraints

- 4.3.1 Supply-chain disruption of coconut shell feedstock

- 4.3.2 Escalating kiln-grade coal prices narrowing margins for coal-based PAC makers

- 4.3.3 High capital intensity of reactivation plants limiting circular business models

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Raw Material

- 5.1.1 Coal-Based

- 5.1.2 Coconut-Shell-Based

- 5.1.3 Wood-Based

- 5.1.4 Other Raw Materials (Peat, Lignite, etc.)

- 5.2 By Form

- 5.2.1 Powdered Activated Carbon (PAC)

- 5.2.2 Granular Activated Carbon (GAC)

- 5.2.3 Extruded / Pelletised Activated Carbon (EAC)

- 5.3 By Application

- 5.3.1 Decolorization Treatment

- 5.3.2 Sugar Production

- 5.3.3 Concentration Treatment

- 5.3.4 Solvent Recovery

- 5.3.5 PFAS Adsorption Treatment

- 5.3.6 Drinking Water Treatment

- 5.3.7 Other Applications

- 5.4 By End-user Industry

- 5.4.1 Water Treatment

- 5.4.2 Industrial Processing

- 5.4.3 Healthcare

- 5.4.4 Food and Beverage

- 5.4.5 Automotive

- 5.4.6 Other End-user Industry

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)

- 6.4.1 Albemarle Corporation

- 6.4.2 Arq, Inc.

- 6.4.3 Carbon Activated Corporation

- 6.4.4 CarboTech

- 6.4.5 CPL

- 6.4.6 Donau Carbon GmbH

- 6.4.7 HAYCARB PLC

- 6.4.8 Ingevity

- 6.4.9 KALPAKA CHEMICALS

- 6.4.10 KURARAY CO., LTD.

- 6.4.11 MICBAC INDIA

- 6.4.12 Nanping Yuanli Active Carbon Company

- 6.4.13 Norit

- 6.4.14 Osaka Gas Chemicals Co., Ltd

- 6.4.15 Rotocarb

- 6.4.16 Silcarbon Aktivkohle GmbH

- 6.4.17 Suneeta Carbons

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment

- 7.2 Rising Research Activities Research to Develop Bio-based Plastics