Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685939

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685939

North America Feed Acidifiers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 205 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

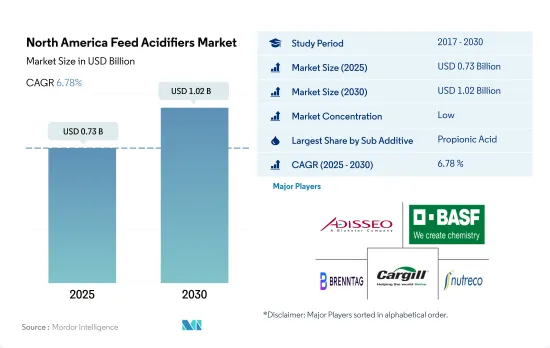

The North America Feed Acidifiers Market size is estimated at 0.73 billion USD in 2025, and is expected to reach 1.02 billion USD by 2030, growing at a CAGR of 6.78% during the forecast period (2025-2030).

- Feed acidifiers are important in promoting animal growth, increasing metabolism, and providing resistance to harmful pathogens while reducing dependence on antibiotics. The North American feed acidifiers market accounted for 7.1% of the total feed additives market in 2022, an 18.8% increase in 2019 compared to 2018. This high share was attributed to the increased market value of probiotic types due to increased feed production.

- The United States dominated the North American feed acidifiers market, accounting for 70% in 2022, mainly due to higher feed production and demand from the country's growing meat and dairy product markets. Among all feed acidifiers, propionic acid was most significantly used, valued at almost USD 0.2 billion in 2022, followed by fumaric acid and lactic acid, accounting for 25% and 22.8% of the market, respectively.

- Ruminants held the largest share of the feed propionic acid segment, accounting for 38.8% in 2022 due to the high demand for ruminant products. The United States is the fastest-growing country in the feed acidifiers market, with a projected CAGR of 7% during the forecast period. The increasing demand for meat, especially poultry and pork, the rising demand for dairy products, and the growing aquaculture cultivation are expected to drive the country's feed acidifiers market in the coming years.

- The rising demand for meat and seafood and increasing awareness about the benefits of feed additives in animal productivity are the major drivers of the North American feed acidifiers market, especially in the United States.

- The North American feed acidifiers market has grown steadily in recent years, and in 2022, it accounted for 7.1% of the global market, with a value of USD 0.65 billion. The use of acidifiers in animal feed has expanded due to the rising demand for meat and meat products, which resulted in an 18.7% increase in the market's value in 2019 compared to 2018.

- Among all animal types, ruminants are the biggest users of feed acidifiers, and the segment accounted for a market value of USD 0.23 billion in 2022. This trend was mainly due to the high demand from dairy industries. The poultry segment followed closely behind, with a market share of 35.4% in 2022. However, swine is emerging as the fastest-growing segment, expected to record a CAGR of 6.7% during the forecast period due to the positive impact of probiotics on animal health.

- The United States is the largest feed acidifiers market in North America, accounting for 70% of the total market share in 2022. It is also the fastest-growing country in the North American feed acidifiers market, expected to witness a CAGR of 7% during the forecast period.

- Among acidifier types, propionic acid, fumaric acid, and lactic acid are the most commonly used in North America, accounting for 37.1%, 25.1%, and 22.7%, respectively, of the total regional market by value. The popularity of these acidifiers is closely linked to their benefits and application in different animals for enhancing feed intake by increasing the palatability of feed.

- The increase in demand for meat and meat products and the rising per capita meat consumption and livestock population are estimated to drive the North American feed acidifiers market with a CAGR of 6.7% during the forecast period.

North America Feed Acidifiers Market Trends

Higher consumption of poultry meat than red meat and the United States is globally largest producer of eggs and poultry meat is driving the demand for poultry production

- The North American poultry industry has experienced significant growth over the past few years, with the poultry headcount increasing by 5.0% from 2017 to 2022. This growth is largely due to the increasing demand for poultry meat and other poultry products. The United States dominates the North American poultry industry as the world's largest producer and second-largest exporter of poultry meat and a major egg producer. The United States accounted for 62.0% of the region's total poultry production in 2022. The high-profit margin in the industry is attracting new poultry producers, leading to an increase in the number of producers in the region. For example, Canada's number of egg producers increased from 1,062 in 2016 to 1,205 in 2021.

- Poultry birds, especially broiler meat, are produced in large quantities due to their quick maturity and market weight, which is faster than other livestock. Poultry birds, including broilers, can be raised in small spaces, making it possible for producers to raise poultry in a variety of environments, including small plots of land. These advantages make poultry production more feasible. Mexican poultry production increased by 12% in 2022 from the previous year.

- Poultry meat consumption is significantly higher than that of beef or pork. More people are choosing poultry as a leaner, healthier source of protein due to the rising health risks linked to eating red meat. This trend is expected to continue, driving the growth of the region's poultry industry. The increasing demand for poultry products from both domestic and international markets and rising poultry production are expected to further drive the growth of the market during the forecast period.

Expansion of retail industry, and demand for high-quality seafood is increasing the demand for macro-nutrients and micro-nutrients rich aquaculture feed

- Aquaculture feed production in North America accounted for a small fraction of global production, representing only 3.8% in 2022. However, the demand for diverse seafood products is driving local aquaculture production. Feed production grew by 9.2% between 2017 and 2022. In response to the increasing demand for nutritionally balanced feed, feed millers in the region plan to increase production from 2.2 million metric tons in 2022 to 2.6 million metric tons in 2029. The compound feed offered to aquaculture species contains the macro and micronutrients needed for healthy growth under intensive rearing conditions, thus contributing to the increased demand for aquaculture feed in the region.

- Fish, which accounted for 73.2% of feed production in 2022, is the most prominent species in terms of feed production. The rising awareness of the health benefits of fish in the human diet, changing food consumption patterns, the expanding retail sector, and high demand in the international market are contributing to the growth of fish production in the region. Fish feed production is expected to increase from 1.6 million metric tons in 2022 to 1.9 million metric tons in 2029 as producers focus on nutritional management to ensure the health and performance of their animals.

- Canada's aquaculture producers spent USD 393.8 million on feed in 2020, a 6.6% increase from 2016, demonstrating the increasing demand for high-quality aquatic food. Overall, the increasing demand for diverse seafood products and the need for nutritionally balanced feed for aquaculture species are expected to drive the growth of aquaculture feed production in North America in the coming years.

North America Feed Acidifiers Industry Overview

The North America Feed Acidifiers Market is fragmented, with the top five companies occupying 25.96%. The major players in this market are Adisseo, BASF SE, Brenntag SE, Cargill Inc. and SHV (Nutreco NV) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49634

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Animal Headcount

- 4.1.1 Poultry

- 4.1.2 Ruminants

- 4.1.3 Swine

- 4.2 Feed Production

- 4.2.1 Aquaculture

- 4.2.2 Poultry

- 4.2.3 Ruminants

- 4.2.4 Swine

- 4.3 Regulatory Framework

- 4.3.1 Canada

- 4.3.2 Mexico

- 4.3.3 United States

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Sub Additive

- 5.1.1 Fumaric Acid

- 5.1.2 Lactic Acid

- 5.1.3 Propionic Acid

- 5.1.4 Other Acidifiers

- 5.2 Animal

- 5.2.1 Aquaculture

- 5.2.1.1 By Sub Animal

- 5.2.1.1.1 Fish

- 5.2.1.1.2 Shrimp

- 5.2.1.1.3 fish

- 5.2.1.1.4 Other Aquaculture Species

- 5.2.2 Poultry

- 5.2.2.1 By Sub Animal

- 5.2.2.1.1 Broiler

- 5.2.2.1.2 Layer

- 5.2.2.1.3 Other Poultry Birds

- 5.2.3 Ruminants

- 5.2.3.1 By Sub Animal

- 5.2.3.1.1 Beef Cattle

- 5.2.3.1.2 Dairy Cattle

- 5.2.3.1.3 Other Ruminants

- 5.2.4 Swine

- 5.2.5 Other Animals

- 5.2.1 Aquaculture

- 5.3 Country

- 5.3.1 Canada

- 5.3.2 Mexico

- 5.3.3 United States

- 5.3.4 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Adisseo

- 6.4.2 Alltech, Inc.

- 6.4.3 BASF SE

- 6.4.4 Bio Agri Mix

- 6.4.5 Brenntag SE

- 6.4.6 Cargill Inc.

- 6.4.7 EW Nutrition

- 6.4.8 Kemin Industries

- 6.4.9 SHV (Nutreco NV)

- 6.4.10 Yara International ASA

7 KEY STRATEGIC QUESTIONS FOR FEED ADDITIVE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Global Market Size and DROs

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.