Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686577

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686577

Spain Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 290 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

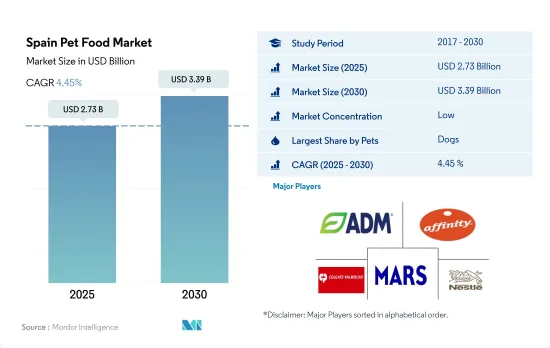

The Spain Pet Food Market size is estimated at 2.73 billion USD in 2025, and is expected to reach 3.39 billion USD by 2030, growing at a CAGR of 4.45% during the forecast period (2025-2030).

Dogs dominate the Spanish pet food market as they are highly owned pets in the country

- In 2022, dogs were the dominant players in the pet food market in Spain, with a market value of USD 1.23 billion. This dominance can be attributed to their large population in the country, accounting for approximately 36% (10.1 million) of the total pet population. As pet humanization continues to increase, pet owners are increasingly favoring premium pet products, including grain-free and vegan dog food. This trend is expected to boost the dog food market at a CAGR of 5.8% during the forecast period, making it the fastest-growing segment in the country.

- Cats held the second-largest market share in the Spanish pet food market, valued at USD 606 million in 2022. However, the main reason for cats holding a comparatively smaller market size than dogs was their lower population. The pet cat population in Spain accounted for 22.5% (6.3 million) of the total pet population, which was 37.8% less than that of dogs in the same year. Additionally, the consumption of cat food is significantly lower than that of dog food.

- Although other pet animals, including birds, fish, reptiles, and rodents, made up around 41.3% of the overall pet population in Spain, they only accounted for 21.4% of the total pet food market value in 2022. This can be attributed to the fact that these pets are typically small in size and, therefore, require relatively small amounts of food.

- With the rise in pet ownership during the pandemic and growing demand for premium pet food and specialized diets for pets' health, as well as the efforts of companies to introduce new products like organic pet foods and treats, the pet food market is expected to expand during the forecast period.

Spain Pet Food Market Trends

The growing adoption of cats as companions from animal shelters and licensed breeders, along with increasing awareness about the benefits of owning a cat, is driving the cat market in the country

- Spain has a larger dog population than a cat population. This trend is opposite to the trend in Europe. People feel more comfortable with dogs due to their unconditional friendship and security while at home alone, which helped the population of dogs to more than the population of cats in the country by 3.9 million in 2022. However, between 2020 and 2022, there was an increase in the cat population as people were confined to their homes because of the lockdowns, and cats could live for a long time indoors without being cooped up. This trend of adoption of cats during the pandemic was expected to have a wider time effect on the pet food market as the average lifespan of cats is more than 20 years.

- There was a rise in the number of households owning a cat as a pet in their homes in the country. For instance, the share of households owing a cat increased from 11% in 2019 to 16% in 2021. An increasing share of households own a cat as a pet due to the rise in pet humanization, and cats can live in smaller places than dogs, which led to an increase of 55.2% in the cat population between 2019 and 2021.

- The acquisition of pets is generally through animal shelters and licensed breeders in the country. People prefer to adopt pets from animal shelters because there are regulations on the pet trade, as pet shops are banned from selling cats, and less number of licensed breeders are present in the country. The increasing number of households owing a cat as a pet, the rise in pet humanization, and benefits such as the ability to adapt to smaller places are anticipated to have helped in increasing the adoption of the cat population in the country, and this will also help the pet food market for cats to witness growth during the forecast period.

The trend toward high-quality and premium pet food and related growing awareness is increasing expenditure on the pet food

- In Europe, Spain holds the fourth position in terms of the total number of pets. The expenditure on pets in Spain is consistently rising, which increased by about 16.6% between 2019 and 2022. This upsurge is primarily due to two reasons: pet humanization and premiumization. In Spain, as of 2020, 37.0% of households possessed a minimum of one pet, and pet owners increasingly perceive their pets as integral members of their families, signifying the growing trend of pet humanization.

- Between 2019 and 2022, pet owners' annual spending on pet food for dogs increased by around 21.8%, while spending on cats increased by about 22.3%, and other pets saw an increase of about 9.0%. Additionally, sales of dog pet food registered a CAGR of 5.9% from 2016 to 2020, while cat food sales increased at a slower CAGR of 3.9%. Additionally, pet owners are increasingly interested in natural and targeted nutrition, leading to a surge in demand for premium brands like "Royal Canin." The brand's retail sales increased from USD 50.2 million in 2016 to USD 79.4 million in 2022, registering a CAGR of 7.9%.

- Pet owners in the country bought pet supplies from various pet shops, hypermarkets, and e-commerce. Offline stores were the top preference for pet supplies in the country. Pet food prices in Spain were affected by the political conflict between Russia and Ukraine in 2022, causing challenges in procuring raw materials and leading to an impact on pet expenditure in the country. Despite this, the increasing trend toward high-quality and premium pet food, as well as the growing awareness of its benefits, is projected to sustain the growth of pet expenditure during the forecast period.

Spain Pet Food Industry Overview

The Spain Pet Food Market is fragmented, with the top five companies occupying 38.82%. The major players in this market are ADM, Affinity Petcare SA, Colgate-Palmolive Company (Hill's Pet Nutrition Inc.), Mars Incorporated and Nestle (Purina) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 52816

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Pet Food Product

- 5.1.1 Food

- 5.1.1.1 By Sub Product

- 5.1.1.1.1 Dry Pet Food

- 5.1.1.1.1.1 By Sub Dry Pet Food

- 5.1.1.1.1.1.1 Kibbles

- 5.1.1.1.1.1.2 Other Dry Pet Food

- 5.1.1.1.2 Wet Pet Food

- 5.1.2 Pet Nutraceuticals/Supplements

- 5.1.2.1 By Sub Product

- 5.1.2.1.1 Milk Bioactives

- 5.1.2.1.2 Omega-3 Fatty Acids

- 5.1.2.1.3 Probiotics

- 5.1.2.1.4 Proteins and Peptides

- 5.1.2.1.5 Vitamins and Minerals

- 5.1.2.1.6 Other Nutraceuticals

- 5.1.3 Pet Treats

- 5.1.3.1 By Sub Product

- 5.1.3.1.1 Crunchy Treats

- 5.1.3.1.2 Dental Treats

- 5.1.3.1.3 Freeze-dried and Jerky Treats

- 5.1.3.1.4 Soft & Chewy Treats

- 5.1.3.1.5 Other Treats

- 5.1.4 Pet Veterinary Diets

- 5.1.4.1 By Sub Product

- 5.1.4.1.1 Diabetes

- 5.1.4.1.2 Digestive Sensitivity

- 5.1.4.1.3 Oral Care Diets

- 5.1.4.1.4 Renal

- 5.1.4.1.5 Urinary tract disease

- 5.1.4.1.6 Other Veterinary Diets

- 5.1.1 Food

- 5.2 Pets

- 5.2.1 Cats

- 5.2.2 Dogs

- 5.2.3 Other Pets

- 5.3 Distribution Channel

- 5.3.1 Convenience Stores

- 5.3.2 Online Channel

- 5.3.3 Specialty Stores

- 5.3.4 Supermarkets/Hypermarkets

- 5.3.5 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Affinity Petcare SA

- 6.4.3 Alltech

- 6.4.4 Colgate-Palmolive Company (Hill's Pet Nutrition Inc.)

- 6.4.5 Dechra Pharmaceuticals PLC

- 6.4.6 General Mills Inc.

- 6.4.7 Mars Incorporated

- 6.4.8 Nestle (Purina)

- 6.4.9 Schell & Kampeter Inc. (Diamond Pet Foods)

- 6.4.10 Virbac

7 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.