Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685967

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685967

China Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 291 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

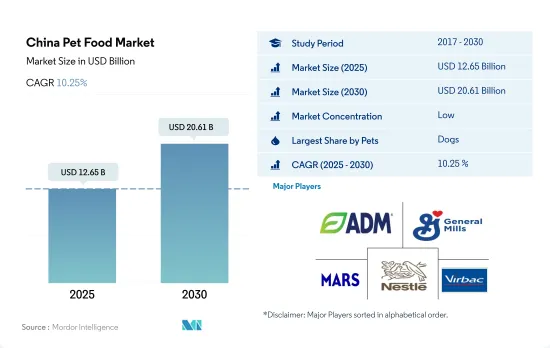

The China Pet Food Market size is estimated at 12.65 billion USD in 2025, and is expected to reach 20.61 billion USD by 2030, growing at a CAGR of 10.25% during the forecast period (2025-2030).

Dogs dominate the market due to their higher usage of commercial pet foods and high per capita consumption

- China is a major country-wise segment of the Asia-Pacific pet food market, accounting for a 33.1% share in 2022, increasing by 98.5% in 2017-2022. This growth was due to the increasing pet ownership and pet humanization. Chinese pet owners are increasingly demanding pet food with nutritious and protein-rich ingredients, which are the factors driving the demand for pet food in the country.

- The dog food segment held the largest share of the country's pet food market, with a value of USD 4,213.6 million in 2022, which is anticipated to reach USD 7,848.0 million in 2029. This significant share is due to factors such as a significant number of pet owners shifting from home-cooked food to commercial protein-rich food in the country and since dogs need more food compared to other pets due to their higher consumption capacity. There is also a growing trend toward premium dog food products.

- Cats are the second major consumer of food items in the country's pet food market, accounting for a 36.9% share in 2022, which is anticipated to register a CAGR of 12.9% during the forecast period. This growth is due to the significant increase in the cat population by 27.5% between 2017 and 2022, followed by the rise in popularity of cat companionship due to their comparatively low maintenance requirements.

- The other pets segment consists of birds, small mammals, rodents, and ornamental fish. These animals have unique nutritional requirements that need to be fulfilled through specialized pet food products. Therefore, in 2022, they accounted for a value of USD 1,907.4 million.

- The rise in commercial food usage, pet humanization, and the growing pet population in the country are anticipated to drive the market at a CAGR of 10.3% during the forecast period.

China Pet Food Market Trends

Cats were the most preferred pets among Gen Z and younger adults, along with growing urbanization, in the country

- China has been witnessing a rise in the adoption of dogs more than cats, but cats held a significant share of 29.1% in 2022. The country witnessed an increase in pet ownership due to health benefits such as feeling relaxed and less stressed, the convenience of keeping them in smaller spaces, and less need for their owners to take them for walks and pet humanization. For instance, in 2020, 55% of cat parents treated their pets, including cats, as their children. Therefore, the cat population as pets increased by 27.5% between 2017 and 2022.

- In 2018, the adoption rate of cats was about 19.9%, which was lower than the adoption rate of other developed markets such as the United States and Canada. To increase the adoption rate of pets, including cats, the government organization Second Chance Animal Aid (SCAA) has created awareness in the country to adopt pets.

- The pet ecosystem has evolved in the country with six pet cafes operating in Shanghai and an online platform, Boqii Mall, which provides pet products, a platform for pet parents to share their experiences, and other services required by the pet parents. These factors are also contributing to the adoption of cats in the country. In China, an increase in the number of pets, including cats, in urban areas as the pet population increased by 10.2% between 2018 and 2020 to reach a pet population of 100.8 million in urban areas in 2020. The rise in the cat population between 2020 and 2022 was driven by the pandemic, and the lifespan of cats is more than 20 years, which is anticipated to help in the growth of cat food in the future.

- The improvements in the pet ecosystem and pet humanization are factors expected to help in the growth of the cat population during the forecast period.

Increase in the usage of premium and high-quality pet food products has increased the expenditure per pet

- China has been witnessing a trend of increasing pet expenditure because of increasing premiumization and young people providing more high-priced products. Additionally, there has been a shift in the purchasing power of pet parents due to increasing disposable income and new varieties of pet food available in the market. These factors increased pet expenditure in the country by 26.1% between 2017 and 2022.

- Dogs have a higher share of pet expenditures than expenditures incurred by cats. An increase in pet expenditure of dogs by 37.1% between 2019 and 2022 reached a value of USD 569.8 because of the pet parents feeding the pets with healthy pet food during the pandemic, and the majority of pet parents, including dog owners, are millennials. For instance, in 2021, 22.9% of pet parents were born after 1995, and 46.3% of pet parents were born after 1990. Therefore, a higher number of millennials have contributed to higher expenditure on pet food for their pets.

- Pet food can be purchased through different channels, such as online retailers, specialized pet stores, and pet stores. It has been witnessed that a high share of pet parents purchase food from online stores compared to offline stores, and pet parents also purchase pet nutritional products such as veterinary diets and nutraceuticals from animal hospitals and pet stores. For instance, in 2022, pet parents who purchased pet food from online stores accounted for 58.9%, and pet parents who purchased nutritional products from pet stores accounted for 27.5%.

- The pet expenditure in the country is expected to increase during the forecast period because of the high number of young pet parents and growing awareness about specialized pet food.

China Pet Food Industry Overview

The China Pet Food Market is fragmented, with the top five companies occupying 12.66%. The major players in this market are ADM, General Mills Inc., Mars Incorporated, Nestle (Purina) and Virbac (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 50015

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Pet Food Product

- 5.1.1 Food

- 5.1.1.1 By Sub Product

- 5.1.1.1.1 Dry Pet Food

- 5.1.1.1.1.1 By Sub Dry Pet Food

- 5.1.1.1.1.1.1 Kibbles

- 5.1.1.1.1.1.2 Other Dry Pet Food

- 5.1.1.1.2 Wet Pet Food

- 5.1.2 Pet Nutraceuticals/Supplements

- 5.1.2.1 By Sub Product

- 5.1.2.1.1 Milk Bioactives

- 5.1.2.1.2 Omega-3 Fatty Acids

- 5.1.2.1.3 Probiotics

- 5.1.2.1.4 Proteins and Peptides

- 5.1.2.1.5 Vitamins and Minerals

- 5.1.2.1.6 Other Nutraceuticals

- 5.1.3 Pet Treats

- 5.1.3.1 By Sub Product

- 5.1.3.1.1 Crunchy Treats

- 5.1.3.1.2 Dental Treats

- 5.1.3.1.3 Freeze-dried and Jerky Treats

- 5.1.3.1.4 Soft & Chewy Treats

- 5.1.3.1.5 Other Treats

- 5.1.4 Pet Veterinary Diets

- 5.1.4.1 By Sub Product

- 5.1.4.1.1 Diabetes

- 5.1.4.1.2 Digestive Sensitivity

- 5.1.4.1.3 Oral Care Diets

- 5.1.4.1.4 Renal

- 5.1.4.1.5 Urinary tract disease

- 5.1.4.1.6 Other Veterinary Diets

- 5.1.1 Food

- 5.2 Pets

- 5.2.1 Cats

- 5.2.2 Dogs

- 5.2.3 Other Pets

- 5.3 Distribution Channel

- 5.3.1 Convenience Stores

- 5.3.2 Online Channel

- 5.3.3 Specialty Stores

- 5.3.4 Supermarkets/Hypermarkets

- 5.3.5 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Affinity Petcare SA

- 6.4.3 Alltech

- 6.4.4 Clearlake Capital Group, L.P. (Wellness Pet Company Inc.)

- 6.4.5 General Mills Inc.

- 6.4.6 Mars Incorporated

- 6.4.7 Nestle (Purina)

- 6.4.8 PLB International

- 6.4.9 Schell & Kampeter Inc. (Diamond Pet Foods)

- 6.4.10 Virbac

7 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.