Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685896

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1685896

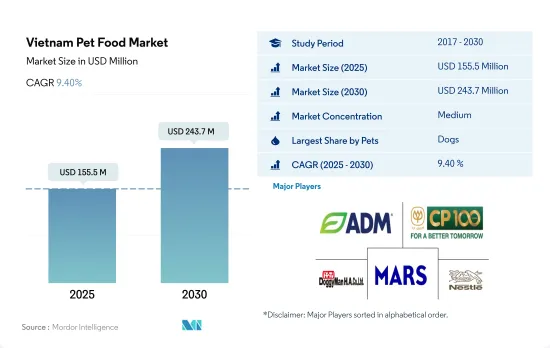

Vietnam Pet Food - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 279 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

The Vietnam Pet Food Market size is estimated at 155.5 million USD in 2025, and is expected to reach 243.7 million USD by 2030, growing at a CAGR of 9.40% during the forecast period (2025-2030).

Dogs dominated the Vietnamese pet food market due to their larger population and higher per capita consumption compared to other pets

- Vietnam is home to one of the fastest-growing pet food industries, and the significant presence of younger adults and teenagers as pet parents in the country is also one of several unique factors driving the country's pet food market. In 2022, the Vietnamese pet food market accounted for 0.4% of the Asia-Pacific pet food market, but the country's share is anticipated to grow faster in the coming years as younger adults become salaried. This is projected to increase the demand for high-quality pet food products in the country over the coming years.

- During the historical period, the pet food market in the country increased by 81% between 2017 and 2021. The growth in the market during the period was because of the increasing usage of commercial pet food products and the rising pet population in the country.

- Dogs comprise the major pet segment in the Vietnamese pet food market, with its share amounting to USD 76.4 million in 2022. The higher share of these pets was because of their larger population among all pets and comparatively higher consumption of pet food. Dogs accounted for 45.1% of the pet population in the country in 2022.

- Cats and other animals occupied the major share of the Vietnamese pet food market after dogs, with shares of 38% and 16.9%, respectively, in 2022. However, cats comprise the fastest-growing pet segment in the market, expected to register a CAGR of 10.7% during the forecast period, with increasing disposable incomes of pet owners driving the shift from homemade foods to commercial foods.

- The increasing usage of commercial pet food products and growing pet adoption among younger adults are estimated to drive the pet food market in the country during the forecast period.

Vietnam Pet Food Market Trends

Cats are considered lucky in Vietnamese culture which is anticipated to drive the cat adoption as pets in the country

- In Vietnam, owning a cat as a pet has become increasingly popular. Thus, the cat population has significantly increased by 28.5% between 2019 and 2022. The growing middle class mainly drives this trend. The changing preference toward cat ownership for their distinct personalities and behavior is also enhancing the adoption of cats. In Vietnamese culture, cats are considered lucky animals and are believed to bring good fortune to households that own them.

- Cat ownership in the country is growing at a slower rate compared to dog ownership. The number of households owning cats increased from 11.3% in 2016 to 12.4% in 2020. As of 2022, the pet cat population accounted for about 38.0% of the total pet population in Vietnam. This considerable share of cats is mainly because of the increasing trend in pet cat ownership, particularly among young age people.

- Despite the significant pet cat population in the country, the pet cat population in Vietnam is facing a serious threat from the illegal, inhumane, and hazardous cat meat trade, which has resulted in cat owners living in constant fear of their pets being stolen and slaughtered for human consumption. Every day, thousands of pet cats are disappearing due to rampant theft. However, the Vietnamese government has taken stringent measures to ban the cat meat trade. Both government and non-government organizations promote the adoption of cats and train responsible cat ownership in the country. Easy accessibility to pet cat products through offline and online retail stores and growing interest in cat cafes and parks are the factors contributing to the increasing adoption or ownership of cats across the country. Such factors are anticipated to rise in the overall pet cat population during the forecast period.

Mid-priced pet foods are the most demanded food products in the country, and increasing awareness of pet health is driving pet expenditure in Vietnam

- In Vietnam, a trend of increasing pet expenditure has been witnessed due to an increase in the prices of pet food products and pet parents preferring customized diets. Dogs are more prone to diseases such as diabetes and obesity; thus, they require large quantities of pet food as compared to other pets. These factors increased the share of dogs in the pet expenditure and attained a higher share in the pet expenditure as they accounted for 39% in 2022.

- Pet parents in Vietnam are expected to continue purchasing pet food that is mid-priced as compared to high-priced pet food due to low income compared to other Asia-Pacific countries such as India, China, South Korea, and Australia. Mid-priced pet food is expected to be given more to pets as there is growing awareness about specialized pet food. Millennial pet parents are expected to spend more time with pets and purchase more branded pet food, which expands further category development and increases expenditure on pet food.

- Sales of pet foods are mostly through pet shops and grocery retailers, whereas there is an increase in the sales of pet food through online retailers. For instance, in 2020, pet food sales through non-grocery specialist stores accounted for 72.8% of the pet food sales in the country, whereas sales through e-commerce accounted for 3.1%, which is expected to register a CAGR of 7.7% during the forecast period. The growing awareness about health concerns and the rise in mid-priced products purchased by pet parents are the factors expected to help in increasing pet expenditure in the country during the forecast period.

Vietnam Pet Food Industry Overview

The Vietnam Pet Food Market is moderately consolidated, with the top five companies occupying 61.44%. The major players in this market are ADM, Charoen Pokphand Group, DoggyMan H. A. Co., Ltd., Mars Incorporated and Nestle (Purina) (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 49083

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Pet Population

- 4.1.1 Cats

- 4.1.2 Dogs

- 4.1.3 Other Pets

- 4.2 Pet Expenditure

- 4.3 Regulatory Framework

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Pet Food Product

- 5.1.1 Food

- 5.1.1.1 By Sub Product

- 5.1.1.1.1 Dry Pet Food

- 5.1.1.1.1.1 By Sub Dry Pet Food

- 5.1.1.1.1.1.1 Kibbles

- 5.1.1.1.1.1.2 Other Dry Pet Food

- 5.1.1.1.2 Wet Pet Food

- 5.1.2 Pet Nutraceuticals/Supplements

- 5.1.2.1 By Sub Product

- 5.1.2.1.1 Milk Bioactives

- 5.1.2.1.2 Omega-3 Fatty Acids

- 5.1.2.1.3 Probiotics

- 5.1.2.1.4 Proteins and Peptides

- 5.1.2.1.5 Vitamins and Minerals

- 5.1.2.1.6 Other Nutraceuticals

- 5.1.3 Pet Treats

- 5.1.3.1 By Sub Product

- 5.1.3.1.1 Crunchy Treats

- 5.1.3.1.2 Dental Treats

- 5.1.3.1.3 Freeze-dried and Jerky Treats

- 5.1.3.1.4 Soft & Chewy Treats

- 5.1.3.1.5 Other Treats

- 5.1.4 Pet Veterinary Diets

- 5.1.4.1 By Sub Product

- 5.1.4.1.1 Diabetes

- 5.1.4.1.2 Digestive Sensitivity

- 5.1.4.1.3 Oral Care Diets

- 5.1.4.1.4 Renal

- 5.1.4.1.5 Urinary tract disease

- 5.1.4.1.6 Other Veterinary Diets

- 5.1.1 Food

- 5.2 Pets

- 5.2.1 Cats

- 5.2.2 Dogs

- 5.2.3 Other Pets

- 5.3 Distribution Channel

- 5.3.1 Convenience Stores

- 5.3.2 Online Channel

- 5.3.3 Specialty Stores

- 5.3.4 Supermarkets/Hypermarkets

- 5.3.5 Other Channels

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 ADM

- 6.4.2 Alltech

- 6.4.3 Charoen Pokphand Group

- 6.4.4 DoggyMan H. A. Co., Ltd.

- 6.4.5 EBOS Group Limited

- 6.4.6 Mars Incorporated

- 6.4.7 Nestle (Purina)

- 6.4.8 Schell & Kampeter Inc. (Diamond Pet Foods)

- 6.4.9 Vafo Praha, s.r.o.

- 6.4.10 Virbac

7 KEY STRATEGIC QUESTIONS FOR PET FOOD CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.