PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849918

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849918

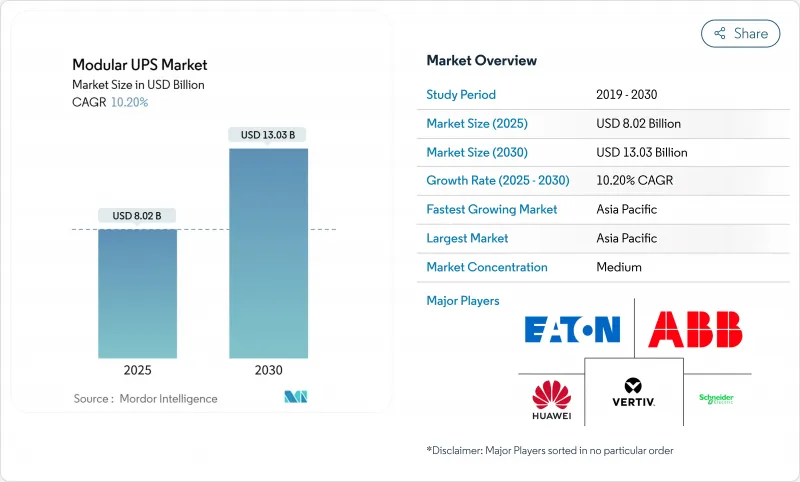

Modular UPS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Modular UPS Market size is estimated at USD 8.02 billion in 2025, and is expected to reach USD 13.03 billion by 2030, at a CAGR of 10.20% during the forecast period (2025-2030).

Rapid data-center construction, edge-computing rollouts, and stringent uptime requirements keep demand strong, while lithium-ion batteries and grid-interactive designs expand system functionality beyond standby power. Scaling in 50 kW building blocks reduces stranded capacity and speeds deployment, a decisive advantage as AI workloads lift rack densities. Vendors also differentiate through cybersecurity hardening after regulators highlighted more than 20,000 vulnerable UPS monitoring devices in 2024. Asia-Pacific commands the largest regional footprint and grows fastest as China, India, and Japan commission multi-megawatt campuses at a record pace.

Global Modular UPS Market Trends and Insights

Growth of Hyperscale, Colocation and Cloud Data Centers

Hyperscale operators plan to add 5,000 MW of global capacity in 2024, driving unprecedented demand for scalable power blocks that align with phased build schedules. AI training clusters raise rack power draw from 10 kW to 40 kW, compelling designers to deploy modular strings that can be expanded in weeks rather than the 12-18-month cycle of monolithic retrofits. Collaboration between Eaton and Siemens Energy underscores the urgency; their standardized 500 MW onsite solution claims to trim data-center construction time by two years and underscores why owners now view power architecture as a competitive lever. Procurement teams further prefer modular UPS market products because they fit inside prefabricated electrical skids, streamlining permitting and commissioning. Together, these forces add an estimated 3.2 percentage points to the overall CAGR through 2030.

Lower TCO and Scalability of Modular Architecture

Lifecycle studies indicate that right-sizing cuts stranded capacity by 30-40%, offsetting the 15-25% price premium versus monolithic frames. Hot-swappable modules slash mean-time-to-repair from hours to minutes, which improves SLA compliance and lowers penalty payments for colocation providers. CFOs favor the pay-as-you-grow model because it defers capital until utilization proves out, a vital hedge in high-interest environments. The modular UPS market also benefits from rising adoption of vendor-financed operating leases that convert capex to opex, easing budget approvals. Collectively, incremental scalability contributes 2.4 percentage points to forecast growth.

High Up-Front Capex Versus Monolithic Systems

Price-sensitive buyers in Southeast Asia and Latin America still favor monolithic cabinets that cost 15-25% less per kilowatt at acquisition. Even though lifecycle analyses prove favorable, procurement policies prioritized around the lowest bid continue to delay adoption. Vendors respond with usage-based financing, allowing clients to add modules under subscription models that mimic cloud billing. Nonetheless, the premium remains a meaningful drag, subtracting 1.2 percentage points from modular UPS market expansion over the near term.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Deployment for Edge and 5 G Micro-Data Centers

- Green-Certification Mandates Driving High-Efficiency UPS

- Cyber-Security Risks in Networked UPS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The >500 kVA class generated the fastest growth at 14% CAGR, despite 51-100 kVA units holding 41% of 2024 revenue. This upper tier addresses AI racks drawing 40 kW each, and colocation providers now standardize on 2 MW power rooms filled with hot-plug bricks to maintain flexibility. The modular UPS market size for this slice will reach USD 3.7 billion by 2030. Operators cite module-level redundancy and lithium-ion compatibility as primary selection criteria. The 101-500 kVA tiers remain vital for corporate data halls that balance cost with future expansion. The <=50 kVA niche serves telecom shelters and smart-factory lines where wall-mount footprints matter.

Advancements in wide-band-gap semiconductors lift conversion efficiency above 98%, allowing heat-density gains without oversizing cooling plants. Phoenix Contact's QUINT HP demonstrates five hot-swappable battery strings monitored by UPS IQ firmware that predicts remaining life to within 3% accuracy. By 2030, shipments in the 301-500 kVA cohort will overtake the 101-300 kVA class as regional edge-core facilities aggregate into 10 MW campuses. This balanced demand curve underpins the modular UPS market's resilience against cyclical spending dips.

Data centers accounted for 48% of 2024 spending, reflecting hyperscale and colocation scale-out. Industrial plants post 12.5% CAGR as Industry 4.0 investments attach power-quality guarantees to robotics lines and wafer fabs. The modular UPS market share within manufacturing rose 210 basis points between 2024 and 2025. Semiconductor fabs, subject to sub-millisecond ride-through requirements, purchase redundant N+2 strings with 20-minute autonomy, treating UPS capacity as yield insurance. Telecom expanded after 5 G densification triggered thousands of micro data hubs, each ordering 10 kVA wall-mount modules.

Commercial buildings and BFSI follow, driven by digital-banking SLAs that penalize downtime. Government adopters specify microgrid-ready designs to meet resiliency mandates, a trend codified in the 2024 DoD UFC guideline. Healthcare facilities value hot-swap batteries for infection-control zones where frequent maintenance visits are impractical. This broadening end-user base shields the modular UPS market from over-reliance on data centers alone.

Modular UPS Market is Segmented by Power Capacity (<= 50 KVA, 51 - 100 KVA, 101 - 300 KVA, and More), End User Industry ( Data Centers, Industrial Manufacturing, and More), Phase Type (Single-Phase and Three-Phase), Component (Solutions and Services), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led the sector with 36% revenue in 2024, and its 11.2% CAGR through 2030 remains unmatched. China accelerated data-center approvals after lifting regional power-grid moratoriums, while India's Digital Public Infrastructure program triggered hyperscale builds around Mumbai, Hyderabad, and Chennai. Japan's semiconductor revival funnels billions into new fabs that specify lithium-ion UPS strings above 500 kVA to cut floor-loading. Local manufacturing of power electronics in Shenzhen and Suzhou reduces lead times, a decisive edge during global component shortages. As a result, the modular UPS market in Asia-Pacific will eclipse USD 5 billion by 2030.

North America ranks second on the back of mature hyperscale campuses in Northern Virginia, Dallas, and Phoenix. Utilities across PJM and ERCOT actively procure frequency-regulation services, encouraging grid-interactive deployments that monetize idle battery assets. The Department of Defense mandates microgrid-compatible UPS for mission-critical bases, elevating demand for ruggedized NEMA enclosures capable of black-start functionality. Canada's proposed Tier 2 energy-efficiency standard further nudges adoption of transformer-less, high-efficiency designs.

Europe follows, propelled by carbon-neutrality targets and rising electricity costs that sharpen the ROI of 99%-efficient eco-modes. The United Kingdom tightens sustainability assessments, and Germany's BaFin regulates data-center resilience for financial services providers. Operators in both nations incorporate dynamic capacity right-sizing that ramps modules on or off to match IT load, cutting annual energy waste. France and the Nordics see brisk colocation growth backed by renewable-energy availability, setting the stage for lithium-ion and sodium-ion battery pilots such as Natron Energy's planned gigafactory in North Carolina, which will ship into the EU by 2026.

- Schneider Electric SE

- Vertiv Holdings Co.

- Eaton Corporation plc

- ABB Ltd.

- Huawei Technologies Co. Ltd.

- Delta Electronics Inc.

- Riello UPS (Riello Elettronica)

- AEG Power Solutions

- Socomec Group

- Borri S.p.A.

- Kehua Data Co., Ltd.

- KSTAR Science and Technology

- CyberPower Systems, Inc.

- Tripp Lite (by Eaton)

- Gamatronic (SolarEdge)

- Salicru S.A.

- Piller Power Systems

- Centiel SA

- Hitec Power Protection

- Statron AG

- PowerShield Ltd.

- Fuji Electric Co., Ltd.

- Mitsubishi Electric Corp.

- Toshiba ESS

- Shenzhen Zhicheng Champion Co., Ltd.

- Zhongheng Electric (China UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of Hyperscale, Colocation and Cloud Data Centers

- 4.2.2 Lower TCO and Scalability of Modular Architecture

- 4.2.3 Rapid Deployment for Edge and 5G Micro-Data Centers

- 4.2.4 Green-Certification Mandates Driving High-Efficiency UPS

- 4.2.5 Grid-Interactive UPS for Ancillary Revenue Streams

- 4.2.6 Microgrid-Ready Designs for Critical Infrastructure

- 4.3 Market Restraints

- 4.3.1 High Up-Front Capex Versus Monolithic Systems

- 4.3.2 Limited Awareness Outside IT Verticals

- 4.3.3 Power-Electronics Supply-Chain Volatility

- 4.3.4 Cyber-Security Risks in Networked UPS

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Power Capacity

- 5.1.1 <= 50 kVA

- 5.1.2 51 - 100 kVA

- 5.1.3 101 - 300 kVA

- 5.1.4 301 - 500 kVA

- 5.1.5 > 500 kVA

- 5.2 By End User Industry

- 5.2.1 Data Centers

- 5.2.2 Industrial Manufacturing

- 5.2.3 Telecommunications

- 5.2.4 Commercial Buildings

- 5.2.5 BFSI

- 5.2.6 Government and Public Infrastructure

- 5.2.7 Healthcare

- 5.2.8 Other End User Industries

- 5.3 By Phase Type

- 5.3.1 Single-Phase

- 5.3.2 Three-Phase

- 5.4 By Component

- 5.4.1 Solutions (Hardware)

- 5.4.2 Services

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Malaysia

- 5.5.4.7 Singapore

- 5.5.4.8 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Overview, Market Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Schneider Electric SE

- 6.4.2 Vertiv Holdings Co.

- 6.4.3 Eaton Corporation plc

- 6.4.4 ABB Ltd.

- 6.4.5 Huawei Technologies Co. Ltd.

- 6.4.6 Delta Electronics Inc.

- 6.4.7 Riello UPS (Riello Elettronica)

- 6.4.8 AEG Power Solutions

- 6.4.9 Socomec Group

- 6.4.10 Borri S.p.A.

- 6.4.11 Kehua Data Co., Ltd.

- 6.4.12 KSTAR Science and Technology

- 6.4.13 CyberPower Systems, Inc.

- 6.4.14 Tripp Lite (by Eaton)

- 6.4.15 Gamatronic (SolarEdge)

- 6.4.16 Salicru S.A.

- 6.4.17 Piller Power Systems

- 6.4.18 Centiel SA

- 6.4.19 Hitec Power Protection

- 6.4.20 Statron AG

- 6.4.21 PowerShield Ltd.

- 6.4.22 Fuji Electric Co., Ltd.

- 6.4.23 Mitsubishi Electric Corp.

- 6.4.24 Toshiba ESS

- 6.4.25 Shenzhen Zhicheng Champion Co., Ltd.

- 6.4.26 Zhongheng Electric (China UPS)

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 8.1 White-Space and Unmet-Need Assessment