PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906926

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906926

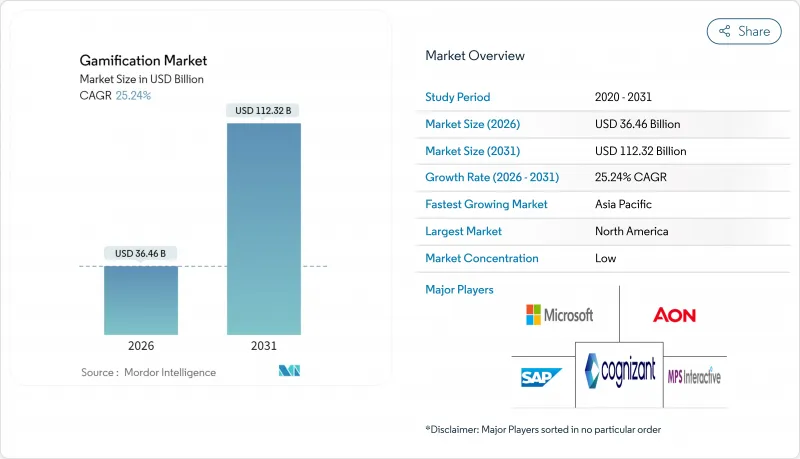

Gamification - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The gamification market was valued at USD 29.11 billion in 2025 and estimated to grow from USD 36.46 billion in 2026 to reach USD 112.32 billion by 2031, at a CAGR of 25.24% during the forecast period (2026-2031).

Cloud-based deployments already capture the majority of spend and, by delivering real-time analytics across distributed teams, underpin much of the current expansion. Large enterprises still account for the bulk of revenue, yet small and medium enterprises (SMEs) are scaling faster as low-code platforms lower adoption costs. Retail loyalty schemes remain the single-largest application, but employee-centric programs-particularly micro-learning initiatives-are recording the strongest uptake. Regionally, North America holds the lead, although Asia-Pacific's mobile-first business culture is shifting the center of gravity toward emerging digital economies. Competitive intensity stays high because established software vendors and specialist start-ups target the same white-space opportunities in regulated verticals.

Global Gamification Market Trends and Insights

Surge in Cloud-First Digital-Workplace Roll-Outs

Enterprises accelerating cloud migration need engagement tools that function natively across hybrid teams. Microsoft Power Apps embeds game mechanics directly into workflows, cutting rollout times from months to weeks . Cloud-hosted platforms generate the 27.58% CAGR forecast because they consolidate data streams and push real-time leaderboards to any device. Organizations integrating gamification with existing cloud infrastructure report up to 90% productivity improvement in remote work settings. The cost advantages of subscription licensing further accelerate adoption. As IT departments rationalize on-premise assets, cloud-native vendors gain a structural advantage that is unlikely to reverse over the outlook period.

Proliferation of Low-Code Gamification Platforms

Drag-and-drop development is democratizing the design of engagement experiences. SAP Build allows citizen developers to insert challenges, badges, and rewards into core business processes without writing code, trimming development spend by 70% against bespoke projects. The accessibility expands the total addressable base beyond large enterprises to SMEs that lacked technical resources. Platform vendors report a surge in templates focused on sales contests and onboarding missions, indicating mainstream business adoption. Because low-code stacks connect directly to SaaS ecosystems, they also shorten proof-of-value cycles, a key procurement hurdle for smaller firms. The structural decline in custom development aligns with the segment's 28.67% SME CAGR.

Poorly-Designed Programs Deliver Negative ROI

Superficial point-and-badge deployments risk disengagement and budget waste. Versus Systems' client roster fell from 16 to 5 in 2023 after lackluster implementations failed to sustain user interest, exemplifying backlash against gimmicky rollouts. Enterprises now demand business-outcome metrics, such as sales lift or error-rate reduction, before green-lighting new projects. This scrutiny lengthens sales cycles and forces vendors to provide stronger consultative support. Implementation missteps in early-adopter sectors also create caution among laggards, dampening near-term spend. Vendors that neglect instructional design and behavioral science risk reputational damage that can reverberate across the wider gamification market.

Other drivers and restraints analyzed in the detailed report include:

- Retail Loyalty Wars Escalating Points and Badges Adoption

- Smartphone-Centric Micro-Learning for Frontline Workforces

- Antigaming Clauses in Sector-Specific Compliance (HIPAA, MiFID-II)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud solutions accounted for 67.62% of 2025 revenue, and their share of the gamification market size is projected to climb further, given a 26.91% CAGR to 2031. Real-time telemetry, seamless updates, and elastic storage underpin the preference, while maturing security certifications sway even conservative sectors. On-premise packages remain relevant where data sovereignty is paramount, yet shrinking IT budgets and rising cyber-insurance premiums tilt cost-benefit equations toward managed hosting.

Rapid iteration cycles, achieved through continuous delivery pipelines, let cloud vendors fine-tune achievement algorithms and A/B-test narratives without client-side patches. Enterprises report 37% productivity gains when advanced analytics recommend personalized challenges in real time. Hybrid rollouts serve as a transitional choice, allowing sensitive data to stay on site while engagement logic resides in the cloud. Over the forecast, migration to public-cloud stacks is expected to standardize integration patterns, reducing total cost of ownership and consolidating vendor footprints.

Large enterprises contributed 57.02% to 2025 revenue, reflecting deep budgets and complex integration needs. In contrast, SMEs represent the fastest-growing slice of the gamification market, expanding at 27.65% CAGR. Freemium pricing, template libraries, and pay-as-you-grow architectures lower entry barriers for smaller firms.

SMEs typically target narrow pain points-motivating a sales pod or onboarding seasonal staff-allowing them to demonstrate ROI within weeks. Government digitalization grants in markets such as Singapore further stimulate uptake by offsetting subscription fees. Feature parity is narrowing because cloud platforms offer enterprise-grade identity management at mass-market price tiers. As a result, mid-market buyers increasingly insist on SOC 2 compliance and single-sign-on, forcing vendors to harden security roadmaps while keeping price elasticity.

Gamification Market Report is Segmented by Deployment (On-Premise, and Cloud), Organization Size (Small and Medium Enterprises, and Large Enterprises), Industry Vertical (Retail, BFSI, Government, Healthcare, and More), Application (Marketing and Sales, HR and Training, Product Development and Innovation, Customer Support and Experience, and Others), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 38.74% of 2025 revenue, benefitting from early SaaS adoption and a deep vendor ecosystem. Corporations prioritize integrations with HRIS and CRM suites, leading to rapid feature rollouts that drive wallet share. Federal accessibility litigation risk motivates platforms to invest in WCAG-compliant design, raising quality thresholds for all suppliers.

Asia-Pacific records the highest regional CAGR at 28.6%, powered by mobile-first working patterns and government-sponsored digital-skills programs. Singapore's public-service gamification initiatives validate efficacy and encourage private-sector replication. Thailand's digital-wallet scheme experiments with gamified Central Bank Digital Currency incentives, signaling policy-level endorsement. Companies capitalize by shipping lightweight applications optimized for low-latency 5G networks, accelerating uptake in populous markets such as India and Indonesia.

Europe shows steady demand despite stringent privacy rules. GDPR obligations spur innovation in differential-privacy analytics that anonymize reward data. Vendors with in-house legal teams gain an edge when customizing consent flows for financial institutions subject to MiFID-II. South America and the Middle East and Africa trail in absolute dollars but benefit from growing smartphone penetration, making cloud-hosted, mobile-native solutions the default choice. Localization-both linguistic and cultural-remains a decisive factor in conversion rates across these emerging territories.

- Microsoft Corporation

- SAP SE

- Cognizant Technology Solutions Corp.

- Axonify Inc.

- Aon plc (incl. Aon Assessment)

- Bunchball Inc.

- Salesforce Inc. (incl. Trailhead)

- Cisco Systems Inc.

- LevelEleven LLC

- Badgeville Inc.

- Genesys Cloud Services Inc.

- Callidus Software Inc. (SAP Litmos)

- Ambition Solutions Inc.

- MPS Interactive Systems Ltd.

- IACTIONABLE Inc.

- G-Cube Solutions

- Gamifier Inc.

- BI Worldwide

- Kahoot! ASA

- Classcraft Studios Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in cloud-first digital-workplace roll-outs

- 4.2.2 Proliferation of low-code gamification platforms

- 4.2.3 Retail loyalty wars escalating points and badges adoption

- 4.2.4 Smartphone-centric micro-learning for frontline workforces

- 4.2.5 Privacy-preserving engagement analytics

- 4.2.6 Gamified CBDC pilots by central banks

- 4.3 Market Restraints

- 4.3.1 Poorly-designed programs deliver negative ROI

- 4.3.2 Inter-platform data-ownership disputes

- 4.3.3 Antigaming clauses in sector-specific compliance (HIPAA, MiFID-II)

- 4.3.4 Accessibility lawsuits on non-inclusive game mechanics

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Industry Ecosystem Analysis

- 4.9 Key Use Cases and Case Studies

- 4.10 Assessment of Macroeconomic Trends

- 4.11 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-Premise

- 5.1.2 Cloud

- 5.2 By Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium Enterprises (SMEs)

- 5.3 By Industry Vertical

- 5.3.1 Retail

- 5.3.2 BFSI

- 5.3.3 Government

- 5.3.4 Healthcare

- 5.3.5 Education and Research

- 5.3.6 IT and Telecom

- 5.3.7 Others

- 5.4 By Application

- 5.4.1 Marketing and Sales

- 5.4.2 HR and Training

- 5.4.3 Product Development and Innovation

- 5.4.4 Customer Support and Experience

- 5.4.5 Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Colombia

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Netherlands

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Singapore

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Egypt

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Microsoft Corporation

- 6.4.2 SAP SE

- 6.4.3 Cognizant Technology Solutions Corp.

- 6.4.4 Axonify Inc.

- 6.4.5 Aon plc (incl. Aon Assessment)

- 6.4.6 Bunchball Inc.

- 6.4.7 Salesforce Inc. (incl. Trailhead)

- 6.4.8 Cisco Systems Inc.

- 6.4.9 LevelEleven LLC

- 6.4.10 Badgeville Inc.

- 6.4.11 Genesys Cloud Services Inc.

- 6.4.12 Callidus Software Inc. (SAP Litmos)

- 6.4.13 Ambition Solutions Inc.

- 6.4.14 MPS Interactive Systems Ltd.

- 6.4.15 IACTIONABLE Inc.

- 6.4.16 G-Cube Solutions

- 6.4.17 Gamifier Inc.

- 6.4.18 BI Worldwide

- 6.4.19 Kahoot! ASA

- 6.4.20 Classcraft Studios Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment