PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444779

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444779

Microfluidics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

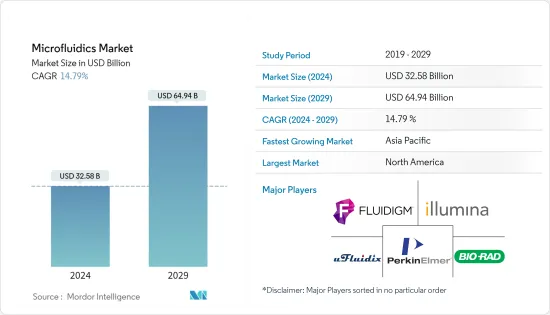

The Microfluidics Market size is estimated at USD 32.58 billion in 2024, and is expected to reach USD 64.94 billion by 2029, growing at a CAGR of 14.79% during the forecast period (2024-2029).

The COVID-19 pandemic had an impact on the healthcare market. During the initial phase of the pandemic, companies were engaged in developing various sensor devices and equipment for wearables and other mobile devices that are used for remote monitoring of chronically ill patients. The high number of COVID-19 cases among the population has increased the demand for point-of-care diagnostics for rapid and effective testing of a large number of samples. This has ultimately increased the development of numerous microfluidic technologies, which has impacted the market's growth. For instance, according to an article published in the Life Journal in May 2022, different techniques are used to detect SARS-CoV-2 antibodies, such as the microfluidic DA-D4 (double-antigen bridging immunoassay technique, which detects total antibodies including all subclasses and isotypes) and sandwich/competitive immune-sensors based methods that help run three samples per device and provide accurate results. As per the same source, the semi-automated microfluidic platform with the classic multilayer soft-lithography technique can detect antibodies against four SARS-CoV-2 antigens while running 50 samples in a single device. New significant opportunities are opening for point-of-care diagnostic test-makers and rapid, miniaturized microfluidic technologies, which are expected to drive the market's growth over the forecast period.

Certain factors propelling the market's growth are the increasing demand for point-of-care testing, rising incidences of chronic diseases, the faster turn-around time for analysis, and improved portability of devices.

The rising burden of infectious diseases and chronic diseases such as cancer, diabetes, cardiovascular diseases, and others increases the demand for point-of-care testing, which is expected to propel the demand for the microfluidics market over the forecast period. For instance, according to the 2022 statistics published by IDF, in Germany, about 6.1 million people were living with diabetes in 2021, which is projected to reach 6.5 million by 2030. Thus, the expected increase in the number of people suffering from diabetes raises the need for novel porous microcapsules encapsulating B cells for diabetes treatment using microfluidic electrospray technology.

A study published in PLOS One in January 2021 stated that about 2.8 million people are expected to have the chronic obstructive pulmonary disease (COPD) by 2025 in France. This is anticipated to increase the demand for testing for COPD using microfluidic chips and small samples of blood, hence boosting the market's growth. According to the 2022 statistics published by Dementia Australia, 487,500 Australians are living with dementia in Australia in 2022, and this number is projected to reach about 1.1 million by 2058. Thus, the increasing burden of dementia among the target population raises the need for effective drug discovery, screening methods, and toxicology studies. This increases the demand for microfluidics systems that can be used to grow neurites, glial cells, endothelial cells, and skeletal muscle cells, along with the maintenance of fluid isolation, and provides an opportunity to investigate organogenesis and disease etiology.

The developments in microfluidics are also leading to the evolution of a cost-effective mass-production process of diagnostic devices and smartphones being paired with microfluidics, thus enabling the deployment of point-of-care testing. This has widened the application of microfluidic devices and is expected to expand.

The rising company focus on developing microfluidics technologies and devices and increasing adoption of various strategic initiatives are expected to drive the market's growth over the forecast period. For instance, in June 2021, Sphere Fluidics, a company commercializing single-cell analysis systems underpinned by its patented picodroplet technology, and ClexBio, a pioneer in solutions for tissue engineering and single-cell techniques, launched the biocompatible CYTRIX Microfluidic Hydrogel Kit. In January 2021, LumiraDx approved a microfluidic immunofluorescence assay to detect SARS-CoV-2 antigens in Japan and Brazil.

However, the integration of microfluidics technology with existing workflows and the low adoption in developing countries due to high prices are expected to hinder the market's growth over the forecast period.

Microfluidics Market Trends

The Point-of-Care Diagnostics Segment is Expected to Register a High CAGR During the Forecast Period

The point-of-care diagnostics segment is expected to witness significant growth in the microfluidics market over the forecast period due to factors such as the rising prevalence of chronic diseases, increasing demand for point-of-care testing devices, and rising technological advancements. For instance, according to GLOBOCAN 2020, there were 19,282,789 new cancer cases worldwide in 2020, with the number expected to rise to 28,887,940 cases by 2040. Thus, an expected increase in cancer cases is anticipated to increase the demand for point-of-care diagnostics, propelling the market's growth.

According to an article published in Frontiers in Bioengineering and Biotechnology in 2021, Revogene, a real-time PCR test, can detect C. difficile, Strep B, and Streptococcus A in about two minutes by using the microfluidic cartridge. This is expected to increase the demand for microfluidics in point-of-care testing, boosting the segment's growth.

Point-of-care diagnostics (POC) is integral to healthcare, especially in disease diagnosis. POC diagnostics offers rapid detection of diseases compared to other conventional methods used near the patients, which leads to better diagnosis, monitoring, and management of disease status and helps healthcare professionals make quick medical decisions regarding the patient. Microfluidics technology is well-suited for point-of-care diagnostics and has the potential to offer rapid and affordable point-of-care diagnostic tools to help during the COVID-19 pandemic, which has increased the segment's growth.

The major advantages associated with the devices are rapid and precise response, cost-effectiveness, and portability. Research is being done in point-of-care diagnostics to develop a chip-based device that can examine multiple analytes in complex samples. Hence, the integration of microfluidics is believed to contribute to the improvisation of point-of-care diagnostics.

Therefore, due to the growth in the range of POC diagnostics, there will be a significant growth in microfluidics, which may enable the development of new devices.

North America is Expected to Dominate the Market Studied During the Forecast Period

North America dominates the microfluidics market and is expected to hold the major share over the forecast period due to factors such as the well-established healthcare system and the higher adoption of novel therapeutics among the general population, increasing prevalence of infectious and chronic diseases among the population in the region.

Microfluidics is a vastly growing field in the region with a high budget for R&D. For instance, according to the Pharmaceutical Research and Manufacturers of America data updates from September 2021, PhRMA member companies have invested more than USD 1.1 trillion in the search for new treatments and cures, including USD 102.3 billion in 2021. These are expected to increase the segment's growth during the forecast period. The point-of-care diagnostics uses microfluidic technology for various applications, like molecular diagnostics, infectious diseases, and chronic diseases, which aim to produce integrated microfluidic devices that are easy to use and rapid.

In August 2020, researchers from the University of Illinois at Urbana-Champaign demonstrated a prototype of a rapid COVID-19 molecular test and a portable instrument for reading the results with a smartphone, which does not require sending samples to a lab.

Increasing product launches by key market players in the region boosts the market's growth. For instance, in January 2021, LexaGene launched the MiQLab system from research-only use to POC use to detect the SARS-CoV-2 virus after receiving emergency use authorization (EUA) in the United States. In October 2021, LumiraDx submitted the LumiraDx SARS-CoV-2 & Flu A/B Test to the Food and Drug Administration (FDA) for Emergency Use Authorization (EUA). The microfluidic immunofluorescence assay can quickly verify infection for patients suspected of flu and COVID-19 to aid in diagnosis and clinical decision-making.

Thus, due to the above-mentioned factors, the microfluidics market in North America is expected to grow at a healthy rate.

Microfluidics Industry Overview

The microfluidics market is fairly competitive, and in terms of market share, few major players currently dominate the market. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by introducing new technologies at affordable prices. Companies like uFluidix, Bio-Rad Laboratories Inc., Fluidigm Corporation, Illumina Inc., and PerkinElmer Inc. hold a substantial share of the market. The key players have been involved in various strategic alliances such as acquisitions, collaborations, and launches of advanced products to secure their positions in the global market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Point-of-care Testing

- 4.2.2 Increasing Incidences of Chronic Diseases

- 4.2.3 Faster Turn-around Time for Analysis and Improved Portability of Devices

- 4.3 Market Restraints

- 4.3.1 Integration of Microfluidics Technology with Existing Workflows

- 4.3.2 Low Adoption in Developing Countries Due to High Prices

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Product Type

- 5.1.1 Microfluidic-based Devices

- 5.1.2 Microfluidic Components

- 5.1.2.1 Microfluidic Chips

- 5.1.2.2 Micro Pumps

- 5.1.2.3 Microneedles

- 5.1.2.4 Other Product Types

- 5.2 By Application

- 5.2.1 Drug Delivery

- 5.2.2 Point-of-care Diagnostics

- 5.2.3 Pharmaceutical and Biotechnology Research

- 5.2.3.1 High-throughput Screening

- 5.2.3.2 Proteomics

- 5.2.3.3 Genomics

- 5.2.3.4 Cell-based Assay

- 5.2.3.5 Capillary Electrophoresis

- 5.2.3.6 Other Pharmaceutical and Biotechnology Research

- 5.2.4 Clinical Diagnostics

- 5.2.5 Other Applications

- 5.3 By Material

- 5.3.1 Polymer

- 5.3.2 Silicone

- 5.3.3 Glass

- 5.3.4 Other Materials

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 France

- 5.4.2.2 United Kingdom

- 5.4.2.3 Germany

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 UFluidix

- 6.1.2 Bio-Rad Laboratories Inc.

- 6.1.3 Emulate Inc.

- 6.1.4 Dolomite Microfluidics (Blacktrace Holdings Ltd)

- 6.1.5 Sphere Fluidics Limited

- 6.1.6 FluIdigm Corporation

- 6.1.7 Illumina Inc.

- 6.1.8 Micronit Microfluidics

- 6.1.9 PerkinElmer Inc.

- 6.1.10 Hesperos Inc.

- 6.1.11 ZEON CORPORATION

- 6.1.12 Bartels-Mikrotechnik

- 6.1.13 Agilent Technologies Inc.

- 6.1.14 Quidel Corporation

- 6.1.15 Fluigent SA

- 6.1.16 Nanomix Inc.

- 6.1.17 Biosurfit SA

7 MARKET OPPORTUNITIES AND FUTURE TRENDS