PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432829

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1432829

Natural Vitamin E - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

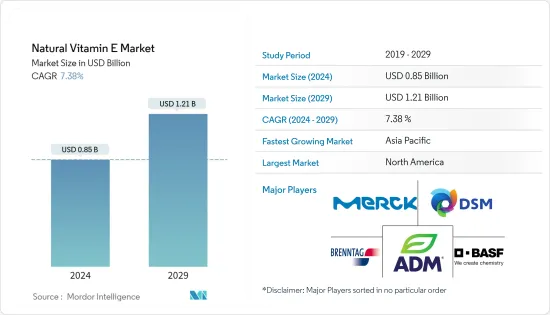

The Natural Vitamin E Market size is estimated at USD 0.85 billion in 2024, and is expected to reach USD 1.21 billion by 2029, growing at a CAGR of 7.38% during the forecast period (2024-2029).

Key Highlights

- Various government initiatives are being taken, in order to increase the consumption of fortified food and beverages, especially in the developing countries, like China and India. For instance: the promotion of fortified foods by China's Ministry of Health, coupled with growing health concerns related to age, myopia in adults, and other diseases, is expected to drive the market studied.

- Consumers are eventually shifting to cosmeceutical, which provides medical alternatives to classical treatments. Consumers are opting for products that do not have chemical ingredients and are infused with naturally sourced essential vitamins including vitamin-E. The introduction of new naturally sourced Vitamin-E ingredients has played a major role in driving the demand for beauty and personal products.

Natural Vitamin E Market Trends

Substantial Growth of Global Health and Wellness Industry

- The health and wellness industry, over the years, has become a dominant lifestyle value among consumers that is profoundly changing consumer behavior towards naturally sourced micronutrients. The growing trend of clean labels and multifunctionality has led to a significant surge in demand for a natural, non-genetically modified organism (GMO) vitamin E across various end-user industries. Industries such as cosmetics, dietary supplements, and functional food and beverage, among others, are experiencing strong growth, wherein natural non-GMO vitamin E has emerged as a prominent ingredient.

- The cosmetic industry is expected to attain a great market share during the forecast period due to the increasing number of skin care products being infused with vitamin E sourced from sunflower oil and other natural sources. Also, beauty from within is one more ongoing trend that is leading to the increasing application of natural vitamin E in cosmeceuticals.

- For instance, in August 2022, skincare brand COSRX, a Korean skin brand, introduced their latest product, the Vitamin E Vitalizing Sunscreen SPF 50+. Further, the company claims that it is hypoallergenic, dermatologist-tested, animal testing-free, parabens-free, sulfates-free, and phthalates-free. Therefore, these product launches increase the demand for natural vitamin E ingredients. Hence manufacturers of natural vitamin E ingredients are pushed to increase their production capabilities as competitors try to launch more such products in the market to gain a competitive edge.

- Additionally, the market for nutraceuticals is gradually changing in favor of fortified foods as a means of achieving maximum nutrient penetration among the general population. Therefore, fortified foods are considered to be practical, affordable, accessible, and safe platforms for the addition of micronutrients like vitamin E. The growing public understanding of the health advantages of micronutrients has contributed to their increased importance. Natural-source supplements have gained popularity, especially among millennials, who are willing to spend more on premium features like clean labeling.

- With a growing preference for individual vitamins and minerals over blends and mixes, the category of vitamins and minerals supplements has dynamically changed through time. Nevertheless, tocotrienols are used for specific conditions like genetic disorders, high cholesterol, scars, and the treatment of some cancers.

- The increase in tocotrienol R&D activity and favorable regulatory conditions is promoting the market expansion for natural vitamin E. Tocotrienols' market is predicted to rise as a result of rising consumer demand for natural sources of vitamin E and its advantages for long-term cardiovascular health, inflammation, and bone health.

North America Emerges As The Largest Market

- The healthcare expenditure pattern in North American countries such as the United States is rising every day, with a growing aged population, advanced technology, better medical facilities, and a rise in the number of insured people. These factors are driving the application of vitamin E across various end-user industries.

- According to a report published by the Food and Agriculture Organization (FAO) of the United Nations, it is stated that the United States is among the largest milk producer globally. As a result, it continues to invest in the production of better-quality animal feed with incorporated nutrients to maintain productivity, thereby driving the demand for natural vitamin E ingredients.

- The region also has a significant growth in functional foods with added health and wellness benefits. The rising geriatric population, increasing healthcare costs, changing lifestyles, and food innovation have increased market growth. Due to the increased focus on quality of life, life expectancy has been consistently increasing.

- The demand for functional foods has expanded across the region as consumers' awareness of their health, attention to healthy lifestyles, and diets have all increased. For instance, according to the National Institutes of Health (NIH) March 2021 factsheet, it is stated that Gamma-tocopherol, which is found in soybean, canola, corn, and other vegetable oils and food products, makes up the majority of vitamin E in American diets.

- Manufacturers in the food and beverage sector are adding nutritious additives to their products, such as fiber, omega-3 fatty acids, vitamins, and minerals. For instance, in June 2022, Vitafusion, a leading American gummy vitamin company, in collaboration with Tiffany Haddish, introduced Vitafusion Multi + Immune Support. This two-in-one gummy vitamin is a daily multivitamin and has immune support vitamins. Another gummy vitamin product that targets hair, skin, and nails was also introduced. The company claims that Vitafusion Multi + Immune Support contains vitamin E as an ingredient. The main goal of using such additives in the production of food and beverages is to boost the nutritional value of the finished products.

- Furthermore, some of the popular functional foods are dairy items like milk, yogurt, cheese, and frozen desserts (like functional ice cream). This enhanced the functional food manufacturers to look for ingredients with enhanced benefits to capture the growing demand. Therefore, all these factors act as the major market drivers for the natural vitamin E market in the region.

Natural Vitamin E Industry Overview

The market for natural vitamin E ingredients is fragmented. However, most of the developed market is dominated by key players' presence. The market is highly competitive, with the presence of various domestic and international players. Moreover, major players with their unique brand positioning and select distribution network have leveled up against each other in determining their presence across global platforms. Major companies such as BASF SE, Archer Daniels Midland Company, etc., are among the active players that have been at the forefront in terms of new product development. The growing demand from various end-use industries supported by extensive R&D focus by the key Vitamin-E ingredient companies across the world to develop innovative products is anticipated to drive the market growth.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Tocopherols

- 5.1.2 Tocotrienols

- 5.2 Application

- 5.2.1 Dietary Supplements

- 5.2.2 Fortified/Functional Food and Beverage

- 5.2.3 Beauty and Personal Care Products

- 5.2.4 Pharmaceuticals

- 5.2.5 Animal Feed

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Spain

- 5.3.2.2 United Kingdom

- 5.3.2.3 Germany

- 5.3.2.4 France

- 5.3.2.5 Italy

- 5.3.2.6 Rest of Europe

- 5.3.3 Asia Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle East & Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle East & Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 BASF SE

- 6.3.2 Archer Daniels Midland Company

- 6.3.3 Koninklijke Dsm N.V

- 6.3.4 Brenntag AG

- 6.3.5 Merck KGaA (Sigma Aldrich)

- 6.3.6 Excel Vite, Inc.

- 6.3.7 Parachem Fine & Specialty Chemicals

- 6.3.8 Kuala Lumpur Kepong Berhad (Davos Life Science)

- 6.3.9 Orah Nutrichem Pvt Ltd

- 6.3.10 One Rock Capital Partners, LLC (Kensing, LLC)

7 MARKET OPPORTUNITIES AND FUTURE TRENDS