PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637836

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1637836

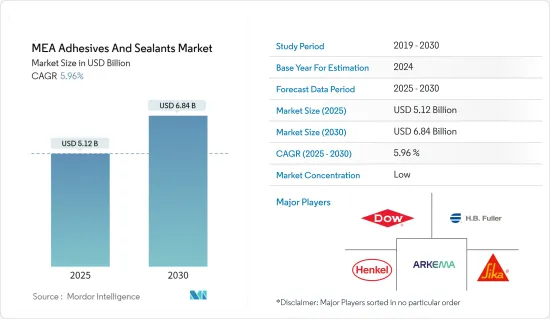

MEA Adhesives And Sealants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The MEA Adhesives And Sealants Market size is estimated at USD 5.12 billion in 2025, and is expected to reach USD 6.84 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

The COVID-19 pandemic disrupted the raw materials supply chain network, negatively affecting the adhesives and sealants market. Post-pandemic, the rising demand for construction, healthcare, and packaging industries is excepted to revive the market for adhesives and sealants.

Key Highlights

- Over the short term, the demand for adhesives and sealants is extensively driven by the growing demand from the construction industry, increasing healthcare infrastructure, and growing usage in the packaging industry.

- However, the market growth is likely to be hindered by the rising environmental concerns regarding the usage of chemicals.

- The innovation and development of bio-based adhesives and shifting focus toward adhesive bonding for composite materials will likely offer opportunities for the adhesives and sealants market in the region.

- Saudi Arabia is the region's largest market for adhesives and sealants, where the end-user industries, such as construction, healthcare, and packaging, majorly drive consumption.

MEA Adhesives and Sealants Market Trends

Packaging End User Industry to Dominate the Market

- The packaging segment is the largest consumer of the adhesives and sealants market. The packaging industry is witnessing strong demand from end-user industries, such as food and beverages, cosmetics, consumer goods, stationery, and others.

- According to the Global Innovation Index (GII), the beauty and personal care industry in Africa and the Middle East in 2022 was worth around USD 35.45 billion.

- Moreover, the demand for cosmetics and food and beverage products is expected to grow due to the growing population and demand for quality products, urbanization, and consumers inclining toward technology. Hence, fueling the demand for the packaging industry.

- According to the International Monetary Fund, overall consumer expenditure on food and non-alcoholic drinks in the United Arab Emirates is expected to rise by USD 9.96 billion (+17.36%) between 2023 and 2028. Food-related spending is expected to reach USD 67.3 billion in 2028.

- According to Agriculture and Agri-Food Canada, the annual per capita expenditure in the United Arab Emirates on food and non-alcoholic beverages was USD 2,337.2 in 2022. It was expected to rise to over USD 2.4 thousand by 2023.

- Additionally, the market value of luxury packaging in the Middle East and Africa is expected to rise to over USD 1.2 billion by 2025. Luxury packaging refers to any packaging for luxury brand items. Recent market developments include sustainable and biodegradable packaging.

- Hence, with such robust growth of the packaging industry across the Middle East and Africa region, the demand in the adhesives and sealants market is also expected to increase during the forecast period.

Saudi Arabia to Dominate the Market

- Saudi Arabia dominates the consumption of adhesives and sealants in the region. Growing construction activities, automotive vehicle production, and increasing consumption in the healthcare and aerospace industries are the key factors driving the consumption of adhesives and sealants in the country.

- The Saudi Arabian government includes various construction projects, like a USD 500 billion futuristic mega-city 'Neom' project, the Red Sea Project - Phase 1, due to be completed in 2022. It also includes 14 luxury and hyper-luxury hotels that may comprise 3,000 rooms across five islands, and two inland resorts, Qiddiya Entertainment City, Amaala - the uber-luxury wellness tourism destination, Jean Nouvel's Sharman resort in Al-Ula, Ministry of Housing's Sakai homes, and Jeddah Tower. Such projects will likely drive the demand for adhesives from various construction sector applications over the forecast period.

- According to the WHO, Saudi Arabia's healthcare spending was USD 60.7 billion in 2022 and is expected to be USD 77.1 billion in 2027.

- Saudi Arabia is investing more than USD 220 million in electric vehicles by operating three potential factories to increase automotive adhesives demand over the coming years. For instance, automotive production is expected to reach 12.8 thousand units by 2028 from 9.8 thousand units in 2021. It is expected to drive the market for adhesives and sealants in the country.

- According to the General Authority for Statistics (Saudi Arabia), in 2022, the revenue of the industry "construction of buildings" in Saudi Arabia was around USD 28.87 billion.

- Hence, all such trends are expected to drive the growth of the adhesives and sealants market in the country over the forecast period.

MEA Adhesives and Sealants Industry Overview

The Middle East and Africa Adhesives and Sealants Market is a fragmented market. Some of the key players in the market (not in any particular order) include Arkema, Henkel AG & Co. KGaA, Sika AG, H.B. Fuller Company, and Dow.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Rising Demand from the Construction Industry in Saudi Arabia

- 4.1.2 Growing Usage in the Packaging Industry

- 4.1.3 Other Drivers

- 4.2 Restraints

- 4.2.1 Growing Environmental Concerns

- 4.2.2 Other Restrains

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Adhesives by Resin

- 5.1.1 Acrylic

- 5.1.2 Cyanoacrylate

- 5.1.3 Epoxy

- 5.1.4 Polyurethane

- 5.1.5 Silicone

- 5.1.6 VAE/EVA

- 5.1.7 Other Resins

- 5.2 Adhesives by Technology

- 5.2.1 Hot Melt

- 5.2.2 Reactive

- 5.2.3 Solvent-borne

- 5.2.4 UV Cured

- 5.2.5 Water-borne

- 5.3 Sealants by Resin

- 5.3.1 Polyurethane

- 5.3.2 Epoxy

- 5.3.3 Acrylic

- 5.3.4 Silicone

- 5.3.5 Other Resins

- 5.4 End-user Industry

- 5.4.1 Aerospace

- 5.4.2 Automotive

- 5.4.3 Building and Construction

- 5.4.4 Footwear and Leather

- 5.4.5 Healthcare

- 5.4.6 Packaging

- 5.4.7 Woodworking and Joinery

- 5.4.8 Other End-user Industries

- 5.5 Geography

- 5.5.1 Saudi Arabia

- 5.5.2 South Africa

- 5.5.3 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Arkema

- 6.4.2 AVERY DENNISON CORPORATION

- 6.4.3 Dow

- 6.4.4 Henkel AG & Co. KGaA

- 6.4.5 H.B. Fuller Company

- 6.4.6 Huntsman International LLC

- 6.4.7 Illinois Tool Works Inc.

- 6.4.8 MAPEI S.p.A

- 6.4.9 Permoseal (Pty) Ltd

- 6.4.10 Sika AG

- 6.4.11 The Industrial Group Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation and Development of Bio-based Adhesives

- 7.2 Shifting Focus Toward Adhesive Bonding for Composite Materials