PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438332

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1438332

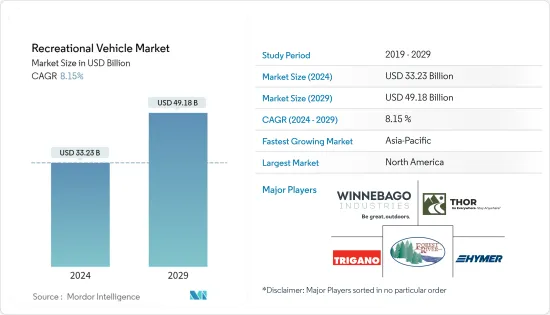

Recreational Vehicle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Recreational Vehicle Market size is estimated at USD 33.23 billion in 2024, and is expected to reach USD 49.18 billion by 2029, growing at a CAGR of 8.15% during the forecast period (2024-2029).

The COVID-19 crisis tremendously affected the tourism industry across the world. This derailed the sales of recreational vehicles in the market for a few months in the first half of the year 2020. However, the market's slow recovery and consumers' preference to stay in caravans than hotels can stimulate the market's growth during the forecast period. The high proliferation of rental services in emerging economies is also expected to drive the market in focus for the short term.

The growing number of active campers is contributing to the demand for RVs. The commercial usage of RVs is on the rise. Growth in peer-to-peer rental services is expected to increase popularity among millennials, which are increasingly seeking rental services. Furthermore, the increasing demand for road trips as a getaway from work-life may boost the market growth. The post-lockdown has witnessed significant growth in the use of recreational vehicles across the globe, especially in North America and Europe.

North America is likely to dominate the market. Moreover, it may expand during the forecast period, propelled by a rapidly growing number of regional recreational parks and camping grounds. More than 13,000 privately-owned and 1,600 public campgrounds within the United States enable individuals to experience camping activities with their recreational vehicles.

Because of the increase in the popularity of recreational activities, the global recreational vehicle market is expected to witness rapid growth, especially in North America and Europe. The Asia-Pacific region is expected to witness significant growth during the forecast period. As these vehicles provide a reliable and personal way to travel, it is considered the safest travel alternative because of the COVID-19 pandemic.

Recreational Vehicle (RV) Market Trends

Motorhomes Segment Expected to Lead the Market

The motorhomes segment of the market is anticipated to register the highest CAGR during the forecast period. The increase in the number of campgrounds in the country illustrates the increasing preference for recreational travel with motorhomes. Additionally, they are widely used in the countries like the United States and Germany, not only for vacation traveling but also for tailgating, traveling with pets, business, and as a preferred mode of transportation for outdoor sports and other leisure activities.

Despite the pandemic, Motorhomes have witnessed a significant rise in the number of new registrations over Caravans over the past five years. For instance, in 2019, in Germany, about 55,000 units of new motorhomes were registered, which increased to more than 78,000 units in 2020. The growing number of motorhomes continued in 2021, too, as over 82,000 units were registered in the country. On the contrary, verses 2020 and 2021 saw a 13% dip in new registrations of caravans.

Among the motorhomes, the Type C motorhomes provide better fuel efficiency than the type A or B motorhomes. They are often referred to as mini-motorhomes, which provide the amenities of a larger motorhome in a scaled-down version and at a lower price. The price of these motorhomes ranges from approximately USD 40,000 and goes up to USD 200,000. Moreover, manufacturers are adding multiple slide-outs to increase the living space and are designing a large variety of floor plans with larger chassis versions.

Type A motorized vehicles are expected to continue to dominate in revenue, contributing approximately 50% of the global recreational vehicle market share in 2021. The growth in online rental websites and applications has further eased the renting process, boosting the demand in the tech-savvy millennial population.

North America also dominated the commercial sales in 2021, which will likely dominate during the forecast period. The United States is the largest commercial RV market in the world, which rental agencies primarily dominate.

North America to Witness Significant Growth

The North American recreational vehicle market is the largest across the globe. RV is highly popular among Americans, and over 11% of households own it. Over 1 million households in the United States live full-time in RVs. It allows traveling at 20-60% less cost, which drives the popularity of RV among millennials. The recreational vehicle market contributes an overall USD 114 billion to the US economy, employing over 600,000 people.

Over the next few years, the United States will drive revenue growth in the North American recreational vehicles market. The Canadian recreational vehicles market may also exhibit significant growth in the years to come. It is expected to hold more than a 10% share of the North American recreational vehicles market until the end of the forecast period.

On the other hand, the United States will likely occupy more than 80% of this regional market until the end of 2024. In terms of CAGR, Canada is more lucrative than the United States in the North American recreational vehicles market. However, the United States is a more attractive market, owing to growing personal disposable income levels and tax relaxation.

For instance, the United States witnessed a surge in the shipments of recreational vehicles in 2021 when compared to 2020. In 2021, more than 600,000 units of shipments of recreational vehicles were observed, which is nearly 30% higher than the figures in 2020.

The proliferation of campgrounds with multiple facilities, including fishing, white water rafting, and hiking, along with natural scenic landscapes, provides robust market opportunities. Luxury RV resorts offer specialized sports facilities, including golf courses, tennis courts, health spas, and gourmet restaurants, which positively influence the market revenue.

Recreational Vehicle (RV) Industry Overview

Key players operating in the global market include Thor Industries, Forest River Inc., Winnebago Industries, Trigano SA, and Hymer GmbH & Co. KG. Other significant players include Airstream, Crossroads RV, Highland Ridge, Skyline Corporation, DRV Luxury Suites, Cruiser RV, Dutchmen RV, Fleetwood Corporation, Grand Design RV, Kropf Industries, GMC Motorhome, Keystone RV, and Pleasure-Way Industries.

The Recreational Vehicle Market is intensely competitive with the presence of several manufacturers selling products that compete directly through product features. Companies operating in the are adopting merger & acquisition strategies coupled with partnerships and collaborations to increase their market share. For instance,

- In January 2022, Ford and Erwin Hymer Group (EHG) announced a framework agreement to deliver customer-ready recreational vehicles and motorhomes based on Ford Transit and Ford Transit Custom.

- In December 2021, Apollo Tourism & Leisure and Tourism Holdings Limited announced the merger of the two entities. The merger will result in Apollo Tourism & Leisure shareholders owning 25% of the combined group. This will expand Apollo's global recreational vehicle networks that include RVs' service, sales, rental, and manufacturing.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Towable RVs

- 5.1.1.1 Travel Trailers

- 5.1.1.2 Fifth Wheel Trailers

- 5.1.1.3 Folding Camp Trailers

- 5.1.1.4 Truck Campers

- 5.1.2 Motorhomes

- 5.1.2.1 Type A

- 5.1.2.2 Type B

- 5.1.2.3 Type C

- 5.1.1 Towable RVs

- 5.2 By Application

- 5.2.1 Domestic

- 5.2.2 Commercial

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 United states

- 5.3.1.2 Canada

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Spain

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 India

- 5.3.3.3 Japan

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia Pacific

- 5.3.4 Rest of the World

- 5.3.4.1 South America

- 5.3.4.2 Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles*

- 6.2.1 Thor Industries Inc.

- 6.2.2 Forest River Inc.

- 6.2.3 Winnebago Industries Inc.

- 6.2.4 REV Group

- 6.2.5 NeXus RV

- 6.2.6 Tiffin Motorhomes Inc.

- 6.2.7 Triple E Recreational Vehicles

- 6.2.8 Dethleffs GmbH & Co. KG

- 6.2.9 Burstner GmbH & Co. KG

- 6.2.10 The Swift Group

- 6.2.11 Rapido Motorhomes

7 MARKET OPPORTUNITIES AND FUTURE TRENDS