PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907301

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907301

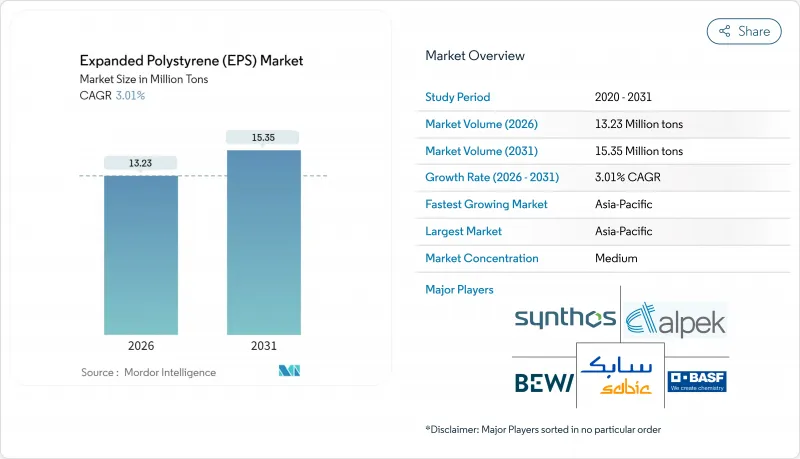

Expanded Polystyrene (EPS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Expanded Polystyrene market size in 2026 is estimated at 13.23 million tons, growing from 2025 value of 12.84 million tons with 2031 projections showing 15.35 million tons, growing at 3.01% CAGR over 2026-2031.

Volume growth reflects the push-pull between rising consumption in construction and packaging and the cost pressures generated by stringent volatile-organic-compound limits on styrene processing. The Expanded Polystyrene market continues to capitalize on its favorable thermal conductivity-to-price ratio, which keeps demand steady even as molded pulp, bio-foams, and paper-based liners scale up. Asia-Pacific remains the single largest outlet, while North America leverages the material for e-commerce last-mile insulation. Corporate strategies increasingly pivot on chemical recycling pathways and feedstock diversification, signaling that circular-economy compliance is an emerging competitive prerequisite across the Expanded Polystyrene market.

Global Expanded Polystyrene (EPS) Market Trends and Insights

Accelerated Push for Net-Zero-Ready Buildings

Rapid decarbonization targets are redrawing insulation specifications worldwide. Energy-performance mandates in Europe require near-zero-energy new builds, pushing architects toward materials that combine low λ-values with proven durability. Gray and silver EPS deliver up to 20% lower thermal conductivity than standard grades, enabling thinner wall assemblies without compromising U-value compliance. Japan's 2024 energy-efficiency revision tightens thermal-envelope criteria, further amplifying demand for graphite-enhanced Expanded Polystyrene market solutions. As building owners prioritize operating-cost reductions, EPS gains traction in continuous insulation and structural insulated panels, reinforcing the Expanded Polystyrene market's profile in the high-performance building segment.

Resurgent Cold-Chain Investments in Emerging APAC

Southeast Asian governments are funneling billions into cold-chain logistics to curb food spoilage and uphold drug-safety standards. EPS boxes and liners dominate because they combine R-value stability with shock absorption at the lowest delivered cost per unit. Semiconductor assembly hubs in Vietnam rely on EPS clamshells to maintain narrow thermal windows, while regional vaccine campaigns depend on validated EPS shippers to protect temperature-sensitive biologics.

Tightening VOC Emission Ceilings on Styrene

The EU lowered occupational styrene limits to 20 ppm in 2024, forcing manufacturers to retrofit abatement systems that can add 3-5% to operating costs. EPA enforcement actions in the United States climbed 40% the same year, raising compliance risk. Smaller converters lacking capital for regenerative thermal oxidizers may exit, narrowing regional supply and nudging prices upward across the Expanded Polystyrene market.

Other drivers and restraints analyzed in the detailed report include:

- E-Commerce Last-Mile Insulated Packaging Boom

- Mandatory Seismic Insulation Codes in Europe and Japan

- EU "Design for Recycling" Mandates Curbing Single-Use EPS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

White EPS accounted for 95.12% of the Expanded Polystyrene market in 2025, yet gray variants are on track to expand faster at 3.89% CAGR through 2031. Builders in Germany and France specify graphite-infused panels to meet U-values without thicker walls, illustrating how performance upgrades redirect demand even when prices are higher. Manufacturers such as BASF added 40% Neopor capacity in 2024 to satisfy this construction pull. Concurrently, reflective silver EPS grades penetrate industrial insulation niches where surface temperatures exceed 80 °C, tapping small but growing specialized opportunities. Commodity packaging still leans heavily on white foam because logistics buyers prioritize low upfront cost. As building codes tighten, however, higher-R-value lines will gradually chip away at white EPS dominance within the Expanded Polystyrene market.

White EPS's cost edge keeps it entrenched in appliance cushioning, molded fish crates, and block-molded architectural shapes. Gray EPS, despite its premium, secures volume through energy-efficient facade systems, ensuring that every new near-zero-energy project allocates tonnage to graphite grades. The expansion of silver EPS stays modest but lucrative, given its fit for petrochemical pipe insulation and high-temperature cold-box linings in LNG terminals. These trends confirm that differentiated performance creates defensible value pockets, even inside a largely commoditized Expanded Polystyrene market.

The Expanded Polystyrene Market Report is Segmented by Product Type (White EPS and Gray and Silver EPS), End-User Industry (Building and Construction, Electrical and Electronics, Packaging, and Other End-User Industries), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa). The Market Forecasts are Provided in Terms of Volume (Tons).

Geography Analysis

Asia-Pacific secured 66.75% of global tonnage in 2025 and is projected to rise at a 3.21% CAGR to 2031. China's urbanization pipeline sustains housing starts, while India's PM Gati Shakti program channels billions into road and warehousing projects, translating into higher insulation demand. Southeast Asia, led by Thailand and Vietnam, bankrolls cold-chain expansion to meet food-safety directives, pulling incremental EPS volumes for pallet-sized fish boxes and vaccine coolers. The region's vertically integrated styrene complexes keep delivering costs low, giving local producers a structural advantage across the Expanded Polystyrene market.

North America is a significant market, driven by e-commerce and modular construction cycles. U.S. state-level energy codes increasingly require continuous-insulation layers, and factory-assembled wall panels frequently embed EPS cores to accelerate job-site completion. Canada's multibillion-dollar cold-storage builds in Quebec and Ontario drive fresh packaging orders, ensuring a dependable baseline for regional EPS demand. Mexico rounds out the North American picture with rising electronics exports, necessitating anti-static EPS packs for printed-circuit-board transit.

Europe confronts stricter waste-reduction rules but still leans on EPS for deep-energy retrofits funded by the EU Green Deal. Italy's seismic-retrofit incentives and Germany's Building Energy Act sustain panel sales, while the United Kingdom's booming meal-delivery services offset volume lost to molded-pulp bans in single-use cutlery. Petrochemical expansions in Saudi Arabia and infrastructure corridors in Brazil suggest these territories could increase their shares as logistics networks mature.

- Alpek SAB de CV

- BASF

- BEWi

- Epsilyte LLC

- Ineos

- Kaneka Corporation

- Ravago

- SABIC

- Shuangliang Group Co., Ltd. (Jiangsu Leasty Chemical Co.,Ltd.)

- SIBUR International GmbH

- Sunde Group

- Sunpor

- Synthos

- TotalEnergies

- Versalis S.p.A.

- Wuxi Xingda foam plastic new material Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated push for net-zero ready buildings

- 4.2.2 Resurgent cold-chain investments in emerging APAC

- 4.2.3 E-commerce last-mile insulated packaging boom

- 4.2.4 Mandatory seismic insulation codes in Europe and Japan

- 4.2.5 Modular prefab construction uptake

- 4.3 Market Restraints

- 4.3.1 Tightening VOC emission ceilings on styrene

- 4.3.2 Rapid scale-up of molded pulp thermal liners

- 4.3.3 EU "Design for Recycling" mandates curbing single-use EPS

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Import-Export Trends

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Product Type

- 5.1.1 White EPS

- 5.1.2 Gray and Silver EPS

- 5.2 By End-user Industry

- 5.2.1 Building and Construction

- 5.2.2 Electrical and Electronics

- 5.2.3 Packaging

- 5.2.4 Other End-user Industries (Agriculture and Automotive)

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 ASEAN

- 5.3.1.6 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Nordic Countries

- 5.3.3.6 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Alpek SAB de CV

- 6.4.2 BASF

- 6.4.3 BEWi

- 6.4.4 Epsilyte LLC

- 6.4.5 Ineos

- 6.4.6 Kaneka Corporation

- 6.4.7 Ravago

- 6.4.8 SABIC

- 6.4.9 Shuangliang Group Co., Ltd. (Jiangsu Leasty Chemical Co.,Ltd.)

- 6.4.10 SIBUR International GmbH

- 6.4.11 Sunde Group

- 6.4.12 Sunpor

- 6.4.13 Synthos

- 6.4.14 TotalEnergies

- 6.4.15 Versalis S.p.A.

- 6.4.16 Wuxi Xingda foam plastic new material Limited

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Bio-based and Chemically Recycled EPS Roadmap