Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686667

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1686667

Asia-Pacific Polyethylene Terephthalate (PET) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

PUBLISHED:

PAGES: 176 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

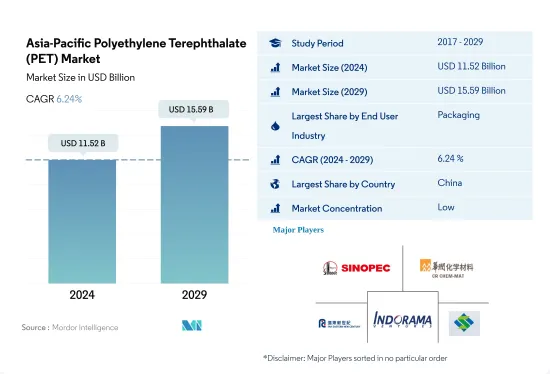

The Asia-Pacific Polyethylene Terephthalate (PET) Market size is estimated at 11.52 billion USD in 2024, and is expected to reach 15.59 billion USD by 2029, growing at a CAGR of 6.24% during the forecast period (2024-2029).

The dominance of the packaging sector over PET is gradually shrinking

- PET has many applications in the packaging and electrical and electronics industries, including packaging foods and beverages, particularly convenience-sized soft drinks, water, coil forms, and electrical devices. Packaging and electrical and electronics industries accounted for 93.92% and 3.80%, respectively, of the revenue of the Asia-Pacific PET market in 2022.

- The packaging industry is the region's largest end-user industry for PET resin. Key factors influencing the region's plastic packaging industry include rising population, rising income levels, and changing lifestyles. The growth prospects of end-user segments such as FMCG, food and beverages, and pharmaceuticals are driving increased demand for the plastic packaging industry. Plastic packaging production in the region is expected to reach 90.7 million tons in 2029 from 70.9 million tons in 2023, registering a CAGR of 4.18%. As a result, the rising demand for packaging in the region is expected to drive the PET resin demand in the future.

- Electrical and electronics is expected to be the fastest-growing industry in the region, by value, registering a CAGR of 7.75% during the forecast period, 2023-2029. The rapid pace of electronic technological innovation drives consistent demand for newer and faster electrical and electronic products. The surge in demand for technologically advanced consumer electronics and appliances, such as smartphones, laptops, and televisions, is expected to boost consumer electronics demand during the forecast period. The consumer electronics in the region is projected to reach USD 565.5 billion in 2027 from USD 518.0 billion in 2023. As a result, the increase in electrical and electronics production in the region is projected to drive the demand for PET resin in the future.

China to dominate Asia-Pacific PET consumption owing to demand from various industries

- Asia-Pacific accounted for 42.47% of the global consumption of polyethylene terephthalate resin in 2022. Polyethylene terephthalate is an important polymer in Asia-Pacific for various industries, including packaging.

- China is the largest consumer of this resin in the region owing to its growing packaging, automotive, and electronics industries. Packaging held a share of around 94.8% in 2022 and is driving the demand for polyethylene terephthalate resins in the country. The rising production in the packaging, automotive, and electrical and electronics industries is expected to drive the demand for polyethylene terephthalate resin in the country during the forecast period.

- India is the region's second-largest plastic packaging producer, and its demand for polyethylene terephthalate resins is increasing significantly due to growing packaging production. In 2022, the country produced 4,158,800 tons, a 3.97% increase over 2021. The country's vehicle production is also expanding, and it may amount to 33,300,764 units in 2023. These factors are expected to drive the demand for polyethylene terephthalate resins in the country.

- India is among the fastest-growing countries in terms of the use of polyethylene terephthalate resin. It is expected to register a CAGR of 6.49% by revenue during the forecast period (2023-2029), in line with the growing demand for resin in the country. For the promotion of the plastic industry in the country, the government has taken various industry-friendly policy initiatives, such as deregulating the petrochemical industry and allowing 100% FDI under the automatic route to facilitate fresh investments.

Asia-Pacific Polyethylene Terephthalate (PET) Market Trends

Rapid growth in ASEAN countries to foster electronics production

- The Asia-Pacific region saw an increase in electrical and electronics production revenue by 13.9% from 2020 to 2021. The electronics sector accounts for 20-50% of the total value of most Asian countries' exports. Consumer electronics such as televisions, radios, computers, and cellular phones are largely manufactured in the ASEAN region.

- ASEAN leads the production of hard drives, with over 80% of hard drives being manufactured in the region. Overall, the electrical and electronics (E&E) industry in ASEAN relies more on foreign inputs and technology than other industries, with 53% of E&E exports arising from foreign value added (FVA) or foreign inputs integrated into ASEAN's E&E exports.

- Countries like Thailand and Malaysia lead in the production of electronics in the region. Thailand, home to one of the largest electronics assembly bases in Southeast Asia, leads in the production of hard drives, integrated circuits, and semiconductors. It ranks second in manufacturing air conditioning units and fourth in the global refrigerators market.

- The electronics industry has greatly benefitted from ASEAN's integrated production networks, which foster improved trade with larger Asian economies like China and Japan.

- China held an 11.2% share of global exports in electrical products and registered a growth of 5.8% in the export of digital products from 2019 to 2020. According to the Asian Development Bank, China provides a large market for electronics in the region. Countries such as Thailand, Japan, China, Malaysia, India, and the Philippines continue to lead the region in the production of electronics.

Asia-Pacific Polyethylene Terephthalate (PET) Industry Overview

The Asia-Pacific Polyethylene Terephthalate (PET) Market is fragmented, with the top five companies occupying 33.09%. The major players in this market are China Petroleum & Chemical Corporation, China Resources (Holdings) Co.,Ltd., Far Eastern New Century Corporation, Indorama Ventures Public Company Limited and Sanfame Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 53965

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.2.1 Polyethylene Terephthalate (PET) Trade

- 4.3 Price Trends

- 4.4 Form Trends

- 4.5 Recycling Overview

- 4.5.1 Polyethylene Terephthalate (PET) Recycling Trends

- 4.6 Regulatory Framework

- 4.6.1 Australia

- 4.6.2 China

- 4.6.3 India

- 4.6.4 Japan

- 4.6.5 Malaysia

- 4.6.6 South Korea

- 4.7 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Automotive

- 5.1.2 Building and Construction

- 5.1.3 Electrical and Electronics

- 5.1.4 Industrial and Machinery

- 5.1.5 Packaging

- 5.1.6 Other End-user Industries

- 5.2 Country

- 5.2.1 Australia

- 5.2.2 China

- 5.2.3 India

- 5.2.4 Japan

- 5.2.5 Malaysia

- 5.2.6 South Korea

- 5.2.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 China Petroleum & Chemical Corporation

- 6.4.2 China Resources (Holdings) Co.,Ltd.

- 6.4.3 Far Eastern New Century Corporation

- 6.4.4 Indorama Ventures Public Company Limited

- 6.4.5 JBF Industries Ltd

- 6.4.6 Lotte Chemical

- 6.4.7 Reliance Industries Limited

- 6.4.8 Sanfame Group

- 6.4.9 Zhejiang Hengyi Group Co., Ltd.

- 6.4.10 Zhejiang Zhink Group Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.