PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687167

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687167

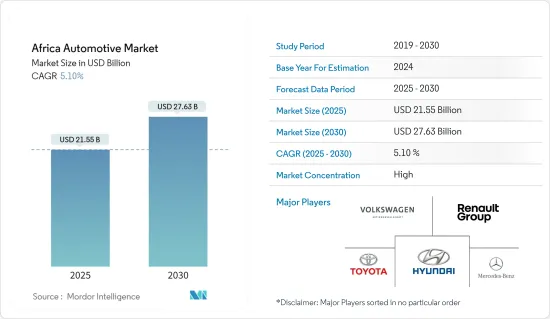

Africa Automotive - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Africa Automotive Market size is estimated at USD 21.55 billion in 2025, and is expected to reach USD 27.63 billion by 2030, at a CAGR of 5.1% during the forecast period (2025-2030).

Over the medium term, the African automotive market is expected to grow rapidly due to supportive government incentives and increasing urbanization in the major countries in the region, which are encouraging infrastructural developments, thus creating a positive outlook for the market. Several larger countries, such as South Africa, Nigeria, and Kenya, also focus on developing domestic automotive production plans. For instance,

South Africa's policy for electrification of transport under South Africa's Just Energy Transition (JET) plan will likely produce its first electric vehicle (EV) in 2026. The JET plan estimates that the transport sector would need an investment of ZAR 128.1 billion (USD 6.84 billion) from 2023 to 2027 to contribute to South Africa's decarbonization commitments.

The South African electric mobility market offers new opportunities for foreign companies and investors to enter and expand operations.

For example, in June 2023, Germany's BM opened a new tab and will build its X3 model in South Africa from 2024, investing ZAR 4.2 billion (USD 25.09 million) to electrify its plant in Rosslyn.

Moreover, Africa's vital raw materials for modern vehicles require new technologies to reach net zero. They include copper, cobalt, bauxite, and lithium. Considering the overall economic and industrial factors, the market is expected to grow in the coming years.

Africa Automotive Market Trends

Passenger Car holds Highest Share in the Market

Passenger cars have gained immense popularity among drivers over the past few years due to features such as stylish design, compact size, and economic value. Passenger cars are the most common mode of transportation in numerous advanced countries. The improving lifestyles, increasing power purchase parity, disposable income, raising brand awareness, and improving the economy are leading to changes in customer preference across the globe, resulting in high sales of passenger cars.

According to the National Association of Automobile Manufacturers of South Africa, automotive giants such as Toyota and Volkswagen have experienced exponential growth in the sale of passenger cars.

The growing presence of international automobile manufacturers and brands in the region and the consumer's ability to purchase new cars and maintain those, coupled with the ever-increasing consumer interest in buying more than one passenger car to suit their daily needs and travel purposes, may improve the demand for vehicles across the region.

Several significant OEMs from different parts of the world are launching the latest passenger car models in the region to enhance their sales and gain market share. For instance,

In June 2023, BYD, the global frontrunner in new energy vehicle production, introduced its latest all-electric model, the BYD ATTO 3, during a brand launch event in Johannesburg, South Africa. It unveiled the model's pricing, with the standard range starting at ZAR 768,000 and the extended range at ZAR 835,000, marking its initial step into the South African passenger vehicle market.

With the growing focus on improved fuel economy and reduced exhaust emissions, the demand for and sales of electric vehicles, especially electric cars, is expected to grow rapidly during the forecast period.

In November 2023, Mercedes-Benz South Africa (MBSA) planned to implement 127 electric vehicle (EV) charging stations nationwide, investing ZAR 40 million in this initiative. Teaming up with Chargify, a Level 2 empowered company, MBSA aims to deploy AC and fast-charging DC stations along major routes, interconnecting metropolitan areas, airports, shopping centers, dining hubs, private hospitals, strategic expansion zones, residential estates, and smaller towns across South Africa.

Considering the growing passenger car sales, it will create a positive impact on the African automotive sector.

South Africa Holds the Highest Market Share

The South African automotive industry is vital to South Africa's economy. With its advancement in infrastructure and developed manufacturing capacity, South Africa is the ideal location for any company aspiring to reach the continental market more effectively.

The South African Automotive Masterplan (SAAM) for 2021-2035 aims to increase the country's global vehicle production by 1% annually by 2035. In addition, it seeks to achieve a localization rate of 60% by the same year, which will significantly enhance South Africa's position in the global vehicle production ranking.

Many major original equipment manufacturers (OEMs) invest in South Africa due to the positive business environment and potential for growth in the market share. Some OEMs are also launching attractive models to expand their customer base. Additionally, several other OEMs actively seek to export their latest models to the South African market. For instance,

In December 2023, Hyundai SA promised to introduce the updated i20 and Tucson in 2024 and the all-new Santa Fe SUV in the year's second half.

Several automotive component suppliers have built strong business links between their South African operations and other international stakeholders. These established business links enhance the potential for mutually beneficial trade between companies and the government. For example,

In March 2023, Stellantis signed an MoU with the Industrial Development Corporation (IDC) and the Department of Trade, Industry, and Competition (DTIC) to develop a manufacturing facility in South Africa.

Also, there has been a rapid growth in demand for automotive aftermarket specialty equipment and accessories in South Africa, as accessorizing and improving the performance of vehicles has transformed into a fully-fledged culture of fierce competition.

Considering such developments, the market is expected to gain significant momentum during the forecast period.

Africa Automotive Industry Overview

The African automotive market is consolidated and led by globally and regionally established players. The companies adopt new product launches, collaborations, and mergers to sustain their market positions. For instance

In April 2023, Autochek, the African-based automotive technology company, announced its latest acquisition of a majority stake in AutoTager. This Egyptian automotive technology company simplifies the car buying and selling process. This allows Autochek to deepen its presence in North Africa and support the ongoing growth of AutoTager.

In January 2024, Pan-African online used car platform AUTO24.africa acquired Tanzania's leading digital classifieds property, Kupatana.com. The purchase from parent company Euroafrica Digital Ventures represents a milestone for AUTO24.africa as it solidifies the dominance of Sub-Saharan Africa's thriving pre-owned automotive market.

Some of the major players in the market include Volkswagen AG, Toyota Motor Corporation, Groupe Renault (including Dacia Sales), Daimler AG, Ford Motor Company, Hyundai Motor Company, and Isuzu Motors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Increasing in The Passenger Car Sales Across the Region

- 4.2 Market Restraints

- 4.2.1 Transportation Infrastructure Development

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value)

- 5.1 Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Commercial Vehicles

- 5.2 Country

- 5.2.1 South Africa

- 5.2.2 Morocco

- 5.2.3 Algeria

- 5.2.4 Egypt

- 5.2.5 Nigeria

- 5.2.6 Ghana

- 5.2.7 Kenya

- 5.2.8 Rest of Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Toyota Motor Corporation

- 6.2.2 Volkswagen AG

- 6.2.3 Groupe Renault

- 6.2.4 Hyundai Motor Company

- 6.2.5 Ford Motor Company

- 6.2.6 Innoson Vehicle Manufacturing Company

- 6.2.7 Daimler AG

- 6.2.8 Volvo Group

- 6.2.9 Isuzu Motors Ltd

- 6.2.10 Tata Motors Limited

- 6.2.11 Ashok Leyland

7 MARKET OPPORTUNITIES AND FUTURE TRENDS