PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1641937

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1641937

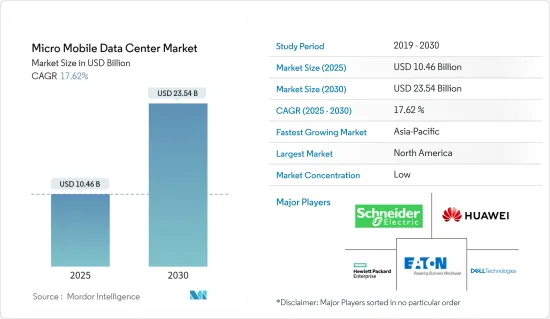

Micro Mobile Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Micro Mobile Data Center Market size is estimated at USD 10.46 billion in 2025, and is expected to reach USD 23.54 billion by 2030, at a CAGR of 17.62% during the forecast period (2025-2030).

Micro mobile data centers are box-like containers filled with the same storage, compute power, and networking needed in a regular data center but delivered in a compact unit. Moreover, with technological advancements, they come with integral cloud connectivity, completing a turnkey package for the edge.

Key Highlights

- The size, versatility, and plug-and-play features of micro mobile data centers make them ideal for use in remote locations for temporary deployments. They are also well suited for temporary use by businesses in locations that are in high-risk zones for floods or earthquakes. In other words, a micro data center minimizes the traditional model's physical footprint and energy consumed.

- Factors such as increasing global digitalization, internet penetration, the relevance of smart technologies, IoT-powered devices, big data, and the development of 5G networks are likely to drive the micro-mobile data center market trends. According to Ericsson, 5G subscriptions are forecast to increase drastically worldwide from 2019 to 2028, from over 12 million to over 4.5 billion, respectively.

- Furthermore, there is a rising need for containerized data centers as corporate offices migrate their infrastructure regularly. Furthermore, corporations spend more on micro-mobile data center growth as workloads increase. Such factors create significant chances for market expansion in the next years.

- Furthermore, businesses are increasing their cloud presence, necessitating the deployment of portable data centers and rising demand for micro mobile data centers for SMEs organizations due to low cost and lower latency. As a result, there would be more prospects for market growth in the future. However, integration with traditional data centers hampers the growth of the market.

- The COVID-19 outbreak positively impacted market growth, and micro-mobile data center technologies are assisting organizations in meeting the high capacity need for data storage. There is a rising requirement to guarantee that micro-mobile data center operators have the ability and capacity to offer high-performance micro-mobile data centers during periods of elevated data storage demand. After the pandemic, the market is growing rapidly with the increased digitization technologies and permanent work from home jobs. Increased demand for software as a service (SaaS) has driven traffic to data centers like never. Hence, players are investing in these solutions.

Micro Mobile Data Center Market Trends

Healthcare End User Vertical is Expected to Hold a Significant Market Share

- Adopting a micro mobile data center helps the healthcare industry bring flexibility, effectiveness, security, and a low-cost model to the healthcare sector. The global healthcare industry's growth is estimated further to drive the demand for micro mobile data centers.

- The growth of electronic health records (EHRs) further increases healthcare providers' demand for micro mobile data centers. Rather than replacing file rooms with server rooms, many opt to have documents hosted by the EHR vendor at a secure facility.

- The growth of Big Data is another motivational factor for transferring data to the cloud. Pulling different datasets together in the cloud allows operational, clinical, and financial data to be aggregated in Big Data analytics processes. These factors contribute to the growing adoption of micro mobile data centers in the healthcare industry.

- The penetration of IoT devices, especially smartphones, boosts the demand for micro mobile data centers in the healthcare industry. According to Ericsson, the number of short-range internet of things (IoT) devices reached 16.6 billion worldwide in the current year. That number is forecast to increase to 22.4 billion by the next three years. The wide-area IoT devices amounted to 3.2 billion in the current year and are predicted to reach 5.2 billion by the next three years. Patients want access to their health organization on their terms. These devices for Healthcare enable enriched data to flow securely through every point of care to help continuously improve the patient experience and health outcomes.

- With IoT and cloud technologies integration into Healthcare, concepts like blockchain are also gaining traction, increasing the demand for data storage and micro mobile data centers.

- Blockchain technology is being used to protect sensitive records and store and authenticate the data related to a user's identity as data generated through blockchain is extremely confidential in healthcare services, like micro mobile data centers have a great healthcare industry scope. Hence, the adoption of micro mobile data centers in the healthcare industry is expected to grow significantly over the forecast period.

Asia-Pacific is Expected to be the Fastest Growing Market

- Asia-Pacific is one of the world's fastest-growing areas for data centers. The adoption of automation and BI tools among SMEs is also high in the region. Hence, the region offers significant potential for the growth of the market studied.

- Much of this growth can be attributed to government agencies' widespread adoption of data centers during the last decade, especially in countries like China and Australia. Major government investments in data center advances, targeted at stimulating the region's digital economy, are boosting the adoption of cloud services, Big Data, and IoT.

- While the demand for cloud computing and other data services continues to increase in China, advancements in data center technology are expected to play a vital role in the integration of these technologies with modern manufacturing and China's gradual transition to a service economy.

- Increasing internet penetration in China would also help increase the demand for micro mobile data centers. Demand for faster, more stable broadband connections is growing in China as companies look to enhance their presence and provide enhanced quality and cybersecurity.

- The Australian investment outlook for data centers remains positive as colocation and cloud providers launch major construction projects and an armada of smaller enterprise facilities to prepare for a role in the accelerating digital future.

- In addition, factors, including high penetration rates in healthcare, retail, e-commerce, and BFSI verticals, are expected to drive the market's growth further. Moreover, the data generated through multiple sources is high due to the high adoption of BYOD and IoT devices in the workplace. The exponential growth of data proliferation in the region is forcing enterprises to invest in micro data centers.

- In the backdrop of current trends, hybrid cloud is emerging as a popular way forward for cloud adoption in Asia-Pacific, as it offers a choice of infrastructure depending on application requirements for compliance and security.

Micro Mobile Data Center Industry Overview

The micro mobile data center market is highly fragmented, with the presence of major players like Schneider Electric SE, Dell EMC Inc., Huawei Technologies Co. Ltd, Hewlett Packard Enterprise, Development LP, and Eaton Corporation PLC. Players in the market are adopting strategies such as partnerships, mergers, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- November 2022 - For hybrid IT infrastructure management, Schneider Electric launched the EcoStruxure Micro Data Center R-Series 42U Medium Density. The new Micro Data Center solution is designed for IT applications in distant locations with industrial conditions, and it delivers fully integrated for easy setup. It also has a hefty weight capacity and huge industrial casters for convenient mobility.

- April 2022 - IBM Corporation announced a collaboration with Airtel, an Indian multinational telecommunications company, to provide edge cloud services in India. Together companies would supply edge cloud services to enterprises through 120 data centers spread across 20 major Indian cities. The collaboration improves the user experience and company performance by reducing latency while fulfilling sovereignty needs and data security, which is crucial as workloads travel to the edge.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Penetration of IOT Devices Enterprises

- 5.1.2 Increasing Speed and Volume of Digital Data Generation

- 5.2 Market Restraints

- 5.2.1 Cryptojacking Threats

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Up to 25 RU

- 6.1.2 25-40 RU

- 6.1.3 Above 40 RU

- 6.2 By Enterprise Type

- 6.2.1 Small and Medium Enterprise (SME)

- 6.2.2 Large Enterprise

- 6.3 By End-user Vertical

- 6.3.1 Retail and E-commerce

- 6.3.2 Education

- 6.3.3 BFSI

- 6.3.4 IT and Telecommunication

- 6.3.5 Healthcare

- 6.3.6 Government and Defense

- 6.3.7 Energy and Utilities

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Schneider Electric SE

- 7.1.2 Dell EMC Inc.

- 7.1.3 Huawei Technologies Co. Ltd

- 7.1.4 Hewlett Packard Enterprise Development LP

- 7.1.5 Eaton Corporation PLC

- 7.1.6 Panduit Corp.

- 7.1.7 Zellabox Pty Ltd

- 7.1.8 Hitachi Ltd

- 7.1.9 IBM Corporation

- 7.1.10 Vertiv Co.

- 7.1.11 Instant Data Centers LLC

- 7.1.12 Dataracks

- 7.1.13 Rittal GmbH & Co. Kg

- 7.1.14 Canovate Group

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET