Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642031

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1642031

Global Wind Power - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 200 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

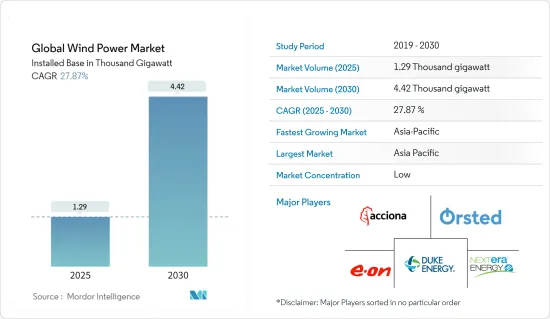

The Global Wind Power Market size in terms of installed base is expected to grow from 1.29 thousand gigawatt in 2025 to 4.42 thousand gigawatt by 2030, at a CAGR of 27.87% during the forecast period (2025-2030).

Key Highlights

- In the medium term, factors such as favorable government policies, the increasing investment in upcoming wind power projects, and the reduced cost of wind energy have led to increased adoption of wind energy and are expected to drive the market between 2024 and 2029.

- The increasing adoption of alternative energy sources, such as gas-based and solar power, is expected to hinder the growth of the market.

- Nevertheless, technological advancements in efficiency and decreased production costs of offshore wind turbines are expected to create ample opportunity for the global market.

- Asia-Pacific is the fastest-growing market due to the rising energy demand. This growth is attributed to increasing investments, coupled with supportive government policies in the countries of this region, including India, China, and Australia.

Global Wind Power Market Trends

The Offshore Wind Power Sector is Expected to Witness Significant Growth

- Europe is the leading continent in offshore wind and is home to the most significant operational wind farms globally. The region's offshore wind capacity is large enough to meet Europe's electricity needs, which will only continue to grow in the upcoming years.

- Installing wind farms in offshore areas is becoming a lucrative market because offshore winds are much faster than onshore winds. Also, offshore wind farms are more convenient than onshore wind farms, given that offshore areas have more wind speed and less land obstruction.

- Offshore wind energy has increased significantly over the last five years worldwide. According to the International Renewable Energy Agency (IRENA), in 2023, offshore wind energy was 72.66 GW, an increase of 1.57 times compared to 2019. The number is expected to rise significantly during the forecast period as many wind projects are expected to be operational in the upcoming years.

- In March 2024, the government of the United Kingdom announced the most significant budget of GBP 1 billion (USD 1.25 billion) for renewable energy projects, which includes GBP 800 million (USD 1 billion) for offshore wind and GBP 105 million (USD 131 million) for floating offshore wind and geothermal technologies.

- Similarly, in September 2023, the United Kingdom's Government announced the distribution of Contract for Difference (CFDs) to 95 new renewable energy initiatives, ensuring 3.7 GW of clean energy capacity. These projects include onshore wind, solar, and tidal energy developments. Furthermore, Octopus Energy, based in the United Kingdom, plans to invest USD 20 billion globally in offshore wind by 2030. The company, which is a subsidiary of Octopus Energy Group, stated that the investment will generate 12 gigatonnes (GW) of renewable electricity per year, enough to power 10 million homes.

- Furthermore, in April 2024, the United States Department of Energy's Wind Energy Technologies Office (WETO) announced an investment of USD 48 million in offshore wind, including enhancing the research and development of offshore wind platforms. These types of projects are expected to accelerate wind energy generation across the world between 2024 and 2029.

- Hence, with such a scenario, the offshore wind power market is expected to grow significantly from 2024 to 2029.

Asia-Pacific is Expected to Dominate the Market

- Asia-Pacific is the world's most significant wind power market, with top markets including China, India, and Australia. Encouraging growth, particularly in China, is likely to propel it to the top spot between 2024 and 2029.

- According to the International Renewable Energy Agency (IRENA), in 2023, wind energy across Asia was 508.45 GW, an increase of 97.32% compared to 2019. China generated 441.89 GW of wind energy in 2023 and became the leader, followed by India, which generated 44.74 GW. The number is expected to rise significantly between 2024 and 2029 as many wind projects are expected to be operational in the upcoming years.

- The government across the region offers multiple renewable energy projects to the leading organizations to boost energy production. For instance, in December 2023, Apraava Energy received the 1200 MW auction capacity project of the Inter-State Transmission System (ISTS) conducted by the Energy Corporation of India (SECI) to construct a 300 MW Wind farm in Karnataka, India. The project's construction is as per the Power Purchase Agreement (PPA), which is for 25 years at a competitive tariff of INR 3.24/kWh.

- Furthermore, the demand for renewable energy has been rising exponentially across the region for the past few years, and companies are investing significantly across Asia-Pacific. For instance, in May 2023, octopus Energy, a United Kingdom-based company, announced an investment of USD 1.8 billion for renewable energy projects, including wind energy projects across Asia-Pacific. The company is likely to invest in wind, solar, and other clean energy projects by 2027. The investment also focused on Japan's wind energy target to increase offshore wind energy capacity by 150 GW by 2030. All these types of targets and investments are likely to drive the market between 2024 and 2029.

- Therefore, large-scale wind power installations, upcoming projects, and plans to expand the offshore wind segment are expected to drive the Asia-Pacific market between 2024 and 2029.

Global Wind Power Industry Overview

The wind power market is fragmented. Some of the key players in this market are Acciona Energia SA, Duke Energy Corporation, Electricite de France (EDF) SA, Orsted AS, NextEra Energy Inc., and E.ON SE.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 66176

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Renewable Energy Mix, 2023

- 4.3 Wind Power Installed Capacity and Forecast in GW, till 2029

- 4.4 Recent Trends and Developments

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Investments in Offshore Wind Power Projects

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 Increasing Adopting of Alternative Clean Energy Sources (Ex: Solar, Hydro)

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography (Regional Market Analysis {Market Size and Demand Forecast till 2029 (for regions only)})

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 United Kingdom

- 5.2.2.2 France

- 5.2.2.3 Norway

- 5.2.2.4 Germany

- 5.2.2.5 Spain

- 5.2.2.6 Turkey

- 5.2.2.7 Russia

- 5.2.2.8 NORDIC

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Japan

- 5.2.3.4 Malaysia

- 5.2.3.5 Thailand

- 5.2.3.6 Indonesia

- 5.2.3.7 Vietnam

- 5.2.3.8 Rest of Asia-Pacific

- 5.2.4 Middle East and Africa

- 5.2.4.1 United Arab Emirates

- 5.2.4.2 Egypt

- 5.2.4.3 Saudi Arabia

- 5.2.4.4 Nigeria

- 5.2.4.5 Qatar

- 5.2.4.6 Rest of Middle East and Africa

- 5.2.5 South America

- 5.2.5.1 Brazil

- 5.2.5.2 Chile

- 5.2.5.3 Argentina

- 5.2.5.4 Colombia

- 5.2.5.5 Rest of South America

- 5.2.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis - Wind Turbine Suppliers

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 Wind Farm Operators

- 6.4.1.1 Acciona Energia SA

- 6.4.1.2 Duke Energy Corporation

- 6.4.1.3 EDF SA

- 6.4.1.4 Orsted AS

- 6.4.1.5 NextEra Energy Inc.

- 6.4.1.6 E.ON SE

- 6.4.2 Equipment Suppliers

- 6.4.2.1 Aerodyn Energiesysteme GmbH

- 6.4.2.2 Envision Energy

- 6.4.2.3 General Electric Company

- 6.4.2.4 Xinjiang Goldwind Science & Technology Co. Ltd (Goldwind)

- 6.4.2.5 Siemens Gamesa Renewable Energy SA

- 6.4.2.6 Suzlon Energy Limited

- 6.4.2.7 Vestas Wind Systems AS

- 6.4.2.8 Dongfang Electric Corporation

- 6.4.1 Wind Farm Operators

- 6.5 Market Share/Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Technological Advancements in Efficiency and Decrease in the Production Cost of Offshore Wind Turbines

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.