PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437948

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1437948

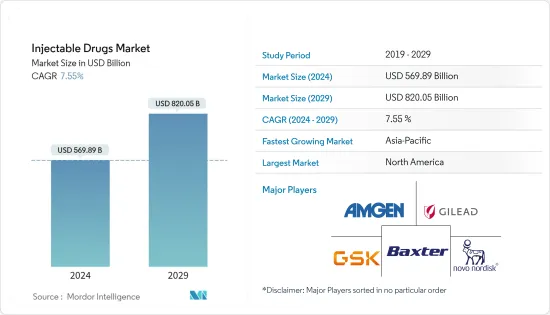

Injectable Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Injectable Drugs Market size is estimated at USD 569.89 billion in 2024, and is expected to reach USD 820.05 billion by 2029, growing at a CAGR of 7.55% during the forecast period (2024-2029).

COVID-19 impacted the growth of the market studied. During the pandemic, companies were developing drugs and seeking collaborations and approvals to develop a vaccine for COVID-19. These vaccines were majorly given in the injectable form, driving the market growth. For instance, in May 2020, AstraZeneca received more than USD 1 billion in funding from the US Health Department's Biomedical Advanced Research and Development Authority (BARDA) for the development, production, and delivery of the University of Oxford's COVID-19 vaccine. Moreover, with the released COVID-19 restrictions and resumed company activities, the market is expected to grow over the forecast period.

The factors such as rising R&D focus on developing biotechnology-engineered anti-cancer drugs, rapid growth in the usage of pre-filled syringes for biologics, and increased outsourcing activities across the value chains expected to raise the supply of injectable drugs are boosting the market growth.

The rising prevalence of chronic diseases such as cancer, diabetes, cardiovascular diseases, and others is the key factor driving the market growth. For instance, from an article published in BioMed Central Journal in May 2022, it has been observed that 26.7 million people in India were suffering from cancer and this number is projected to increase to 29.8 million by 2025. Also, according to 2022 statistics published by the IDF, about 3.9 million people were living with diabetes in France, and this number is projected to reach 4.1 million by 2030 and 4.2 million by 2045. Thus, the high burden of chronic diseases among the population is anticipated to increase the demand for effective and safe injectable drugs hence propelling the market growth.

Additionally, a report published by the UK Health Security Agency in December 2021, stated that in 2020, an estimated 97,740 people were living with HIV in England and an estimated 4,660 in 2020 were unaware of their infection, indicating the demand for injectable HIV drugs and formulations, which are anticipated to augment the market growth over the forecast period. Also, from an article published in the International Journal for Equity in Health in August 2021, it was observed that 75.8% of the elderly population aged 60 years and above were troubled by one or more chronic diseases such as heart disease, cancer, chronic lung diseases, and others.

Furthermore, the rising focus of companies on developing injectable drugs for new therapeutic classes is expected to increase their adoption by physicians and patients and their availability in the market, which in turn is anticipated to fuel market growth. For instance, in September 2022, the USFDA accepted the Biologics License Application (BLA) and granted Priority Review designation to Chiesi Global Rare Diseases, velmanase alfa, an enzyme replacement therapy, for the treatment of alpha-mannosidosis. Also, in December 2021, the USFDA approved Apretude (Cabotegravir extended-release injectable suspension) for adolescents weighing at least 35 kg for pre-exposure prophylaxis to reduce the risk of sexually acquired HIV.

Moreover, the rising development of bio-engineered anti-cancer drugs is also increasing the market growth. For instance, in April 2022, the China National Medical Products Administration (NMPA) approved BeiGene's tislelizumab to treat patients with locally advanced or metastatic oesophageal squamous cell carcinoma (ESCC), a type of oesophageal cancer. Also, in December 2021, the Center for Drug Evaluation (CDE) of China's National Medical Products Administration (NMPA) approved I-Mab's IND submission for the initiation of a phase 2 trial in China for enoblituzumab (also known as TJ271) in combination with pembrolizumab (Keytruda) in patients with solid tumors, including non-small cell lung cancer (NSCLC), urothelial carcinoma (UC), and other selected cancers.

However, the high expenses associated with inventory management and the availability of alternate drug delivery methanes are likely to hinder the market growth over the forecast period.

Injectable Drugs Market Trends

Oncology Is Expected to Have Significant Market Share During the Forecast Period

The oncology segment is expected to witness significant growth in the injectable drugs market over the forecast period, owing to factors such as the rising prevalence of cancer among the population and the development of advanced cancer drugs using bio-engineered methods. For instance, according to Globocan 2020, China reported 4,568,754 new cancer cases in 2020, and 9,294,006 cancer cases were prevalent for five years. Further, the same report projected that cancer cases will reach 5,811,629 by 2030 and 6,845,787 by 2040. Similarly, as per the same source, Japan reported 1,028,658 new cancer cases in 2020, and the total number of five-year prevalent cancer cases was 2,710,728. The same report projected the number of cancer cases to reach 1,110,549 by 2030 and 1,128,057 by 2040. Thus, the expected rise in the number of cancer cases among the population is projected to propel the demand for injectable cancer drugs, which, in turn, is anticipated to fuel market growth.

Furthermore, the rise in company activities and increasing product launches are also contributing to this segment's growth. For instance, in November 2022, the Food and Drug Administration approved tremelimumab in combination with durvalumab and platinum-based chemotherapy for adult patients with metastatic non-small cell lung cancer (NSCLC). Also, in May 2022, Gland Pharma launched Bortezomib injection, which is used to treat certain types of cancer, such as multiple myeloma and mantle cell lymphoma, in the United States.

Thus, the increasing burden of cancer and the launch of novel products are expected to drive the market's growth over the forecast period.

North America Holds the Largest Market Share of the Injectable Drugs Market

North America is expected to dominate the injectable drugs market over the forecast period owing to the high prevalence of chronic diseases such as cancer, diabetes, and cardiovascular diseases, robust healthcare infrastructure, and major players in the region.

In addition, the increasing number of novel product launches, huge investments in R&D, and the increased adoption of injectable drugs in hospitals to treat different types of cancer are also contributing to the market growth in the region.

According to the American Cancer Society's 2022 report, over 1.9 million new cancer cases are expected to be recorded in the United States in 2022. Also, per the same source, cancer risk rises dramatically as one ages. In the United States, 80% of cancer patients are 55 years or older, with 57% being 65 years or older. Thus, the growing geriatric population is expected to impact the market studied significantly. Further, according to the International Diabetes Federation's report of December 2021, about 32.2 million people were living with diabetes in the United States. This number is estimated to increase to 36.3 million by 2045. This increase in the diabetes patient pool is expected to drive demand for injectable drugs, which will boost growth in the market.

With the growing demand for effective therapeutics for chronic diseases, company activities such as product launches, mergers and acquisitions, partnerships, and strategic collaborations are expected to augment growth in the market studied in the country. For instance, in May 2022, Roche launched PHESGO, a combination of Perjeta (pertuzumab) and Herceptin (trastuzumab) with hyaluronidase to treat breast cancer. Also, in February 2022, the United States Food and Drug Administration (FDA) approved Takeda's TAKHZYRO (lanadelumab-flyo) injection single-dose prefilled syringe (PFS) to prevent attacks of hereditary angioedema (HAE) in adult and pediatric patients 12 years of age and older.

Therefore, due to the factors mentioned above, the injectable drugs market is expected to grow in the region over the forecast period.

Injectable Drugs Industry Overview

The injectables drugs market is moderately competitive. The key market players include GlaxoSmithKline PLC, Baxter International Inc., and Amgen Inc. Some of the major players in the market have consolidated partnerships for certain products that allow for ease of manufacturing and distribution. The expansion of different companies to increase their production capacities also helps boost the overall market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising R&D Focus on the Development of Biotechnology-engineered Anti-cancer Drugs

- 4.2.2 Rapid Growth in the Usage of Pre-filled Syringes for Biologics

- 4.2.3 Increased Outsourcing Activities Across Value Chain Expected to Boost Supply of Injectable Products

- 4.3 Market Restraints

- 4.3.1 High Expenses Associated with Inventory Management

- 4.3.2 Availability of Alternate Drug Delivery Methods

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION (Market Size by Value - USD million)

- 5.1 By Molecule Type

- 5.1.1 Small Molecule

- 5.1.2 Large Molecule

- 5.2 By Drug Class

- 5.2.1 Blood Factors

- 5.2.2 Cytokines

- 5.2.3 Peptide Hormone

- 5.2.4 Immunoglobulin

- 5.2.5 Monoclonal Antibodies (mAbs)

- 5.2.6 Insulin

- 5.2.7 Other Drug Classes

- 5.3 By Application

- 5.3.1 Oncology

- 5.3.2 Neurology

- 5.3.3 Cardiovascular Diseases

- 5.3.4 Autoimmune Diseases

- 5.3.5 Infectious Diseases

- 5.3.6 Pain

- 5.3.7 Other Applications

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Italy

- 5.4.2.5 Spain

- 5.4.2.6 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Rest of Asia-Pacific

- 5.4.4 Middle East and Africa

- 5.4.4.1 GCC

- 5.4.4.2 South Africa

- 5.4.4.3 Rest of Middle East and Africa

- 5.4.5 South America

- 5.4.5.1 Brazil

- 5.4.5.2 Argentina

- 5.4.5.3 Rest of South America

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Novo Nordisk AS

- 6.1.2 Amgen Inc.

- 6.1.3 Baxter International Inc.

- 6.1.4 Gilead Sciences Inc.

- 6.1.5 GlaxoSmithKline PLC

- 6.1.6 Johnson & Johnson

- 6.1.7 Merck & Co. Inc.

- 6.1.8 Novartis AG

- 6.1.9 Pfizer Inc.

- 6.1.10 Sanofi SA

- 6.1.11 AbbVie

- 6.1.12 F. Hoffmann-La Roche Ltd

7 MARKET OPPORTUNITIES AND FUTURE TRENDS