PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910511

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910511

Personal Care Wipes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

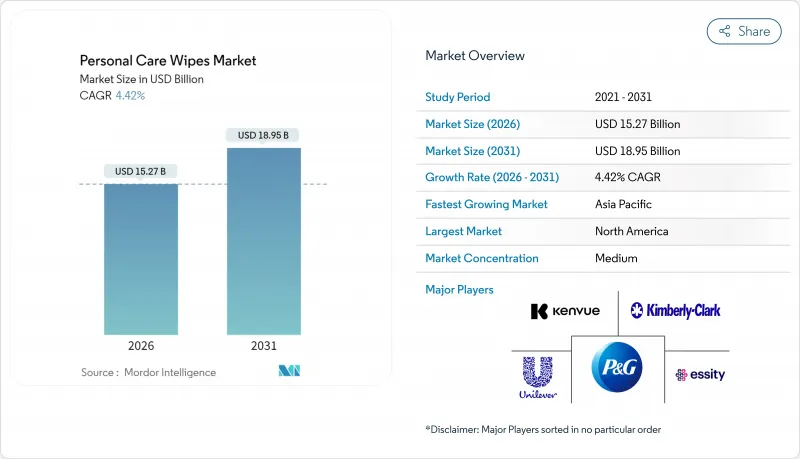

The personal care wipes market was valued at USD 14.62 billion in 2025 and estimated to grow from USD 15.27 billion in 2026 to reach USD 18.95 billion by 2031, at a CAGR of 4.42% during the forecast period (2026-2031).

The market's growth is primarily driven by the persistent consumer preference for convenient, single-use hygiene products, a behavior reinforced by post-pandemic hygiene practices. At the same time, increasing regulatory pressure on reducing plastic usage and chemical preservatives is encouraging manufacturers to adopt biodegradable materials and develop milder formulations. To address rising production costs, companies are leveraging material-saving technologies and water-efficient processes, which also align with sustainability goals. Additionally, the introduction of premium natural product lines is creating opportunities for margin expansion, particularly in developed markets. While the urban middle class in the Asia-Pacific region contributes the largest incremental volume to the market, North America continues to lead in product innovation and omnichannel retail strategies, setting a benchmark for the global industry.

Global Personal Care Wipes Market Trends and Insights

Heightened health and hygiene awareness

The post-pandemic era has seen a significant rise in hygiene awareness, with 88% of consumers now using disinfectant wipes, compared to 64% before the pandemic, and 73% incorporating them into their daily routines. This behavioral shift highlights the growing prioritization of hygiene in everyday life. The World Health Organization underscores the critical role of hygiene products in both outbreak response and routine sanitation, which has fueled sustained demand across key sectors such as healthcare, foodservice, and personal care. The Centers for Disease Control and Prevention further emphasizes the vast market potential for accessible hygiene solutions, noting that 2 billion people globally still lack basic hygiene services. This unmet need presents a significant growth opportunity for the hygiene products market. In healthcare, the adoption of EPA-registered disinfectant wipes has increased, driven by the need for effective infection prevention. To ensure consistent performance, new standardized efficacy testing methods for these wipes were introduced in November 2024, reinforcing their reliability and effectiveness in critical applications.

Rising demand for natural, organic, and clean hygiene products

Consumer preference for natural and organic formulations continues to grow, driven by increasing awareness of ingredient safety and environmental sustainability. This trend is particularly evident in the baby care market, where concerns about skin sensitivity significantly influence purchasing decisions. For example, Millie Moon's Sensitive Wipes, formulated with 99% natural ingredients and plant-based materials, received the PARENTS 2025 Best for Baby Awards, highlighting the market's recognition of clean and safe formulations. Similarly, Huggies introduced Natural 0% Plastic Baby Wipes, made entirely from 100% naturally derived plant-based fibers, which have been approved by the British Skin Foundation for their suitability for sensitive skin. WaterWipes has also capitalized on this trend with its products containing 99.9% water and minimal ingredients, attracting substantial investment. The 3i Group committed approximately EUR 145 million to support WaterWipes' expansion across Europe, Latin America, and Asia, reflecting confidence in the growing demand for such products. Beyond baby care, this shift towards natural formulations is gaining traction in the adult personal care and household cleaning markets, as consumers increasingly prioritize safer and more sustainable product options.

Environmental concerns and waste management issues

Municipalities are increasingly struggling with rising waste management costs and infrastructure strain caused by the improper disposal of single-use wipes, fueling growing environmental opposition to these products. In response, the UK has implemented a ban on plastic-containing wipes, a significant regulatory step that mirrors broader European efforts to prioritize environmental sustainability over consumer convenience. This regulatory push is pressuring manufacturers to expedite the development of sustainable alternatives to meet compliance requirements. However, consumer behavior remains a critical challenge. Despite widespread awareness of the severe sewer blockages caused by flushing wipes-an issue that costs the industry hundreds of millions annually-Water UK's 'Bin the Wipe' campaign highlights the ongoing need for effective consumer education to mitigate these impacts.

Other drivers and restraints analyzed in the detailed report include:

- Growing popularity for sustainable and biodegradable wipes

- Product innovation in terms of functionality and fragrance

- Regulatory and safety compliance challenges

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, baby wipes command a leading 51.92% market share, buoyed by steady global birth rates, a trend towards premium products in developed nations, and a rising middle class in emerging markets embracing Western hygiene norms. Huggies, leveraging over 25 years of research in infant skin health, has set industry benchmarks for safety and efficacy. Their commitment to hypoallergenic formulations and plant-based materials has not only built consumer trust but also set a standard that rivals strive to meet. The segment enjoys predictable revenue streams, bolstered by brand loyalty and repeat purchases. Furthermore, clear regulations on cosmetic classifications offer a stable compliance landscape, encouraging long-term investments in product development.

Cosmetic wipes are the fastest-growing segment, projected to expand at a 4.66% CAGR through 2031. This growth is fueled by trends favoring simplified beauty routines, the convenience of travel, and the influence of social media, which has popularized multi-step skincare regimens. Positioned as premium products, cosmetic wipes command higher margins compared to their commodity counterparts. This premium status has drawn investments into advanced fiber technologies and the incorporation of active ingredients, boosting both makeup removal efficiency and skin benefits. Innovations like micellar water technology and gentle surfactants allow for effective cleansing without the need for harsh rubbing. This appeals particularly to consumers with sensitive skin, who value both convenience and skin health in their beauty routines.

The Personal Care Wipes Market Report is Segmented by Product Type (Baby Wipes, Cosmetic Wipes, and More); by Ingredient (Conventional and Natural/Organic); by Distribution Channel (Supermarkets/Hypermarkets, and More); and by Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2025, North America holds a commanding 37.10% share of the market, bolstered by its established hygiene practices, a penchant for premium products, and a robust retail infrastructure. This infrastructure not only supports the launch of new products but also aids in brand-building efforts across varied demographic segments. Furthermore, the region enjoys the benefits of regulatory clarity, courtesy of the FDA and EPA frameworks. These frameworks delineate predictable compliance requirements, empowering manufacturers to channel investments confidently into innovation and strategies for market expansion. Additionally, consumers' readiness to pay a premium for natural and sustainable products not only boosts profit margins but also fuels research into advanced formulations. These formulations are designed to adapt to evolving safety and environmental standards without compromising on performance expectations.

Asia-Pacific is set to outpace all others, charting a robust 5.55% CAGR through 2031. This growth is driven by swift urbanization, increasing disposable incomes, and a cultural shift towards Western hygiene practices. These factors unveil vast, untapped market opportunities across a spectrum of economic and demographic landscapes. The presence of regional manufacturing companies bolsters supply chain development, ensuring cost competitiveness. This presence also allows for tailored solutions that cater to local preferences and adhere to regulatory mandates. While China's burgeoning middle class and India's youthful demographic fuel volume growth, Japan and South Korea are at the forefront of the premium segment. Their consumers, with a penchant for specialized formulations and cutting-edge packaging, are willing to pay a premium, thereby enhancing margins and bolstering brand differentiation strategies.

Europe stands at the crossroads of a mature market and stringent environmental regulations. These regulations are hastening the shift towards sustainable products and plastic-free alternatives in the personal care sector. A case in point is the UK's widely supported ban on plastic-containing products, underscoring Europe's commitment to environmental stewardship. This commitment not only sets the tone for global manufacturing standards but also positions Europe as a leader in the arena. Companies like Codi Group are capitalizing on this European expertise. With a keen focus on sustainability, they're crafting tailored solutions spanning baby care, personal hygiene, home care, and even medical applications, all while adhering to rigorous environmental benchmarks. Moreover, the EU's unified regulatory landscape streamlines product development and market entry, simultaneously fostering investments in sustainable technologies that align with both environmental mandates and consumer expectations.

- The Procter & Gamble Company

- Kimberly-Clark Corporation

- Kenvue Inc.

- Essity Hygiene and Health AB

- Unilever PLC

- Ecolab Inc.

- Edgewell Personal Care Company

- Unicharm Corporation

- Hengan International Group Company Limited

- Robanda International Inc.

- Albaad Massuot Yitzhak Ltd.

- WaterWipes Unlimited Company

- The Honest Company, Inc.

- 3M Company

- GAMA Healthcare Ltd

- Ontex Group NV

- Pigeon Corporation

- Reckitt Benckiser Group plc

- Bodyography Inc.

- A. M. HYGIENE

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Heightened health and hygiene awareness

- 4.2.2 Rising demand for natural, organic, and clean hygiene products

- 4.2.3 Growing popularity for sustainable and biodegradable wipes

- 4.2.4 Product innovation in terms of functionality and fragrance

- 4.2.5 Urbanization driving demand for quick solutions.

- 4.2.6 Growth in e-commerce accessibility

- 4.3 Market Restraints

- 4.3.1 Environmental concerns and waste management issues

- 4.3.2 Regulatory and safety compliance challenges

- 4.3.3 Stricter regulations on ingredients and disposal hinder market growth.

- 4.3.4 Fluctuating prices of non-woven fabrics and chemicals affect margins

- 4.4 Consumer Behaviour Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Baby Wipes

- 5.1.2 Cosmetic Wipes

- 5.1.3 Moist Toilet Wipes

- 5.1.4 General Purpose Wipes

- 5.1.5 Intimate Wipes

- 5.2 By Ingredient

- 5.2.1 Conventional

- 5.2.2 Natural/Organic

- 5.3 By Distribution Channel

- 5.3.1 Supermarkets/Hypermarkets

- 5.3.2 Convenience/Grocery Stores

- 5.3.3 Online Retail Stores

- 5.3.4 Other Distribtution Channels

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 France

- 5.4.2.3 United Kingdom

- 5.4.2.4 Spain

- 5.4.2.5 Netherlands

- 5.4.2.6 Italy

- 5.4.2.7 Sweden

- 5.4.2.8 Norway

- 5.4.2.9 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Australia

- 5.4.3.5 South Korea

- 5.4.3.6 Vietnam

- 5.4.3.7 Indonesia

- 5.4.3.8 Rest of Asia-Pacific

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Chile

- 5.4.4.4 Rest of South America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Info, Market Rank/Share, Products & Services, Recent Developments)

- 6.4.1 The Procter & Gamble Company

- 6.4.2 Kimberly-Clark Corporation

- 6.4.3 Kenvue Inc.

- 6.4.4 Essity Hygiene and Health AB

- 6.4.5 Unilever PLC

- 6.4.6 Ecolab Inc.

- 6.4.7 Edgewell Personal Care Company

- 6.4.8 Unicharm Corporation

- 6.4.9 Hengan International Group Company Limited

- 6.4.10 Robanda International Inc.

- 6.4.11 Albaad Massuot Yitzhak Ltd.

- 6.4.12 WaterWipes Unlimited Company

- 6.4.13 The Honest Company, Inc.

- 6.4.14 3M Company

- 6.4.15 GAMA Healthcare Ltd

- 6.4.16 Ontex Group NV

- 6.4.17 Pigeon Corporation

- 6.4.18 Reckitt Benckiser Group plc

- 6.4.19 Bodyography Inc.

- 6.4.20 A. M. HYGIENE

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK