PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850374

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850374

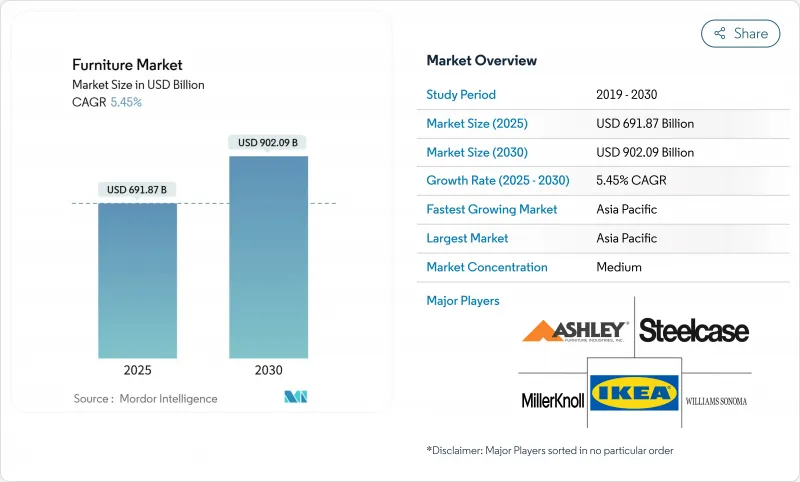

Furniture - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The furniture market stands at USD 691.87 billion in 2025 and is forecast to reach USD 902.09 billion by 2030, posting a 5.45% CAGR during the period.

Urban migration, sustainability mandates, and rapid digital adoption are together redirecting category investment toward recycled materials, connected products, and omnichannel sales formats. Rising middle-class incomes across emerging cities are expanding the addressable furniture market far beyond traditional metropolitan hubs, while premiumization gains momentum as consumers attach tangible value to certified sustainable finishes and smart-home compatibility. Production is steadily shifting toward Southeast Asian export clusters where labor availability, raw-material proximity, and trade linkages lower landed costs, supporting competitive pricing and flexible supply. Conversely, widened regulatory scrutiny on end-of-life stewardship in Europe is prompting global brands to standardize circular design frameworks and invest ahead of compliance deadlines. At the competitive level, fragmented regional players coexist with multinational incumbents that leverage scale, integrated e-commerce platforms, and data-driven product planning to safeguard margin and accelerate product velocity.

Global Furniture Market Trends and Insights

Home Remodel Spending by Millennials is Powering Multi-Functional Furniture Demand

Millennial households continue to channel rising disposable income into compact dwellings that require space-savvy solutions. Robust online confidence among younger buyers accelerates the channel shift toward direct-to-consumer specialists that compress price ladders and speed delivery. The PwC 2024 Voice of Consumer Survey, which was conducted between July and September 2024, gathered insights from over 9,800 consumers across 27 countries, targeting major furniture markets in North America, Europe, and Asia Pacific. The survey unveiled that 67% of millennials are open to buying high-value furniture items online without a prior physical inspection. In contrast, only 38% of baby boomers share this sentiment, underscoring a swift shift towards digital-first brands. With millennials making up about 22% of global furniture spending in 2024 and projected to increase their share by 3-4% annually, they are on track to dominate nearly 35% of the market by 2030.

Rapid Urbanization Is Driving Space-Saving Modular Furniture Sales

As global urbanization accelerates, there's a rising demand for space-efficient furniture, especially in emerging markets witnessing the swiftest population growth. In the Asia-Pacific region, urban populations are swelling at an annual rate of 1.5-2%, outpacing the 0.5-0.8% growth seen in developed markets. This disparity fuels a heightened demand for solutions that optimize space. Rigid cabinetry yields to share to wall-mounted desks, fold-out beds, and transforming seating systems that adapt to daytime and nighttime roles. Rising housing costs have left many households cost-burdened, reinforcing demand for durable yet versatile items that postpone replacement cycles.

EU Extended Producer Responsibility (EPR) Rules Raising Compliance Costs For Exporters

New obligations in January 2025 compel every furniture supplier entering the European Economic Area to finance the collection, recycling, and verified disposal of products at end-of-life. Firms lacking reverse-logistics networks now face fees, administrative reporting, and potential penalties that erode export margin. Larger incumbents with circular design roadmaps gain an edge, while smaller producers in developing countries confront higher barriers to market entry or must collaborate through collective take-back schemes. The short-term rise in compliance expenditure may constrain near-term import volumes, yet beneficiaries include service providers specializing in material recovery and traceability platforms. Over time, alignment with EPR principles should spur global convergence around recyclable substrates, thereby stabilizing supply chains and reinforcing environmental narratives that many consumers already demand.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of Digital-First D2C Furniture Brands Boosting Online Penetration

- Smart-Home Proliferation is Propelling Demand for Iot-Enabled Adjustable Furniture

- High Cross-Border Logistics Costs & Damage Rates Curbing Bulky E-Commerce Furniture Margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The home furniture segment generated 68% of overall sales in 2024. Demand stayed buoyant because households prioritize comfort, aesthetics, and sustainability upgrades inside owned or rented residences. Within this arena, bathroom collections outpaced every other sub-category with a 6.9% CAGR trajectory. Growth stems from rising investment in wellness rituals, wider adoption of moisture-resistant recycled polymers, and smart mirrors that track air quality and skincare routines. Retailers curate coordinated vanity, storage, and fixture packages that raise average order value while simplifying renovation decision chains. In parallel, office furniture volumes rebounded as enterprises retrofitted collaborative zones that support hybrid occupancy, whereas hospitality refurbishments accelerated to capture travel rebounds and social media engagement. Multifunctionality remains the cross-cutting narrative, prompting designers to embed charging ports, integrated lighting, and concealed storage in everyday pieces that stretch square-foot utility in dense urban apartments.

Bathroom furniture's innovation arc now extends to antimicrobial coatings, touch-free flushing mechanisms, and grey-water recycling modules that reinforce resource stewardship. Suppliers that offer customization in color, finish, and hardware capitalize on consumers' desire for boutique hotel aesthetics at home. The rising penetration of compact modular bathrooms in prefabricated housing projects across Asia-Pacific ensures a sizeable downstream customer base for value-engineered ranges. As aging populations pursue safety upgrades, demand grows for grab-integrated cabinets and seated shower benches that blend form with function. Collectively, bathroom's elevated share of future category spend highlights how wellness and sustainability priorities govern purchasing behavior inside the furniture market.

Wood held a dominant 55% share of the furniture market in 2024, underpinned by its renewable image and enduring aesthetic warmth. Yet, Plastic & Polymer alternatives record the fastest ascent, projected at 7.2% CAGR through 2030, due to breakthroughs in recycled content and bio-based composites. Manufacturers combine post-consumer resin with natural fibers to produce light yet strong panels suitable for indoor and outdoor use, cutting virgin material dependency and easing finish consistency challenges. Aluminum is likewise gaining currency in commercial specifications due to corrosion resistance and a favorable strength-to-weight ratio, with secondary smelters supplying low-carbon billets from scrap streams. Hybrid frames that integrate timber frames with polymer joints optimize dimensional stability, curtail waste, and facilitate end-of-life separation.

Sustained R&D investment targets eco-friendly adhesives, VOC-free coatings, and digital finishing that mimics wood grain on recycled plastic fronts. AkzoNobel's new recycled-plastic lacquer system elevates surface durability, enabling polymers to migrate from hidden structural elements into visible premium applications. Designers rely on generative software to engineer lattice structures that preserve stiffness with less material, further shrinking carbon footprints. Regulatory momentum around deforestation and EPR heightens interest in traceable supply chains, pushing suppliers to provide chain-of-custody certification and QR-code-based material passports. The combined push of regulation and consumer preference cements polymers as a credible challenger to timber dominance, though responsibly sourced wood will remain integral to many aesthetic styles within the furniture market.

The Furniture Market Report is Segmented by Application (Home Furniture, Office Furniture, Hospitality Furniture, Educational Furniture, and More), Material (Wood, Metal, Plastic & Polymer, and More), Price Range (Economy, Mid-Range, Premium), Distribution Channel (B2C/Retail, and B2B/Project), and Geography (North America, South America, Europe, Asia-Pacific, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific leads global sales with 42% of 2024 revenue, anchored by expanding urban populations, higher home-ownership aspirations, and robust export manufacturing. The region benefits from integrated supply clusters where component producers, hardware makers, and finishing plants coexist, cutting cycle times and inventory costs. Within Asia-Pacific, Southeast Asia is forecast to clock a 7.8% CAGR to 2030, fueled by Vietnam's double-digit factory output growth, Indonesia's youthful demographics, and supportive trade pacts that grant duty-free access to key consumer markets. Government incentives in Vietnam and Malaysia subsidize automation and energy-efficiency upgrades, lifting productivity and environmental performance.

North America records high ticket sizes per household, driven by lifestyle upgrades, hybrid work re-planning, and a mature credit environment that supports financing options. Stringent purchasing criteria around traceability and indoor air quality elevate demand for certified low-VOC products, prompting suppliers to secure GREENGUARD and FSC labels. Systemic investment in 3PL networks and rapid-deployment fulfillment centers improves delivery reliability for bulky items, sustaining online conversion rates. Canada's rising immigration intake further stokes housing formation, translating into stable incremental demand for essential furniture categories.

Europe stands at the forefront of regulatory transformation with bloc-wide EPR mandates that favor producers able to document material composition, reparability, and recyclability. Nordic consumers exhibit some of the world's highest per-capita spending on refurbished items, underscoring an appetite for circular solutions. Central and Eastern European manufacturing hubs attract near-shoring investment from Western European brands seeking to cut lead times and lower transport emissions. Further south, Spain and Italy witness elevated renovation activity backed by government energy-retrofit subsidies that often include interior upgrades.

The Middle East and Africa together remain modest in absolute value yet register among the fastest relative growth rates as urban infrastructure expands and tourism investment spurs hospitality fit-outs. Gulf Cooperation Council megaprojects commission premium outdoor and wellness furnishings suited to high-temperature climates, creating export opportunities for weather-resistant polymer and aluminum lines. Sub-Saharan African demand is driven predominantly by affordable wooden furniture sourced from regional timber bases, though import volumes of ready-to-assemble ranges are rising with e-commerce penetration.

South America's prospects improve alongside macro stabilization in Brazil and Colombia, where mortgage availability and residential construction pipelines stimulate bedroom and kitchen segment orders. Trade corridors within Mercosur encourage intra-regional sourcing of particleboard, hardware, and upholstery fabrics, fostering cost-effective assembly. Across every continent, the furniture market demonstrates sensitivity to exchange rates, freight costs, and policy shifts, yet underlying urbanization and lifestyle trends define a durable upward trajectory.

- IKEA

- Ashley Furniture Industries Inc.

- Steelcase Inc.

- MillerKnoll, Inc.

- HNI Corporation

- Williams-Sonoma Inc.

- La-Z-Boy Incorporated

- Hooker Furniture Corp.

- Kimball International Inc.

- Haworth Inc.

- Wayfair LLC

- Godrej Interio

- Durian Industries Ltd.

- Foshan Huasheng Furniture

- KOKUYO Co. Ltd.

- Shanghai UE Furniture

- Leggett & Platt Inc.

- Okamura Corporation

- Nitori Holdings Co. Ltd.

- KUKA Home

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Drivers

- 4.1.1 Home-Remodel Spend By Millennials Powering Multi-Functional Furniture Demand

- 4.1.2 Rapid Urbanization Is Driving Space-Saving Modular Furniture Sales

- 4.1.3 Expansion of Digital-First D2C Furniture Brands Boosting Online Penetration

- 4.1.4 Corporate ESG Mandates Spurring Adoption Of Recycled & Bio-Based Furniture Materials

- 4.1.5 Smart-Home Proliferation is Propelling Demand For Iot-Enabled Adjustable Furniture

- 4.2 Market Restraints

- 4.2.1 EU Extended Producer Responsibility (EPR) Rules Raising Compliance Costs For Exporters

- 4.2.2 High Cross-Border Logistics Costs & Damage Rates Curbing Bulky E-Commerce Furniture Margins

- 4.2.3 Timber Import Restrictions Inflating Raw-Material Costs

- 4.3 Industry Value Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Bargaining Power of Buyers

- 4.4.4 Threat of Substitutes

- 4.4.5 Competitive Rivalry

- 4.5 Insights into the Latest Trends and Innovations in the Market

- 4.6 Insights on Recent Developments (New Product Launches, Strategic Initiatives, Investments, Partnerships, JVs, Expansion, M&As, etc.) in the Market

- 4.7 Insights on Regulatory Framework and Industry Standards for the Furniture Industry in Key Geographies

5 Market Size & Growth Forecasts (Value)

- 5.1 By Application

- 5.1.1 Home Furniture

- 5.1.1.1 Chairs

- 5.1.1.2 Tables (side tables, coffee tables, dressing tables, etc.)

- 5.1.1.3 Beds

- 5.1.1.4 Wardrobes

- 5.1.1.5 Sofas

- 5.1.1.6 Dining Tables/Dining Sets

- 5.1.1.7 Kitchen Cabinets

- 5.1.1.8 Other Home Furniture (bathroom furniture, outdoor furniture, etc.)

- 5.1.2 Office Furniture

- 5.1.2.1 Chairs

- 5.1.2.2 Tables

- 5.1.2.3 Storage Cabinets

- 5.1.2.4 Desks

- 5.1.2.5 Sofas and Other Soft Seating

- 5.1.2.6 Other Office Furniture

- 5.1.3 Hospitality Furniture

- 5.1.4 Educational Furniture

- 5.1.5 Healthcare Furniture

- 5.1.6 Other Applications (public places, retail malls, government offices, etc.)

- 5.1.1 Home Furniture

- 5.2 By Material

- 5.2.1 Wood

- 5.2.2 Metal

- 5.2.3 Plastic & Polymer

- 5.2.4 Other Materials

- 5.3 By Price Range

- 5.3.1 Economy

- 5.3.2 Mid-Range

- 5.3.3 Premium

- 5.4 By Distribution Channel

- 5.4.1 B2C/Retail

- 5.4.1.1 Home Centers

- 5.4.1.2 Specialty Furniture Stores

- 5.4.1.3 Online

- 5.4.1.4 Other Distribution Channels

- 5.4.2 B2B /Project

- 5.4.1 B2C/Retail

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 Canada

- 5.5.1.2 United States

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Peru

- 5.5.2.3 Chile

- 5.5.2.4 Argentina

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 BENELUX (Belgium, Netherlands, and Luxembourg)

- 5.5.3.7 NORDICS (Denmark, Finland, Iceland, Norway, and Sweden)

- 5.5.3.8 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 India

- 5.5.4.2 China

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 South East Asia (Singapore, Malaysia, Thailand, Indonesia, Vietnam, and Philippines)

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East And Africa

- 5.5.5.1 United Arab of Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle East And Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 IKEA

- 6.4.2 Ashley Furniture Industries Inc.

- 6.4.3 Steelcase Inc.

- 6.4.4 MillerKnoll, Inc.

- 6.4.5 HNI Corporation

- 6.4.6 Williams-Sonoma Inc.

- 6.4.7 La-Z-Boy Incorporated

- 6.4.8 Hooker Furniture Corp.

- 6.4.9 Kimball International Inc.

- 6.4.10 Haworth Inc.

- 6.4.11 Wayfair LLC

- 6.4.12 Godrej Interio

- 6.4.13 Durian Industries Ltd.

- 6.4.14 Foshan Huasheng Furniture

- 6.4.15 KOKUYO Co. Ltd.

- 6.4.16 Shanghai UE Furniture

- 6.4.17 Leggett & Platt Inc.

- 6.4.18 Okamura Corporation

- 6.4.19 Nitori Holdings Co. Ltd.

- 6.4.20 KUKA Home

7 Market Opportunities & Future Outlook

- 7.1 Sustainability & Eco-Friendly Furniture

- 7.2 E-commerce and Digital Experience