PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851749

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851749

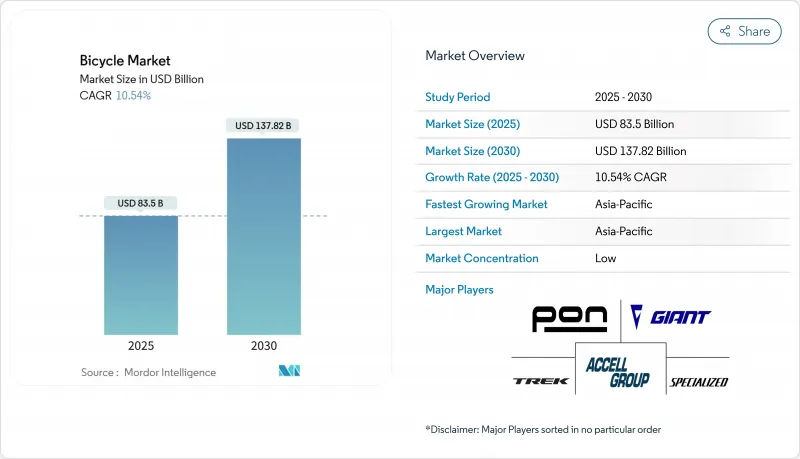

Bicycle - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The bicycle market size is estimated at USD 83.50 billion in 2025, and is expected to reach USD 137.82 billion by 2030, at a CAGR of 10.54% during the forecast period (2025-2030).

Urban centers are increasingly implementing congestion charges, while employers are incorporating bicycle incentives into wellness programs, driving sustained demand for bicycles. This demand is further reinforced by significant government investments in infrastructure, which have already exceeded projections, alongside stricter climate policies aimed at reducing carbon emissions. Additionally, ongoing advancements in battery safety technology are expanding the potential consumer base by addressing safety concerns. The emergence of direct-to-consumer brands and the integration of software-enabled fleet services are redefining the retail landscape, optimizing operational efficiencies, and enhancing customer accessibility. Rising fuel prices are further amplifying the cost advantage of bicycles over motorized vehicles, making them a more economically viable option. Overall, the bicycle market continues to experience growth, supported by favorable regulatory frameworks, technological progress, and a shift in urban lifestyles toward sustainable and active mobility solutions.

Global Bicycle Market Trends and Insights

Government support encourages eco-friendly transportation methods

Governments worldwide are increasingly recognizing cycling as a critical element of climate infrastructure rather than merely a recreational activity. This shift is evident in the European Union's adoption of the European Declaration on Cycling in April 2024, which outlines 36 binding commitments for member states to enhance cycling infrastructure and promote its integration into sustainable transport systems . Similarly, in the United States, the Active Transportation Infrastructure Investment Program provides USD 44.5 million annually to develop connected cycling networks, fostering greater accessibility and safety for cyclists. On a state level, California has committed USD 930 million over four years to build 265 miles of new bike paths, further emphasizing the importance of cycling in urban planning . These comprehensive policy measures are driving sustained demand for cycling-related products and services, encouraging manufacturers to scale up production capacities and motivating retailers to increase their inventory levels to meet the growing market needs.

Urban congestion boosts bicycle usage for daily commute

As urban density pressures rise, especially in Asia-Pacific megacities facing traffic congestion's economic and social costs, the need for cycling solutions is critical. Congestion pricing and low-emission zones further promote cycling over private vehicles. Hybrid work models have also reshaped commuting, making cycling ideal for shorter, flexible trips. The Netherlands exemplifies successful cycling integration with cycling highways linked to rail networks, creating a multimodal transport system that rivals car ownership while addressing environmental and mobility challenges. Corporations are increasingly adopting cycling, driven by employee wellness initiatives and sustainability reporting mandates. Investments in cycling infrastructure help attract talent and meet carbon reduction goals, aligning with environmental and social governance (ESG) objectives.

Availability of substitute like bikes, and other faster transport modes discourages the use of bicycle

Competition among transport modes is intensifying as electric scooters, ride-sharing services, and autonomous vehicle pilots address short-distance mobility. In urban areas, e-bike ownership costs now rival those of electric scooters and ride-sharing subscriptions, heightening pricing competition. Integrated transport apps, driven by micromobility platform consolidation, have made bicycles one of many transport options. In Asia-Pacific cities with extensive metro systems, public transportation advancements have reduced cycling's appeal for longer commutes. While regulations for alternative transport modes advance quickly, cycling infrastructure faces delays. For instance, electric scooter-sharing programs receive rapid approvals, whereas cycling projects take longer. However, cycling's health and environmental benefits limit substitution threats, ensuring its market presence.

Other drivers and restraints analyzed in the detailed report include:

- Fitness trends increase popularity of cycling activities

- Environmental awareness and sustainability drives bicycle usage among consumers

- High e-bike cost restricts wider adoption globally

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-bicycles held 51.25% of the bicycle market in 2024, and the segment is forecast to post a 12.76% CAGR to 2030. The bicycle market size for e-bicycles is therefore on track to more than double within the decade, propelled by safety certifications such as UL 2849 that boost consumer trust. Batteries are now removable and airline-compliant, widening use cases. Meanwhile, conventional road and city bikes preserve large sales volumes, sustaining economies of scale for component suppliers.

Technology convergence defines competitive edges: integrated navigation, theft-tracking, and predictive maintenance enrich the rider experience and push premium price points. Asia-Pacific producers benefit from cost-efficient capacity, while European assemblers leverage proximity to capture premium niches. Battery recycling mandates in China set a template other regions may follow, adding after-sales service revenue for compliant brands. Market entry remains open for software-native firms bundling bikes with fleet analytics, providing asset-light access to mobility budgets.

In 2024, regular frames continue to dominate the bicycle market, accounting for a substantial 85.78% market share. This dominance highlights the strong appeal of mass-produced geometries, cost-effective pricing, and seamless compatibility with existing infrastructure, which collectively make regular frames a preferred choice among consumers. On the other hand, folding designs are projected to experience a robust growth trajectory, registering an impressive 11.43% CAGR through 2030. This growth rate, which is double that of the overall bicycle market, is primarily driven by the rising demand for compact and space-efficient solutions, particularly in response to challenges such as limited urban housing space and the growing need for efficient last-mile connectivity with rail networks.

Material advances in magnesium hinges and quick-release clamps now limit weight premiums, and warranty parity with regular bikes removes past hesitations. In the bicycle industry, corporations also favor foldables for employee fleets because units store safely under desks and in small lockers. European policy supporting combined rail-bike commutes, notably in Germany and the Netherlands, gives folding models regulatory tailwinds. Yet the bulk of annual volume will still come from regular bikes until folding retail prices close the gap.

The Bicycle Market Report is Segmented by Product Type (Road/City, Mountain/All-Terrain, Hybrid, E-Bicycle, and Others), Design (Regular and Folding), End-User (Men, Women, and Children), Distribution Channel (Offline Retail Stores and Online Retail Stores), and Geography ((North America, Europe, Asia-Pacific, South America, and Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

In 2024, the Asia-Pacific region solidified its position as a key revenue contributor, accounting for 48.11% of the global market. The region is forecasted to achieve a strong compound annual growth rate (CAGR) of 13.33% through 2030, driven by several factors. In China, the bicycle market is experiencing significant growth due to the widespread adoption of e-bikes, the enforcement of mandatory battery-recycling initiatives, and urban traffic policies that actively encourage the use of two-wheelers as a sustainable mode of transportation. Japan, on the other hand, is strategically aligning its certification frameworks with European standards, thereby simplifying export procedures and enhancing the global competitiveness of its domestic brands.

In North America and Europe, large-scale infrastructure investment programs are creating a stable and sustained demand for bicycles. The market's geographic distribution underscores a concentration of manufacturing activities in Asia, while developed markets are witnessing growth driven by favorable policy measures. This dynamic fosters trade flows that not only reinforce the dominance of established Asian manufacturers but also create opportunities for premium product positioning in Western markets, catering to a consumer base that values high-quality and innovative offerings.

The bicycle market in the Middle East and Africa is experiencing robust growth, with e-bike adoption accelerating at double-digit rates and traditional bicycles maintaining steady demand. Urban consumers in key cities such as Dubai, Cape Town, Nairobi, and Tel Aviv are increasingly perceiving bicycles, particularly e-bikes, as modern, eco-conscious alternatives to conventional vehicles like cars and motorbikes. However, the lack of standardized safety regulations, insurance frameworks, and traffic rights continues to pose challenges, hindering the rapid formalization of the bicycle market in several African nations.

- Accell Group NV

- Trek Bicycle Corporation

- Pon Holdings BV

- Giant Manufacturing Co. Ltd

- Specialized Bicycle Components Inc.

- Shimano Inc.

- Scott Sports SA

- Merida Industry Co. Ltd

- Stryder Cycle Private Limited

- Cycles Devinci inc.

- Pending System GmbH & Co. KG

- Brompton Bicycle Ltd

- Decathlon SA

- Rad Power Bikes Inc.

- Riese and Muller GmbH

- Bulls Bikes GmbH

- Yadea Group Holdings Ltd

- Canyon Bicycles GmbH

- Hero Cycles Limited

- Ribble Cycles

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Urban congestion boosts bicycle usage for daily commute

- 4.2.2 Fitness trends increase popularity of cycling activities

- 4.2.3 Government support encourages eco-friendly transportation methods

- 4.2.4 Environmental awareness and sustainability drives bicycle usage among consumers

- 4.2.5 Workplace wellness programs encourage employee bicycle usage

- 4.2.6 Rising fuel prices make bicycles cost-effective alternatives

- 4.3 Market Restraints

- 4.3.1 Availability of substitute like bikes, and other faster transport modes discourages the use of bicycle

- 4.3.2 Presence of counterfeit bicycles hinders market growth

- 4.3.3 High e-bike cost restricts wider adoption globally

- 4.3.4 Poor road conditions in rural areas hinder smooth bicycle experience

- 4.4 Regulatory Landscape

- 4.5 Technological Advancements

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Road/City

- 5.1.2 Mountain/All-Terrain

- 5.1.3 Hybrid

- 5.1.4 E-Bicycle

- 5.1.5 Other Types

- 5.2 By Design

- 5.2.1 Regular

- 5.2.2 Folding

- 5.3 By End-User

- 5.3.1 Men

- 5.3.2 Women

- 5.3.3 Children

- 5.4 By Distribution Channel

- 5.4.1 Offline Retail Stores

- 5.4.2 Online Retail Stores

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.1.4 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Italy

- 5.5.2.4 France

- 5.5.2.5 Spain

- 5.5.2.6 Netherlands

- 5.5.2.7 Poland

- 5.5.2.8 Belgium

- 5.5.2.9 Sweden

- 5.5.2.10 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Australia

- 5.5.3.5 Indonesia

- 5.5.3.6 South Korea

- 5.5.3.7 Thailand

- 5.5.3.8 Singapore

- 5.5.3.9 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Chile

- 5.5.4.5 Peru

- 5.5.4.6 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 United Arab Emirates

- 5.5.5.4 Nigeria

- 5.5.5.5 Egypt

- 5.5.5.6 Morocco

- 5.5.5.7 Turkey

- 5.5.5.8 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Accell Group NV

- 6.4.2 Trek Bicycle Corporation

- 6.4.3 Pon Holdings BV

- 6.4.4 Giant Manufacturing Co. Ltd

- 6.4.5 Specialized Bicycle Components Inc.

- 6.4.6 Shimano Inc.

- 6.4.7 Scott Sports SA

- 6.4.8 Merida Industry Co. Ltd

- 6.4.9 Stryder Cycle Private Limited

- 6.4.10 Cycles Devinci inc.

- 6.4.11 Pending System GmbH & Co. KG

- 6.4.12 Brompton Bicycle Ltd

- 6.4.13 Decathlon SA

- 6.4.14 Rad Power Bikes Inc.

- 6.4.15 Riese and Muller GmbH

- 6.4.16 Bulls Bikes GmbH

- 6.4.17 Yadea Group Holdings Ltd

- 6.4.18 Canyon Bicycles GmbH

- 6.4.19 Hero Cycles Limited

- 6.4.20 Ribble Cycles

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK