PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444872

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444872

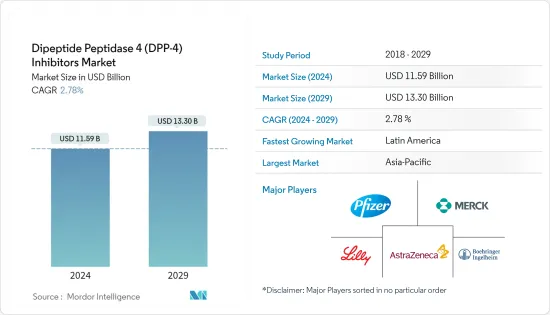

Dipeptide Peptidase 4 (DPP-4) Inhibitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Dipeptide Peptidase 4 Inhibitors Market size is estimated at USD 11.59 billion in 2024, and is expected to reach USD 13.30 billion by 2029, growing at a CAGR of 2.78% during the forecast period (2024-2029).

The market is estimated to reach a value of more than USD 36 billion by 2027.

The COVID-19 pandemic positively impacted the Dipeptide Peptidase 4 (DPP-4) Inhibitors Market. Diabetes and uncontrolled hyperglycemia are risk factors for poor outcomes in patients with COVID-19 including an increased risk of severe illness or death. People with diabetes have a weaker immune system, the COVID-19 complication aggravates the condition, and the immune system gets weaker very fast. In the current crisis, type 2 diabetes patients are at much higher risk.

Dipeptidyl peptidase 4 (DPP-4) inhibitors are a class of medicine that lower high blood glucose levels and are used in the treatment of type 2 diabetes. DPP4 inhibitors increase insulin and GLP-1 secretion and are commonly prescribed for people suffering from type 2 diabetes. The use of DPP4 inhibitors in patients with COVID-19 with or even without type 2 diabetes offers a simple way to reduce the virus entry and replication into the airways and to hamper the sustained cytokine storm and inflammation within the lung in patients diagnosed with COVID-19 infection.

According to International Diabetes Federation (IDF), the adult diabetes population in 2021 is approximately 537 million, and this number is going to increase by 643 million in 2030. Technological advancements have increased over the period leading to several modifications either in the DPP-4 Inhibitor drugs or the formulations being developed.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Dipeptide Peptidase 4 (DPP-4) Inhibitors Market Trends

The Tradjenta segment is expected to witness the highest CAGR in the dipeptide peptidase 4 (DDP-4) inhibitors market over the forecast period

The Tradjenta segment is expected to witness the highest CAGR of around 6.4% in the dipeptide peptidase 4 (DDP-4) inhibitors market over the forecast period.

Tradjenta is a prescription drug approved by the Food and Drug Administration to help improve blood glucose control in adults with type 2 diabetes. It is considered an adjunct treatment to diet and exercise. It is also used as an add-on therapy to insulin. Tradjenta should not be used in patients with type 1 diabetes or for treating diabetic ketoacidosis (increased ketones in the blood or urine).

Boehringer Ingelheim Pharmaceuticals, Inc. offers a Tradjenta Savings card, and eligible commercially insured patients 18 years or older pay as little as USD 10/month with a maximum savings of up to USD 150. This offer is not valid for patients without commercial coverage or patients whose prescriptions for Tradjenta are eligible to be reimbursed, in whole or in part, by any governmental program. These programs include Medicaid, Medicare, Medigap, the Retiree Drug Subsidy Program, VA, DOD, TRICARE, or any state patient or pharmaceutical assistance program.

According to International Diabetes Federation, the adult diabetes population in 2021 was approximately 537 million, which will increase by 643 million in 2030. Obesity is considered one of the major factors contributing to the disease, primarily Type 2 diabetes. Continued elevation in blood glucose levels in diabetes patients can contribute to progressive complications such as renal, nerve, and ocular damage.

Owing to the rising prevalence and factors above, the growth of the studied market is anticipated over the forecast period.

Asia-Pacific region held the highest market share in the Dipeptide Peptidase 4 (DPP-4) Inhibitors Market in the current year

The Asia-Pacific region held the highest market share of about 36.7% in the Dipeptide Peptidase 4 (DPP-4) Inhibitors Market in the current year.

According to International Diabetes Federation, 90 million adults lived with diabetes in the IDF South-East Asia Region and 206 million adults in the IDF Western Pacific Region in 2021. This figure is estimated to increase to 113 million and 238 million by 2030. China holds the highest market share and is recognized as a potential developing market due to the growing diabetic population. It is a mature market with associated challenges, like slow economic growth, an aging population, and increased competition. The country is witnessing a significant increase in generic drug manufacturers. Furthermore, the leading global players in the market studied are facing intense competition from the regional players.

Diabetes reduces lifespan, and people with the disease are likely to experience blindness and be hospitalized for amputations, kidney failure, heart attacks, strokes, and heart failure. First-line therapy used in patients with T2D is metformin monotherapy. Other options must be considered when metformin is contraindicated or not tolerated or when treatment goals are not achieved after three months of use at the maximum tolerated dose. The growing spectrum of diabetes mellitus drugs includes dipeptidyl peptidase-4 (DPP-4) inhibitors, sodium-glucose cotransporter-2 inhibitors, and glucagon-like peptide-1 agonists, which are generally used to supplement treatment with metformin.

The market is expected to grow during the forecast period due to the factors above.

Dipeptide Peptidase 4 (DPP-4) Inhibitors Industry Overview

The Dipeptide Peptidase 4 (DPP-4) Inhibitors Market is moderately fragmented, with manufacturers like AstraZeneca, Merck, Boehringer Ingelheim, Novartis, etc., gaining presence in major countries. At the same time, the remaining market comprises other local or region-specific manufacturers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Drugs

- 5.1.1 Januvia (Sitagliptin)

- 5.1.2 Onglyza (Saxagliptin)

- 5.1.3 Tradjenta (Linagliptin)

- 5.1.4 Vipidia (Alogliptin)

- 5.1.5 Galvus (Vildagliptin)

- 5.1.6 Others

- 5.2 Geography

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 France

- 5.2.2.2 Germany

- 5.2.2.3 Italy

- 5.2.2.4 Spain

- 5.2.2.5 United Kingdom

- 5.2.2.6 Russia

- 5.2.2.7 Rest of Europe

- 5.2.3 Latin America

- 5.2.3.1 Mexico

- 5.2.3.2 Brazil

- 5.2.3.3 Rest of Latin America

- 5.2.4 Asia-Pacific

- 5.2.4.1 Japan

- 5.2.4.2 South Korea

- 5.2.4.3 China

- 5.2.4.4 India

- 5.2.4.5 Australia

- 5.2.4.6 Vietnam

- 5.2.4.7 Malaysia

- 5.2.4.8 Indonesia

- 5.2.4.9 Philippines

- 5.2.4.10 Thailand

- 5.2.4.11 Rest of Asia-Pacific

- 5.2.5 Middle East and Africa

- 5.2.5.1 Saudi Arabia

- 5.2.5.2 Iran

- 5.2.5.3 Egypt

- 5.2.5.4 Oman

- 5.2.5.5 South Africa

- 5.2.5.6 Rest of Middle East and Africa

- 5.2.1 North America

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Merck And Co.

- 7.1.2 AstraZeneca

- 7.1.3 Bristol Myers Squibb

- 7.1.4 Novartis

- 7.1.5 Takeda Pharmaceuticals

- 7.1.6 Eli Lilly and Company

- 7.1.7 Boehringer Ingelheim

- 7.1.8 Pfizer

- 7.1.9 GlaxoSmithKline

- 7.2 Company Share Analysis

- 7.2.1 Merck And Co.

- 7.2.2 AstraZeneca

- 7.2.3 Takeda Pharmaceuticals

- 7.2.4 Novartis

- 7.2.5 Others

8 MARKET OPPORTUNITIES AND FUTURE TRENDS