PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444875

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444875

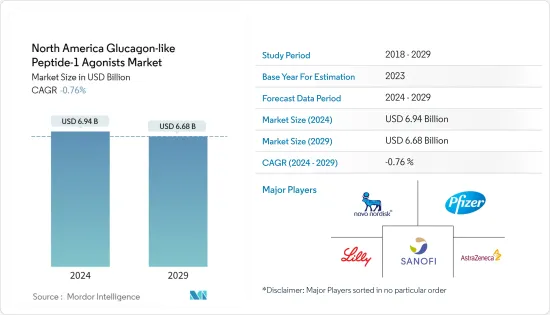

North America Glucagon-like Peptide-1 Agonists - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The North America Glucagon-like Peptide-1 Agonists Market size is estimated at USD 6.94 billion in 2024, and is expected to decline to USD 6.68 billion by 2029.

The COVID-19 pandemic positively impacted a few segments of the North American Glucagon-like Peptide-1 (GLP-1) Agonists Market. Diabetes and uncontrolled hyperglycemia are risk factors for poor outcomes in patients with COVID-19 including an increased risk of severe illness or death. People with diabetes have a weaker immune system, the COVID-19 complication aggravates the condition, and the immune system gets weaker very fast. People with diabetes have more chances to get into serious complications rather than normal people.

Glucagon-like peptide-1 receptor agonists (GLP-1RAs) are a class of medications used for the treatment of type 2 diabetes and some drugs are also approved for obesity. One of the benefits of this class of drugs over sulfonylureas or meglitinides is that they have a lower risk of causing hypoglycemia. Besides being important glucose-lowering agents, GLP-1RAs have significant anti-inflammatory and pulmonary protective effects and an advantageous impact on gut microbes' composition. Therefore, GLP-1RAs have been potential candidates for treating patients affected by COVID-19 infection, with or even without type 2 diabetes, as well as excellent antidiabetic (glucose-lowering) agents during COVID-19 pandemic times.

In North America, till April 2022, the United States is having the highest COVID cases around 82 million, the country also registered the highest death rate. According to the Diabetes Voice article published in May 2020, close to 40,000 deaths of people who are having diabetes. Pandemic emergency has created a rise in remote care from both patients and providers and removed many long-standing regulatory barriers.

The North American region had witnessed an alarming increase in the prevalence of diabetes, in recent years. In developed countries, such as the United States and Canada, the rate of diabetes is at an all-time high, mainly due to lifestyle changes. Diabetes is associated with many health complications. Patients with diabetes require many corrections throughout the day for maintaining nominal blood glucose levels, such as the administration of additional insulin or ingestion of additional carbohydrates by monitoring their blood glucose levels.

North America GLP-1 Agonists Market Trends

Liraglutide Segment holds the highest market share in the North American Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year

Liraglutide drug holds the highest market share of about 42.6% in the North American Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year.

GLP1RAs are available internationally and are recommended for use when treatment escalation for type 2 diabetes is required after metformin and lifestyle management. They can be safely used with all other glucose-lowering therapies except vildagliptin. Liraglutide, sold under Victoza, is an anti-diabetic medication for treating type 2 diabetes, obesity, and chronic weight management.

Liraglutide controls high blood sugar levels alone or in combination with other medications. It is prescribed to people with type 2 diabetes. Liraglutide is also used to reduce the risk of heart attack, stroke, or death in people with type 2 diabetes and heart disease. It works by increasing insulin release in response to high blood sugar levels after a meal and decreasing the amount of sugar produced by the liver. GLP1RAs elicit greater weight reduction and are recommended over SLGT2 inhibitors when cerebrovascular disease other than heart failure or renal disease predominates.

To help make the therapy cost more manageable, the Victoza Instant Savings Card Program allows the patient to print the savings card for instant use. With this card, the patient pays not more than USD 25 per Victoza prescription fill, valid for two years. It is equivalent to 24 prescription refills. However, due to the increased efficacy of the exenatide and semaglutide and the risks associated with Liraglutide causing dose-dependent and treatment-duration-dependent thyroid C-cell tumors, it will face tough competition leading to a decline in sales during the forecast period.

United States held the highest market share in the North America Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year

United States held the highest market share of about 95% in the North American Glucagon-like Peptide-1 (GLP-1) Agonists Market in the current year.

The Centers for Disease Control and Prevention National Diabetes Statistics Report 2022 estimated that more than 130 million adults are living with diabetes or prediabetes in the United States. Type 2 diabetes is more common, and diabetes is more consequential among communities of color, those who live in rural areas, and those with less education, lower incomes, and lower health literacy.

In addition to lowering blood glucose levels to help treat type 2 diabetes, GLP-1 agonists are also used in weight loss and other metabolic health benefits. GLP-1 RAs can be taken alone or in combination with other treatments for type 2 diabetes to improve blood glucose management, i.e., time in range. In addition to lowering blood glucose, they benefit heart health by reducing the risk of heart attack, stroke, and heart-related death. It is important because people with type 2 diabetes are at substantially higher risk of heart disease than those without diabetes.

In August 2022, Novo Nordisk announced headline results from a phase 2 clinical trial with CagriSema, a once-weekly subcutaneous combination of semaglutide and a novel amylin analog, cagrilintide. The trial investigated the efficacy and safety of a fixed dose combination of CagriSema (2.4 mg semaglutide and 2.4 mg cagrilintide) compared to the individual components, all administered once weekly, in 92 people with type 2 diabetes and overweight.

Owing to the rising prevalence and factors above, the growth of the studied market is anticipated over the forecast period.

North America GLP-1 Agonists Industry Overview

The North America Glucagon-like Peptide-1 (GLP-1) Agonists Market is consolidated with major manufacturers, namely Eli Lilly, Sanofi, Novo Nordisk, AstraZeneca, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 Market Segmentation

- 5.1 Drugs

- 5.1.1 Dulaglutide

- 5.1.1.1 Trulicity

- 5.1.2 Exenatide

- 5.1.2.1 Byetta

- 5.1.2.2 Bydureon

- 5.1.3 Liraglutide

- 5.1.3.1 Victoza

- 5.1.4 Lixisenatide

- 5.1.4.1 Lyxumia

- 5.1.5 Semaglutide

- 5.1.5.1 Ozempic

- 5.1.1 Dulaglutide

- 5.2 Geography

- 5.2.1 United States

- 5.2.2 Canada

- 5.2.3 Rest of North America

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 Competitive Landscape

- 7.1 Company Profiles

- 7.1.1 Novo Nordisk

- 7.1.2 AstraZeneca

- 7.1.3 Eli Lilly and Company

- 7.1.4 Sanofi

- 7.1.5 Pfizer

- 7.2 Company Share Analysis

- 7.2.1 Novo Nordisk

- 7.2.2 AstraZeneca

- 7.2.3 Eli Lilly and Company

- 7.2.4 Others

8 MARKET OPPORTUNITIES AND FUTURE TRENDS