PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687730

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687730

Coffee Pods And Capsules - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

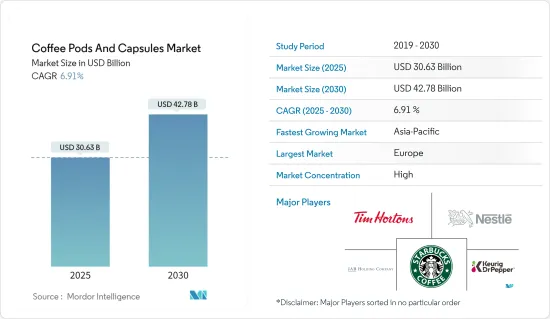

The Coffee Pods And Capsules Market size is estimated at USD 30.63 billion in 2025, and is expected to reach USD 42.78 billion by 2030, at a CAGR of 6.91% during the forecast period (2025-2030).

Key Highlights

- The quality, efficiency, and diverse choices offered in a single serving of coffee are significant for the demand for coffee pods and capsules. Consumers are willing to purchase coffee machines to recreate the cafe-style experience at home, boosting the demand for coffee pods and capsules. Using a modern coffee machine and preferred capsule or coffee pod in the home allows consumers to produce a comprehensive range of coffee quickly.

- Additionally, one of the major factors responsible for the rising popularity of coffee pods among consumers is their one-time use and disposable features that offer convenience to the users. However, as they are single-use products, buyers are conscious about the type of packaging and are looking for sustainable and eco-friendly packaging. In line with this, the market players are making efforts to make environment-friendly and biodegradable coffee capsules. For instance, in November 2022, a Nestle brand, Nespresso, launched compostable coffee capsules made from paper. The capsules are compatible with Nespresso coffee machines.

- Moreover, the coffee pods and capsule market is growing due to the demand for ready-to-drink coffee beverages. Due to the hectic schedules of individuals, they need quick refreshments and easy-to-make coffee, and coffee pods and capsules align with their demands by saving time. Such factors and the increasing coffee-consuming population worldwide are expected to support the market growth during the forecast period.

Coffee Pods and Capsules Market Trends

Increasing Demand For Specialty And Organic Coffee Pods And Capsules

- Globally, the demand for organic food and beverages, mainly tea and coffee, is growing faster due to changes in lifestyle patterns, increased expenditure on food and drink, awareness about healthy foods, and the desire to taste new products. The above factors boost the demand for specialty and organic coffee pods and capsules. Sustainability remains essential for buyers and retailers, and the certification of organic nature is no longer an option but a requirement. In addition, consumers and the industry demand traceability in the value chain with the increasing preference for organic food products.

- For instance, according to Statistics Denmark, in 2022, the annual turnover of organic coffee in retail shops in Denmark amounted to 335 million Danish kroner. Similarly, according to TransFair, in 2021, around 74% of all fair trade coffee sold in Germany came from organic production. This increased compared to the previous year, in which only 68% of all fair trade coffee sold in Germany came from organic production.

- Moreover, with this growing demand for organic coffee pods, players are focused on offering organic coffee in pods and capsule formats. This is expected to boost the market growth during the forecast period. For instance, in December 2022, Chamberlain Coffee, the coffee lifestyle brand and brainchild of Emma Chamberlain that offers sustainably sourced organic coffee, launched their first-ever coffee pods, claiming that their casing is commercially compostable. Such launches mark a new wave of convenience for the brands and showcase their continued commitment to innovation and ability to meet customer needs, which eventually aids the market to grow.

Europe Leads the Coffee Pods and Capsules Market

- The European market witnessed a rising demand for specialty coffee and single-serve methods in the past few years due to the growing demand for instant non-alcoholic drinks. Among all, Germany and France are the regional leaders in the market. Coffee producers in the region are keen on choosing coffee capsules due to their suitability, comfort, and wide diversity of coffee products and machinery.

- Additionally, the proliferation of premium coffee shops, such as Starbucks, has stimulated consumers' appetite for high-end, fresh-brewed coffee, thus boosting the demand for coffee capsules and pods in Europe. For instance, Starbucks had 1,156 stores in the United Kingdom in 2022, of which 838 were franchised and 318 were company-operated locations, which increased from almost 1,097 shops compared to the previous year.

- Moreover, with the rising market value for coffee pods and capsules made of sustainable materials, several international and private-label players are entering the market in the region with their innovative package offerings. In July 2023, Darlington-based manufacturer Beanies made a significant stride by introducing its compostable coffee pods in Aldi stores across the United Kingdom. Simultaneously, the company unveiled its products in three delectable flavors: vanilla, caramel, and hazelnut.

- Similarly, in September 2022, Cafe Royal revolutionized the coffee pod industry with a spherical-shaped pod enveloped in a vegetable-based, 100% compostable shell-a groundbreaking zero-waste solution for capsules. This innovative product not only showcases advancing packaging technologies but also positions the brand to compete with high-end, exotic counterparts, projected to drive substantial market growth in the region.

Coffee Pods and Capsules Industry Overview

The coffee pods and capsules market is primarily dominated by Tim Hortons, Nestle, and JAB Holding Company, with a strong global presence of brands like Nespresso, Keurig, Tassimo, Senseo, and Dolce Gusto. Other key players, such as Keurig Dr Pepper Inc. and Starbucks Corporation, also hold a prominent share of the overall market. However, high product innovations, the launch of limited edition coffee pods, extensive distribution networks, and better supply chains have resulted in high consolidation of the coffee pods and capsules market, with Nestle (Nespresso and Dolce Gusto) and JAB Holdings (Senseo, Tassimo, and Keurig) holding the maximum share in the overall market. Major players are focused on packaging innovations and launching products with attractive flavor options to meet consumer demand.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Demand for specialty and organic coffee pods and capsules

- 4.1.2 Innovations in packaging formats

- 4.2 Market Restraints

- 4.2.1 Availability of counterfeit products

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Pods

- 5.1.2 Capsules

- 5.2 Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 Online Retailing

- 5.2.4 Other Distribution Channels

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 Italy

- 5.3.2.4 France

- 5.3.2.5 Russia

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Share Analysis

- 6.2 Most Active Companies

- 6.3 Company Profiles

- 6.3.1 Nestle SA

- 6.3.2 JAB Holding Company

- 6.3.3 The Kraft Heinz Company

- 6.3.4 Inspire Brands Inc. (Dunkin' Brands)

- 6.3.5 Luigi Lavazza SpA

- 6.3.6 Starbucks Corporation

- 6.3.7 Gloria Jean's Coffees

- 6.3.8 Strauss Group

- 6.3.9 Coffeeza

- 6.3.10 Trilliant Food & Nutrition LLC

7 MARKET OPPORTUNITIES AND FUTURE TRENDS