PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444879

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444879

Middle East and Africa Human Insulin - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

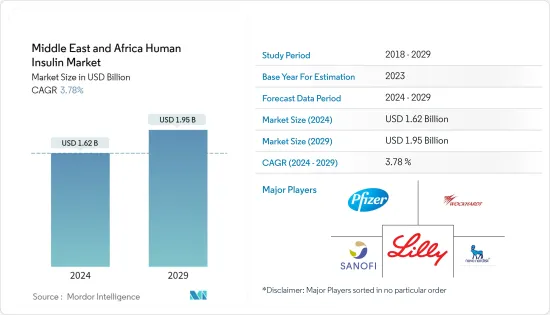

The Middle East and Africa Human Insulin Market size is estimated at USD 1.62 billion in 2024, and is expected to reach USD 1.95 billion by 2029, growing at a CAGR of 3.78% during the forecast period (2024-2029).

In the Middle East and Africa area as well as elsewhere, COVID-19 and diabetes have a considerable impact on public health. Diabetes has been found to increase the risk of fatal infections and increase the risk of severe infections in COVID-19 patients. The current research concentrated on understanding the epidemiology of COVID-19 in persons with diabetes and the strategies put in place by the governments to lessen its impact because diabetes is one of the major health diseases that are extensively common in the Middle East and African nations. Middle-East and African nations have implemented several preventative and control measures to lessen the effects of the epidemic in light of the significance and necessity. Although there has been a lot of study on COVID-19, only a small number of Middle-East and African nations have concentrated on the epidemiology of COVID-19 among diabetic patients and its implications. We underline the critical need for a thorough study to fully understand COVID-19 and its relationship to diabetes to create and implement evidence-based initiatives and policies in the Middle-East and African areas.

In the Middle-East and Africa, Type 1 diabetes forms approximately 10% of the diabetes conditions, and Type 2 contributes to 90%. Type 1 patients need to take insulin throughout their lives while maintaining a healthy diet and regular physical exercise. Type 2 patients need to eat healthily, remain physically active, and perform regular tests to check their blood glucose levels. They may also need to take oral medication and insulin to control the glucose levels in their blood. There are many complications associated with diabetes, like diabetic ketoacidosis and non-ketotic hyperosmolar coma. Serious long-term complications include heart disease, stroke, kidney failure, foot ulcers, and damage to the eyes.

As the production of insulin is very complex, there are very few companies in the market that manufacture insulin. Thus, there is high competition between these manufacturers, and they always strive to meet the patient's needs and supply the best-quality insulin.

Middle East and Africa Diabetes Treatment Market Trends

Biosimilar Insulin Segment Holds Highest Market Share in Middle-East and Africa Human Insulin Market.

Biosimilar insulin is highly popular in the Middle East and Africa region because of its low cost as compared to branded insulins. The Middle East and African countries have substantial economic diversity. The per-capita expenditure on diabetes in the region is low, although some countries in the region have managed to modify their healthcare expenditure to include biologic and biosimilar therapies. The governments of the Middle East and African countries are recognizing the importance of driving biosimilar uptake to create a competitive and sustainable biosimilar market. With no clinically significant differences in efficacy, safety, purity, or potency, a number of companies are developing biosimilars that are very similar to the reference insulin glargine.

The total diabetes population in the Middle East and Africa has increased by more than 200% over the past few years. Approximately 8% of the diabetic population in the region has type-1 diabetes. The Middle East and Africa were two of the largest markets for these biosimilars in 2022. There is increasing adoption of insulin glargine biosimilars across the Middle East and Africa, which is contributing to the overall growth of the segment. Several governments are recognizing the importance of driving biosimilar uptake to create a competitive and sustainable biosimilar market. Driven by government initiatives, several companies are developing biosimilars that are highly similar to the reference insulin glargine with no clinically meaningful differences in efficacy, safety, purity, or potency. Developments are expected to help the growth of the insulin biosimilar market during the forecast period.

Saudi Arabia Holds Highest Market Share in Middle-East and Africa Insulin Market.

Diabetes is one of the mounting health problems the country is facing. Saudi is ranked among the top three in the Middle East and African countries with the highest prevalence of diabetes. The diabetes population in Saudi Arabia increased from 1.48 million in 2012 to 5.95 million in 2021 and is expected to reach more than 8 million by forecast period. The type-1 diabetes population in the country is projected to reach more than 0.5 million by forecast period from 0.39 million in current period. In Saudi Arabia, diabetes mellitus is a condition that is on the rise. In this context, a cross-sectional retrospective study was done to assess Saudi Arabia's non-insulin-dependent diabetic mellitus disease management costs and medicine usage patterns. According to the WHO, the number of people with diabetes in Saudi Arabia is expected to rise by almost 300% from 890,000 in 2000 to 2,523,000 in 2030. Its prevalence was strongly correlated with energy use, sedentary behavior, and Gross Domestic Product (GDP).

Saudi Arabia, which has the second-highest rate of DM in the Middle East and seven million and three million people with diabetes and pre-diabetes, respectively, is vulnerable to the worldwide diabetes epidemic. Few studies, however, have looked at the levels of treatment compliance and adherence among diabetic patients living in different parts of Saudi Arabia. According to a study by Ahmed et al., 54.8% of diabetic patients disregarded follow-up schedules, medication instructions, and recommendations for healthy foods, and 45.5% of patients with diabetes skipped follow-up sessions.

Saudi Arabia is aiming to reduce the prevalence of the disease by 10% over the next decade. Several initiatives, including taxing sugary drinks, fitness initiatives, and focusing on preventative care, are being taken up by the government to stem the rising epidemic. The government's focus on combating diabetes and the higher purchasing power of the people in the country may help the market for diabetes drugs, like insulin drugs, during the forecast period.

Middle East and Africa Diabetes Treatment Industry Overview

The Middle-East and Africa human insulin market is dominated by Novo Nordisk, Sanofi, and Eli Lilly. However, there are many local players like Biocon, Julphar, Sedico, and Exir, who hold a significant market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Dynamics

- 4.2.1 Market Drivers

- 4.2.2 Market Restraints

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products and Services

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Basal or Long-acting Insulins

- 5.1.1.1 Lantus (Insulin Glargine)

- 5.1.1.2 Levemir (Insulin Detemir)

- 5.1.1.3 Toujeo (Insulin Glargine)

- 5.1.1.4 Tresiba (Insulin Degludec)

- 5.1.1.5 Basaglar (Insulin Glargine)

- 5.1.2 Bolus or Fast-acting Insulins

- 5.1.2.1 NovoRapid/Novolog (Insulin Aspart)

- 5.1.2.2 Humalog (Insulin Lispro)

- 5.1.2.3 Apidra (Insulin Glulisine)

- 5.1.3 Traditional Human Insulins

- 5.1.3.1 Novolin/Actrapid/Insulatard

- 5.1.3.2 Humilin

- 5.1.3.3 Insuman

- 5.1.4 Combination Insulins

- 5.1.4.1 NovoMix (Biphasic Insulin Aspart)

- 5.1.4.2 Ryzodeg (Insulin Degludec and Insulin Aspart)

- 5.1.4.3 Xultophy (Insulin Degludec and Liraglutide)

- 5.1.4.4 Soliqua/Suliqua (Insulin glargine/Lixisenatide)

- 5.1.5 Biosimilar Insulins

- 5.1.5.1 Insulin Glargine Biosimilars

- 5.1.5.2 Human Insulin Biosimilars

- 5.1.1 Basal or Long-acting Insulins

- 5.2 Geography

- 5.2.1 Saudi Arabia

- 5.2.2 Iran

- 5.2.3 Egypt

- 5.2.4 Oman

- 5.2.5 South Africa

- 5.2.6 Rest of Middle East and Africa

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Novo Nordisk

- 7.1.2 Sanofi Aventis

- 7.1.3 Eli Lilly

- 7.1.4 Biocon

- 7.1.5 Pfizer

- 7.1.6 Wockhardt

- 7.1.7 Julphar

- 7.1.8 Exir

- 7.1.9 SEDICO

- 7.2 Company Share Analysis

- 7.2.1 Novo Nordisk AS

- 7.2.2 Sanofi Aventis

- 7.2.3 Eli Lilly and Company

- 7.2.4 Other Company Share Analyses

8 MARKET OPPORTUNITIES AND FUTURE TRENDS