PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444880

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444880

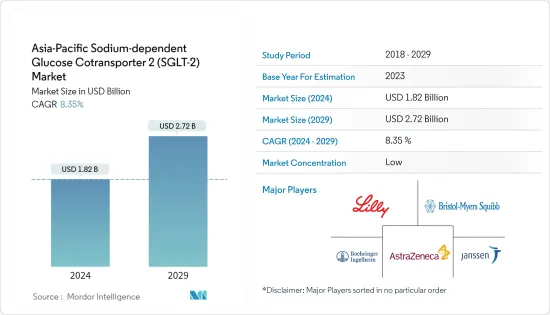

Asia-Pacific Sodium-dependent Glucose Cotransporter 2 (SGLT-2) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Asia-Pacific Sodium-dependent Glucose Cotransporter 2 Market size is estimated at USD 1.82 billion in 2024, and is expected to reach USD 2.72 billion by 2029, growing at a CAGR of 8.35% during the forecast period (2024-2029).

The COVID-19 pandemic positively impacted the Asia-Pacific Sodium-Dependent Glucose Cotransporter 2 market. People with diabetes have a weak immune system so, with COVID-19, the immune system gets weaker very fast. People with diabetes have more chances to get into serious complications rather than normal people. The manufacturers of diabetes drugs have taken care during COVID-19 to deliver the medications to diabetes patients with the help of local governments. NovoNordisk stated on their website that 'Since the start of COVID-19, our commitment to patients, our employees and the communities where we operate has remained unchanged, we continue to supply our medicines and devices to people living with diabetes and other serious chronic diseases, safeguard the health of our employees, and take actions to support doctors and nurses as they work to defeat COVID-19.'

SGLT-2 inhibitors also called gliflozins are a class of medicine used to lower high blood glucose levels in people with type 2 diabetes. SGLT-2 drugs have a significant role in managing cardiovascular risk factors including blood pressure, glycemia, weight, cardiac function, and antiinflammatory activity. Diabetic drugs have been potential candidates for treating diabetic patients affected by SARS-CoV-2 infection during the COVID-19 pandemic.

The Asia-pacific region had witnessed an alarming increase in the prevalence of diabetes, in recent years. Diabetes is associated with many health complications. Patients with diabetes require many corrections throughout the day for maintaining nominal blood glucose levels, such as medications or ingestion of additional carbohydrates by monitoring their blood glucose levels. Diabetes mellitus has been of wide concern with its high prevalence, resulting in increased financial burdens for clinical systems, individuals, and governments. The market players are adopting various strategies such as collaborations, partnerships, mergers, acquisitions, and expansions to increase market share. Technological advancements have increased over the period leading to several modifications either in the SGLT-2 inhibitors or the formulations being developed.

Therefore, due to increased prevalence and the aforementioned factors, the studied market is anticipated to witness growth over the analysis period.

Asia-Pacific Sodium-dependent Glucose Cotransporter 2 (SGLT-2) Market Trends

Jardiance Segment holds the highest market share in the Asia-Pacific Sodium-dependent Glucose Cotransporter 2 (SGLT-2) Market in the current year

Jardiance holds the highest market share of about 43.3% in the Asia-Pacific Sodium-dependent Glucose Cotransporter 2 (SGLT-2) Market in the current year.

Jardiance is a prescription medicine to lower blood sugar, diet, and exercise in adults with type 2 diabetes. It reduces the risk of cardiovascular death in adults with type 2 diabetes, including cardiovascular disease. Jardiance also reduces the risk of cardiovascular death and hospitalization for heart failure in adults when the heart cannot pump enough blood to the rest of the body. It is not for people with type 1 diabetes.

SGLT-2 inhibitor drugs are available internationally and are recommended for use when escalation of treatment for type 2 diabetes is required, along with lifestyle management. Oral agents are typically the first medications used in treating type 2 diabetes due to their wide range of efficacy, safety, and mechanisms of action. SGLT-2 inhibitor drugs help diabetes patients control their condition and lower the risk of diabetes complications. People with diabetes may need to take antidiabetic drugs for their whole lives to control their blood glucose levels and avoid hypoglycemia and hyperglycemia. These agents present the advantages of easier management and lower cost. So they became an attractive alternative to insulin with better acceptance, which enhances adherence to the treatment.

According to International Diabetes Federation, 90 million adults were living with diabetes in the IDF South-East Asia Region in 2021. This figure is estimated to increase to 152 million by 2045, and 206 million adults were living with diabetes in the IDF Western Pacific Region in 2021, which is estimated to increase to 260 million by 2045. The Asia-Pacific region witnessed an alarming increase in the prevalence of diabetes in recent years. In developing countries, such as China and India, the rate of diabetes is at an all-time high. Also, the use of oral anti-diabetes drugs is rising because new-generation drugs reduce the rate of CV risk in diabetes patients. Leading manufacturers are focusing on technological innovations and developing advanced products to gain a substantial market share.

Japan is expected to dominate Asia-Pacific Sodium-dependent Glucose Cotransporter 2 (SGLT-2) Market over the forecast period

Japan holds the highest market share in the Asia-Pacific Sodium-dependent Glucose Cotransporter 2 (SGLT-2) Market in the current year and is expected to grow with a CAGR of about 8% over the forecast period.

Japan includes around 11 million people with diabetes, according to IDF 2021 data. While Type 1 diabetes is caused by an immune system malfunction, Type 2 diabetes is linked to leading a sedentary lifestyle, resulting in inherent resistance to insulin. Japan contains one of the largest elderly populations in the world, which is more susceptible to the onset of type 2 diabetes. As Japan's population continues to age, the prevalence of diabetes also increases. The rise in the number of people with type 2 is driven by a complex interplay of socio-economic, demographic, environmental, and genetic factors. Key contributors include urbanization, an aging population, decreasing levels of physical activity, and increased levels of overweight and obesity.

Much can be done to reduce the impact of diabetes. Evidence suggests that type 2 diabetes can often be prevented. In contrast, early diagnosis and access to appropriate care for all types of diabetes can avoid or delay complications in people with the condition. When diabetes is undetected or inadequately treated, people with diabetes are at risk of serious and life-threatening complications, such as heart attack, stroke, kidney failure, blindness, and lower-limb amputation. These result in reduced quality of life and higher healthcare costs.

Diabetes is identified as a healthcare priority by the Ministry of Health, Labour, and Welfare. The costs of diabetes are increased in patients with co-morbidities such as hypertension and hyperlipidemia and in patients who develop complications. Costs increase with an increasing number of complications. Well-organized medical insurance systems cover all medical fees for diabetes mellitus, and people with diabetes can visit doctors freely in Japan.

Therefore, owing to the factors above, the growth of the studied market is anticipated in the Asia-Pacific Region.

Asia-Pacific Sodium-dependent Glucose Cotransporter 2 (SGLT-2) Industry Overview

The Asia-Pacific Sodium-dependent Glucose Cotransporter 2 (SGLT-2) Market is highly consolidated, with major manufacturers, namely Eli Lilly, Sanofi, and Novo Nordisk, with a global and regional market presence. The joint ventures that occurred between players in the recent past helped the companies strengthen their market presence. For example, Eli Lilly and Boehringer Ingelheim make Jardiance together, which is a very popular SGLT-2 class drug.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Invokana (Canagliflozin)

- 5.2 Jardiance (Empagliflozin)

- 5.3 Farxiga/Forxiga (Dapagliflozin)

- 5.4 Suglat (Ipragliflozin)

- 5.5 Geography

- 5.5.1 Japan

- 5.5.2 South Korea

- 5.5.3 China

- 5.5.4 India

- 5.5.5 Australia

- 5.5.6 Vietnam

- 5.5.7 Malaysia

- 5.5.8 Indonesia

- 5.5.9 Philippines

- 5.5.10 Thailand

- 5.5.11 Rest of Asia-Pacific

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 COMPANY PROFILES

- 7.1.1 Eli Lilly

- 7.1.2 Janssen Pharmaceuticals

- 7.1.3 Boehringer Ingelheim

- 7.1.4 AstraZeneca

- 7.1.5 Bristol Myers Squibb

- 7.2 MARKET SHARE ANALYSIS

- 7.2.1 Eli Lilly

- 7.2.2 AstraZeneca

- 7.2.3 Others

8 MARKET OPPORTUNITES AND FUTURE TRENDS