PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444666

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1444666

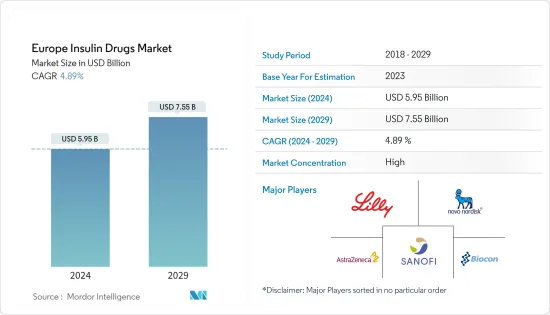

Europe Insulin Drugs - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029)

The Europe Insulin Drugs Market size is estimated at USD 5.95 billion in 2024, and is expected to reach USD 7.55 billion by 2029, growing at a CAGR of 4.89% during the forecast period (2024-2029).

The COVID-19 pandemic has substantially impacted the European Insulin Drugs Market. Type-1 diabetes patients are impacted more during Covid-19. People with diabetes are having a weak immune system so, with COVID-19, the immune system gets weaker very fast. People with diabetes will have more chances to get into serious complications rather than normal people. The manufacturers have taken care during COVID-19 to deliver insulin products to diabetes patients with the help of local governments. Novo Nordisk stated on their website that 'Since the start of COVID-19, our commitment to patients, our employees and the communities where we operate has remained unchanged, we continue to supply our medicines and devices to people living with diabetes and other serious chronic diseases, safeguard the health of our employees, and take actions to support doctors and nurses as they work to defeat COVID-19.' Doctors around the world suggested diabetes patients should check their diabetes levels more often to be careful and the intake of medicine has increased, which lead to an increase in the usage of insulin drugs.

According to the diabetes category, the estimated cost per hospital admission during the first wave of COVID-19 in Europe ranged from EUR 25,018 for type 2 diabetes patients in good glycemic control to EUR 57,244 for type 1 diabetes patients in poor glycemic control, reflecting a higher risk of intensive care, ventilator support, and a longer hospital stay. The estimated cost for patients without diabetes was EUR 16,993. The expected total direct expenditures for COVID-19 secondary care in Europe were 13.9 billion euros. Diabetes treatment thus accounted for 23.5% of total expenditures.

The European countries are suffering from the burden of high diabetes expenditure due to its rising prevalence. Approximately 10% of the total diabetes population is having type-1 diabetes and approximately out of this 10% of people only 80-90% use Insulin but the usage of insulin is rising from time to time, even type-2 diabetes patients are using the insulin drugs during COVID-19. Technological advancements have increased over the period in Insulin drugs.

Therefore, owing to the aforementioned factors the studied market is anticipated to witness growth over the analysis period.

Europe Insulin Drugs Market Trends

Increasing diabetes prevalence

The diabetes population in the European region is expected to rise by more than 15% during the forecast period. According to the IDF 2021 report, about 1 in 11 adults in Europe had diabetes, which accounted for approximately 61 million. The overall diabetes expenditure in Europe was USD 189 billion. These figures indicate that approximately 19.6% of global expenditures are spent on diabetes in Europe.

The European region has witnessed an alarming increase in the prevalence of diabetes in recent years. Patients with diabetes require many corrections throughout the day for maintaining normal blood glucose levels, such as oral anti-diabetic medication or the ingestion of additional carbohydrates, by monitoring their blood glucose levels. The rate of newly diagnosed type-1 and type-2 diabetes cases is seen to increase, mainly due to obesity, an unhealthy diet, and physical inactivity. The rapidly increasing incidence and prevalence of diabetic patients and healthcare expenditure are indications of the increasing usage of diabetic drugs.

According to the IDF, the overall diabetes expenditure in Europe among the population aged 20-79 years was USD 156 billion, and it is expected to increase to USD 174 billion by 2040. According to other statistics from the IDF, every year 21,600 children are added to the type-1 diabetic population pool. These figures indicate that approximately 9% of the total healthcare expenditure is spent on diabetes in Europe.

Germany is expected to register a healthy growth rate in the European Insulin Drugs Market

Germany is expected to register a CAGR of more than 2% in the forecast period.

Diabetes is a significant health problem and one of the astounding challenges facing healthcare systems all over Germany. The prevalence of known type-1 and type-2 diabetes in the German adult population is very high, along with a high number of patients who are not yet diagnosed with the disease. Due to an aging population and an unhealthy lifestyle, the prevalence of type-2 diabetes is expected to increase steadily over the next few years. High-quality care, including adequate monitoring, control of risk factors, and active self-management, are the key factors for preventing complications in German patients with type-2 diabetes.

The growing incidence, prevalence, and progressive nature of the disease have encouraged the development of new drugs to provide additional treatment options for diabetic patients. According to the German Diabetes Center (DDZ), at least 7.2% of the population in Germany currently lives with diabetes, which will increase significantly over the next two decades. German law requires public plans to cap out-of-pocket health care costs and to cover all medically necessary treatment, including insulin. Germany is one of the most developed countries in terms of healthcare facilities. Moreover, the reimbursement policy and the pricing policy are highly regulated, which drives the market. The roll-out of many new products, increasing international research collaborations in technological advancement, and increasing awareness about diabetes among the public are some of the market opportunities for the players in the German insulin drug market.

Europe Insulin Drugs Industry Overview

The European insulin drug market is highly consolidated in nature due to the presence of only a few major companies operating globally as well as regionally. Mergers and acquisitions between players in the recent past have helped companies strengthen their market presence. Eli Lilly and Boehringer Ingelheim have an alliance to develop and commercialize Abasaglar (Insulin Glargine).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Insulin

- 5.1.1 Basal or Long-acting Insulins

- 5.1.1.1 Lantus (Insulin Glargine)

- 5.1.1.2 Levemir (Insulin Detemir)

- 5.1.1.3 Toujeo (Insulin Glargine)

- 5.1.1.4 Tresiba (Insulin Degludec)

- 5.1.1.5 Abasaglar (Insulin Glargine)

- 5.1.2 Bolus or Fast-acting Insulins

- 5.1.2.1 NovoRapid\Novolog (Insulin Aspart)

- 5.1.2.2 Humalog (Insulin Lispro)

- 5.1.2.3 Apidra (Insulin Glulisine)

- 5.1.2.4 FIASP (Insulin Aspart)

- 5.1.2.5 Admelog (Insulin Lispro)

- 5.1.3 Traditional Human Insulins

- 5.1.3.1 Novolin\Actrapid\Insulatard

- 5.1.3.2 Humilin

- 5.1.3.3 Insuman

- 5.1.4 Insulin Combinations

- 5.1.4.1 NovoMix (Biphasic Insulin Aspart)

- 5.1.4.2 Ryzodeg (Insulin Degludec and Insulin Aspart)

- 5.1.4.3 Xultophy (Insulin Degludec and Liraglutide)

- 5.1.4.4 Soliqua/Suliqua (Insulin Glargine and Lixisenatide)

- 5.1.5 Biosimilar Insulins

- 5.1.5.1 Insulin Glargine Biosimilars

- 5.1.5.2 Human Insulin Biosimilars

- 5.1.1 Basal or Long-acting Insulins

- 5.2 Geography

- 5.2.1 United Kingdom

- 5.2.2 Germany

- 5.2.3 France

- 5.2.4 Russia

- 5.2.5 Spain

- 5.2.6 Italy

- 5.2.7 Rest of Europe

6 MARKET INDICATORS

- 6.1 Type-1 Diabetes Population

- 6.2 Type-2 Diabetes Population

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Novo Nordisk

- 7.1.2 Eli Lilly

- 7.1.3 Sanofi

- 7.1.4 AstraZeneca

- 7.1.5 Biocon

- 7.1.6 Pfizer

- 7.1.7 Wockhardt

- 7.2 Company Share Analysis

- 7.2.1 Novo Nordisk

- 7.2.2 Eli Lilly

- 7.2.3 Sanofi

- 7.2.4 Other Company Share Analyses

8 MARKET OPPORTUNITIES AND FUTURE TRENDS