PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850974

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1850974

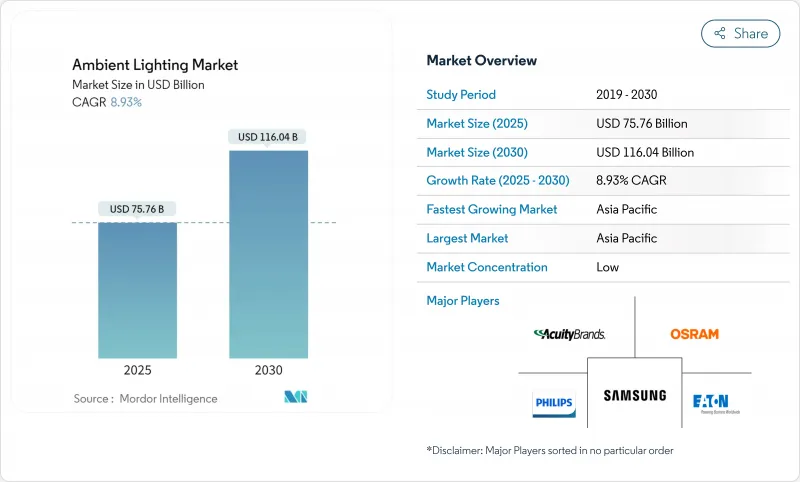

Ambient Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The ambient lighting market stands at USD 75.76 billion in 2025 and is forecast to reach USD 116.04 billion by 2030, advancing at an 8.93% CAGR.

Growth is anchored in global efficiency mandates, rapid LED penetration, and the widening appeal of connected systems that link lighting with broader smart-building platforms. LED-based products already account for 90% of total lighting sales, reshaping value chains toward software, sensors, and services. Asia Pacific owns nearly one-half of worldwide revenue and continues to expand at double-digit speed on the back of urbanization programs and state-funded smart-city rollouts. Product mix is shifting: lamps and luminaires still dominate, yet controls are now the strategic growth engine as end users seek energy savings, data, and human-centric functions that raise productivity.

Global Ambient Lighting Market Trends and Insights

LED retrofit mandates accelerating commercial upgrades in EU and Australia

Stringent policy frameworks such as the European Union Ecodesign Directive and Australia's National Construction Code are forcing the phase-out of legacy lamps. Compliance rather than payback is now the tipping point, pushing building owners to adopt LED fixtures that satisfy minimum efficacy thresholds. The commercial segment alone is projected to jump from USD 17.07 billion in 2024 to USD 27.38 billion by 2030 as mandated upgrades converge with rising demand for connected controls. Suppliers are responding with quick-fit lamps, driverless tubes, and field-programmed retrofit kits that minimize downtime and labor costs.

Smart-city investments driving connected street-light retrofits in Asia

National smart-city missions across China, India, and Japan place adaptive street lighting at the core of digital infrastructure. Municipalities are replacing conventional high-pressure sodium fixtures with networked LEDs that can host 5G small cells, air-quality sensors, and traffic cameras. Wireless protocols such as Zigbee and BLE Mesh offer scalability without trenching new cables, a decisive factor in dense urban cores. Hardware specialists that deliver open-API nodes are well-positioned as cities bundle lighting with broader IoT services.

High inrush-current failures in large-scale LED strip deployments

Multi-string strip systems can draw damaging current spikes when thousands of drivers power up simultaneously, triggering breaker trips and warranty claims. Soft-start power supplies and sequential controllers mitigate risk but add cost. Reliability concerns may delay rollouts in logistics hubs where linear lighting often spans hundreds of meters.

Other drivers and restraints analyzed in the detailed report include:

- OEM-triggered ambient packages in mid-segment autos

- WELL and LEED v4 standards pushing human-centric lighting in US offices

- Fragmented wireless protocols elevating control-system integration cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Lamps and luminaires remain the revenue cornerstone, holding 71% in 2024 thanks to the mass conversion from fluorescent and halogen to LED. ENERGY STAR-rated fixtures consume 90% less power than incandescent alternatives and last 15 times longer, slashing maintenance budgets and carbon footprints. Replacement activity across offices, homes, and warehouses keeps demand stable even as unit prices fall.

Lighting controls are the market's accelerant, forecast to grow 9.4% annually. Open DALI gateways, Bluetooth LE networks, and cloud dashboards embed data insights that extend beyond energy management. Signify reports that connected systems and services delivered 30% of company sales in 2024, confirming rising customer appetite for software-centric propositions. The ambient lighting market size for connected controls is set to widen as building codes mandate occupancy sensing and daylight harvesting.

Retrofit and renovation projects generated 63% of 2024 revenue as owners upgraded vast stocks of outdated fixtures. The United States residential remodeling market surpassed USD 600 billion in 2022, with 34% of spend flowing into energy-related upgrades that include lighting. City carbon caps such as New York Local Law 97 amplify urgency, imposing fines starting in 2025 for inefficiency breaches. Guidance from the U.S. General Services Administration lists LED tubes, retrofit kits, or full luminaire swaps as approved pathways, fueling a deep replacement funnel.

New construction accounts for a smaller base but will outpace retrofits at 9.1% CAGR. Architects now program lighting early in design workflows to capture WELL and LEED credits, integrate sensors, and streamline commissioning. Smart commercial campuses specify network-ready fixtures as baseline, propelling ambient lighting market penetration in mixed-use towers, data centers, and healthcare facilities. Ambient lighting market size gains in new builds are also supported by economies of scale that allow bundled hardware-plus-software contracts.

The Ambient Lighting Market Report is Segmented by Offering (Lamps and Luminaires, and Lighting Controls), Installation Phase (New Construction, Retrofit and Renovation), Type (Surface-Mounted Light, Track Light, Sand More), Lumen Output (<=3 000 Lm (Residential), and More), Connectivity (Wired, and Wireless), End User (Residential, Automotive, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific controls 46% of 2024 revenue and will grow at 12.8% CAGR through 2030, driven by state subsidies for efficient lighting, sprawling residential construction, and global leadership in LED component production. China spearheads both manufacturing prowess and giant smart-city pilots that anchor connected street-light demand. India's 100-city mission and Japan's Society 5.0 vision reinforce the regional pipeline for controls, sensors, and platform integration.

North America is a mature but innovation-led arena. Signify's 2024 data show that the United States contributed USD 2.20 billion, roughly one-third of its global sales. Residential remodels remain strong, yet office downsizing after COVID slows some retrofit schedules. WELL and LEED adoption maintains momentum for human-centric upgrades that justify premium fixtures and advanced controls.

Europe occupies a design-centric and regulation-heavy position. The Ecodesign Directive obliges LED transitions across commercial estates, and the region champions high color-rendering products that align with its emphasis on visual comfort. Automakers in Germany and France extend ambient packages downrange, spurring component suppliers to deliver cost-optimized RGB modules.

South America and the Middle East & Africa together contribute a smaller share but post healthy growth. GCC hospitality refurbishments prioritize dramatic ambience, while African infrastructure programs channel public funds into efficient street lighting that doubles as a smart-city gateway. The ambient lighting market gains long-term upside as governments apply green-building codes and attract foreign direct investment.

- Signify N.V. (Philips Lighting)

- Acuity Brands, Inc.

- ams OSRAM AG

- Hubbell Incorporated

- Eaton Corporation plc (Cooper Lighting)

- Cree Lighting (Savant Systems)

- Zumtobel Group

- GE Lighting, a Savant company

- Panasonic Life Solutions

- Wipro Lighting

- Samsung Electronics (LED Division)

- LG Innotek

- Bridgelux, Inc.

- Helvar Oy

- Dialight plc

- Fagerhult Group

- Legrand S.A.

- Lutron Electronics

- SPI Lighting

- Amerlux, LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 LED Retrofit Mandates Accelerating Commercial Up-grades in EU and Australia

- 4.2.2 Smart-city Investments Driving Connected Street-light Retrofits in Asia

- 4.2.3 OEM-Triggered Ambient Packages in Mid-segment Autos (Asia and Europe)

- 4.2.4 WELL and LEED v4 Standards Pushing Human-Centric Lighting in United States Offices

- 4.2.5 Hospitality Re-brand Cycles Increasing Aesthetic Ambient Budgets (Gulf Cooperation Council Countries)

- 4.2.6 Rapid e-commerce Warehouse Build-outs Needing Low-glare Luminaires

- 4.3 Market Restraints

- 4.3.1 High Inrush-Current Failures in Large-scale LED Strip Deployments

- 4.3.2 Fragmented Wireless Protocols Elevating Control-System Integration Cost

- 4.3.3 Post-COVID Office Downsizing Reducing Retrofit Pipelines (NA and EU)

- 4.3.4 Tight Rare-earth Supply Chain Inflating Phosphor and Driver Prices

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Offering

- 5.1.1 Lamps and Luminaires

- 5.1.1.1 Incandescent Lamps

- 5.1.1.2 Halogen Lamps

- 5.1.1.3 Fluorescent Lamps

- 5.1.1.4 Light-Emitting Diode (LED)

- 5.1.2 Lighting Controls

- 5.1.1 Lamps and Luminaires

- 5.2 By Installation Phase

- 5.2.1 New Construction

- 5.2.2 Retrofit and Renovation

- 5.3 By Type

- 5.3.1 Surface-mounted Light

- 5.3.2 Track Light

- 5.3.3 Strip Light

- 5.3.4 Suspended Light

- 5.3.5 Recessed Light

- 5.4 By Lumen Output

- 5.4.1 Sub 3 000 lm (Residential)

- 5.4.2 3 001 - 10 000 lm (Commercial)

- 5.4.3 Above10 000 lm (Industrial and Outdoor)

- 5.5 By Connectivity

- 5.5.1 Wired (DALI, KNX)

- 5.5.2 Wireless (Zigbee, BLE Mesh, Thread)

- 5.6 By End User

- 5.6.1 Residential

- 5.6.2 Automotive

- 5.6.3 Hospitality and Retail

- 5.6.4 Healthcare

- 5.6.5 Industrial and Logistics

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Italy

- 5.7.2.5 Spain

- 5.7.2.6 Nordics

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 South Korea

- 5.7.3.4 India

- 5.7.3.5 South East Asia

- 5.7.3.6 Australia

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Rest of South America

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Signify N.V. (Philips Lighting)

- 6.4.2 Acuity Brands, Inc.

- 6.4.3 ams OSRAM AG

- 6.4.4 Hubbell Incorporated

- 6.4.5 Eaton Corporation plc (Cooper Lighting)

- 6.4.6 Cree Lighting (Savant Systems)

- 6.4.7 Zumtobel Group

- 6.4.8 GE Lighting, a Savant company

- 6.4.9 Panasonic Life Solutions

- 6.4.10 Wipro Lighting

- 6.4.11 Samsung Electronics (LED Division)

- 6.4.12 LG Innotek

- 6.4.13 Bridgelux, Inc.

- 6.4.14 Helvar Oy

- 6.4.15 Dialight plc

- 6.4.16 Fagerhult Group

- 6.4.17 Legrand S.A.

- 6.4.18 Lutron Electronics

- 6.4.19 SPI Lighting

- 6.4.20 Amerlux, LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment