PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851786

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1851786

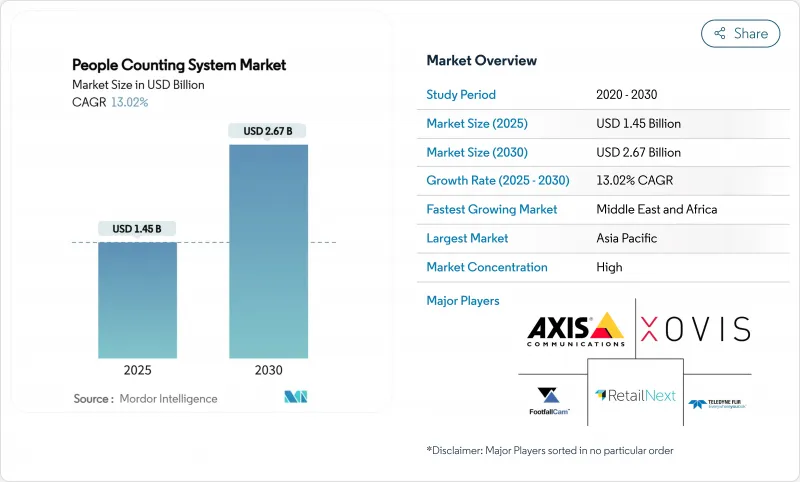

People Counting System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The People Counting System Market size is estimated at USD 1.45 billion in 2025, and is expected to reach USD 2.67 billion by 2030, at a CAGR of 13.02% during the forecast period (2025-2030).

Steady demand comes from smart-city spending, post-pandemic occupancy requirements, and the continuing shift toward AI-enabled sensor fusion that raises accuracy while lowering operating costs. Adoption accelerates as Time-of-Flight (ToF) sensors deliver 99.8% accuracy and integrate privacy-by-design features that help owners meet GDPR and CCPA mandates. Energy-saving tie-ins with HVAC systems underline a move from point analytics to portfolio-wide optimization, with documented commercial-building pilots posting 12.5% energy reductions. Smart-transport projects across Asia Pacific, metro expansion in the Middle East, and mall traffic rebounds in the United States sustain multi-vertical momentum. At the same time, semiconductor supply disruption and heightened compliance costs create price tension that smaller retailers must navigate.

Global People Counting System Market Trends and Insights

Smart-retail demand for real-time footfall analytics in North America and Europe

Retailers rely on anonymized footfall data to raise conversion and calibrate staffing; evidence from U.S. malls shows 5-15% revenue uplift after analytics rollouts. Link Retail's LinkVision camera software leverages existing CCTV to surpass 95% accuracy, lowering retrofit costs for European chains. Telstra's 2024 deployment across Australian stores underscores global reach, pairing >95% accuracy with on-device processing that addresses privacy risk. By enriching traffic counts with demographic metadata, retailers adjust layouts and execute targeted promotions without data-sharing exposure. These traction points reinforce the People Counting System market as a core pillar of omnichannel strategy.

Post-COVID occupancy compliance mandates fueling installations (EU, US)

Revised building codes now require live head-counting to support emergency egress and indoor-air-quality monitoring, spurring adoption in health facilities and public offices. The GSA Oklahoma City Federal Building linked occupancy sensors to its BMS and cut energy use 41%, proving ROI to government buyers. GDPR-aligned designs from FootfallCam anonymize data at chip level, preventing storage of personal imagery while sustaining counting fidelity. Homeland Security's 2024 survey that endorsed 15 crowd-analysis tools confirms the technology's relevance to public-safety readiness. Heightened compliance requirements therefore work as both catalyst and filter, rewarding vendors with defensible privacy credentials.

GDPR/CCPA privacy compliance hindering camera-based adoption in EU and CA

Stringent consent rules compel vendors to embed anonymization and local processing, raising bill-of-materials and legal consultancy costs. Aura Vision's on-device analytics avoid image storage, satisfying regulators yet still capturing directional counts. ToF sensors emerge as a substitute, providing >95% accuracy without identifiable frames, easing certification hurdles. Vendors that can verify end-to-end compliance are increasingly favored in public tenders, which shapes competitive dynamics within the People Counting System market.

Other drivers and restraints analyzed in the detailed report include:

- Smart-city transportation hubs deploying crowd-flow sensors across Asia

- AI-enabled video analytics cutting TCO and boosting accuracy

- Accuracy gaps in open-area counting reducing buyer confidence (stadiums)

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware continues to dominate People Counting System market revenue, holding 64% share in 2024. Capital outlays concentrate on ToF and LiDAR sensors installed across retail thresholds, airport terminals, and public facilities. Managed services, however, are climbing at a 13.7% CAGR as operators seek outsourced analytics, compliance auditing, and continuous calibration. The migration from one-off installs to subscription models transforms revenue visibility and underpins sustainable growth. People Counting System industry participants leverage cross-selling-pairing sensor upgrades with dashboard training-to lock in multi-year contracts. Software platforms move toward micro-services that ingest third-party data, supporting predictive staffing and energy-optimization use cases.

Integration depth raises complexity, positioning services firms as orchestrators that align IT security, facilities management, and marketing. Projects that join occupancy data with HVAC schedules demonstrate tangible opex gains, encouraging building owners to shift spending from fixed assets to outcome-based agreements. As a result, the services category helps diversify the People Counting System market beyond hardware refresh cycles.

Infrared beam sensors captured 36.5% of People Counting System market share in 2024 on the back of reliability in narrow-door installations. Yet ToF 3D sensors are set to expand at a 14.4% CAGR, catalyzed by privacy laws that favor non-imaging depth measurement. By converting light-flight time into depth maps, ToF differentiates people from carts and pets, sustaining accuracy under changing lighting. The shift bodes well for vendors with proprietary ToF ASICs that can embed GDPR-inclusive logic. Video-based approaches survive by pivoting to on-edge inference that strips personal imagery, but some buyers remain cautious. Thermal imaging occupies a niche in hospitals where temperature screening merges with head counts. The People Counting System market size tied to ToF sensors is projected to eclipse infrared revenues before 2030 as component cost curves decline.

Hybrid deployments that blend ToF at entry points with Wi-Fi probes in open zones demonstrate rising interest in multimodal precision. Qualcomm's patent work on scalable depth estimation underscores wider tech-stack investment that will keep ToF on a steep performance trajectory. As adoption broadens, economies of scale further compress price points, reinforcing switch-over momentum.

People Counting System Market Report is Segmented by Offering (Hardware, Software, Services), Sensor Technology (Infrared Beam, Thermal Imaging, Video-Based and More), Deployment Mode (On-Premise, Cloud), Connectivity (Wired, Wireless, LP-WAN), End-User Vertical (Retail, Malls, Transportation, Hospitality and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific holds a 31.4% revenue stake in 2024, propelled by government-funded smart-city frameworks and locally manufactured sensor hardware that compresses unit costs. Singapore's MRT applies camera upgrades and ticket data to push crowdedness alerts, while Hong Kong integrates LiDAR-backed edge AI for railway safety. Japan's JR East processes Suica transaction logs across ~600 stations to model commuter flow, feeding both transport planning and retail placement. China's tier-two city urbanization fuels bulk orders for crowd-management kits, and Southeast Asian airports deploy ToF counters to speed security lines. These coordinated infrastructure goals cement the region's long-term dominance within the People Counting System market.

The Middle East emerges as the fastest-growing geography at a 14.2% CAGR. Vision 2030 programs back large-scale sensor rollouts in Saudi Arabia, the UAE, and Qatar. Bold Technologies allocates USD 2.5 billion to the Aion Sentia cognitive-city platform that fuses mobility, healthcare, and energy data on one AI layer. Dubai targets a city-wide digital twin via street-level sensors, expanding opportunities for crowd analytics providers. Venture-capital flows into MENA analytics startups indicate rising local supply capacity.

North America sustains adoption through retail refresh cycles and federal facility mandates. The return of U.S. mall shoppers in 2025 renews appetite for staff-versus-shopper differentiation features. Europe's GDPR regime fosters privacy-centric ToF and on-edge video solutions, stimulating upgrades rather than greenfield sales. South America grapples with SMB affordability, while Africa's nascent smart-city schemes provide longer-dated upside.

- RetailNext Inc.

- Sensormatic Solutions (ShopperTrak)

- Axis Communications AB

- Teledyne FLIR Systems Inc.

- HELLA Aglaia Mobile Vision GmbH

- IEE S.A.

- InfraRed Integrated Systems Ltd. (IRISYS)

- Traf-Sys Inc.

- FootfallCam Ltd.

- V-Count Inc.

- Xovis AG

- iris-GmbH infrared and intelligent sensors

- DILAX Intelcom GmbH

- Eurotech S.p.A.

- SensMax Ltd.

- Countlogic LLC

- Dor Technologies Inc.

- Density Inc.

- Cognimatics AB

- Megvii Technology Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smart-Retail Demand for Real-Time Footfall Analytics in North America and Europe

- 4.2.2 Post-COVID Occupancy Compliance Mandates Fueling Installations (EU, US)

- 4.2.3 Smart-City Transportation Hubs Deploying Crowd-Flow Sensors Across Asia

- 4.2.4 AI-Enabled Video Analytics Cutting TCO and Boosting Accuracy

- 4.2.5 HVAC Energy-Optimization via Occupancy Integration in Commercial Buildings

- 4.2.6 Venture-Capital Surge into MENA Footfall-as-a-Service Platforms

- 4.3 Market Restraints

- 4.3.1 GDPR/CCPA Privacy Compliance Hindering Camera-Based Adoption in EU and CA

- 4.3.2 Accuracy Gaps in Open-Area Counting Reducing Buyer Confidence (Stadiums)

- 4.3.3 Legacy BMS Integration Complexity in Emerging Markets

- 4.3.4 Price Sensitivity of SMB Retailers in South America

- 4.4 Regulatory and Technological Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Technology Snapshot

- 4.6.1 Wired Sensors

- 4.6.2 Wireless (Wi-Fi / BLE / LoRa)

- 4.6.3 Thermal Imaging Sensors

- 4.6.4 Time-of-Flight 3-D Sensors

- 4.6.5 Other Technologies (Pressure Mats, Magnetic, LiDAR)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Offering

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Sensor Technology

- 5.2.1 Infrared Beam

- 5.2.2 Thermal Imaging (IR)

- 5.2.3 Video-Based (Mono / Stereo / AI)

- 5.2.4 Time-of-Flight (3-D)

- 5.2.5 Pressure and Magnetic

- 5.2.6 Wi-Fi / BLE Probe

- 5.3 By Deployment Mode

- 5.3.1 On-Premise

- 5.3.2 Cloud

- 5.4 By Connectivity

- 5.4.1 Wired (Ethernet / PoE)

- 5.4.2 Wireless (Wi-Fi)

- 5.4.3 LP-WAN (LoRa, Zigbee, BLE)

- 5.5 By End-User Vertical

- 5.5.1 Retail Stores

- 5.5.2 Shopping Malls and Hypermarkets

- 5.5.3 Transportation Hubs (Airports / Metro / Bus)

- 5.5.4 Hospitality and Leisure (Hotels, Casinos, Theme Parks)

- 5.5.5 Sports and Entertainment Venues

- 5.5.6 Banks and Financial Institutions

- 5.5.7 Corporate and Government Buildings

- 5.5.8 Healthcare Facilities

- 5.5.9 Smart Cities and Public Spaces

- 5.5.10 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics (Sweden, Norway, Denmark, Finland)

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Southeast Asia

- 5.6.4.6 Australia

- 5.6.4.7 New Zealand

- 5.6.4.8 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 RetailNext Inc.

- 6.4.2 Sensormatic Solutions (ShopperTrak)

- 6.4.3 Axis Communications AB

- 6.4.4 Teledyne FLIR Systems Inc.

- 6.4.5 HELLA Aglaia Mobile Vision GmbH

- 6.4.6 IEE S.A.

- 6.4.7 InfraRed Integrated Systems Ltd. (IRISYS)

- 6.4.8 Traf-Sys Inc.

- 6.4.9 FootfallCam Ltd.

- 6.4.10 V-Count Inc.

- 6.4.11 Xovis AG

- 6.4.12 iris-GmbH infrared and intelligent sensors

- 6.4.13 DILAX Intelcom GmbH

- 6.4.14 Eurotech S.p.A.

- 6.4.15 SensMax Ltd.

- 6.4.16 Countlogic LLC

- 6.4.17 Dor Technologies Inc.

- 6.4.18 Density Inc.

- 6.4.19 Cognimatics AB

- 6.4.20 Megvii Technology Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment