PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687765

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687765

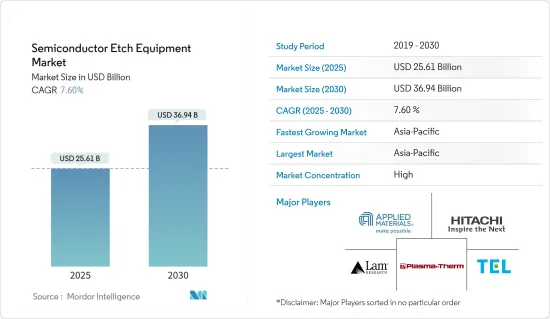

Semiconductor Etch Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Semiconductor Etch Equipment Market size is estimated at USD 25.61 billion in 2025, and is expected to reach USD 36.94 billion by 2030, at a CAGR of 7.6% during the forecast period (2025-2030).

Key Highlights

- Capital Spending Drives Semiconductor Etch Equipment Growth: The Semiconductor Etch Equipment Market is experiencing robust growth, fueled by increased capital spending on semiconductor processing. Global investments in the semiconductor industry have surged, with countries like France allocating USD 1.9 billion and Germany investing USD 12 billion into microelectronics projects. US firms dominate the market, controlling over 50% of major manufacturing process equipment categories, while Japan commands 90% of the photoresist processing market. This investment surge is propelling demand for advanced etching technologies, critical for producing smaller, thinner, and faster devices.

- China's Investment: China announced plans to invest USD 1.4 trillion between 2020 and 2025, focusing on advanced technologies, including semiconductors.

- Joint Investment in Japan: TSMC and Sony Corp. jointly invested USD 7 billion in a new chip factory in Japan.

- EU's Digital Infrastructure Focus: The European Union allocated up to 20% of its USD 917 billion Covid recovery fund toward digital infrastructure, focusing on microelectronics.

- Intel's Mega Investment: Intel unveiled plans for a USD 88 billion investment across Europe, including a new "megafab" in Germany.

- Technological Advancements Reshape Market Landscape: Rapid technological advancements are reshaping the Semiconductor Etch Equipment Market, with a clear shift towards plasma etch systems, which consume fewer chemicals and are more suited for automating single wafer manufacturing. This evolution is driven by the growing demand for energy-efficient electronic devices with improved performance, spurring the development of miniature semiconductor integrated circuits (ICs).

- Selective Etching: Lam Research introduced selective etch devices in February 2022, employing innovative wafer fabrication techniques for gate-all-around (GAA) transistor architectures.

- Surface Preparation Tech: ClassOne Technology expanded its Solstice automated single-wafer platform with surface preparation (SP) technologies in July 2022.

- Thermal Processing Innovation: Plasma-Therm revamped its Heatpulse Rapid Thermal Processing (RTP) platform, securing multiple purchases from global chipmakers.

- FPD Equipment Development: Tokyo Electron continues to evolve its FPD production equipment, optimizing it for higher resolutions and ultra-low power consumption for TVs, smartphones, and other devices.

- Market Segmentation Reflects Diverse Applications: The Semiconductor Etch Equipment Market is segmented by product type, etching film type, and application. High-density etch equipment leads the market, with revenue expected to reach USD 19,289.61 million by 2027. The conductor etching segment is forecasted to grow at a CAGR of 4.55% from 2022 to 2027, reaching USD 12,554.46 million by the end of the forecast period.

- Key Growth Drivers: Foundries, MEMS, sensors, and power devices are key application areas driving market growth.

- Smart Devices and IoT: The adoption of IoT and growing demand for smart devices are increasing the need for miniature semiconductors, fueling the etch equipment market.

- Wet Etching for Solar Cells: Wet etching continues to find applications in solar cell manufacturing due to its high selectivity and material preservation properties.

- Investment Analysis Reveals Market Potential: Significant investments are pouring into the Semiconductor Etch Equipment Market, reflecting its potential for growth. Companies are scaling up manufacturing capacities and boosting R&D efforts to meet the rising demand for advanced semiconductor technologies.

- Lam Research's Expansion: Lam Research Corporation opened its largest facility in Malaysia in August 2021, enhancing its global manufacturing footprint.

- US Semiconductor Investment: The US government approved a USD 50 billion investment in the semiconductor industry, focusing on production, research, and design.

- India's Semiconductor Push: India greenlit a USD 10 billion investment in semiconductor manufacturing, aiming to establish a variety of fabrication plants.

- MIT.nano's R&D Expansion: MIT.nano acquired a new SAMCO inductively coupled plasma (ICP) reactive-ion etching (RIE) system in July 2021, boosting research into novel materials.

Semiconductor Etch Equipment Market Trends

High-Density Etch Equipment Segment Holds Significant Market Share

- Dominant Market Share and Robust Growth: The high-density etch equipment segment holds the largest market share, comprising 63.59% of the semiconductor etch equipment market in 2021, valued at USD 12,544.1 million. Projections indicate that this segment will grow to USD 19,289.6 million by 2027, at a compound annual growth rate (CAGR) of 5.66%.

- Technological Advancements Driving Demand: As industries push for "smart everything," demand for smaller, more efficient devices is soaring. This trend is propelling semiconductor manufacturing technologies to deliver precision in high-temperature chemical processes, where cleanliness and precise chemical dosing are key.

- Shift to Advanced Etching Technologies: The industry has largely transitioned from traditional wet etching to plasma etch systems, which are more efficient and better suited for automating single wafer manufacturing. This shift is essential for the development of miniature semiconductor ICs, which power energy-efficient devices.

- Investment in Research and Development: Heavy R&D investment is critical in the semiconductor sector. The United States, for instance, has committed to doubling research investments in semiconductor-related fields, aiming to spur innovation in artificial intelligence, quantum computing, and advanced wireless technologies.

Industry Innovations:

- ClassOne's Solstice Expansion: ClassOne Technology incorporated new surface preparation technologies into its Solstice platform in July 2022.

- Plasma-Therm's RTP Platform: Plasma-Therm's flagship Heatpulse RTP platform saw multiple purchases from major global chipmakers after its recent overhaul.

Asia-Pacific to Witness Significant Growth

- Market Leadership and Rapid Growth: Asia Pacific dominates the semiconductor etch equipment market with an 84.72% market share in 2021, valued at USD 16.71 billion. This region is projected to grow at a CAGR of 4.52%, reaching USD 23.80 billion by 2029.

- China's Push for Self-Reliance: China has made substantial progress towards self-reliance in 7nm chip production, developing tools and know-how for several semiconductor manufacturing segments. This drive for self-sufficiency is a major factor propelling investments and innovations in semiconductor etch equipment in the region.

- Strategic Investments and Collaborations: The region has attracted significant investment from both domestic and international players. For example, TSMC announced a USD 2.8 billion investment in China to ramp up automotive chip production. Similarly, India is making strides with ISMC's planned USD 3 billion semiconductor manufacturing facility.

- Localization of Manufacturing: Global companies are increasingly localizing production in Asia Pacific. In February 2022, Lam Research started manufacturing next-generation core equipment in South Korea, strengthening its ties with Samsung Electronics' memory and system semiconductor production.

- Automotive Industry Driving Demand: The development of fully-autonomous vehicles is expected to significantly impact the semiconductor industry, particularly in Asia Pacific. As the automotive and semiconductor industries work to enhance technologies for autonomous driving, demand for semiconductor and etch equipment is expected to rise sharply.

Semiconductor Etch Equipment Industry Overview

Global Leaders Dominate Consolidated Market: The Semiconductor Etch Equipment Market is highly consolidated, dominated by global players and specialized companies. The largest players hold significant market shares, owing to the high barriers to entry in terms of capital and technological expertise. Large, multinational corporations with extensive research capabilities primarily drive the market.

Innovation and Technological Prowess Define Market Leaders: Key market leaders include Applied Materials Inc., Lam Research Corporation, Tokyo Electron Limited, and Hitachi High-Technologies America Inc. These companies maintain their positions through continuous R&D, focusing on advancing plasma etch systems and high-density inductively coupled plasma (ICP) etching technologies. Their global reach and strategic partnerships with key semiconductor manufacturers further solidify their market dominance.

Strategies for Future Success in the Market: To gain a larger market share, players must focus on innovation in precision and efficiency, particularly for smaller node sizes. Expanding manufacturing capacity and forming strategic partnerships with research institutions and semiconductor manufacturers will also be key. Moreover, adapting to the growing demand for semiconductors driven by trends like IoT and AI will be essential for success in this competitive market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in Capital Spending on Semiconductor Processing

- 5.1.2 Rapid Technological Advances and Transition

- 5.2 Market Restraints

- 5.2.1 Trade Uncertainties and Semiconductor Memory Markets

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 High-density Etch Equipment

- 6.1.2 Low-density Etch Equipment

- 6.2 By Etching Film Type

- 6.2.1 Conductor Etching

- 6.2.2 Dielectric Etching

- 6.2.3 Polysilicon Etching

- 6.3 By Application

- 6.3.1 Foundries

- 6.3.2 MEMS

- 6.3.3 Sensors

- 6.3.4 Power Devices

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Applied Materials Inc.

- 7.1.2 Hitachi High Technologies America, Inc.

- 7.1.3 Lam Research Corporation

- 7.1.4 Tokyo Electron Limited

- 7.1.5 Plasma-Therm LLC

- 7.1.6 Panasonic Corporation

- 7.1.7 SPTS Technologies Limited (Orbotech)

- 7.1.8 Suzhou Delphi Laser Co., Ltd

- 7.1.9 ULVAC Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS